-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: Bank Risk Debate; Debt Ceiling Vote

- MNI INTERVIEW: U.S. Urged to Require Banks To Recapitalize

- MNI INTERVIEW: Canada Job Data Keep Defying Gloom-Govt Analyst

- MNI: BOC Discussed Rate Hike, Lacked Enough Evidence: Minutes

- MNI INTERVIEW: Riksbank Policy Must Stay Restrictive - Thedeen

US

US: The authors of a widely circulated study that found an additional 186 U.S. banks at risk of meeting the same fate as that of Silicon Valley Bank are urging regulators to require banks to promptly raise hundreds of billions of dollars in equity capital to soothe solvency concerns.

- Erica Jiang of the University of Southern California and Tomasz Piskorski of Columbia University, along with researchers at Stanford University and Northwestern University, have presented a proposal to Treasury, FDIC and OCC officials that would restrict equity payouts indefinitely, require an increase in equity in order to access government lending facilities, and tie all additional support and regulatory forbearance to an increase in capital requirements for the most affected banks.

- They estimate that an infusion of private capital in the range of USD190 billion to USD400 billion is needed to get banks to between a 0% and 5% liabilities coverage ratio.

- "The U.S. banking system is certainly not safe. There's a lot of inherent hidden fragility," Piskorski said in an interview. "This is a market-based proposal. We're suggesting that regulators sit down with banks and say, look, we need you to raise capital. This is maybe a better time to do it now than doing it in an abrupt manner. It will, in some ways, restore the calm in the short run." For more see MNI Policy main wire at 1338ET.

CANADA

CANADA: There’s plenty of evidence Canada’s hot job market has momentum beyond a pandemic rebound, a senior government analyst told MNI, even as many economists doubt good times will last even through the next few quarters.

- "We’re in a different sort of gear,” says Statistics Canada senior analyst Andrew Fields, who helps lead preparations of the monthly Labour Force Survey. “What’s funny too is it does seem everybody’s still sort of watching it very closely as if it’s always on some kind of precipice,” he said of the job market. “In the data we aren’t seeing any signs of it turning and declining we’re seeing continued growth.”

- The BOC stopped raising interest rates in March on evidence inflation is slowing to 3% in the next few months and Governor Tiff Macklem predicts the economy will show slack in the second half of the year. Other experts have been forecasting a mild recession for a while now, with Bank of Montreal for example saying GDP will contract in Q2 and Q3 while joblessness climbs from 5% to 5.7% in Q4. For more see MNI Policy main wire at 0959ET.

- "Discussion around increasing the interest rate further focused on whether monetary policy was restrictive enough and whether it was best to raise the policy rate now or wait for more evidence," according to meeting minutes published Wednesday.

- Possible justifications for a ninth rate increase included the resilient economy, persistent core inflation, the need to be forward looking on price pressures, and potential difficulty bringing CPI all the way back to the 2% target, according to the deliberations. Instead the rate was held at 4.5% for a second meeting because the economic outlook was little changed and there remained signs inflation pressures were easing.

EUROPE

SWEDEN: The Riksbank's policy rate will need to stay in restrictive territory for a good while yet, Governor Erik Thedeen told MNI, even as the Board's collective policy path published Wednesday shows rates heading lower in the latter stages of the current forecast period.

- The collective rate path, published alongside the April decision to raise rates by 50 bps to 3.5%, showed the benchmark rate rising to 3.65%, with the board stating another 25 bps hike was likely in June or September. The rate was then shown holding at that level deep into 2025, before falling back to 3.35% three years ahead. February's forecast had it holding at a 3.33% peak through to end forecast.

- "I wouldn't over exaggerate the messaging here. I think the broad message is the same. We should go up and we should stay there. But, of course, if our forecast is fulfilled then we would have had stable 2% inflation for a while and then, of course, it is natural to cut rates," Thedeen told MNI in an exclusive interview. For more see MNI Policy main wire at 1045ET.

Tsys Weaker/Off Lows, Focus On House Debt Ceiling Vote, Equity Earnings

- Front month Treasury futures are currently weaker, but off second half lows, possibly in reaction to late procedural headline regarding the debt ceiling bill: "Republican Debt Ceiling Bill Advances In US House Toward Debate, Possible Vote On Passage" Twitter.

- Rates had sold off on stale FRC bank headlines regarding potential buyers ahead the NY open. As noted in this morning's What to Watch bullet: markets will be keeping a wary eye on First Republic Bank (FRC) headlines.

- Trading desks cited "US GOVERNMENT CURRENTLY UNWILLING TO INTERVENE ON FIRST REPUBLIC - CNBC CITING SOURCES" for a midday downturn in rates, Jun'23 10Y futures falling to 115-110 low, 10Y yield at 3.4259%.

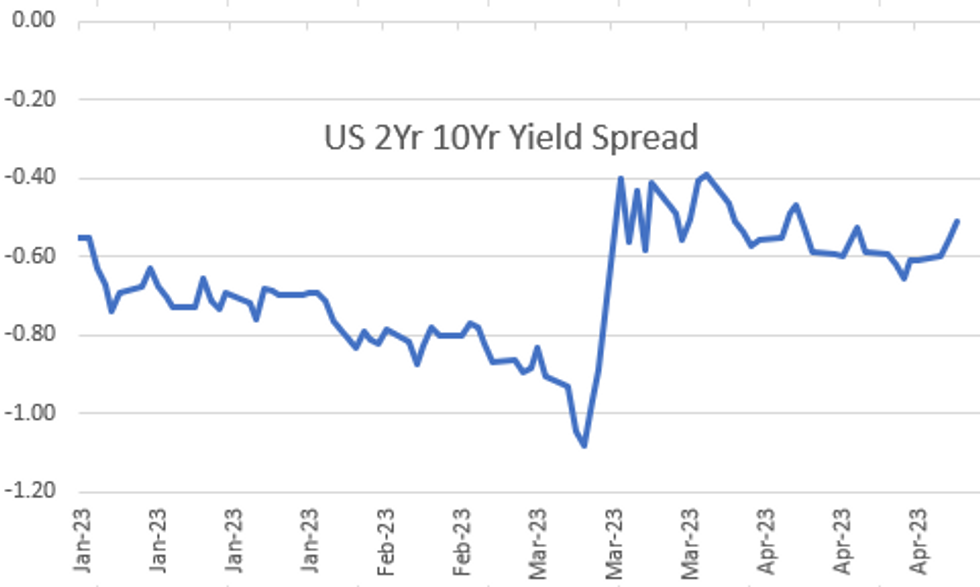

- Curves holding onto steeper profiles (2s10s +5.711 at -49.988%) amid pre-auction and corporate supply related unwinds.

- Stocks on the other hand have reversed midday gains and through 50-day EMA technical support to 4071.25 low.

OVERNIGHT DATA

- US MAR DURABLE NEW ORDERS +3.2%; EX-TRANSPORTATION +0.3%

- US FEB DURABLE GOODS NEW ORDERS REV TO -1.2%

- US MAR NONDEF CAP GOODS ORDERS EX-AIR -0.4% V FEB -0.7%

- US MARCH ADV GOODS TRADE DEFICIT $84.6B; EST. -$90.0B

- US MARCH RETAIL INVENTORIES RISE 0.7% M/M; EST. +0.2%

- US MARCH WHOLESALE INVENTORIES RISE 0.1%; EST. 0.1%

- US MBA: MARKET COMPOSITE +3.7% SA THRU APR 21 WK

- US MBA: REFIS +2% SA; PURCH INDEX +5% SA THRU APRIL 21 WK

- US MBA: UNADJ PURCHASE INDEX -28% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.55% VS 6.43% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 229.37 points (-0.68%) at 33301.31

- S&P E-Mini Future down 19 points (-0.46%) at 4074.25

- Nasdaq up 57.2 points (0.5%) at 11856.82

- US 10-Yr yield is up 3.4 bps at 3.4334%

- US Jun 10-Yr futures are down 9.5/32 at 115-16

- EURUSD up 0.0062 (0.57%) at 1.1035

- USDJPY down 0.15 (-0.11%) at 133.6

- WTI Crude Oil (front-month) down $2.64 (-3.43%) at $74.44

- Gold is down $10.17 (-0.51%) at $1987.18

- EuroStoxx 50 down 30.14 points (-0.69%) at 4347.71

- FTSE 100 down 38.49 points (-0.49%) at 7852.64

- German DAX down 76.4 points (-0.48%) at 15795.73

- French CAC 40 down 64.95 points (-0.86%) at 7466.66

US TREASURY FUTURES CLOSE

- 3M10Y -4.793, -170.282 (L: -174.592 / H: -166.397)

- 2Y10Y +4.17, -51.529 (L: -59.535 / H: -48.685)

- 2Y30Y +3.852, -25.95 (L: -35.243 / H: -22.801)

- 5Y30Y -0.75, 19.845 (L: 16.8 / H: 21.81)

- Current futures levels:

- Jun 2-Yr futures down 3.375/32 at 103-10.25 (L: 103-07.125 / H: 103-15.375)

- Jun 5-Yr futures down 6.25/32 at 110-1.75 (L: 109-28 / H: 110-11)

- Jun 10-Yr futures down 9.5/32 at 115-16 (L: 115-10 / H: 115-30.5)

- Jun 30-Yr futures down 21/32 at 131-23 (L: 131-13 / H: 132-21)

- Jun Ultra futures down 29/32 at 141-6 (L: 140-26 / H: 142-21)

US 10YR FUTURE TECHS: (M3) Holding On To This Week’s Gains

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-30+ High Apr 26

- PRICE: 115-23+ @ 16:00 BST Apr 26

- SUP 1: 114-30+/17 The 20- and 50-day EMA values

- SUP 2: 113-30+ Low Apr 19 and key short-term support

- SUP 3: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 4: 113-08+ Low Mar 15

Treasury futures are holding on to this week’s gains. The recovery Tuesday undermines the recent bearish theme and price remains above both the 20- and 50-day EMAs. A continuation higher would signal scope for a climb towards 116-08, the Apr 12 high and expose the key resistance at 117-01+, the Mar 24 high. Key support has been defined at 113-30+, the Apr 19 low. A break of this support would reinstate the recent bearish theme.

SOFR FUTURES CLOSE

- Jun 23 -0.030 at 94.970

- Sep 23 -0.045 at 95.270

- Dec 23 -0.040 at 95.705

- Mar 24 -0.050 at 96.205

- Red Pack (Jun 24-Mar 25) -0.08 to -0.06

- Green Pack (Jun 25-Mar 26) -0.065 to -0.045

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.04

- Gold Pack (Jun 27-Mar 28) -0.055 to -0.05

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01427 to 4.98221 (+.08223 total last wk)

- 3M -0.03335 to 5.04542 (+.06226 total last wk)

- 6M -0.06335 to 5.02735 (+.08430 total last wk)

- 12M -0.11819 to 4.74481 (+.06573 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00500 to 4.79571%

- 1M +0.00686 to 5.02457%

- 3M -0.01886 to 5.27271% */**

- 6M -0.03400 to 5.37186%

- 12M -0.08443 to 5.28857%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $112B

- Daily Overnight Bank Funding Rate: 4.82% volume: $280B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.329T

- Broad General Collateral Rate (BGCR): 4.77%, $547B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $540B

- (rate, volume levels reflect prior session)

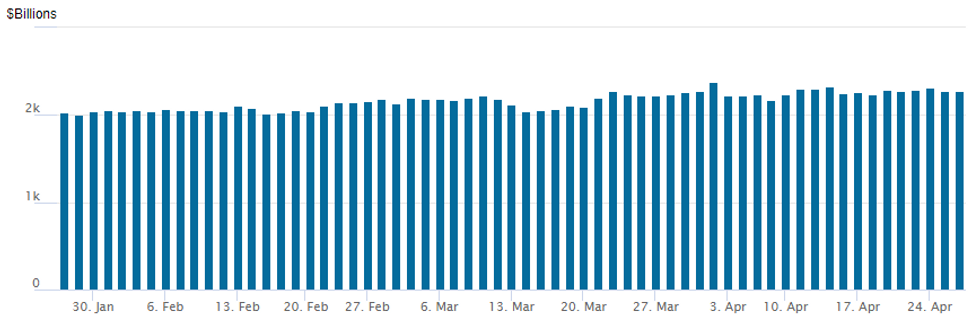

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches up to $2,279.561B w/ 97 counterparties, compares to prior $2,275.402B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B American Express, $3B ERAC Launched

$8.4B to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 04/26 $3B #ERAC USA Finance $1B 5Y +120, $1B 10Y +150, $1B 30Y +175

- 04/26 $2.5B #American Express $1.25B 3NC2 +98, $1.25B 11NC10 +160

- 04/26 $1.25B *Swedish Export Credit +2Y SOFR +31

- 04/26 $1B *Sasol Financing USA LLC 6Y 8.75%

- 04/26 $650M #SMBC Aviation 5Y +200

- 04/26 $Benchmark Eximbank -5Y +300a

FOREX: EURUSD Pierces Key 1.1076 Resistance, EURAUD Highest Since Oct'20

- Despite multiple headlines regarding potential government intervention on First Republic Bank prompting volatile two-way trade in G10 currency markets, the USD index looks set to close with 0.4% losses as we approach the APAC crossover.

- The weaker greenback has most noticeably been seen in EURUSD which has advanced 0.55% on Wednesday. Despite fading off the day's highs, the pair has still reversed the entirety of Tuesday’s pullback to breach resistance at 1.1076, the Apr 1 2022 high and recent Apr 14 high. This confirms a resumption of the primary uptrend and opens 1.1127, a Fibonacci retracement.

- Note that moving average studies are in a bull-mode condition highlighting a rising trend. On the downside, key short-term support is unchanged at the 20-day EMA which intersects at 1.0930 today.

- Interestingly, EUR crosses have seen an extension of recent strength amid the weaker equity backdrop and softer CPI prints from the likes of Australia and New Zealand. EUR/AUD has rallied through 1.67 to the upside for the first time since October 2020, opening the path to the 50% retracement for the 2020 - 2022 downleg at 1.7045.

- Rising US yields and the recovery for major equity indices off mid-session lows has prompted a not insignificant 80 pip bounce for USDJPY with the pair now unchanged on the session, just below earlier highs of 133.94.

- We noted that the prior move lower had seen the pair clear initial support at the 20-day EMA which intersected at 133.51. While the breach does suggest scope for a potential continuation lower, bulls will look favourably on the supportive price action late Wednesday. More significant support remains lower down at 132.02, the Apr 13 low, of which a break would strengthen overall bearish conditions. On the upside, key short-term resistance is at 135.13, the Apr 19 high, where a break is required to reinstate the recent bullish theme.

- Focus turns to the Advanced reading of Q1 GDP from the US on Thursday, as well as Core PCE and March Pending Home Sales.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2023 | 0130/1130 | ** |  | AU | Trade price indexes |

| 27/04/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/04/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/04/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/04/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 27/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/04/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 27/04/2023 | 1230/0830 | *** |  | US | GDP |

| 27/04/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 27/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/04/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 27/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/04/2023 | 1615/1815 |  | EU | ECB Panetta at EACB Board Meeting | |

| 27/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.