-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Core Services Inflation Uncertain

EXECUTIVE SUMMARY

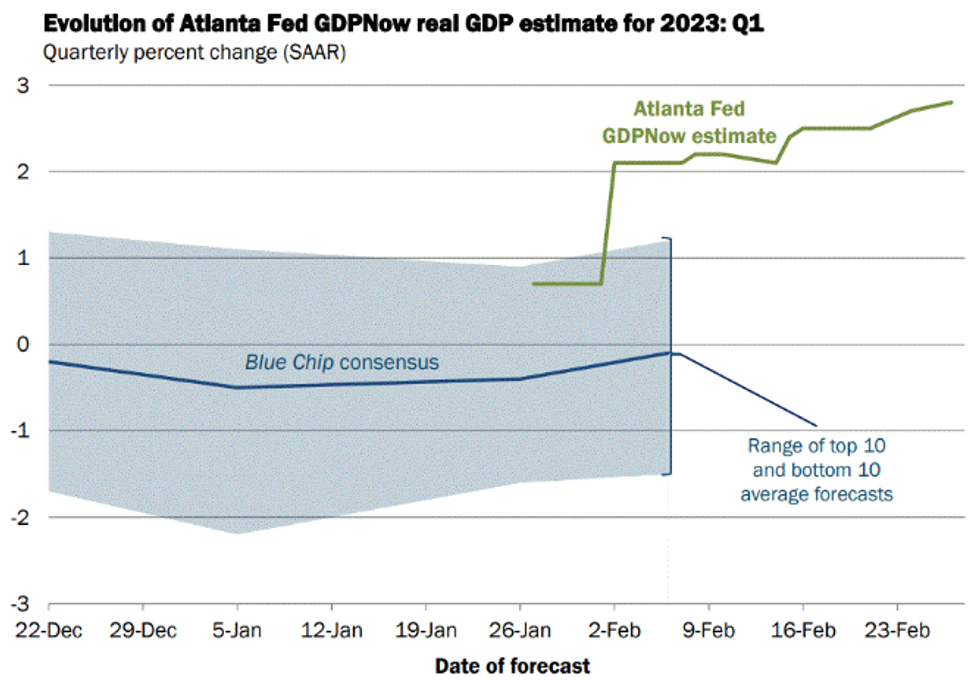

Atlanta Fed GDPNow Estimate Inches Higher

Atlanta Fed's latest GDPNow model estimate for real GDP growth in the first quarter of 2023 climbs to 2.8% from 2.7% prior. "After this morning's Advance Census Manufacturing report from the US Census Bureau, the nowcast of first-quarter real gross private domestic investment growth increased from -5.3 percent to -5.1 percent."

US

FED: Core goods and housing services inflation are likely to slow, but the trend of inflation in core services excluding housing is "uncertain," Fed Governor Philip Jefferson said Monday.

- "In summary, core goods inflation has started to come down. Several indicators suggest that housing services inflation is likely to come down in the coming months. There is more uncertainty surrounding inflation in core services excluding housing. Over time, we’ll learn more about inflation dynamics in this sector," he said in remarks prepared for a Harvard University lecture.

- Fed Chair Jerome Powell has noted core services excluding housing prices are strongly tied to the strength of the labor market and seeing those categories slow will be key in bringing inflation back to target.

- Food inflation has slowed somewhat while energy prices have fallen noticeably, Jefferson added. But "because energy prices are shaped primarily by global developments and not by U.S. monetary policy, there is a lot of uncertainty about the future course of energy inflation." For more see MNI Policy main wire at 1030ET.

FED: A new era of global shortages including of commodities and productive workers will require permanently higher central bank interest rates, former top BIS and OECD official Bill White told MNI.

- Governments could add to instability if they advance spending plans that fuel underlying inflation pressures or financial instability, he said on MNI’s FedSpeak podcast.

- In the short term, the U.S. Federal Reserve needs to push interest rates well above their projected endpoint of about 5.1%, White said. More permanent frictions in the global economy will challenge all central banks under their current inflation-targeting frameworks, he said.

- “Short term rates will have to rise higher than people currently anticipate, 5.5 for the Fed and 3.5 for the ECB, won’t be enough,” White said. “This may be a longer-run haul than you think, so it may not only be higher than you think, but it may be longer than you think.”

FED: Former Kansas City Fed President Thomas Hoenig told MNI the U.S. central bank might need to raise interest rates more than investors expect because demand remains strong and monetary policy is still loose compared with the rate of inflation.

- The FOMC will hike rates at least twice more in quarter-point increments, but might need to go even further if the data do not cooperate -- particularly on employment, Hoenig said.

- “If they get strong jobs numbers continually then they probably will have to push rates higher than people had anticipated and increase the risk of a downturn,” he said. “Now that the market is more convinced that inflation is more embedded than even it thought, the Fed is going to have to be determined if they’re going to hold on to their credibility.” For more see MNI Policy main wire at 1534ET.

US TSYS: Tsy 2s Off Contract Lows

Tsy futures continue to bob around session highs after the bell, holding narrow range since rates bounced post Durables/Cap-Goods. Heavy spate of corporate debt issuance (over $19B over 17 names) provided two way hedging across the curve.

FI markets gained

- Rates gained earlier after larger drop in Jan durables new orders (-4.5% vs. -4.0%; Dec revised +5.1%) then scaled back from session highs following Pending Home Sales read for Jan at 82.5 up from 76.3 in Dec, +8.1 MoM well over 1.0% estimate. Futures reluctant to recede very far from session highs, however, 30YY 3.9097% (-.0194). Some technical buying in the mix as rates move off contract lows (TUH3 101-17.75 vs. 101-22.38 last).

- STIR: Fed funds implied hike for Mar'23 at 29.8bp, May'23 cumulative 55.8bp (-1.4) to 5.138%, Jun'23 73.2bp (-1.9) to 5.312%, terminal at 5.395-5.400 in Aug'23-Oct'23 (5.41-5.415% prior).

- Tuesday focus: Adv Goods, Wholesale Inv and MNI Chicago PMI.

OVERNIGHT DATA

- US JAN DURABLE NEW ORDERS -4.5%; EX-TRANSPORTATION +0.7%

- US DEC DURABLE GDS NEW ORDERS REV TO +5.1%

- US JAN NONDEF CAP GDS ORDERS EX-AIR +0.8% V DEC -0.3%

- Link to US Census

- US JAN. PENDING HOME SALES FALL 22.4% FROM PREVIOUS YEAR

- US FEB. DALLAS FED MANUFACTURING INDEX -13.5; EST. -9.3

- US FEB. DALLAS FED GENERAL BUSINESS ACTIVITY AT -13.5

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 52.22 points (0.16%) at 32868.66

- S&P E-Mini Future up 9.75 points (0.25%) at 3985.25

- Nasdaq up 64.5 points (0.6%) at 11459.08

- US 10-Yr yield is down 2.1 bps at 3.9219%

- US Mar 10-Yr futures are up 6.5/32 at 111-4

- EURUSD up 0.0058 (0.55%) at 1.0606

- USDJPY down 0.23 (-0.17%) at 136.25

- WTI Crude Oil (front-month) down $0.67 (-0.88%) at $75.61

- Gold is up $5.75 (0.32%) at $1816.75

- EuroStoxx 50 up 69.19 points (1.66%) at 4248.01

- FTSE 100 up 56.45 points (0.72%) at 7935.11

- German DAX up 171.69 points (1.13%) at 15381.43

- French CAC 40 up 108.28 points (1.51%) at 7295.55

US TREASURY FUTURES CLOSE

- 3M10Y +0.714, -88.001 (L: -98.242 / H: -87.523)

- 2Y10Y +0.55, -87.104 (L: -90.113 / H: -85.31)

- 2Y30Y +1.475, -87.414 (L: -92.284 / H: -84.868)

- 5Y30Y +3.025, -25.577 (L: -30.953 / H: -23.714)

- Current futures levels:

- Mar 2-Yr futures up 0.625/32 at 101-21.25 (L: 101-17.75 / H: 101-22.75)

- Mar 5-Yr futures up 4.5/32 at 106-20.5 (L: 106-10.5 / H: 106-24)

- Mar 10-Yr futures up 6.5/32 at 111-4 (L: 110-23 / H: 111-10.5)

- Mar 30-Yr futures up 9/32 at 124-5 (L: 123-14 / H: 124-17)

- Mar Ultra futures up 11/32 at 134-17 (L: 133-10 / H: 135-03)

US 10YR FUTURE TECHS: (H3) Trend Needle Points South

- RES 4: 113-26 High Feb 9

- RES 3: 113-09 50-day EMA

- RES 2: 112-19+ 20-day EMA

- RES 1: 111-19 High Feb 24

- PRICE: 111-02+ @ 16:19 GMT Feb 27

- SUP 1: 110-21 Low Feb 24

- SUP 2: 110-07 Lower 2.0% Bollinger Band

- SUP 3: 110-00 Round number support

- SUP 4: 109-22/19 Low Nov 3 / 2.0% 10-dma envelope

Treasury futures remain in a clear downtrend and price is trading close to recent lows. Last week’s extension lower maintains the current bearish sequence of lower lows and lower highs. Potential is seen for a move towards the 110.00 handle and support at 109-22, the Nov 3 low. Moving average studies are in a bear mode position, highlighting current market sentiment. Initial resistance is seen at 111-19, the Feb 24 high.

EURODOLLAR FUTURES CLOSE

- Mar 23 steady00 at 94.925

- Jun 23 steady00 at 94.480

- Sep 23 -0.005 at 94.330

- Dec 23 -0.005 at 94.480

- Red Pack (Mar 24-Dec 24) -0.015 to +0.025

- Green Pack (Mar 25-Dec 25) +0.040 to +0.055

- Blue Pack (Mar 26-Dec 26) +0.065 to +0.070

- Gold Pack (Mar 27-Dec 27) +0.045 to +0.060

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00528 to 4.55643% (+0.00485 total last wk)

- 1M +0.02714 to 4.66200% (+0.04357 total last wk)

- 3M +0.00900 to 4.96243% (+0.03814 total last wk)*/**

- 6M +0.03600 to 5.27114% (-0.00786 total last wk)

- 12M +0.05272 to 5.69143% (-0.00415 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $109B

- Daily Overnight Bank Funding Rate: 4.57% volume: $298B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.122T

- Broad General Collateral Rate (BGCR): 4.51%, $456B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $442B

- (rate, volume levels reflect prior session)

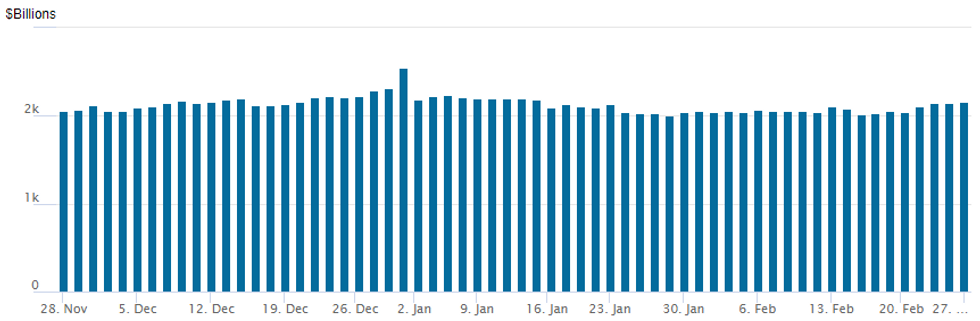

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,162.435B w/ 110 counterparties vs. prior session's $2,142.141B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

$19.65B to Price Monday From 17 Issuers; BoE 3Y Rolled to Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 02/27 $2B #John Deere $500M 2Y +40, $550M 3Y +55, $300M 3Y SOFR+57, $650M 5Y +75

- 02/27 $2B #NatWest $1B 4NC3 +135, $1B 11NC10 +210

- 02/27 $1.8B #Fiserv $900M each: 5Y +130, 10Y +170

- 02/27 $1.5B #Williams Cos $750M 3Y +93, $750M 10Y +175

- 02/27 $1.5B #Colgate-Palmolive $500M each: 3Y +33, 5Y +45, 10Y +70

- 02/27 $1.35B #PPL Electric $600M 10Y +120, $750M 30Y +145

- 02/27 $1.25B #Humana $500M 3NC1 +120, $750M 30Y +180

- 02/27 $1.25B #Lloyds 6NC5 +170

- 02/27 $1.2B #DTE Electric $600M each: 10Y +130, 30Y +148

- 02/27 $1.2B #SoCal Edison $750M 5Y +115, $450M 30Y +180

- 02/27 $950M #Arthur J Gallagher $350M 10Y +160, $600M 30Y +190

- 02/27 $850M #American Electric Power 10Y +175

- 02/27 $850M #American Electric 10Y +175

- 02/27 $600M #Air Products 10Y +90

- 02/27 $550M *Vulcan Materials 3NC1 +130

- 02/27 $500M #Union Electric WNG 30Y +155

- 02/27 $500M #Arrow Electronics 3NC1 +163

- 02/27 $Benchmark Teva Pharmaceuticals investor calls ($500M each 6.5Y, 8.5Y in addition to EUR issuance)

- Expected to launch Tuesday:

- 02/28 $Benchmark Bank of England 3Y +16a

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/02/2023 | 0030/1130 |  | AU | Balance of Payments: Current Account | |

| 28/02/2023 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2023 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 28/02/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 28/02/2023 | 0745/0845 | ** |  | FR | PPI |

| 28/02/2023 | 0745/0845 | *** |  | FR | GDP (f) |

| 28/02/2023 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2023 | 1015/1015 |  | UK | BOE Treasury Select Committee hearing: The crypto-asset industry | |

| 28/02/2023 | 1215/1215 |  | UK | BOE Pill Closes BEAR Research Conference | |

| 28/02/2023 | 1230/1230 |  | UK | BOE Mann Panellist at EIB Forum | |

| 28/02/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 28/02/2023 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 28/02/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/02/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/02/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/02/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/02/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/02/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/02/2023 | 1930/1430 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.