-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Core CPI Gain Tempers Rate Cut Pricing

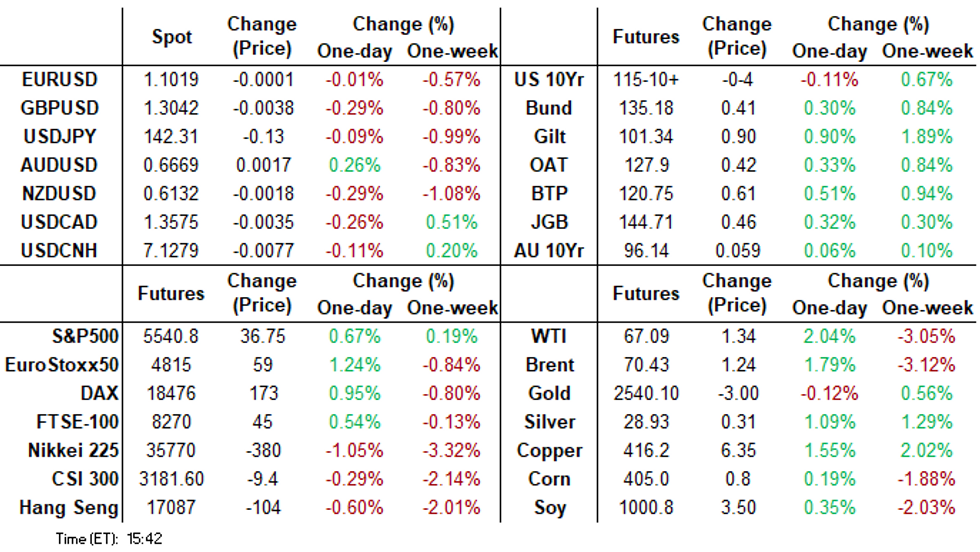

- Treasuries gapped lower after an unexpected gain in Core CPI inflation data, curves bear flattened as projected rate cuts into year end receded from aggressive pricing.

- Markets continued to digest data ahead of Thursday's PPI, however, rates alternately rallying then reversing course again as stocks rebounded from late morning lows.

- Some trading desks discussed asset allocation flow out of bonds into equities (chip makers outperforming, bank weaker for a second day running, as they reevaluated political risk following Tuesday evening's presidential debate.

US TSYS: Focus Turns From Core CPI Gain to PPI, Weekly Claims

- Treasuries look to finish well off lows following a volatile first half on an unexpected gain in Core CPI inflation metrics.

- Dec'24 10Y Tsy futures are -2.5 after the bell at 115-12 vs. 115-02 low, curves flatter but off lows, 2s10s -3.190 at 1.216 vs. -1.535 low.

- U.S. core CPI surprised higher in August on a housing inflation rebound, rising 0.281% last month against expectations for a 0.2% increase. Headline CPI added 0.187%, in line with expectations, the Bureau of Labor Statistics said Wednesday. That brings the 12-month rate for headline and core CPI inflation to 2.5% and 3.2%, respectively.

- Owners' equivalent rent rose 0.50% last month, its strongest increase since January. Rent inflation slowed a tad to 0.37% from 0.49% the previous month. Core services prices excluding housing costs, or supercore CPI, accelerated to a 0.328% increase over the month from 0.207% in July.

- Projected rate cuts through year end remain soft vs. pre-data levels (*): Sep'24 cumulative -28.5bp (-32.7bp), Nov'24 cumulative -65.1bp (-72.5bp), Dec'24 -105.3bp (-114.5bp).

- While chances of a 50bp rate hike has fallen off, markets still have Thursday's PPI and weekly claims data to absorb.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.01485 to 5.09592 (-0.01392/wk)

- 3M -0.01757 to 4.93129 (-0.00735/wk)

- 6M -0.02531 to 4.55357 (-0.03842/wk)

- 12M -0.04090 to 3.95353 (-0.10007/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.161T

- Broad General Collateral Rate (BGCR): 5.31% (-0.01), volume: $808B

- Tri-Party General Collateral Rate (TGCR): 5.31% (-0.01), volume: $766B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

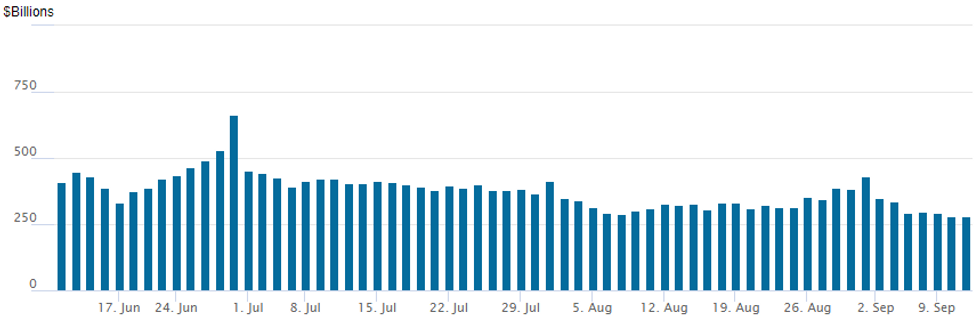

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage slips to new multi-year low of $279.215B (early May 2021 levels) vs. $281.392B on Monday. Number of counterparties at 58 from 60.

US SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option flow were mixed on net as underlying futures see-sawed lower following an unexpected increase in Core CPI inflation measures Wednesday. Better call buying in anticipation of as much as 150bp in rate cuts by year end, turned two-way after this morning's data. Projected rate cuts through year end remain soft vs. pre-data levels (*): Sep'24 cumulative -28.5bp (-32.7bp), Nov'24 cumulative -65.1bp (-72.5bp), Dec'24 -105.3bp (-114.5bp).- SOFR Options: Reminder, Sep options expire Friday

- Block, 5,000 SFRZ4 95.75/96.00/96.25 call flys, 4.75 ref 95.87

- +10,000 SFRZ4 95.87/96.12/96.37 call flys, 4.25 vs. 95.87/0.06%

- +5,000 SFRV4 96.00/96.50 call spds, 5.25 ref 95.875

- -5,000 SFRM5 96.37 puts, 19.0 vs. 96.88/0.28%

- -4,000 SFRZ4 96.00/97.00 1x2 call spds, 7.25 ref 95.865

- -8,000 SFRZ4 96.00/96.25 call spds vs 95.62 puts, 0.75 put over

- -6,000 SFRV4 95.50 put v SRX4 95.43 put, 0.75 net/Nov over

- +4,000 SFRZ4 95.81/96.06/96.31 call flys, 4.0 ref 95.86

- -15,000 SFRZ4 96.25/96.75 call spds, 3.5-3.75 ref 95.845 to -0.855

- +5,000 SFRU4 95.06/95.12/95.18 call flys, 0.75 ref 95.055

- -10,000 SFRV4 97.43 calls 1.0 over 96.87/97.12 put spds ref 95.93

- +10,000 SFRV4 96.87/97.12 put spds .5 over 97.50 calls, ref 95.93

- Block, 4,000 SFRU4 95.12 calls

- 2,000 SFRZ4 95.56/95.62/95.75 put flys ref 95.94

- 3,000 0QU4/2QU4 97.25 call spds

- 4,000 SFRZ4 95.25/95.37/95.50/95.62 call condors ref 95.955

- over 21,200 SFRU4 95.06 puts

- over 11,000 SFRU4 98.18 calls

- 2,000 SFRZ5 96.50/96.87/97.25 put flys ref 97.235

- 2,500 SFRH5 95.75/96.00 put spds, 4.5 ref 96.61

- 6,000 SFRM5 97.00 calls, 43.0-42.5

- Treasury Options:

- 2,000 FVX4 108.5/109.5 put spds ref 110-25

- 5,000 Wednesday weekly 10Y 115/115.25 2x1 put spds ref 115-20.5

- 2,000 TUZ4 105/105.5 strangles ref 104-15.12

- 10,000 TYV4 114 puts, 4-5 ref 115-21.5

- 11,600 TYV4 115/116 call spds, 32-34 ref 115-21

BONDS: EGBs-GILTS CASH CLOSE: Yields Test August Lows Ahead of ECB

Risk-off trade remained the dominant theme Wednesday as Gilts and Bunds extended their yield drop to a 7th consecutive session.

- Bunds and Gilts opened firmer, owing partly to the overnight unwind of reflationary trades after Wednesday night's US presidential debate boosted VP Harris's bookmaker-implied winning probability. Softer than expected UK activity data also contributed.

- The key event was US CPI, the core component of which came in well above expectations. Coming against the backdrop of next week's Fed decision, this all but priced out a 50bp cut in favour of 25bp.

- That initially saw short-end yields back up to session highs as global central bank cuts were priced out. But concerns over the broader macro impact of relatively tighter monetary policy won out in the end, ultimately helping revive the ongoing global growth slowdown-related bid for bonds.

- European yields tested the August lows. On the day, Gilts outperformed Bunds, with both curves seeing bull steepening.

- Periphery spreads narrowed slightly, led by GGBs and BTPs.

- Thursday's highlight is the ECB decision - a 25bp cut is unanimously expected and fully priced in - MNI's preview is here (PDF).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.6bps at 2.152%, 5-Yr is down 2.2bps at 1.971%, 10-Yr is down 1.9bps at 2.112%, and 30-Yr is down 1.1bps at 2.395%.

- UK: The 2-Yr yield is down 6.9bps at 3.791%, 5-Yr is down 7bps at 3.615%, 10-Yr is down 5.8bps at 3.761%, and 30-Yr is down 2.6bps at 4.372%.

- Italian BTP spread down 2.2bps at 143bps / Greek down 2.2bps at 102.7bps

FOREX: Volatile Swings Post US CPI, Daily Adjustments Contained

- The USD index tilts very marginally stronger on Wednesday, reflective of the higher front-end US yields, however, the small 0.1% move does not tell the entire story of an extremely volatile session for currencies, and namely the Japanese Yen.

- A lot of the action came before the US data with the US election debate and BOJ comments helping USDJPY print fresh lows on the year at 140.70, with narrowing yield differentials underpinning the move.

- Since then, a strong recovery ahead of and following the higher-than-expected US data saw USDJPY reach as high as 142.54 and subsequent volatile swings for both US yields and equities have prompted multiple 100 pip swings for the pair.

- The late recovery for major equity benchmarks to close to unchanged levels on the session (Nasdaq has risen 1%) has assisted USDJPY back above 142.00 as we approach the APAC crossover. 140.25, the Dec 28 low from last year remains key support and resistance is not seen until 143.71, the Sep 9 high.

- Ahead of tomorrow’s ECB, there has been similar price action for EURJPY which has yet to breach the lows seen in early August. As noted earlier, yield differentials with Japan continue to narrow and this is helping to underpin the bearish theme for the cross. Key support and the bear trigger at 154.42, the Aug 5 low.

- Elsewhere, CHF (-0.4%) has underperformed G10 peers, although weakness for the likes of GBP, AUD, CAD and NZD has also been evident, all falling around 0.3% against the dollar.

- As well as the ECB decision/presser, US PPI and jobless claims data will highlight Thursday’s docket.

Late Equities Roundup: IT Leads Stocks Off Early Lows

- Stocks continued to climb off post-data/mid-morning lows. The DJIA catching up with S&P Eminis and Nasdaq indexes late as Information Technology sector shares leavened weaker Financial and Energy sectors.

- Banks had led Wednesday morning's sell-off following an unexpected gain in Core CPI inflation data that saw projected rate cuts scale back chances of a 50bp move at next week's FOMC policy announcement.

- Currently, the DJIA trades up 27.81 points (0.07%) at 40765.47, S&P E-Minis up 35 points (0.64%) at 5539. Nasdaq up 280.9 points (1.6%) at 17306.58.

- Information Technology and Consumer Discretionary sector shares led gainers, renewed demand for high-end AI chips helped First Solar rally 14.66%, Super Micro +6.49% while Nvidia climbed 6.3%. Cruise lines buoyed the Consumer Discretionary sector: Norwegian +5.01%, Royal Caribbean +2.34%.

- On the flipside, banks, insurance and financial services weighed on the Financial sector for the second day running amid ongoing concerns over interest income and credit challenges for lenders: Travelers -2.74%, Brown & Brown -2.67%, Chubb -2.48%.

- Despite a bounce in crude following Tuesday's rout, Energy sector shares continued to lag amid ongoing surplus overhang concerns: Marathon Petroleum -2.92%, Valero -2.64%, Diamondback Energy -2.02%.

EQUITY TECHS: E-MINI S&P: (U4) Bearish Corrective Cycle Still In Play

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and key resistance

- RES 1: 5669.75 High Sep 3 and a bull trigger

- PRICE: 5545.50 @ 1525ET Sep 11

- SUP 1: 5394.00 Low Sep 6

- SUP 2: 5367.50 Low Aug 13

- SUP 3: 5330.00 61.8% retracement of the Aug 5 - Sep 3 bull leg

- SUP 4: 5249.74 76.4% retracement of the Aug 5 - Sep 3 bull leg

A corrective bearish cycle in S&P E-Minis remains in play, despite this week’s recovery. Scope is seen for a deeper retracement near-term and an extension lower would open 5330.00, 61.8% retracement of the Aug 5 - Sep 3 bull leg. For bulls, key resistance has been defined at 5669.75, the Sep 3 high. Initial firm resistance to watch is 5535.19, the 20-day EMA. A breach of the average would be an early bullish signal.

COMMODITIES: Crude Rebounds, Spot Gold Remains Steady

- WTI has rebounded today and is closing with strong gains after yesterday’s plunge to the lowest since 2021.

- WTI Oct 24 is up 2.6% at $67.5/bbl.

- WTI futures remain in a bearish condition and a continuation lower would open $63.93 next, a Fibonacci projection point, ahead of the psychological $60.00 handle. Firm resistance is at $71.58, the 20-day EMA.

- Henry Hub is continuing its recovery seen yesterday as the market assesses the impact of Hurricane Francine on operations the Gulf Coast.

- US Natgas Oct 24 is up 1.9% at $2.27/mmbtu.

- Spot gold has dipped by 0.2% to $2,513/oz today, having earlier in the session risen briefly to a peak of $2,529, close to last month’s record high.

- Although gold continues to trade inside a range, the trend condition is unchanged and the primary direction remains up. Sights are on $2,536.4 next, a Fibonacci projection.

- Meanwhile, copper has rebounded by 1.5% to $416/lb.

- In Chile, copper commission Cochilco said that BHP’s Escondida copper mine, the world’s largest, saw production rise 29% y/y in July.

- With a bear cycle in copper still intact, focus remains on initial support at $396.45, the Aug 7 low. On the upside, attention is on the 50-day EMA at $423.03.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 12/09/2024 | 0600/0800 | *** |  | Inflation Report |

| 12/09/2024 | 0700/0900 | *** |  | HICP (f) |

| 12/09/2024 | - |  | OBR Fiscal Risks and Sustainability Report | |

| 12/09/2024 | 1215/1415 | *** |  | ECB Deposit Rate |

| 12/09/2024 | 1215/1415 | *** |  | ECB Main Refi Rate |

| 12/09/2024 | 1215/1415 | *** |  | ECB Marginal Lending Rate |

| 12/09/2024 | 1230/0830 | *** |  | Jobless Claims |

| 12/09/2024 | 1230/0830 | ** |  | WASDE Weekly Import/Export |

| 12/09/2024 | 1230/0830 | *** |  | PPI |

| 12/09/2024 | 1230/0830 | * |  | Building Permits |

| 12/09/2024 | 1230/0830 | * |  | Household debt-to-income |

| 12/09/2024 | 1245/1445 |  | ECB Monetary Policy Press Conference | |

| 12/09/2024 | 1345/1545 |  | Eurosystem staff macroeconomic projections publications | |

| 12/09/2024 | 1415/1615 |  | ECB Podcast: Lagarde presents the latest monetary policy decisions | |

| 12/09/2024 | 1430/1030 | ** |  | Natural Gas Stocks |

| 12/09/2024 | 1600/1200 | *** |  | USDA Crop Estimates - WASDE |

| 12/09/2024 | 1700/1300 | *** |  | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.