-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Disinflationary Data Ahead Fed Blackout

- MNI INTERVIEW: Soft Landing Could Turn Hard, Says ISM Chief

- MNI POLICY: Fed Most Divided Since Start Of Hikes, More Loom

- MNI: Fed’s Harker Says Close To Point Of Holding Rates Steady

- MNI INTERVIEW: Canada Export Windfall Over, Dollar Weakens-EDC

- MNI Unit Labor Costs Look Less Inflationary After Revisions

- MNI ISM Mfg Headline Print Masks Prices Paid and New Orders Decline

US

FED: U.S. manufacturing has contracted for the seventh consecutive month and if consumer confidence and demand do not pick up again in coming months then the sector could move from a soft to a hard landing, according to Timothy Fiore of the Institute for Supply Management.

- "I'm arguing that I don't know that this is so good that we're in a soft landing," he said in an interview with MNI. "Do I think that it's going to be a successful soft landing? It doesn't really feel like it."

- Fiore, chair of the ISM Manufacturing Business Survey Committee, pointed to a continued slump in consumer confidence, contracting demand, and the Federal Reserve's continued fight to bring inflation down that will require wage growth to roll over.

- Fed officials have signaled a preference to skip a rate hike in June before potentially raising rates again at the July 25-26 meeting, though the FOMC appears more divided than at other times. For more see MNI Policy main wire at 1338ET.

FED: The Federal Reserve is approaching its June policy meeting at its most divided since the central bank began raising interest rates last year, with officials torn between pushing ahead with another quarter-point rate increase or pausing to see how the data evolve -- though further hikes seem increasingly likely at some point.

- Fed governor and vice chair nominee Philip Jefferson seemed to tip the scales in favor of a "skip" in a speech Wednesday, flipping market expectations for a hike in June back to a pause. “Skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming,” he told a Fed conference in Washington.

- Before the string of strong data this month, Fed Chair Jerome Powell appeared to signal his preference for a pause in remarks that stressed the idea that financial sector strains might mean less need for monetary tightening. Still, the latest PCE inflation reading Friday suggested progress on the inflation front has stalled. There are still two major data releases ahead of the June 13-14 meeting – payrolls and CPI for May. For more see MNI Policy main wire at 0702ET.

FED: The Federal Reserve is approaching the point where it can hold interest rates steady after a sharp tightening since March of last year, although inflation remains uncomfortably high, Philadelphia Fed President Patrick Harker said Thursday.

- “We are close to the point where we can hold rates in place and let monetary policy do its work to bring inflation back to the target in a timely manner,” said Harker. He's a voting member this year who has already said he supports skipping a hike at the June meeting and is speaking Thursday to the National Association for Business Economics.

- He expects U.S. economic growth to be modest, below 1% for the year, and sees inflation falling to around 3.5% in 2023 before dropping to 2.5% in 2024. For more see MNI Policy main wire at 1300ET.

FED: Bullard Sticks To Taylor Type Rules Indicating Need For Further Hikes. Just to be aware, St Louis Fed's Bullard (non-voter) published the following a little earlier but content looks very similar to his Hoover remarks from May 12, including the Taylor-Type Rules analysis in the chart. StL Fed

CANADA

CANADA: Canada's biggest export boom in four decades from the windfall of high commodity prices is ending, though shipment volumes will find support from a currency weakened by a central bank lagging the Fed on rate hikes, the government trade bank's chief economist told MNI.

- Shipments growth will slow to 0.9% following gains of around 20% in the prior two years, Stuart Bergman of Export Development Canada said in a phone interview. Energy and metals prices are seen fading after a surge linked to the pandemic rebound and the Ukraine invasion, though fertilizer demand remains solid, he said.

- Canada's dollar will weaken four cents on average this year against the U.S. dollar to about 73 cents or CAD1.37, he said. EDC is the most prominent government body that forecasts the currency, something the central bank doesn't do. Canada is one of the most trade-reliant advanced economies, though three-quarters of its exports are bound for its southern neighbor the U.S. For more see MNI Policy main wire at 1209ET.

US TSYS: Holding Near Highs, Projected Year-End Rate Cut Back In Play

- Treasury futures holding moderate gains late in the second half, holding relatively narrow range near highs as focus turned to US data ahead Friday's NFP employment release (default concerns cooled slightly after the Fiscal Responsibility Act passed the House yesterday, currently debated in Senate.

- Whippy two-way trade tied to first half data: stronger than expected ADP private employment data of +278k vs. +170k est, saw futures trade lower but quickly recovered half the move in 10s. Treasuries rallied further after lower than expected 1Q Unit Labor Cost (4.2% vs. 6.0%) while Weekly Claims gained only 2k to 232k.

- Treasury futures gapped higher yet again (10s breached 20D EMA resistance on way to 115-00 session high) after ISM data showed a large drop in Factory prices paid (44.2 from 53.2 prior, 52.3 exp) slightly lower than expected Mfg figure (46.9 vs. 47.0 est).

- The ISM-tied rally saw short end rates fully price in a 25bp rate CUT in December before scaling back to appr 94% of a projected cut.

- Fed speak proved mixed ahead Blackout at midnight Friday. Non-voter StL Fed pres Bullard commented on need for further hikes, while Philly Fed Harker reprised his dovish comments from Wed.

OVERNIGHT DATA

- May ADP Payrolls +278k (170k expected, April 291k Rev. from 296k)

US DATA: Strong ADP Headline Beat, Offset With Caution On Wages. A strong beat on the headline ADP number for May (+278k vs +170k expected and only modest revisions to prior), but with this cautionary note on wages (which were up 6.5% Y/Y overall vs 6.7% in Apr) from the release (job changer wages rose by a still-robust 12.1% in May).

- "This is the second month we've seen a full percentage point decline in pay growth for job changers," said Nela Richardson, chief economist, ADP. "Pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring."

- US JOBLESS CLAIMS +2K TO 232K IN MAY 27 WK

- US PREV JOBLESS CLAIMS REVISED TO 230K IN MAY 20 WK

- US CONTINUING CLAIMS +0.006M to 1.795M IN MAY 20 WK

US DATA: Initial claims were largely as expected in the week to May 27, at a seasonally adjusted 232k (cons 235k) after a minimally upward revised 230k (initial 229k).

- The 4-week average ticked down 2k to 230k but is little changed in recent weeks in its newly revised trend after Massachusetts fraud has been accounted for, down from 240k seen in late Mar/early Apr.

- The pace of growth in Challenger job cut announcements slowed in April before re-accelerating again in May, something that portend a further increase in claims ahead.

- For now though, the non-seasonally adjusted 208k is within levels from ‘typical’ non-pandemic years having previously been at the higher end.

- Continuing claims were also near expectations, at 1795k (cons 1800k) after 1789k (initial 1795k).

- US FINAL 1Q LABOR COST RISES 4.2% Q/Q; EST. +6.0%

- US FINAL 1Q LABOR PRODUCTIVITY FALLS 2.1% Q/Q; EST. -2.4%

US DATA: Very large revisions to Unit Labor Costs published by the BLS today make the past 2 quarters look less worrisome from an inflation perspective. From the BLS report:

- For Q4 2022: Hourly compensation was revised down from the previously reported increase of 4.9 percent to a decrease of 0.7 percent, due entirely to a downward revision to compensation. (Productivity estimate was unchanged.)

- For Q1 2023: Unit labor costs increased 4.2 percent rather than increasing 6.3 percent as previously reported, reflecting a 1.3-percentage point downward revision to hourly compensation and a 0.6-percentage point upward revision to labor productivity.

- US ISM MAY MANUF PURCHASING MANAGERS INDEX 46.9

- US ISM MAY MANUF PRICES PAID INDEX 44.2

- US ISM MAY MANUF NEW ORDERS INDEX 42.6

- US ISM MAY MANUF EMPLOYMENT INDEX 51.4

US DATA: ISM mfg was as expected at 46.9 (cons 47.0) after 47.1. However, it masked prices paid sliding from 53.2 to 44.2 (cons 52.3) for the lowest since Dec'22 and with the -9pt decline the sharpest monthly drop since Jul'22.

- New orders also showed further weakness, falling 3.1pts to 42.6 (no cons), which aside from January’s 42.5 is the lowest since May’20.

- With the inventories component only dipping 0.5pts, the NO-Inventories measure fell back to -3.2 although it remains off lows of -7/8 at the turn of the year that really signalled a further move lower in overall manufacturing which has since transpired in trend terms.

- Going against this, the employment series saw its highest figure since August as it increased 1.2pts to 51.4.

- US APR CONSTRUCT SPENDING +1.2%

- US APR PRIVATE CONSTRUCT SPENDING +1.3%

- US APR PUBLIC CONSTRUCT SPENDING +1.1%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 252.23 points (0.77%) at 33161.56

- S&P E-Mini Future up 48 points (1.15%) at 4238.75

- Nasdaq up 201.8 points (1.6%) at 13137.11

- US 10-Yr yield is down 3.8 bps at 3.6045%

- US Sep 10-Yr futures are up 8.5/32 at 114-23.5

- EURUSD up 0.0072 (0.67%) at 1.0761

- USDJPY down 0.48 (-0.34%) at 138.86

- WTI Crude Oil (front-month) up $2.01 (2.95%) at $70.11

- Gold is up $14.32 (0.73%) at $1977.05

- EuroStoxx 50 up 39.57 points (0.94%) at 4257.61

- FTSE 100 up 44.13 points (0.59%) at 7490.27

- German DAX up 189.64 points (1.21%) at 15853.66

- French CAC 40 up 38.73 points (0.55%) at 7137.43

US TREASURY FUTURES CLOSE

- 3M10Y -0.858, -178.31 (L: -184.984 / H: -174.965)

- 2Y10Y +3.213, -73.211 (L: -80.451 / H: -72.227)

- 2Y30Y +3.757, -50.815 (L: -60.923 / H: -49.316)

- 5Y30Y +2.624, 12.923 (L: 5.894 / H: 14.053)

- Current futures levels:

- Sep 2-Yr futures up 3.75/32 at 103-1 (L: 102-24.75 / H: 103-02.875)

- Sep 5-Yr futures up 6.75/32 at 109-9.25 (L: 108-25 / H: 109-15.5)

- Sep 10-Yr futures up 8.5/32 at 114-23.5 (L: 114-01 / H: 115-00)

- Sep 30-Yr futures up 18/32 at 128-29 (L: 127-26 / H: 129-16)

- Sep Ultra futures up 23/32 at 137-19 (L: 136-08 / H: 138-10)

US 10YR FUTURE TECHS: (U3) Short-Term Reversal

- RES 4: 115-19 High May 18

- RES 3: 115-10 1.0% 10-dma Envelope

- RES 2: 115-06+ 50-day EMA

- RES 1: 115-00 Intra-day High June1

- PRICE: 114-23 @ 16:46 BST Jun 1

- SUP 1: 114-00 Low May 31

- SUP 2: 112-29+ Low May 26 / 30

- SUP 3: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures have recovered from the recent low of 112-29+ and the contract is holding on to the bulk of its recent gains. A potential S/T reversal has occurred. Tuesday’s price pattern is a bullish engulfing candle and Wednesday's gains reinforce the pattern, suggesting scope for an extension to the 50-day EMA at 115-06+. Clearance of the EMA would highlight a stronger reversal. Key support and the bear trigger is 112-29+, the 26 / 30 low.

SOFR FUTURES CLOSE

- Jun 23 +0.035 at 94.755

- Sep 23 +0.045 at 94.875

- Dec 23 +0.055 at 95.210

- Mar 24 +0.075 at 95.695

- Red Pack (Jun 24-Mar 25) +0.055 to +0.080

- Green Pack (Jun 25-Mar 26) +0.040 to +0.050

- Blue Pack (Jun 26-Mar 27) +0.030 to +0.040

- Gold Pack (Jun 27-Mar 28) +0.015 to +0.025

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00197 to 5.17424 (+.02080/wk)

- 3M -0.01644 to 5.27638 (+.01264/wk)

- 6M -0.03543 to 5.28528 (-.01308/wk)

- 12M -0.07580 to 5.06270 (-.09544/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 to 5.06471%

- 1M -0.03000 to 5.16300%

- 3M -0.01814 to 5.49857 */**

- 6M +0.00172 to 5.64743%

- 12M +0.00986 to 5.72543%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $118B

- Daily Overnight Bank Funding Rate: 5.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 5.08%, $1.623T

- Broad General Collateral Rate (BGCR): 5.05%, $596B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $577B

- (rate, volume levels reflect prior session)

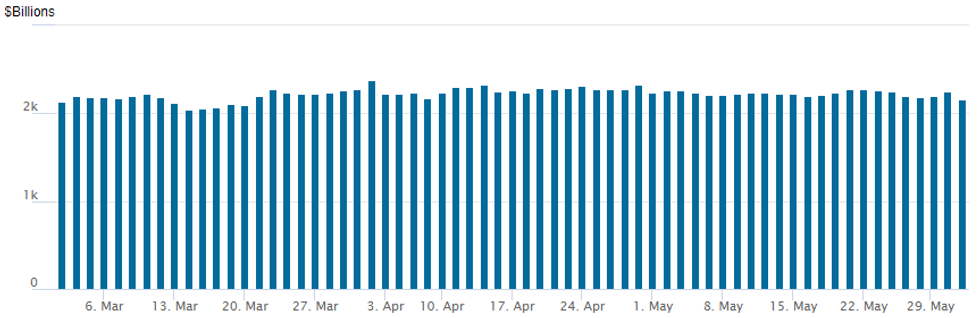

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,160.055B w/ 102 counterparties, compares to prior $2,254.859B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B Pacific Gas & Electric 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/01 $2.5B #Pacific Gas & Electric $850M +5Y +240, $1.15B 10Y +280, $500M 30Y +315

- 06/01 $1.75B #CIBC 5Y SOFR+92

EGBs-GILTS CASH CLOSE: Bull Flatter As Eurozone Disinflation Confirmed

Gilts outperformed Bunds Thursday, with curves leaning bull flatter.

- 10Y Gilt yields closed at the lowest since May 23rd; Bunds since the 12th as further data pointed to potential central bank restraint amid softer price pressures.

- Eurozone flash CPI reflected the deceleration seen in most national prints this week, with core pulling back; EGBs and Gilts extended their gains in the afternoon as US labour cost data was revised sharply downward.

- We saw an uptick in inflation expectations in the latest BoE DMP survey, but it did not heavily influence Gilts.

- BoE and ECB terminal hike pricing was flat on the day, though had fallen a few bp intraday at one point before recovering higher.

- Friday sees French industrial production data and an appearance by ECB's Vasle, but most attention will be on the US nonfarm payrolls report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at 2.718%, 5-Yr is down 3.3bps at 2.245%, 10-Yr is down 3.3bps at 2.249%, and 30-Yr is down 0.5bps at 2.456%.

- UK: The 2-Yr yield is down 4.4bps at 4.291%, 5-Yr is down 5.1bps at 4.05%, 10-Yr is down 6.7bps at 4.116%, and 30-Yr is down 5.6bps at 4.459%.

- Italian BTP spread up 4bps at 183.9bps / Spanish down 1.4bps at 103.6bps

FOREX: USD Index Extends Pullback Ahead Of US Employment Data

- Despite some initial strength during APAC hours on Thursday, the greenback has steadily edged lower, extending on the prior day’s move that was kickstarted by relatively dovish remarks from Fed officials who appear open to pausing rate hikes in June.

- The USD weakness has persisted through the London close, and the Bloomberg USD Index sits close to session lows, having pulled back around 1% from Wednesday’s cycle high. The move was initially triggered by the markdown in Unit Labour Costs with price action gaining momentum following the ISM prices paid registering at 44.2 versus a 52.3 estimate.

- The move has favoured high beta currencies in G10 with a further tailwind provided by the boost to the commodity complex. This has tipped AUD/USD through to the week's best levels, rising 1.15% on the day, closely followed by the likes of CAD and GBP.

- GBPUSD’s short-term rally has extended, and this week’s recovery has resulted in a move above the 20- and 50-day EMAs. The break provided strong impetus for a continuation higher, significantly narrowing the gap to 1.2547, the May 16 high. Above here, attention will turn back to 1.2680, the May 10 high and the bull trigger.

- USDCAD also sharply extended the reversal from the May 26 high of 1.3655. Today’s 1.3437 low, as of writing, places the pair in close proximity to the next support to watch at 1.3404, the May 16 low. A break of this level would highlight a stronger reversal.

- All focus on tomorrow’s NFP release where Bloomberg consensus looks for further moderation in payrolls growth in May to +195k versus a prior read of +253k.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 02/06/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 02/06/2023 | 1230/0830 | *** |  | US | Employment Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.