-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Canada Apr-Dec Budget Deficit CAD21.7B Vs Prior CAD23.6B

MNI Credit Weekly: Fault Lines

MNI ASIA OPEN - Dealmaking Goes to the Wire

EXECUTIVE SUMMARY:

- US SENATE PASSES STOPGAP FUNDING BILL TO AVERT SHUTDOWN

- US HIRING SLOWDOWN WILL LAST INTO SPRING - ADP

- UK PM JOHNSON: NO DEAL "VERY, VERY LIKELY"

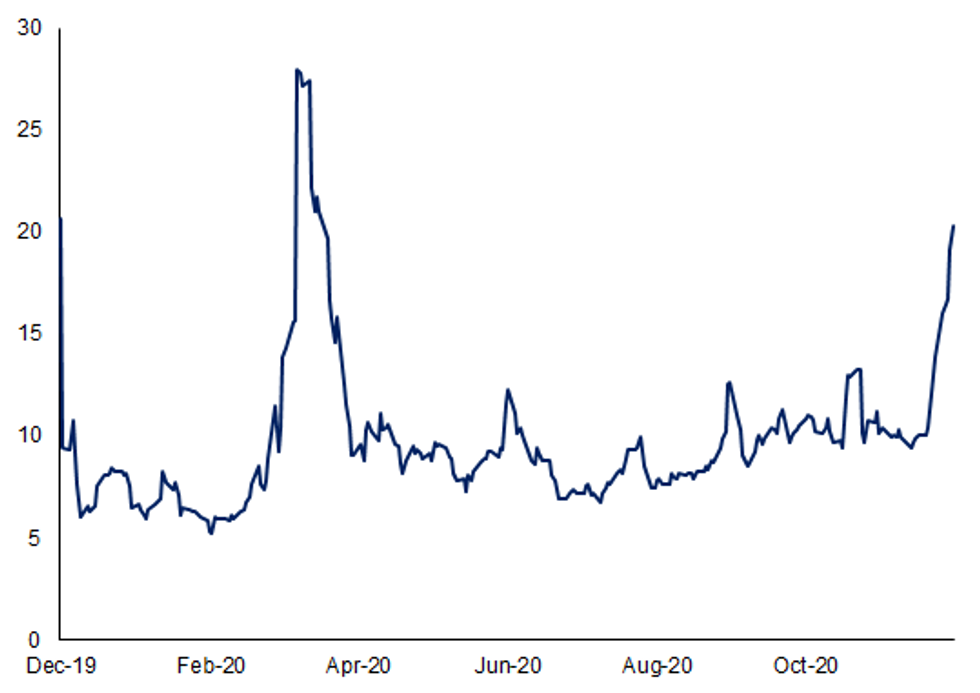

- GBP IMPLIED VOL SURGES AHEAD OF SUNDAY BREXIT DEADLINE

Figure 1: GBP/USD One-week Implied Vols

US

MNI INTERVIEW: US Hiring Slowdown Will Last Into Spring - ADP

U.S. hiring will potentially remain weak into the second quarter of next year as the surge in Covid-19 closes shops and hurts consumer spending, ADP chief economist Nela Richardson told MNI.

MNI: US SENATE PASSES STOPGAP FUNDING BILL TO AVERT SHUTDOWN

*US SPENDING MEASURE GOES TO PRESIDENT FOR SIGNATURE

MNI BRIEF: Fed's George Urges Discretion in Bank Disclosures

Greater bank disclosures would strengthen the fairness and stability of the financial system, but supervisors should have some discretion over the release of sensitive supervisory information, Federal Reserve Bank of Kansas City President Esther George said Friday.

MNI BRIEF: Fed To Add Uncertainty, Risk Charts to SEP

New charts to be added to the FOMC's quarterly Summary of Economic Projections starting next week will illustrate officials' characterization of risks to their outlook as well as their degree of uncertainty, the Fed said Friday.

MNI PREVIEW: Fed To Issue QE Guidance, Debate Maturity Shift

The Federal Reserve is expected to hold its benchmark interest rate near zero and deliver forward guidance around QE on Wednesday, bolstering the promise to buy at least USD120 billion of bonds a month until the economy improves.

DATA

*CANADA FACTORY CAPACITY UTILIZATION RATE 75.3%

CANADA Q3 INDUSTRIAL CAPACITY UTILIZATION RATE 76.5%

**MNI: US NOV FINAL DEMAND PPI +0.1%, EX FOOD, ENERGY +0.1%

*US NOV PPI: GOODS +0.4%; SERVICES +0.0%; TRADE SERVICES -0.3%

*US NOV PPI: FOOD +0.5%; ENERGY +1.2%

*US NOV FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

*US NOV FINAL DEMAND PPI Y/Y +0.8%, EX FOOD, ENERGY Y/Y +1.4%

EUROPE

MNI SOURCES: PM's Hold On Italy's Govt Weakens Amid Funds Spat

Italy's Prime Minister Giusseppe Conte is likely to back down from plans to centralise management of EU Covid crisis funds in order to avert a cabinet rebellion, but support for the PM is weakening across the governing coalition and he faces a dangerous start to next year with a chance he could be forced from office, political sources told MNI.

MNI BRIEF: BOE Work On Negative Rates Ongoing: Bailey

The Bank of England's work on negative interest rates is ongoing and in the meantime, the central bank has plenty of ammunition in its armory if needed, Bank of England Governor Andrew Bailey, said Friday.

US TSYS SUMMARY: Waiting-And-Seeing On Stimulus, Fed

A solid if unexciting session for Treasuries, with most gains made overnight on no-deal Brexit concerns.

- We had modest follow through in U.S. hours as markets considered potential for a government shutdown at midnight, and a continued COVID fiscal impasse.

- Slightly sub-par volume too, with a real wait-and-see feel on political developments and next week's FOMC.

- Curve mixed, with the belly outperforming. The 2-Yr yield is down 2bps at 0.117%, 5-Yr is down 3.5bps at 0.3512%, 10-Yr is down 2.5bps at 0.8816%, and 30-Yr is down 1.2bps at 1.6151%.

- Mar 10-Yr futures (TY) up 8.5/32 at 138-05 (L: 137-26.5 / H: 138-07)

- Attention has also been on equities which continue to stumble after recent all-time highs; in contrast data (mildly weaker-than-expected PPI, strong beat in UMichigan sentiment) didn't really move the needle significantly.

- That said, plenty of data next week, which will provide greater insight into the economic impact of the 2nd wave of the pandemic: retail sales, flash PMI, housing starts, and industrial production all on the docket.

FOREX: Crunch Time

Sterling had a poor finish to the week, falling against all others in G10 as markets gear for yet another self-imposed deadline for make-or-break trade deal negotiations on Sunday evening. Options markets have taken note and are pricing in a sizeable swing for GBP on Monday, indicating decent two way risk in GBP crosses. Nonetheless, it may come as no surprise that some see the negotiations going beyond this weekend, with the German foreign minister suggesting talks could extend through to next week.

Equities retreated into the Friday close, capping a negative week for stocks globally. Losses were muted, however, with the S&P 500 still well within range of the alltime highs posted midweek. This supported JPY throughout the Friday session, which rose against all others in G10.

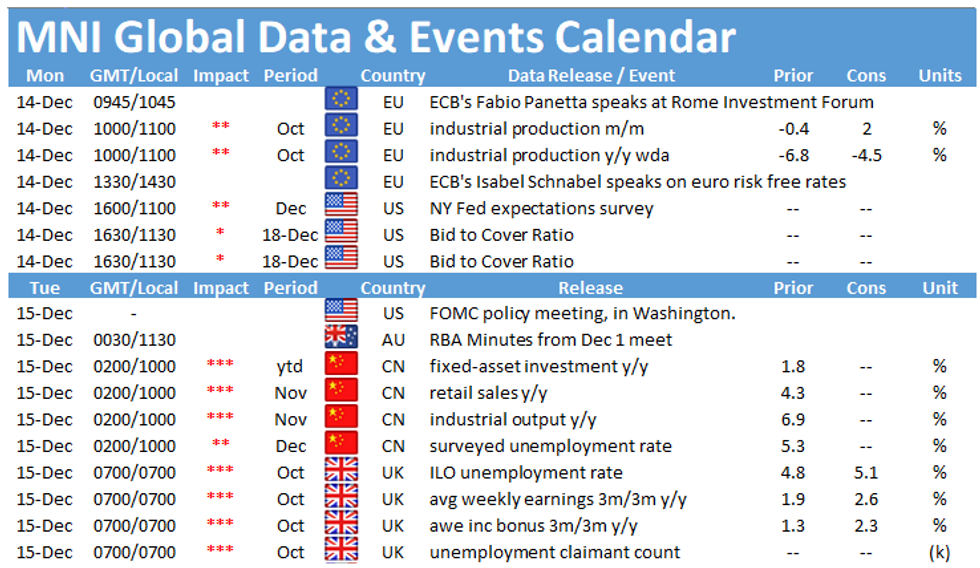

Focus in the coming week turns to global central banks. Rate decisions are due from the US, UK, Norwegian, Swiss, Hungarian, Mexican central banks (among others), which should keep markets busy regardless.

EGBs-GILTS CASH CLOSE: Rally Ahead Of Sunday 'Deadline' For Deal

Gilts have faded early gains made on no-deal Brexit concerns, but yields still remain firmly lower, with bull flattening intact. That said, Bunds actually outperformed on the day, with periphery spreads widening, as Eurozone equities fell sharply.

- FI opened strong on headlines that EU's von der Leyen told European leaders that a no-deal outcome was more likely than not, and later PM Johnson described no-deal as " very, very likely".

- The next deadline to reach a deal in the Brexit saga is said to be Sunday, though already various officials have suggested that this is not necessarily the end of the road.

- Thin calendar otherwise early next week, little in the way of data/speakers, and no bond supply the entire week. BoE Thursday is the main event.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.7bps at -0.783%, 5-Yr is down 2.5bps at -0.812%, 10-Yr is down 3.3bps at -0.636%, and 30-Yr is down 5.3bps at -0.239%.

- UK: The 2-Yr yield is up 0.3bps at -0.112%, 5-Yr is down 1.2bps at -0.095%, 10-Yr is down 2.9bps at 0.172%, and 30-Yr is down 3.1bps at 0.713%.

- Italian BTP spread up 2.9bps at 119.4bps

- Spanish bond spread up 1.3bps at 63.8bps/ Portuguese spread up 1.5bps at 59.8bps

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.