-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Beige Book, Credit Tightens

EXECUTIVE SUMMARY:

- MNI BRIEF: Beige Book: Inflation Slows, Credit Tightens

- MNI SOURCES: ECB To Hold Rates At Peak Into 2024

US

FED: The Fed's latest Beige Book report Wednesday said price increases appear to be slowing, overall economic activity was little changed in recent weeks and several regions reported tighter lending standards following SVB's collapse.

- "Economic activity was little changed in recent weeks. Nine Districts reported either no change or only a slight change in activity this period while three indicated modest growth. Expectations for future growth were mostly unchanged as well," the Fed said. "Consumer spending was generally seen as flat to down slightly amid continued reports of moderate price growth."

- The Fed also said employment growth moderated as a small number of firms reported mass layoffs. "Wages have shown some moderation but remain elevated," the report said. "Overall price levels rose moderately during this reporting period, though the rate of price increases appeared to be slowing." For more see MNI Policy main wire at 1417ET.

EUROPE

ECB: The European Central Bank looks set to hike by 25 basis points in May, with at least one further 25-point increase expected over the summer, after which policymakers see rates holding steady at their peak into 2024, sources close to the Governing Council’s discussions told MNI.

- With fallout from global banking turbulence in March and April seemingly limited for the eurozone, May’s debate will focus on the size of the hike needed to contain inflation, rather than on whether to hike or not. An upside surprise in flash April inflation data could still tilt the argument towards 50bp, but for the moment most Governing Council members feel that downgrading to 25bp hikes will better enable them to gauge whether they need to push the deposit rate to 3.5% or to 3.75%, though some might still argue for a maximum of 4% if prices remains hot. (See MNI INTERVIEW:Core Inflation Jump Needed For 50Bp-ECB's Simkus)

- After reaching the peak, the ECB is likely to stay on hold for some time. One eurosystem official, who foresees a possibly lower top than would have been anticipated earlier in the year but persisting for longer, said a cut in benchmark rates would be unlikely “well into 2024,” although he wouldn’t be drawn on whether that meant the second quarter or into the second half. Another looked for rates at stay at their peak until at least this Christmas. For more see MNI Policy main wire at 1059ET.

US TSYS: Little Change in Economic Activity: Beige Book

- Treasury futures holding weaker but off midday lows, partially due to $16B total corporate bond issuance pricing and rate locks being unwound, TYM3 currently at 114-06 (-9.5) vs. 113-30.5 low, yield 3.6023% high.

- From a technical perspective, 10Y futures remain in a short-term downtrend as the contract extends the pullback from 117-01+, the Mar 24 high. The contract has recently traded through both the 20- and 50-day EMAs and has pierced the 114-00 handle today. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Curves bear flattened earlier, extending inversion to -66.009 low at -64.181 currently amid chunky short end selling earlier. Projected rate hikes over the next three FOMC meeting firm up (Fed funds implied hike for May'23 at 22bp, Jun'23 +29.7bp cumulative at 5.126%, Jul'23 +25.4bp at 5.083%).

- Large corporate bond issuance ($8.5B Bank of America 2-part, $7.5B Morgan Stanley 3-part) in addition to pre-auction short sets ahead the US Treasury $12B 20Y bond auction re-open weighed on Treasury futures through midday.

- No significant react to data, Federal Reserve Releases Beige Book showed little change in economic activity over the last few weeks while MBA Mortgage Applications recently announced: -8.8% last week (5.3% prior).

OVERNIGHT DATA

- FED RELEASES BEIGE BOOK REPORT ON ECONOMIC CONDITIONS

- FED'S BEIGE BOOK: CONSUMER SPEND GENERALLY FLAT, SLIGHTLY DOWN

- FED'S BEIGE BOOK: GROWTH EXPECTATIONS LARGELY UNCHANGED

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 87.08 points (-0.26%) at 33889.91

- S&P E-Mini Future up 1.25 points (0.03%) at 4181.25

- Nasdaq up 20.2 points (0.2%) at 12173.52

- US 10-Yr yield is up 2.5 bps at 3.6004%

- US Jun 10-Yr futures are down 9.5/32 at 114-6

- EURUSD down 0.0019 (-0.17%) at 1.0953

- USDJPY up 0.62 (0.46%) at 134.74

- WTI Crude Oil (front-month) down $1.67 (-2.07%) at $79.19

- Gold is down $9.5 (-0.47%) at $1995.94

- EuroStoxx 50 down 0.38 points (-0.01%) at 4393.57

- FTSE 100 down 10.67 points (-0.13%) at 7898.77

- German DAX up 12.53 points (0.08%) at 15895.2

- French CAC 40 up 15.81 points (0.21%) at 7549.44

US TREASURY FUTURES CLOSE

- 3M10Y +3.857, -154.693 (L: -163.962 / H: -152.794)

- 2Y10Y -3.708, -66.457 (L: -66.945 / H: -62.25)

- 2Y30Y -5.889, -47.459 (L: -48.341 / H: -41.577)

- 5Y30Y -3.754, 6.769 (L: 5.729 / H: 10.627)

- Current futures levels:

- Jun 2-Yr futures down 4.5/32 at 102-25.875 (L: 102-24.75 / H: 102-30.25)

- Jun 5-Yr futures down 7/32 at 108-30.25 (L: 108-25.25 / H: 109-05)

- Jun 10-Yr futures down 9.5/32 at 114-6 (L: 113-30.5 / H: 114-14.5)

- Jun 30-Yr futures down 11/32 at 129-22 (L: 129-04 / H: 130-01)

- Jun Ultra futures down 9/32 at 138-24 (L: 137-27 / H: 139-02)

US 10YR FUTURE TECHS: (M3) Bear Cycle Still In Play

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-00+/23 20-day EMA / High Apr 14

- PRICE: 114-01 @ 16:11 BST Apr 19

- SUP 1: 113-26 Low Mar 22

- SUP 2: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 3: 113-08+ Low Mar 15

- SUP 4: 112-30 61.8% retracement of the Mar 3 - 24 bull run

Treasury futures remain in a short-term downtrend as the contract extends the pullback from 117-01+, the Mar 24 high. The contract has recently traded through both the 20- and 50-day EMAs and has pierced the 114-00 handle today. This signals scope for weakness to 113-23, a Fibonacci retracement. On the upside, initial firm resistance is seen at 115-00+, the 20-day EMA. A break of this average is required to ease the current bearish threat.

STIR: SOFR FUTURES CLOSE

- Jun 23 -0.025 at 94.890

- Sep 23 -0.045 at 95.090

- Dec 23 -0.065 at 95.415

- Mar 24 -0.080 at 95.840

- Red Pack (Jun 24-Mar 25) -0.09 to -0.065

- Green Pack (Jun 25-Mar 26) -0.05 to -0.02

- Blue Pack (Jun 26-Mar 27) -0.02 to -0.015

- Gold Pack (Jun 27-Mar 28) -0.025 to -0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00756 to 4.94596 (+.05290/wk)

- 3M +0.00705 to 5.05550 (+.07262/wk)

- 6M +0.01030 to 5.07839 (+.13537/wk)

- 12M +0.01224 to 4.88293 (+.19866/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 4.80671%

- 1M +0.02958 to 4.98229%

- 3M +0.01100 to 5.26143% */**

- 6M +0.03928 to 5.45057%

- 12M +0.05614 to 5.48171%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $112B

- Daily Overnight Bank Funding Rate: 4.82% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.364T

- Broad General Collateral Rate (BGCR): 4.77%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $518B

- (rate, volume levels reflect prior session)

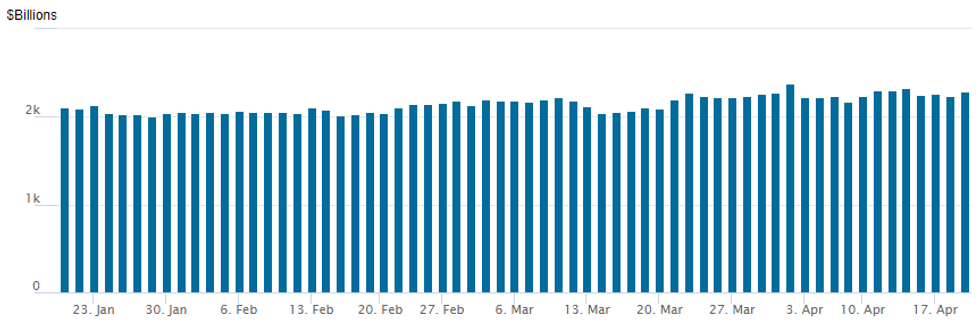

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,294.677B w/ 110 counterparties, compares to prior $2,238.994B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $2.5B Bank of NY Mellon 2Pt Launched

BNY Mellon finally launched, pushes total issuance for Wednesday to $24.75B -- $16k of which comprised of Bank of America and Morgan Stanley issuance:

- Date $MM Issuer (Priced *, Launch #)

- 04/19 $8.5B #Bank of America $3.5B 6NC5 +148, $5B 11NC10 +168*

- 04/19 $7.5B #Morgan Stanley $1.5B 3Y +80, $2.75B 6NC5 +145, $3.25B 11NC10 +165

- 04/19 $4B #Canadian Government Bond 5Y +11

- 04/19 $2.5B #Bank of NY Mellon $1.5B 4NC3 +97, $1B 11NC10 +137

- 04/19 $1.25B #New Development Bank (NEWDEV) 3Y SOFR+125

- 04/19 $1B *Kommuninvest WNG -3Y SOFR+27

EGBs-GILTS CASH CLOSE: Bear Flattening With More BoE Hikes Priced

European curves bear flattened Wednesday, with the UK leading losses for a second straight day on more data spurring higher BoE hike expectations.

- March UK inflation surprised to the upside, which with Tuesday's strong wage growth data cemented a May 25bp hike and led BoE terminal rate pricing to close above 5% for the first time since October (up 15bp on the day).

- ECB pricing lagged but still rose 4bp for a fresh post-Credit Suisse crisis high.

- An MNI article published in late afternoon cited ECB sources as saying the Governing Council looks set to hike 25bp in May with at least one further 25bp increase this summer, and a pause currently foreseen to into 2024.

- Periphery EGBs were mixed, with BTP spreads widening, and GGBs tightening following a solid 2033 auction.

- BoE's Mann speaks after hours; German PPI and various eurozone confidence indices feature early Thursday, while later in the session we get accounts of the ECB's March meeting with appearances by Visco, Holzmann and Schnabel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 2.968%, 5-Yr is up 4.6bps at 2.566%, 10-Yr is up 3.8bps at 2.515%, and 30-Yr is up 1.9bps at 2.552%.

- UK: The 2-Yr yield is up 13.9bps at 3.83%, 5-Yr is up 12.8bps at 3.716%, 10-Yr is up 10.9bps at 3.856%, and 30-Yr is up 8.5bps at 4.183%.

- Italian BTP spread up 2.4bps at 184.8bps / Greek down 4bps at 181.4bps

FOREX: USDJPY Prints Above 135.00, GBP Whipsaws Post UK CPI Data

- Two-way price action for the US Dollar on Wednesday leaves the USD index moderately higher on the week as US 2-year yields extended their upward shift to around 15bps since Friday’s close.

- USD/JPY underwent a sharp bout of volatility as Bloomberg cited sources in reporting that the Bank of Japan are said to be wary over any tweak of yield curve control in April, with the smoother curve said to suggest no need for a policy move at this juncture. The piece adds that the bank is said to be mulling if a guidance change can wait or not.

- Volumes surged across futures markets, with spot USDJPY very briefly spiking to a fresh high of 135.13 before fading back below the 135 handle. Notably, EURJPY (+0.32%) looks set to extend its two-week rally to around 3.2%.

- GBP also saw some sharp two-way price action after initially rising on an above-expected March inflation release. While headline inflation slowed from the February print, Y/Y CPI remaining in double digits and core CPI holding above forecast poses further problems for the Bank of England, prompting a number of sell-side analysts to add 25bps to their MPC hike cycle.

- GBP/USD's post-data rally put the pair at 1.2472 before running out of momentum and falling victim to a mid-session correction higher for the greenback. However, the pair has settled in positive territory ahead of the APAC crossover with sights remaining on the bull trigger at 1.2546.

- The Canadian dollar is among the weakest G10 performers today, declining 0.45%. The Public Service Alliance of Canada has seen around 150,000 government workers striking in a dispute over wage increases, providing a marginal tailwind for USDCAD.

- New Zealand CPI headlines the APAC docket on Thursday with potential comments from RBA Governor Lowe, due to hold a media briefing about Review of the RBA.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams | |

| 20/04/2023 | 2350/0850 | ** |  | JP | Trade |

| 20/04/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/04/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 20/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/04/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/04/2023 | 1415/1015 |  | US | Secretary Yellen on U.S.-China economic relationship | |

| 20/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/04/2023 | 1530/1130 |  | CA | BOC Governor testifies at Senate committee | |

| 20/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panels National Bureau of Economics Research Conf | |

| 20/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/04/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 20/04/2023 | 1620/1220 |  | US | Cleveland Fed's Loretta Mester | |

| 20/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/04/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan | |

| 20/04/2023 | 1900/1500 |  | US | Fed Governor Michelle Bowman | |

| 20/04/2023 | 2015/2215 |  | EU | ECB Schnabel Lecture at Stanford Graduate School of Business | |

| 20/04/2023 | 2100/1700 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.