-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Debt Ceiling Agreement Need to Pass Lawmakers

- MNI Debt Ceiling Deal Done "In Principle"; X Date Pushed to June 5

- MNI INTERVIEW: Fed Needs Limit On Reverse Repo - McAndrews

- MNI INTERVIEW: Companies' Contribution To US Inflation Falling

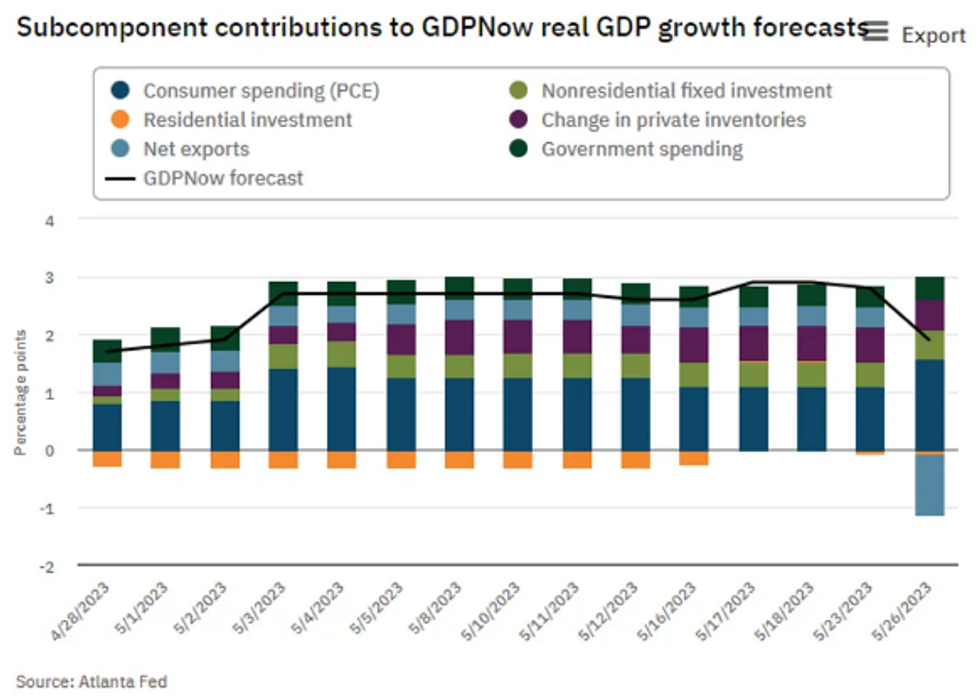

- MNI: Atlanta Fed GDPNow Revised Down From 2.9% to 1.9% On Net Exports Drag

US

US: Wires reported a bipartisan agreement to suspend the debt limit for the next two years while keeping non-defense spending flat for the next year (+1% in the second year) was announced Saturday.

- Now comes the hard part: securing support from enough lawmakers on both sides of the aisle. The NY Times writes Republican "lawmakers have a history of doing everything they can to block spending deals they disapprove of. They could do so again, and they have sufficient power to kill the deal because McCarthy has only a nine-vote majority."

- Short "X-Date" reprieve: Focus has been on reaching a deal before the government would run out of cash to honor it's debt obligations, estimated at around June 1. In a late Friday letter to House Speaker McCarthy, Treasury Secretary Yellen stated the deadline has been extended to June 5.

- "During the week of June 5, Treasury is scheduled to make an estimated $92 billion of payments and transfers, including a regularly scheduled quarterly adjustment that would result in an investment in the Social Security and Medicare trust funds of roughly $36 billion. Therefore, our projected resources would be inadequate to satisfy all of these obligations."

FED: The Federal Reserve needs to put a growth limit on the overnight reverse-repo facility as it would remove the destabilizing fear that a run into it is a possibility, James McAndrews, former head of research at the Federal Reserve Bank of New York, told MNI.

- "This concern by market participants that the RRP could be a vehicle into which people run does pose a risk to the economy," he said in an interview. "And there's a very straightforward solution to damp down that concern, which is to implement a growth limit."

- While there is a per-participant cap of USD160 billion and an absolute limit to the size of the facility now that the Fed enacted several years ago, that number is so large given the program's nearly 150 participants that it far exceeds the amount of securities that the Federal Reserve holds. Consequently, the current absolute limit is ineffective, McAndrews said. For more see MNI Policy main wire at 1145ET.

US: Corporations' profit margins contributed little to U.S. inflation in the first quarter and will be an even smaller driver of price pressures going forward as inflation eases, Federal Reserve Bank of Kansas City economists Andrew Glover and Jose Mustre-del-Rio said in an interview.

- Firms' mark-ups spiked in early 2021 when costs were actually falling, and profit margins rose at higher rates than inflation. But by the end of 2021, as inflation started picking up, profit growth was already a falling share of price pressures and contributed less than 20% of overall inflation in 2022, according to a recent paper by the economists.

- That trend accelerated in the first quarter. According to Commerce Department data released Thursday, corporate profits slipped 5.1% in the first three months of the year and contributed only 0.2 percentage point to the 5.3% GDP deflator inflation rate, Glover told MNI. Due to data limitations, the economists use GDP deflator as their inflation rate; it has been running slightly hotter than the Fed's preferred PCE inflation measure since the pandemic. For more see MNI Policy main wire at 0653ET.

- “Decreases in the nowcasts of Q2 real net exports and real gross private domestic investment growth were partially offset by increases in the nowcasts of Q2 real personal consumption expenditures growth and real government spending growth.”

- Contributions show a heavy drag from net trade of -1.1pps (vs previously seen +0.34pps) whilst personal spending is now seen tracking a contributions of 1.58pps (up from 1.1pps).

OVERNIGHT DATA

- US APR DURABLE NEW ORDERS +1.1%; EX-TRANSPORTATION -0.2%

- US MAR DURABLE GDS NEW ORDERS REV TO +3.3%

- US APR NONDEF CAP GDS ORDERS EX-AIR +1.4% V MAR -0.6%

US DATA: Durable Goods and Real Consumer Spending Add To April Upside Surprises. Further to the surprise strength in various core PCE metrics, both personal spending and core durable goods were stronger than expected.

- Real consumer spending increased 0.5% M/M in April (cons 0.3) after an unrevised 0.0% in March, in continued contrast to calculated real retail sales falling -0.2% M/M in April and -0.3% in March when deflating by CPI goods prices.

- Core durable goods orders meanwhile saw a larger beat again, rising 1.4% M/M (cons -0.1%) after a upward revised -0.6% (initial -1.1%). Core shipments, with its more direct impact into GDP data, saw a smaller beat with 0.5% (cons 0.1) after an upward revised -0.2% (cons -0.5%) but the combination nevertheless supports a latest push nudge higher in industrial production.

- US APR PERSONAL INCOME +0.4%; NOM PCE +0.8%

- US APR PCE PRICE INDEX +0.4%; +4.4% Y/Y

- US APR CORE PCE PRICE INDEX +0.4%; +4.7% Y/Y

- US APR UNROUNDED PCE PRICE INDEX +0.364%; CORE +0.380%

US DATA: PCE Unrounded

- M/M (SA): 0.380% in Apr

- Follows 0.311% in Mar (initial 0.281%), 0.353% in Feb (initial 0.347%), 0.550% in Jan (initial 0.559%).

- Y/Y (SA): 4.697% in Apr from 4.626% in Mar

US DATA: Core PEC and Non-Housing Services Surprisingly Accelerate In April. Core PCE inflation was stronger than expected in April at 0.380% M/M (cons 0.3) after a stronger skew to Q1 revisions from yesterday’s quarterly data. Q1 was revised up from 4.94% to 4.96% annualized but it consisted of larger upward revisions in Feb and Mar with a partly offsetting lower figure back in January.

- Of note, it was led by the Fed's preferred core non-housing services. Bloomberg’s calculation accelerated to 0.42% M/M from an upward revised 0.29% in Mar (initial 0.24%) and 0.37% in Feb (initial 0.35%). It’s the fastest pace since January’s 0.53% M/M and follows the Q1 average of 0.40% M/M.

- MICHIGAN MAY EXPECTATIONS INDEX AT 55.4 FROM 60.5

- MICHIGAN MAY 1-YR EXPECTED INFLATION AT 4.2% FROM 4.6%

- MICHIGAN MAY 5-YR EXPECTED INFLATION AT 3.1% FROM 3%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 285.02 points (0.87%) at 33040.43

- S&P E-Mini Future up 49.75 points (1.2%) at 4209.25

- Nasdaq up 270.5 points (2.1%) at 12967.79

- US 10-Yr yield is down 1.3 bps at 3.8041%

- US Jun 10-Yr futures are down 3.5/32 at 112-16.5

- EURUSD down 0 (0%) at 1.0726

- USDJPY up 0.51 (0.36%) at 140.56

- Gold is up $3.31 (0.17%) at $1944.98

- EuroStoxx 50 up 67.86 points (1.59%) at 4337.5

- FTSE 100 up 56.33 points (0.74%) at 7627.2

- German DAX up 190.17 points (1.2%) at 15983.97

- French CAC 40 up 89.91 points (1.24%) at 7319.18

US TREASURY FUTURES CLOSE

- 3M10Y +1.976, -148.893 (L: -161.559 / H: -144.031)

- 2Y10Y -3.836, -75.598 (L: -78.792 / H: -70.258)

- 2Y30Y -5.804, -59.771 (L: -64.128 / H: -51.264)

- 5Y30Y -4.665, 3.57 (L: 0.692 / H: 10.098)

- Current futures levels:

- Jun 2-Yr futures down 3.875/32 at 101-31.5 (L: 101-27.125 / H: 102-05.875)

- Jun 5-Yr futures down 6.25/32 at 107-20.75 (L: 107-12.5 / H: 108-00)

- Jun 10-Yr futures down 4/32 at 112-16 (L: 112-05.5 / H: 112-29)

- Jun 30-Yr futures up 7/32 at 125-24 (L: 124-31 / H: 125-30)

- Jun Ultra futures up 22/32 at 133-27 (L: 132-28 / H: 133-31)

The Jun/Sep quarterly futures roll is over 90% complete after this week's heavy volumes. Sep'23 futures take lead quarterly position on Wednesday, May 31 (First notice date). Current levels:

- TUM/TUU 336,000 from -19.5 to -17.88, -18.62 last, 92% complete

- FVM/FVU 553,300 from -19.25 to -18.5, -18.5 last, 91% complete

- TYM/TYU 638,700 from -25.0 to -23.75, -24.75 last, 90% complete

- UXYM/UXYU 128,400 from -100.25 to -30.25, -30.5 last, 94% complete

- USM/USU 85,500 from -10.25 to -9.0, -10.0 last, 89% complete

- WNM/WNU 85,800 from -16.0 to -15.25, -15.75 last, 91% complete

- Reminder, June futures won't expire until next month: 10s, 30s and Ultras on June 21, June 30 for 2s and 5s.

US 10YR FUTURE TECHS: (M3) Bear Trend Extension

- RES 4: 115-18+ High May 16

- RES 3: 114-05/114-19+ High May 19 / 50-day EMA

- RES 2: 113-30+ Low Apr 19 and a recent breakout level

- RES 1: 113-25 High May 24

- PRICE: 112-10+ @ 16:56 BST May 26

- SUP 1: 112-05+ Intraday low

- SUP 2: 111-31 76.4% retracement of the Mar 2 - 24 rally

- SUP 3: 111-20+ Low Mar 10

- SUP 4: 111-00 Round number support

Treasury futures have registered another short-term trend low Friday as the pullback from the May 4 high extends. The recent break of 113-30+, the Apr 19 low and a key support, reinforced a bearish theme. The focus is on 111-31 next, 76.4% of the Mar 2 - 24 rally. On the upside, initial firm resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-19+. A break of the average is required to signal a potential reversal.

SOFR FUTURES CLOSE

- Jun 23 +0.003 at 94.685

- Sep 23 -0.005 at 94.780

- Dec 23 -0.035 at 95.045

- Mar 24 -0.065 at 95.445

- Red Pack (Jun 24-Mar 25) -0.085 to -0.065

- Green Pack (Jun 25-Mar 26) -0.06 to -0.04

- Blue Pack (Jun 26-Mar 27) -0.035 to -0.02

- Gold Pack (Jun 27-Mar 28) -0.015 to +0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01765 to 5.15344 (+.05971/wk)

- 3M +0.03846 to 5.26374 (+.10027/wk)

- 6M +0.06018 to 5.29836 (+.15183/wk)

- 12M +0.09923 to 5.10171 (+.22405/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00257 to 5.06543%

- 1M -0.00629 to 5.15371%

- 3M +0.01257 to 5.47571 */**

- 6M +0.01686 to 5.58100%

- 12M +0.03772 to 5.66029%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.47571% on 5/26/23

- Daily Effective Fed Funds Rate: 5.08% volume: $131B

- Daily Overnight Bank Funding Rate: 5.07% volume: $285B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.537T

- Broad General Collateral Rate (BGCR): 5.05%, $602B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $590B

- (rate, volume levels reflect prior session)

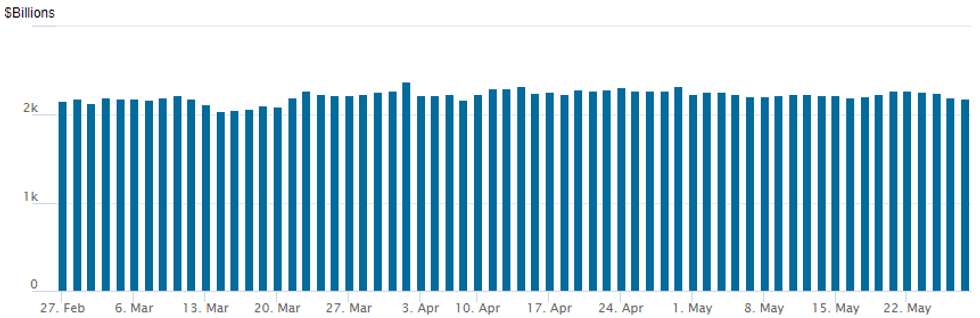

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo slips to $2,189.638B w/ 107 counterparties, compares to prior $2,197.638B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE

No new US$ issuance Thursday-Friday after $20.675B total high grade corporate debt issued on the week.

EGBs-GILTS CASH CLOSE: Gilts In Rare Outperformance Of Bunds

Gilts outperformed Bunds Friday for the first time since May 16, with short ends in particular moving in opposite directions.

- The German curve bear flattened modestly, with the UK's bull steepening as some of the previous two sessions' sharp moves saw a partial unwind.

- 1bp was added to the ECB hike path to a fresh 1-month high close of 3.86% - 61bp of hikes left in the path, in accordance with ECB Makhlouf's comments today pointing to hikes in Jun and July and open to more later.

- BoE hike expectations dialled back (UK retail sales beat but downward revisions dampened the hawkish read). But the implied peak Bank rate was still 60bp higher than it began the week, with 107bp further hikes now expected.

- Periphery EGB spreads were mixed, with BTPs outperforming modestly.

- Attention will be on US debt limit negotiations over the weekend, but trade Monday will be thinned as UK and US markets are closed for a holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.1bps at 2.943%, 5-Yr is up 2.7bps at 2.558%, 10-Yr is up 1.7bps at 2.539%, and 30-Yr is up 1bps at 2.674%.

- UK: The 2-Yr yield is down 6.1bps at 4.495%, 5-Yr is down 4.9bps at 4.279%, 10-Yr is down 3.5bps at 4.339%, and 30-Yr is down 0.3bps at 4.647%.

- Italian BTP spread down 2.4bps at 185.2bps / Spanish down 0.7bps at 106.2bps

FOREX: Greenback Consolidates Strong Weekly Gains, JPY Pressure Continues

- Despite some early weakness on Friday, the greenback was well supported following a set of strong US data and the USD index looks set to consolidate solid 1% gains on the week.

- Continuing the similar themes from prior sessions, the New Zealand Dollar and the Japanese Yen are the weakest across G10. Kiwi weakness continues to stem from the dovish RBNZ and the higher US yields continue to exacerbate the widening yield differentials that have underpinned Cross/JPY longs.

- USDJPY in particular has established itself back above the 140.00 handle with initial resistance (bull channel top drawn from the Jan 16 low) around 140.70 capping the price action for now. The next obvious target for the move resides at 141.61, the Nov 23 2022 high.

- Elsewhere, performance across G10 was mixed with the likes of the GBP, AUD and CNH benefitting from more buoyant stock markets on the back of greater optimism over the debt ceiling heading into an extended holiday weekend.

- Bearish conditions for EURUSD have been reinforced and the 1.0713 objective was briefly breached, the Mar 24 low. This signals scope for an extension towards 1.0653 next, a Fibonacci retracement point.

- Holidays across Europe and the US should keep currency markets subdued on Monday. Looking forward, inflation readings across Europe and Australia will be in focus as well as manufacturing and non-manufacturing data from China. The week will be highlighted by an important jobs report from the US on Friday.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/05/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 30/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 30/05/2023 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2023 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 30/05/2023 | 0800/1000 | ** |  | IT | PPI |

| 30/05/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2023 | 1230/0830 | * |  | CA | Current account |

| 30/05/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/05/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/05/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/05/2023 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 30/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.