-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: CPI Underscores Fed Resolve to Hold Rate Steady

- MNI BRIEF: US Budget Deficit Expands To USD828B Through Feb

- MNI INTERVIEW: June Cut Not Done Deal - ECB's Holzmann

- MNI US DATA: Breadth of Inflationary Pressures Holds Most Of January Surge

- MNI US DATA: February CPI Report Unlikely To Give FOMC Greater Confidence On Inflation Returning To 2%

US

US DATA (MNI): February CPI Report Unlikely To Give FOMC Greater Confidence On Inflation Returning To 2%: Headline and core CPI inflation both came in at 0.4% M/M in February, headline rounded down from 0.44% (cons 0.4) vs core rounded up from 0.36% M/M (cons 0.3).

- The main upside came from used car prices surprisingly increasing 0.5% (analyst av -1%, the difference adding ~0.04pps to core CPI vs expectations) and airfares increasing 3.6% (analyst av +1.2%, worth ~0.02pps vs expectations).

- Rents as expected on balance: There wasn’t a major surprise from OER, coming in at the lower end of analyst expectations at 0.44% M/M as it pulled back from the 0.56% in Jan to equal the average pace seen in Q4. Rent of primary residence inflation offset OER being on the lower side, with its 0.46% M/M above any estimate we’d seen and the strongest since Oct.

- Supercore still strong but with softer details: the 0.47% M/M was within the wide range of analyst estimates (0.39-0.62) after a particularly strong 0.85% M/M. However, this is boosted by the above airfares strength whilst we noted earlier weakness is some heavily weighted components.

- Broader core goods as expected: Outside of used vehicles, core goods price developments were largely as expected at 0.06% M/M and mean that the positive overall core goods outturn was not particularly alarming from a disinflationary perspective. This appears consistent with a return to a more neutral setting for global supply chain pressures.

- With those caveats aside, it’s another strong CPI report even if it doesn’t match the strength seen in January. Further, our estimate of dispersion across 57 items over the entire CPI basket saw relatively limited moderation considering the sharp increase in the breadth of inflationary pressure in January.

- Six-month run rates for both core and supercore CPI increased three months to 3.9% and a particularly eye-catching 5.9% annualized. PPI details will be important here for honing PCE estimates, and we expect a continued large wedge between the two, but this CPI report is unlikely to give the FOMC “greater confidence” that inflation is set for a sustainable return to 2%.

NEWS

US (MNI): Rep Buck To Depart Congress At End Of Week In Major Blow House GOP Majority: Republican House Representative Ken Buck (R-CO) has announced on X that he will retire from Congress at the end of the next week. Buck had previously announced his intention to retire from Congress in November, but see out his term.

SECURITY (MNI): McConnell Urges Speaker Johnson To Hold Vote On Foreign Aid Package: Senate Minority Leader Mitch McConnell (R-KY) has again urged House Speaker Mike Johnson (R-LA) to hold a vote on the Senate-passed foreign aid package will includes new funds for Ukraine, Israel, and Taiwan. McConnell: “I want to encourage the speaker to allow a vote so that the House can speak.”

BRIEF (MNI): US Budget Deficit Expands To USD828B Through Feb: The U.S. government has racked up a USD828 billion budget deficit in the first five months of fiscal year 2024, up USD105 billion dollars relative to the same time period in the previous fiscal year, the Treasury Department reported Tuesday.

INTERVIEW (MNI): June Cut Not Done Deal - ECB's Holzmann: The European Central Bank is more likely to cut rates in June than April, but cuts will depend on inflation projections being confirmed, the governor of the Austrian National Bank told MNI in an interview, stressing that wage data and geopolitical risk are key and that the ECB should remain data-dependent.

UKRAINE (MNI): EU Nears Agreement On EUR5bn Aid Package-FT: The FT is reporting that the EU could sign off on an EUR5bn military aid package for Ukraine as soon as 13 March. The reportclaims that according to four officials briefed on discussions the deal "...unlocks fresh cash for the reimbursement of supplies to Kyiv by EU countries.

SWEDEN (MNI): PM-We Will Look To Reinforce Gotland To Boost Baltic Security: In an interview with the FT following Sweden's formal accession to NATO, PM Ulf Kristersson states that "...bolstering Gotland, an island viewed by defence experts and military officials as the most strategic location in the Baltic Sea, would be in the first slew of items to discuss with Nato partners."

NATO (MNI): Romanian President Iohannis Confirms Run For Secretary-General Role: Romanian President Klaus Iohannis has confirmed that he intends to seek the role of NATO secretary general, with incumbent Jens Stoltenberg's term coming to an end in October

US TSYS CPI Higher Than Hoped For

- After some initial volatility this morning's higher than hoped for CPI inflation data weighed on rates as projected rate cut pricing has receded - CPI data unlikely to provide the FOMC confidence of inflation returning to 2% in the near term.

- CPI MoM (0.4% vs. 0.4% est), YoY (3.2% vs. 3.1% est); CPI Ex Food and Energy MoM (0.4% vs. 0.3% est) YoY (3.8% vs. 3.7% est). Meanwhile, Real Avg Hourly Earning YoY (1.1% vs. prior 1.3% (rev), Weekly Earnings YoY (0.5% vs. prior 0.1% (rev).

- Estimated dispersion across 57 items over the entire CPI basket saw relatively limited moderation in February considering the sharp increase in the breadth of inflationary pressure back in January. As such it lends support to that Jan jump for figures that can be noisy from month-to-month.

- Treasury futures extended lows (TYM4 111-03) after the $39B 10Y re-open sale (91282CJZ5) tailed 1.1bp: 4.166% high yield vs. 4.155% WI; 2.51x bid-to-cover vs. 2.56x prior. Indirect take-up recedes to 64.29% vs. 70.97% prior; direct bidder take-up rebounds to 18.65% from 16.05% prior; primary dealer take-up rebounds to 17.06% vs. 12.98%.

- Look ahead: data limited to Mortgage Applications and a Treasury bond sale re-open, the main focus is on Thursday's Retail Sales and PPI data.

OVERNIGHT DATA

US DATA: Supercore CPI Unrounded - February:- Core services excl OER & primary rents ('supercore'): 0.47% M/M after 0.85%. Latest 3mth av of 0.55%

- Core services excl all shelter: 0.52% M/M after 0.74%. Latest 3mth av of 0.54%

- Unrounded % M/M (SA): Headline 0.442%; Core: 0.358% (from 0.392%)

- Unrounded % Y/Y (NSA): Headline 3.153%; Core: 3.752% (from 3.862%)

US DATA (MNI): Breadth of Inflationary Pressures Holds Most Of January Surge: Our estimate of dispersion across 57 items over the entire CPI basket saw relatively limited moderation in February considering the sharp increase in the breadth of inflationary pressure back in January. As such it lends support to that Jan jump for figures that can be noisy from month-to-month

* Share in excess of 3% annualized in Feb: 53% vs 58% in Jan and 39% in Dec. It averaged 41% in 2019.

* Share in excess of 5% annualized in Feb: 44% vs 49% in Jan and 23% in Dec. It averaged 25% in 2019.

* Share seeing outright deflation in Feb: 33% vs 32% in Jan and 37% in Dec. It averaged 38% in 2019.

US DATA (MNI) Atlanta Fed Sticky CPI Series Revert To Prior Trends After January Spike: The Atlanta Fed’s sticky CPI measures saw sizeable moderation in Febr, fully reversing the acceleration seen in Jan.

- Sticky ex-shelter: 0.24% M/M in Feb after 0.56% in Jan and 0.28% in Dec.

- The Y/Y rate eased from 3.25% to 3.07% Y/Y, back to where it was in Dec.

- Sticky core ex-shelter: 0.27% M/M in Feb after 0.58% in Jan and 0.28% in Dec

- The Y/Y rate eased from 3.01% to 2.88% Y/Y, still a little above the recent bottom of 2.7% in Nov.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 261.21 points (0.67%) at 39039.68

- S&P E-Mini Future up 57 points (1.1%) at 5244.25

- Nasdaq up 245.4 points (1.5%) at 16269.61

- US 10-Yr yield is up 5.6 bps at 4.1546%

- US Jun 10-Yr futures are down 13/32 at 111-6

- EURUSD down 0.0001 (-0.01%) at 1.0925

- USDJPY up 0.73 (0.5%) at 147.67

- WTI Crude Oil (front-month) down $0.17 (-0.22%) at $77.76

- Gold is down $26.43 (-1.21%) at $2156.31

- European bourses closing levels:

- EuroStoxx 50 up 52.78 points (1.07%) at 4983.2

- FTSE 100 up 78.58 points (1.02%) at 7747.81

- German DAX up 218.84 points (1.23%) at 17965.11

- French CAC 40 up 67.75 points (0.84%) at 8087.48

US TREASURY FUTURES CLOSE

- 3M10Y +5.948, -125.022 (L: -138.105 / H: -123.721)

- 2Y10Y -0.006, -44 (L: -48.635 / H: -42.89)

- 2Y30Y -0.599, -28.315 (L: -33.791 / H: -25.741)

- 5Y30Y -1.414, 15.674 (L: 13.13 / H: 19.299)

- Current futures levels:

- Jun 2-Yr futures down 4.375/32 at 102-13.625 (L: 102-12 / H: 102-19.25)

- Jun 5-Yr futures down 9.75/32 at 107-10.25 (L: 107-08.25 / H: 107-23.25)

- Jun 10-Yr futures down 13/32 at 111-6 (L: 111-02.5 / H: 111-24)

- Jun 30-Yr futures down 21/32 at 120-24 (L: 120-16 / H: 121-27)

- Jun Ultra futures down 27/32 at 129-10 (L: 129-01 / H: 130-30)

US 10Y FUTURE TECHS: (M4) Bullish Theme Remains Intact

- RES 4: 113-08+ 2.0% 10-dma envelope

- RES 3: 112-29+ 76.4% retracement of the Feb 1 - 23 bear leg

- RES 2: 112-10+ 61.8% retracement of the Feb 1 - 23 bear leg

- RES 1: 112-04+ High Mar 8

- PRICE: 111-07+ @ 1430 ET Mar 12

- SUP 1: 111-03+ 20-day EMA

- SUP 2: 110-21 Low Mar 4

- SUP 3: 110-05+/109-25+ Low Mar 1 / Low Feb 23 and bear trigger

- SUP 4: 109-14+ Low Nov 28

A bullish theme in Treasuries remains intact and the contract has recovered from its intraday low. The recent break of the 50-day EMA and 111-27, 50% of the downleg off the Feb 1 high, reinforces the bullish theme. This opens 112-10+, the 61.8% retracement. For bears, a reversal lower would return focus back to support at 109-25+, the Feb 23 low and bear trigger. Initial firm support is at 110-21, the Mar 4 low.

SOFR FUTURES CLOSE

- Mar 24 -0.015 at 94.670

- Jun 24 -0.035 at 94.90

- Sep 24 -0.050 at 95.215

- Dec 24 -0.070 at 95.535

- Red Pack (Mar 25-Dec 25) -0.095 to -0.09

- Green Pack (Mar 26-Dec 26) -0.085 to -0.065

- Blue Pack (Mar 27-Dec 27) -0.065 to -0.055

- Gold Pack (Mar 28-Dec 28) -0.06 to -0.045

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00475 to 5.32544 (+0.00674/wk)

- 3M +0.01018 to 5.32516 (+0.00432/wk)

- 6M +0.02405 to 5.23326 (+0.00342/wk)

- 12M +0.04021 to 4.98235 (-0.00459/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.804T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $689B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $263B

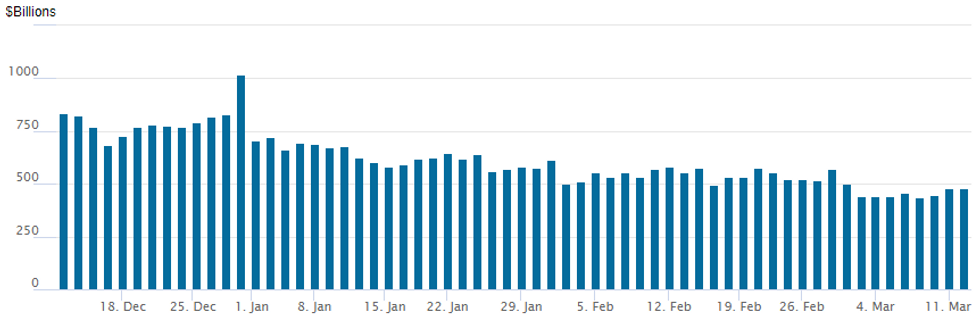

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $476.862B from $478.728B on Monday, compares to $436.754B last Thursday - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties remains steady at 73 (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $3B Goldman Sachs 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 3/12 $3B #Goldman Sachs $2.25B 3NC2 +68, $750M 3NC2 SOFR+77

- 3/12 $900M #Constellation Energy 30Y +145

- 3/12 $500M #Avic Int 3Y +87.5

- 3/12 $500M #Southern California Gas WNG 30Y +133

- 3/12 $750M #Global Atlantic 30Y +250

- Expected to issue Wednesday:

- 3/13 $1B Kommunivest WNG 2Y +29a

- 3/13 $Benchmark Dexia 3Y SOFR+42a

EGBs-GILTS CASH CLOSE: Softer UK Labour Data Sees Gilts Outperform Bunds

Gilts outperformed Bunds for a second day this week Tuesday as UK labour market data was seen bolstering the case for BoE cuts.

- UK wage data came in on the soft side of consensus, with the unemployment rate also a touch higher than expected, helping spur an early Gilt bid (our review of the data is here).

- The highlight of the global session was US CPI data which spurred a selloff in rates upon initial release as the core figure was above expectations.

- The initial move reversed briefly as some softer details of the report were digested, but ultimately Treasuries resolved decisively lower, dragging down core European FI.

- ECB's Holzmann said in an MNI interview published today that a rate cut by June would depend on inflation projections being confirmed. UK implied rates ticked lower toward the end of the session as BoE's Bailey noted that concerns about second-round inflation have fallen.

- The German curve bear flattened with the UK's bull flattening. Periphery EGB spreads closed tighter in a largely risk-on session, with 10Y BTP/Bund moving well below 130bp.

- UK data features once again early Wednesday, with GDP / activity data. Eurozone industrial production is out later in the morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.3bps at 2.847%, 5-Yr is up 3.8bps at 2.359%, 10-Yr is up 2.7bps at 2.33%, and 30-Yr is up 1.4bps at 2.472%.

- UK: The 2-Yr yield is down 1.7bps at 4.22%, 5-Yr is down 2.3bps at 3.871%, 10-Yr is down 2.5bps at 3.946%, and 30-Yr is down 0.7bps at 4.403%.

- Italian BTP spread down 4.7bps at 127.9bps / Greek down 4.2bps at 95.4bps

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/03/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/03/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 13/03/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 13/03/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/03/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/03/2024 | 1145/1245 |  | EU | ECB's Cipollone at conference in Milan | |

| 13/03/2024 | - | *** |  | CN | Money Supply |

| 13/03/2024 | - | *** |  | CN | New Loans |

| 13/03/2024 | - | *** |  | CN | Social Financing |

| 13/03/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/03/2024 | 1400/1000 | * |  | US | Services Revenues |

| 13/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/03/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.