-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: CB's Sending Dovish Signals

EXECUTIVE SUMMARY

US

FED: The Federal Reserve could step down to a slower pace of rate increases in December and it may not need to do much more to constrain inflation, former Fed Governor Randal Quarles told MNI.

- It "would be reasonable" to slow the pace of interest rate hikes in December, Quarles said in an interview, pointing to debt levels that have built up over the last 15 years that may mean interest rate increases now have a greater impact.

- "Any given nominal increase in interest rates is going to be a huge percentage increase in the cost of debt service," he said. "So the constraining effect of any given increase in nominal rates is greater than it has been in previous tightening cycles."

- Federal borrowing from the public as a percentage of GDP has increased from 35% in 2007 to 97% of GDP at the end of fiscal year 2022, while corporate debt has roughly doubled. For more see MNIU Policy main wire at 0938ET.

US: U.S. growth rebounded at a slightly faster pace in the third quarter than Wall Street expectations, rising 2.6%, two tenths higher than analysts anticipated, after falling for two straight quarters, the Bureau of Economic Analysis said Thursday. The PCE price index decelerated to a 4.2% increase over the July through September period while core PCE inflation was 4.5%, down from 7.3% and 4.7%, respectively.

- The rebound reflected a smaller decrease in inventory investment, acceleration in nonresidential fixed investment and rise in federal government spending, while residential fixed investment and a deceleration in consumer spending hurt growth, the BEA said. Imports also fell.

CANADA

BOC: Canada's central bank is nearly done hiking rates and will lag the Fed to avoid the danger that over-tightening will drag the economy into recession under the weight of high consumer debts, former adviser Angelo Melino told MNI.

- Governor Tiff Macklem could stop after a quarter-point hike to 4% at the next meeting or perhaps at 4.25%, leaving it well short of some forecasts for the Fed to go to 5%, Melino said. The Bank of Canada on Wednesday hiked 50bps instead of the 75 most economists predicted.

- “There has been a lot of tightening that has been in the system already and is working its way through,” said Melino, a Bank adviser around the 2008 global financial crisis. “There’s a high chance that they over-do it.” For more see MNIU Policy main wire at 1245ET.

EUROPE

ECB: The European Central Bank raised its 3 key interest rates by 75 bps Thursday, pushing the current benchmark deposit rate to 1.5%. The move was largely expected by financial markets, with the move well priced in, as policymakers continue their fight with inflation.

- The Governing Council also moved to adjust the rates on the outstanding TLTRO 3 operations, with the new terms applicable from November 23. The move had been highlighted by MNI in the run-up to the October meeting (MNI ECB WATCH: ECB Eye TLTRO Changes As Depo Rate Set For 1.5%).

- Although the ECB offered no explicit forward guidance, the policy statement said further rate hikes were expected to ensure the timely return of inflation to the 2% medium-term inflation target.

UK

BOE: A further delay to publication of the UK government’s fiscal statement will make little difference to the Bank of England’s calculations ahead of what is likely to be another split decision by the Monetary Policy Committee in November, with members divided over how to weight risks from elevated inflation expectations and falling real incomes and over the optimal pace for hikes.

- While Wednesday’s announcement of a delay from Oct 31 to Nov 17 means the Monetary Policy Committee will not have access to the full medium-term fiscal arithmetic for its Nov 3 policy decision, the government’s direction of travel is clear. Chancellor of the Exchequer Jeremy Hunt has reversed GBP32 billion of tax cuts set out in his predecessor's ill-fated Sep 23 mini-Budget, and is set to spell out plans to raise additional revenue to fill a reported GBP35 billion shortfall in order to begin to reduce debt as a percentage of output within the forecast horizon. For more see MNIU Policy main wire at 1047ET.

US TSYS: Bonds Near Post-ECB Highs

Treasury futures trade stronger after the bell, see-sawing in relative narrow range since surging higher in midmorning trade; 30YY currently -.0338 at 4.1042% vs. 4.0571% L/4.2033% H.

- Impetus largely after ECB policy annc: though in-line w/ expected 75bp rate hike, markets fixated on discussion over ECB forward rate guidance turns dovish (though ECB Lagarde admits job of normalizing rates not finished, did not discuss QT).

- Not as striking as Wed's less than expected 50bp hike from the BOC, but US markets nervous over additional 75bp rate hikes going into year-end, are eager to take the cue and (continue) to unwind restrictive expectations into year end.

- As noted Wed, foreign central bank decisions unlikely to sway the FOMC, particularly next wk's annc where 75bp is considered a lock. Fed Chairman Powell likely to push back on less hawkish rate hike optimism and reiterate Sep messaging/DOT plot guidance. (Reminder: next employment report (covering October) is on November 4 - after the FOMC. An in-line read will likely tip the scales back toward 75bp hike in Dec).

- Data roundup: Tsys pared losses after round of mixed to in-line data: Q3 GDP better than exp (+2.6% vs. +2.4% est), core PCE and weekly jobless claims largely in-line (continuing claims higher 1.438M vs. 1.390M est), durable goods weaker than exp (0.4% vs. 0.6% est).

- Tsys dip/pare gains slightly after $35B 7Y note auction (91282CFT3) tails: 4.027% high yield vs. 4.017% WI; 2.43x bid-to-cover vs. 2.57x last month.

OVERNIGHT DATA

- US Q3 GDP +2.6%

- US SEP DURABLE NEW ORDERS +0.4%; EX-TRANSPORTATION -0.5%

- US AUG DURABLE GDS NEW ORDERS REV TO +0.2%

- US SEP NONDEF CAP GDS ORDERS EX-AIR -0.7% V AUG +0.8%

- US JOBLESS CLAIMS +3K TO 217K IN OCT 22 WK

- US PREV JOBLESS CLAIMS REVISED TO 214K IN OCT 15 WK

- US CONTINUING CLAIMS +0.055M to 1.438M IN OCT 15 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 293.88 points (0.92%) at 32134.25

- S&P E-Mini Future down 14.5 points (-0.38%) at 3826.75

- Nasdaq down 152.3 points (-1.4%) at 10819.42

- US 10-Yr yield is down 5.3 bps at 3.9495%

- US Dec 10Y are up 15.5/32 at 111-18.5

- EURUSD down 0.011 (-1.09%) at 0.9971

- USDJPY down 0.19 (-0.13%) at 146.18

- WTI Crude Oil (front-month) up $0.79 (0.9%) at $88.68

- Gold is down $4.53 (-0.27%) at $1660.04

- EuroStoxx 50 down 0.8 points (-0.02%) at 3604.51

- FTSE 100 up 17.62 points (0.25%) at 7073.69

- German DAX up 15.42 points (0.12%) at 13211.23

- French CAC 40 down 32.28 points (-0.51%) at 6244.03

US TSY FUTURES CLOSE

- 3M10Y -6.834, -10.046 (L: -13.446 / H: 3.967)

- 2Y10Y +2.503, -38.223 (L: -42.543 / H: -37.4)

- 2Y30Y +4.038, -22.961 (L: -28.756 / H: -22.462)

- 5Y30Y +4.82, -0.02 (L: -7.127 / H: 1.181)

- Current futures levels:

- Dec 2Y up 4.5/32 at 102-16.875 (L: 102-09.5 / H: 102-18.75)

- Dec 5Y up 13.5/32 at 107-9.25 (L: 106-18.25 / H: 107-14.25)

- Dec 10Y up 16/32 at 111-19 (L: 110-18 / H: 111-27.5)

- Dec 30Y up 21/32 at 122-4 (L: 120-21 / H: 122-20)

- Dec Ultra 30Y up 1-00/32 at 130-3 (L: 128-02 / H: 130-31)

US 10YR FUTURES TECHS: (Z2) New Weekly Highs

- RES 4: 113-11+ 50-day EMA

- RES 3: 112-22+ High Oct 6

- RES 2: 111-28+ High Oct 13 and key near-term resistance

- RES 1: 111-25 High Oct 27

- PRICE: 110-22 @ 1515ET Oct 27

- SUP 1: 109-20/108-26+ Low Oct 25 / 21 and the bear trigger

- SUP 2: 108-06+ Low Oct 2007 (cont)

- SUP 3: 107.02 3.0% 10-dma envelope

- SUP 4: 106-20+ Low Aug 2007 (cont)

Treasuries erased losses following the US open to hit a new weekly high at 111-25. Despite recent gains, the primary trend remains down. Moving average studies are in a bear mode and a broader price sequence of lower lows and lower highs is intact. A resumption of weakness would open 108-20, a Fibonacci projection. Initial firm resistance to watch is at 111-28+. A break here would open 112-22+ and above.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.005 at 94.980

- Mar 23 +0.025 at 94.915

- Jun 23 +0.070 at 95.020

- Sep 23 +0.110 at 95.225

- Red Pack (Dec 23-Sep 24) +0.120 to +0.135

- Green Pack (Dec 24-Sep 25) +0.080 to +0.105

- Blue Pack (Dec 25-Sep 26) +0.060 to +0.075

- Gold Pack (Dec 26-Sep 27) +0.045 to +0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00243 to 3.06329% (-0.01843/wk)

- 1M +0.12157 to 3.75386% (+0.16829/wk)

- 3M +0.04085 to 4.41471% (+0.05628/wk) * / **

- 6M -0.00357 to 4.92829% (+0.05329/wk)

- 12M -0.02100 to 5.37243% (-0.10314/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.41471% on 10/27/22

- Daily Effective Fed Funds Rate: 3.08% volume: $99B

- Daily Overnight Bank Funding Rate: 3.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 3.03%, $972B

- Broad General Collateral Rate (BGCR): 3.00%, $402B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $381B

- (rate, volume levels reflect prior session)

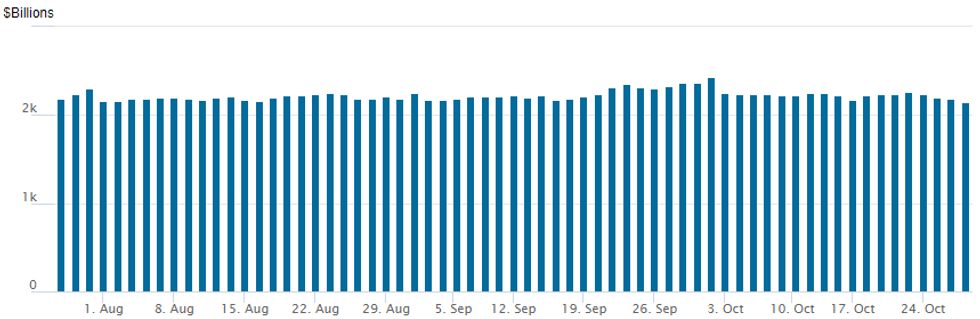

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,152.485B w/ 97 counterparties vs. $2,186.856B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $5B Barclays 3Pt Launched, Outpaces GS

- Date $MM Issuer (Priced *, Launch #)

- 10/27 $5B #Barclays $1.5B 4NC3 +305, $1.5B 6NC5 +330, $2B 11NC10 +350

- 10/27 $2B #Goldman Sachs 2Y +137.5

- 10/27 $Benchmark FHLB 2Y +165a

EGBs-GILTS CASH CLOSE: ECB Takes A Dovish Turn

EGBs rallied strongly Thursday in the wake of the ECB's policy decision, with the expected 75bp hike accompanied by a Statement pointing to a softer rate hike path ahead.

- In particular phrase “expects to raise interest rates further” dropped “over the next several meetings”, with the ECB emphasising a meeting-by-meeting approach.

- Terminal rate pricing fell 30bp (2.55% Jul 2023), helping the short-end / belly of the German curve outperform.

- Periphery EGBs outperformed with BTPs gaining most: initially on the more dovish ECB rate outlook and accelerating after Lagarde said the Governing Council "deliberately" didn't discuss QT in a substantive way.

- The UK curve underperformed Germany at the short end, but outperformed through the rest of the curve. The BOE confirmed the first QT Gilt sale will take place on Nov 1.

- German state inflation is the highlight first thing Friday morning.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 17.2bps at 1.773%, 5-Yr is down 17.9bps at 1.818%, 10-Yr is down 14.9bps at 1.962%, and 30-Yr is down 9.6bps at 2.011%.

- UK: The 2-Yr yield is down 14bps at 3.138%, 5-Yr is down 18.3bps at 3.48%, 10-Yr is down 17.3bps at 3.403%, and 30-Yr is down 16.8bps at 3.51%.

- Italian BTP spread down 17.2bps at 204.6bps / Greek down 8.6bps at 244.3bps

FOREX: ECB Fails To Bolster Recent Euro Optimism, Greenback Recovers

- Having recently broken above 2022 channel resistance, EURUSD extended gains overnight to trade at a six-week high of 1.0094, however, Thursday saw a sharp reversal for the single currency.

- Despite the ECB delivering its second 75bps hike in two meetings, the Governing Council appeared to suggest a slowdown is likely, following “substantial progress” in the withdrawal of monetary policy accommodation.

- EURUSD is hugging intra-day lows approaching the APAC crossover, back below parity and down 1.15% for the session. On the downside, support to watch is 0.9856, the former bear channel resistance.

- Losses have been even more pronounced in EURJPY (-1.32%). Despite the sharp fall, moving average studies continue to highlight a bullish backdrop and the cross will focus on strong support at 143.80, Monday’s low and just below the 20-day exponential moving average.

- Single currency declines have boosted the USD index (+0.80%), however, some strong performances in emerging markets, especially in LatAm FX, are offsetting the greenback resurgence with dollar indices remaining substantially lower on the week.

- Bank of Japan highlights the Friday calendar in APAC trade, with their decision and Monetary Policy Statement due. A mixture of European GDP and CPI data releases will follow. Canadian GDP crosses alongside US Core PCE Price Index, before US pending home sales and UMich confidence data rounds off the week.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/10/2022 | 0430/0630 | *** |  | DE | North Rhine Westphalia CPI |

| 28/10/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/10/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/10/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/10/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/10/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/10/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/10/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/10/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/10/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/10/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/10/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/10/2022 | 0800/1000 | ** |  | IT | PPI |

| 28/10/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/10/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/10/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/10/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/10/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/10/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 28/10/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/10/2022 | - | *** |  | JP | BOJ policy announcement |

| 28/10/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/10/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/10/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/10/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/10/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/10/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.