-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: CPI Miss Green Lights Fall Rate Cuts

- MNI US Inflation Insight, Jul'24: Summer Progress Means September Cut

- MNI FED BRIEF: Fed's Musalem: Interest Rates Likely To Be 3.5%-4% Over Long Run

- MNI FED BRIEF: SF Daly Says Fed Adjustments Warranted At Some Point

- MNI US DATA: CPI Miss Driven By Comprehensively Slower Services Inflation

- MNI US DATA: A Rare Week With Both Initial And Continuing Claims Lower Than Expected

- MNI US DATA: Back-to-Back CPI Supercore Deflation In June

US

US Inflation Insight (MNI) Jul'24: Summer Progress Means September Cut

June’s CPI data was softer than any analyst estimate foresaw, and will provide Fed policymakers further confidence that the spike in inflationary readings earlier this year has given way to renewed disinflation. The breadth and depth of the “miss” was fairly impressive. Closely-eyed “supercore” (ex-housing services) CPI has now printed negative M/M for 2 consecutive months for the first time since 2021.

FED BRIEF (MNI): Fed's Musalem: Interest Rates Likely To Be 3.5%-4% Over Long Run

The Federal Reserve's benchmark overnight interest rate is likely to be in a 3.5%-4% range over the long run, St. Louis Fed President Alberto Musalem said Thursday. Both macro models and market pricing suggest "interest rates need to be a little higher now than they were before the pandemic," he told a business forum in Little Rock, Ark. Investments in AI, reshoring and green energy as well as higher projected fiscal deficits over the next 10 years support this belief, he said. The target fed funds rate is currently in a 5.25%-5.5% range, and FOMC officials last month projected it to fall to 2.4% to 3.8% over the long run.

FED BRIEF (MNI): Daly Says Fed Adjustments Warranted At Some Point

San Francisco Fed President Mary Daly said Thursday that policy "adjustments" appear to be warranted at some point because the central bank's dual mandate goals are coming into better balance, while saying the exact timing of a move is less important than keeping the economy on track. “I don’t see any evidence at this point that policy is not restrictive,” Daly said on a call with reporters, adding the thinking now is more about making sure the economy isn’t “too bridled.”

NEWS

US (MNI): Dem Statements Calling On Biden To Step Aside Could Come After NATO Presser

US President Joe Biden is scheduled to deliver a press conference to conclude the NATO Summit at the revised time of 18:30 ET 23:30. (Livestream) It is possible that a fresh wave of public statements from Democrat lawmakers calling on Biden to withdraw from the 2024 presidential race could come after the presser, regardless of his performance. Former House Speaker Nancy Pelosi (D-CA), while strongly signaling that Biden should withdraw, yesterday noted Dem lawmakers should, "hold off" until after the NATO summit.

ISRAEL (MNI): Netanyahu 'Committed To Ceasefire Framework':

Wires carrying comments from PM Benjamin Netanyahu speaking on the Israel-Hamas ceasefire proposal and Gaza. Says that he is 'committed to the ceasefire framework', but that 'Hamas is sticking to demands that contradict the ceasefire deal framework'. Adds that 'We will not stop the Gaza war until all its goals are reached'.

US TSYS June CPI Inflation Miss Rekindles Rate Cut Pricing, Little Fed Pushback

- Treasury futures gapped higher after June CPI inflation data came out lower than expected, curves bull steepened as rate cut pricing into year end gained momentum.

- Supercore (services ex-housing) inflation printed negative again, at -0.05% (-0.04% prior), vs +0.27% expected, for the first back-to-back deflations since Aug-Sep 2021 (the lowest analyst expectation we'd seen was Nomura's +0.15%). Overall core services printed just +0.13%, vs +0.32% MNI avg (and 0.22% May), the lowest since August 2021.

- Overshadowed by the surprisingly soft CPI report, jobless claims data offered the first week since early May with both initial and continuing claims coming in lower than expected.

- Little pushback from the Fed: San Francisco Fed President Mary Daly said Thursday that policy "adjustments" appear to be warranted at some point because the central bank's dual mandate goals are coming into better balance, while saying the exact timing of a move is less important than keeping the economy on track.

- Treasury support waned slightly after the $22B 30Y auction reopen (912810AU4) tailed 2.1bp: 4.405% high yield vs. 4.384% WI; 2.30x bid-to-cover vs. 2.49x in the prior month.

- Focus turns to Friday's June PPI and UofM Sentiment and the start of the latest equity earnings cycle: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup headlining.

OVERNIGHT DATA

US DATA (MNI): Back-to-Back CPI Supercore Deflation In June

Core services excl OER & primary rents ('supercore'): -0.052% M/M after -0.042%. Latest 3mth av of 0.109%

- Core services excl all shelter: 0.028% M/M after -0.024%. Latest 3mth av of 0.152%

- Analyst estimates we had seen had averaged 0.27% M/M, ranging from 0.15 to 0.4

US DATA (MNI): CPI Miss Driven By Comprehensively Slower Services Inflation

Breaking down the reasons for June's CPI miss (no analyst of 23 previews we'd read expected under +0.1% core) - it's pretty comprehensive across the board:

- Supercore (services ex-housing) inflation printed negative again, at -0.05% (-0.04% prior), vs +0.27% expected, for the first back-to-back deflations since Aug-Sep 2021 (the lowest analyst expectation we'd seen was Nomura's +0.15%).

- Overall core services printed just +0.13%, vs +0.32% MNI avg (and 0.22% May), the lowest since August 2021.

- As noted, housing inflation had been expected to slow but the drop was much bigger than expected: OER rose just 0.28% (+0.38% expected,+ 0.43% prior), with tenant rents +0.26% (+0.34% exp., +0.39% prior). Those readings are back to early 2021 levels.

- The soft supercore reading comes despite auto insurance snapping back higher as had been expected (+0.92% v +0.80% exp, -0.12% prior).

- Lodging (-2.0% vs -0.8% exp, -0.1% prior) and airfares (-5.0% vs -1.1% exp, -3.6% prior) were much weaker than expected. Medical care services were soft at 0.17%, half of May's rate and the lowest since Feb.

US DATA (MNI): Core Goods Above-Expected, But Headline Weakest Since Pandemic

Conversely to core services, core goods inflation actually came in a little higher than expected but still in deflationary territory for the 4th consecutive month and the 12th in 13 (-0.12% vs expected -0.18% MNI avg, -0.04% in May).

- Apparel bounced back from deflation in May (-0.3%) to +0.1% with new vehicle price deflation moderating slightly (-0.2% from -0.5%). Used cars deflated a little more than expected though at -1.5%.

- Headline at -0.06% was unexpectedly low (+0.08% expected, +0.01% prior) and in deflation for the first time since July 2022 - and the weakest M/M print since April 2020.

- Food prices were a little punchier than expected at +0.24% (+0.14% expected/prior), with food away from home printing +0.4% for a 2nd consecutive month - but that was offset in headline by energy pulling back more than expected (-2.04% vs -1.6% exp, -2.03% prior

US DATA (MNI): A Rare Week With Both Initial And Continuing Claims Lower Than Expected

Overshadowed by the surprisingly soft CPI report, jobless claims data offered the first week since early May with both initial and continuing claims coming in lower than expected.

- Only being one week of a downward surprise, it leaves a trend of steady push higher in those claiming for unemployment insurance in a sign of a continued gradual rebalancing in the labor market.

- Initial claims fell to a seasonally adjusted 222k (cons 235k) in the week to Jul 6 after a slightly upward revised 239k (initially 238k).

- The four-week average fell from the prior week’s fresh recent high of 239k (highest since late Aug 2023) to 234k, still a notable upward trend from the 210k in April and recent low of 201k in Jan.

- Continuing claims meanwhile fell to a seasonally adjusted 1852k (cons 1860k) in the week to Jul 6 after a slightly downward revised 1856k (initially 1858k).

- It leaves a small pullback for continuing claims after they pushed to their highest since Nov 2021.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 32.39 points (0.08%) at 39753.75

- S&P E-Mini Future down 49.5 points (-0.87%) at 5638.25

- Nasdaq down 364 points (-2%) at 18283.41

- US 10-Yr yield is down 8 bps at 4.2043%

- US Sep 10-Yr futures are up 18.5/32 at 111-2.5

- EURUSD up 0.0036 (0.33%) at 1.0866

- USDJPY down 2.86 (-1.77%) at 158.83

- WTI Crude Oil (front-month) up $0.99 (1.21%) at $83.08

- Gold is up $43.5 (1.83%) at $2414.76

- European bourses closing levels:

- EuroStoxx 50 up 17.27 points (0.35%) at 4976.13

- FTSE 100 up 29.83 points (0.36%) at 8223.34

- German DAX up 127.34 points (0.69%) at 18534.56

- French CAC 40 up 53.58 points (0.71%) at 7627.13

US TREASURY FUTURES CLOSE

- 3M10Y -5.302, -114.517 (L: -119.956 / H: -108.162)

- 2Y10Y +2.928, -30.87 (L: -36.45 / H: -30.676)

- 2Y30Y +4.58, -9.951 (L: -17.632 / H: -8.596)

- 5Y30Y +3.679, 27.443 (L: 21.562 / H: 29.946)

- Current futures levels:

- Sep 2-Yr futures up 7.25/32 at 102-15.625 (L: 102-07.25 / H: 102-17.125)

- Sep 5-Yr futures up 14.25/32 at 107-12.5 (L: 106-28 / H: 107-17.5)

- Sep 10-Yr futures up 18.5/32 at 111-2.5 (L: 110-13 / H: 111-10.5)

- Sep 30-Yr futures up 29/32 at 119-21 (L: 118-16 / H: 120-11)

- Sep Ultra futures up 1-06/32 at 127-2 (L: 125-16 / H: 127-31)

US 10Y FUTURE TECHS: (U4) Bull Cycle Resumes

- RES 4: 112-25 High Mar 8

- RES 3: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-13 High Mar 25

- RES 1: 111-10+ Intraday high

- PRICE: 111-05 @ 1500 ET Jul 11

- SUP 1: 110-04+/109-28+ 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-22+ Trendline drawn from the Apr 25 low

Treasuries have rallied today, confirming an extension of the bull cycle that started Jul 1. The move higher has resulted in a breach of resistance at 111-01, the Jun 14 high. This cancels a recent bearish threat and instead signals scope for an bullish continuation with the focus on 111-13 next, the Mar 25 high. Clearance of this hurdle would open 111-31, a Fibonacci projection. Initial firm support is at 110-04+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.070 at 94.945

- Dec 24 +0.105 at 95.310

- Mar 25 +0.140 at 95.670

- Jun 25 +0.160 at 95.965

- Red Pack (Sep 25-Jun 26) +0.130 to +0.155

- Green Pack (Sep 26-Jun 27) +0.10 to +0.125

- Blue Pack (Sep 27-Jun 28) +0.085 to +0.095

- Gold Pack (Sep 28-Jun 29) +0.070 to +0.080

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00007 to 5.32880 (+0.00137/wk)

- 3M -0.00272 to 5.30137 (-0.00552/wk)

- 6M -0.00883 to 5.20508 (-0.02139/wk)

- 12M -0.01435 to 4.94460 (-0.06089/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $1.949T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $767B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $745B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $257B

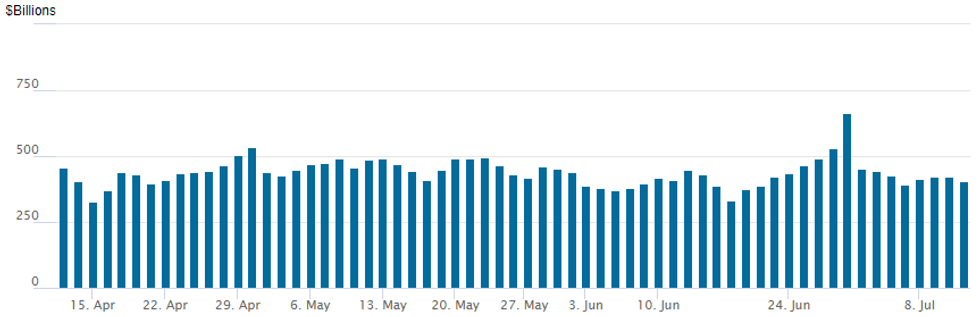

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $403.708B from $422.147B on Wednesday. Number of counterparties: 71 from 76 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE

No new corporate debt issued Thursday after $7.75B priced Wednesday, $30.25B total on the week. The start of latest earnings cycle tomorrow is keeping issuers sidelined.

- Date $MM Issuer (Priced *, Launch #)

- 7/10 $6B *Saudi Aramco $2B each: 10Y +105, 30Y +145, 40Y +155

- 7/10 $1.25B *Banque Federative du Credit Mutuel (BFCM) $750M 3.5Y +80, $500M 3.5Y SOFR+107

- 7/10 $500M *Mitsubishi 10Y +93

EGBs-GILTS CASH CLOSE: Soft US CPI Drives European Bull Steepening

European curves bull steepened Thursday as a downside US inflation surprise drove a dovish repricing in central bank cut expectations.

- With the highly anticipated US June CPI release coming in softer than expected, global FI rallied sharply in the European afternoon session.

- Earlier in the session, Gilts had weakened after firmer-than-expected UK GDP data, and follow-through from hawkish rhetoric late Wednesday from BoE's Pill and Mann.

- Bunds outperformed Gilts on the day, with both the UK and German curves bull steepening.

- In sympathy with US Fed cut repricing, an August BoE cut is now back to around a 50/50 proposition, vs closer to 40% pre-CPI. While the ECB still isn't seen moving at its meeting next week, September cumulative cut pricing pushed up to close to 90%, vs under 80% pre-US CPI.

- The 10Y OAT/Bund spread reversed early tightening to close basically flat. Periphery EGB spreads closed mixed and little changed overall.

- Friday's European calendar sees few impactful events (final French and Spanish inflation), with US inflation data (PPI) once again likely to be at the fore.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10.5bps at 2.792%, 5-Yr is down 8.7bps at 2.439%, 10-Yr is down 7bps at 2.463%, and 30-Yr is down 3.7bps at 2.658%.

- UK: The 2-Yr yield is down 5.5bps at 4.068%, 5-Yr is down 5.8bps at 3.922%, 10-Yr is down 5.2bps at 4.074%, and 30-Yr is down 4.7bps at 4.589%.

- Italian BTP spread unchanged at 132.1bps / Spanish bond spread up 0.6bps at 76.9bps

FOREX USDJPY Plummets Post Soft US CPI, Potential Intervention Exacerbates Decline

- Despite the broad-based greenback weakness in the aftermath of the weaker-than-expected US CPI report for June, all the focus is on the Japanese Yen. Market speculation is that the Bank of Japan may have intervened in the currency given the aggressive moves following the data.

- USDJPY had initially sold off around 90 pips following the release from 161.58 to 160.65. However, shortly after the data release, USDJPY took a very aggressive next leg lower, printing as low as 157.44 in short order before stabilising. The pair is 1.9% lower on the session.

- Lower core yields and a positioning squeeze will have undoubtedly been working in favour of the Japanese yen, however, the relative outperformance and subsequent commentary from Japanese officials point to the high likelihood of central bank intervention. For reference, Japan’s Kanda said recent moves are not reflecting fundamentals and are not stable, without giving an explicit reference to the MOF taking action.

- The pair has traded through the 20-day EMA and this exposed the next important support at 158.11, the trendline drawn from the Dec 28 low last year. The line has been pierced, a clear break is required to highlight a potential reversal. This would open 156.83, a Fibonacci retracement.

- Elsewhere, the USD index sits 0.6% in the red, and the likes of EURUSD and GBPUSD are holding onto moderate gains as we approach the APAC crossover. EURGBP continues to edge further away from 0.8500, underpinning the bearish technical conditions. Below here, 0.8397, the Jun 14 low represents the bear trigger.

- China trade data is due overnight, before US PPI and prelim UMich sentiment and inflation expectations data round off the week’s calendar.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 12/07/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 12/07/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/07/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/07/2024 | - | *** |  | CN | Trade |

| 12/07/2024 | - | *** |  | CN | Money Supply |

| 12/07/2024 | - | *** |  | CN | New Loans |

| 12/07/2024 | - | *** |  | CN | Social Financing |

| 12/07/2024 | 1230/0830 | *** |  | US | PPI |

| 12/07/2024 | 1230/0830 | * |  | CA | Building Permits |

| 12/07/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 12/07/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 12/07/2024 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.