-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: ECB Doves VS Cautious Fed Cut Timing

- MNI INTERVIEW: ECB's Wunsch Sees At Least Two Cuts By December

- MNI INTERVIEW: BOC On Track For June Cut- Ex Researcher

- MNI: BOC's Macklem Says Inflation Is Moving In Right Direction

- MNI BOE: Inflation Risks Now Shifted To Downside-BOE Ramsden

- MNI US DATA: State U/E Rates Support Sahm’s Warning Of Using Her Rule Beyond National Level

US

US DATA (MNI): State U/E Rates Support Sahm’s Warning Of Using Her Rule Beyond National Level: Recent months have seen some analysts noting the relatively high share of US states that have triggered a Sahm rule, potentially indicative of greater labor market moderation ahead.

- However, Claudia Sahm herself wrote last month on how this rule isn’t designed to be used on a state level – see this Bloomberg article here.

- Of note from the article: “The national unemployment rate drifted higher, from 3.5% in July to 3.9% in February, along with increased immigration and other new entrants to the labor force, such as women, people of color, and people with disabilities. However, immigrants are not evenly spread across the country, so the national drift upward in unemployment has been more pronounced in certain states. The three with highest immigrant share in their state population — California (27%), New Jersey (24%), and New York (27%) — have some of the largest increases in unemployment. They also account for 20% of the US labor force.”

NEWS

ECB INTERVIEW (MNI): ECB's Wunsch Sees At Least Two Cuts By December: The European Central Bank will likely cut interest rates at least twice this year, but it is important to manage market expectations regarding the pace of further easing when faced with upside risks including higher inflation in the U.S., Belgium’s central bank chief Pierre Wunsch told MNI on Saturday.

BOC INTERVIEW (MNI): BOC On Track For June Cut- Ex Researcher: The Bank of Canada remains on track to lower interest rates in June even after this week's inflation bump and a federal budget with more deficit spending because underlying prices are cooling as Governor Tiff Macklem wants, former central bank economist Charles St-Arnaud told MNI.

BOC (MNI): BOC's Macklem Says Inflation Is Moving In Right Direction: Bank of Canada Governor Tiff Macklem said Friday this week's inflation report is further evidence price pressures are moving in the right direction, without signaling whether that means he could lower borrowing costs at the next decision in June.

BOE BRIEF (MNI): Inflation Risks Now Shifted To Downside-BOE Ramsden: Inflation risks have shifted to the downside and the Bank of England's previous forecast, showing it rebounding after hitting the 2% target may well be wrong and it could instead drop to 2% and stay around there, BOE Deputy Governor Dave Ramsden said at a Petersen Institute event Friday.

US Tsys Hold Modest Gains, Fed Enters Policy Blackout Tonight

- Treasury futures have been trading sideways in modestly positive territory since midmorning Friday - a rather quiet end to a hectic week, the Federal Reserve entering their self-imposed media Blackout regarding policy at midnight tonight.

- Treasuries surged higher on heavy volumes early overnight (TYM4>1.13M by the open) after Israel launched targeted attack against Iran. Safe haven support in rates faded receded as both sides downplayed the action.

- Safe haven bid pushed Jun'24 10Y futures to 108-22.5 high late Thursday evening, while the contract currently trades 107-28.5 (+6) after the bell - well above initial technical support of 107-13+ Low Apr 16. 10Y yield 4.6125% -.0181, curves mildly flatter: 2s10s -.485 -36.050.

- Projected rate cut pricing held largely steady vs. late Thursday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -13.5% w/ cumulative rate cut -4.5bp at 5.283%. July'24 cumulative at 12.1bp, Sep'24 cumulative -23bp.

- Look ahead: economic data picks up next Tuesday with regional manufacturing data from Philly and Richmond Fed, S&P PMIs and New Home Sales.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 188.89 points (0.5%) at 37965.11

- S&P E-Mini Future down 44.5 points (-0.88%) at 5004.75

- Nasdaq down 322.5 points (-2.1%) at 15280.37

- US 10-Yr yield is down 1.8 bps at 4.6145%

- US Jun 10-Yr futures are up 6/32 at 107-28.5

- EURUSD up 0.001 (0.09%) at 1.0654

- USDJPY down 0.04 (-0.03%) at 154.6

- WTI Crude Oil (front-month) up $0.51 (0.62%) at $83.24

- Gold is up $14.54 (0.61%) at $2393.59

- European bourses closing levels:

- EuroStoxx 50 down 18.48 points (-0.37%) at 4918.09

- FTSE 100 up 18.8 points (0.24%) at 7895.85

- German DAX down 100.04 points (-0.56%) at 17737.36

- French CAC 40 down 0.85 points (-0.01%) at 8022.41

US TREASURY FUTURES CLOSE

- 3M10Y -4.178, -82.285 (L: -97.35 / H: -78.237)

- 2Y10Y -0.27, -35.835 (L: -38.924 / H: -35.112)

- 2Y30Y -0.218, -26.021 (L: -29.437 / H: -24.622)

- 5Y30Y +0.16, 5.339 (L: 3.478 / H: 9.057)

- Current futures levels:

- Jun 2-Yr futures up 1.25/32 at 101-16.625 (L: 101-15.5 / H: 101-22.25)

- Jun 5-Yr futures up 3.5/32 at 105-1.75 (L: 104-30.75 / H: 105-18.25)

- Jun 10-Yr futures up 6/32 at 107-28.5 (L: 107-24.5 / H: 108-22.5)

- Jun 30-Yr futures up 16/32 at 114-20 (L: 114-09 / H: 116-05)

- Jun Ultra futures up 22/32 at 121-0 (L: 120-15 / H: 122-30)

US 10Y FUTURE TECHS: (M4) Bear Cycle Remains In Play

- RES 4: 110-00+ 50-day EMA

- RES 3: 109-26+ High Apr 10

- RES 2: 109-03+ 20-day EMA

- RES 1: 108-25+ High Apr 12

- PRICE: 107-31 @ 1200 ET Apr 19

- SUP 1: 107-13+ Low Apr 16

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

A bear cycle in Treasuries remains in play and S/T gains are considered corrective. This week’s move lower reinforces the current bear theme and the move down has resumed this year’s downtrend and in the process, cleared a number of short-term support points. Moving average studies remain in a bear-mode set-up too. Scope is seen for a move to 107.07+ next, a Fibonacci retracement. Firm resistance is at 109-08, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 +0.015 at 94.745

- Sep 24 +0.020 at 94.890

- Dec 24 +0.020 at 95.060

- Mar 25 +0.025 at 95.245

- Red Pack (Jun 25-Mar 26) +0.020 to +0.025

- Green Pack (Jun 26-Mar 27) +0.020 to +0.025

- Blue Pack (Jun 27-Mar 28) +0.020 to +0.025

- Gold Pack (Jun 28-Mar 29) +0.025 to +0.030

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00146 to 5.31690 (-0.00239/wk)

- 3M +0.00189 to 5.32640 (-0.00116/wk)

- 6M +0.00312 to 5.30290 (-0.00047/wk)

- 12M +0.01084 to 5.21451 (+0.02823/wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (-0.01), volume: $1.764T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $702B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $690B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $246B

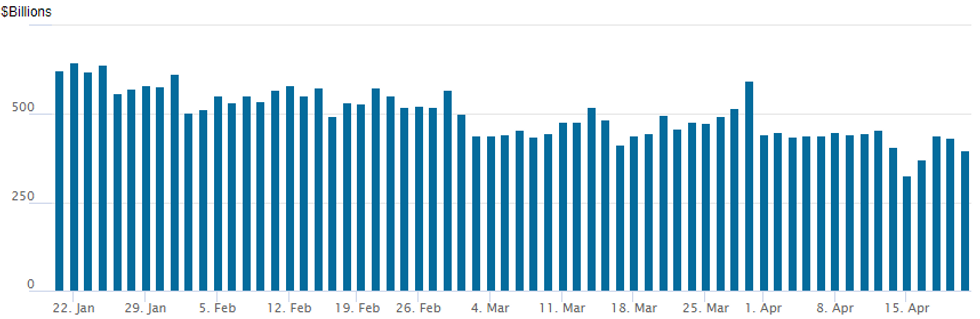

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls back below $400B but remains below Monday's near 3-year low. Usage falls to $397.234B vs. $433.006B yesterday. Compares to $327.066B on Monday -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties recedes to 68 vs. 75 prior.

EGBs-GILTS CASH CLOSE: UK Curve Bull Steepens On Dovish Developments

Gilts easily outperformed Bunds Friday on soft data and dovish BoE commentary.

- An early rally - triggered by Israel's attack on Iran overnight which spurred very large trading volumes in Bund futures, and softer than-expected UK retail sales - faded later in the morning as geopolitical risk premia subsided.

- Gilts pared losses in mid-afternoon after a speech by BoE's Ramsden leaned dovish, noting that inflation risks were to the downside.

- ECB's Wunsch, who has a hawkish reputation, dovishly noted potential for back-to-back cuts in June and July.

- There's now 52bp of BoE cuts priced for the year, vs around 42bp Thursday; ECB implied cuts were pared to 74bp from 76bp. Consequently, the UK curve bull steepened with Germany's twist flattening.

- Periphery EGB spreads closed mixed, with Italy underperforming. S&P reviews Greece's and Italy's credit ratings after the weekly close.

- Next week's schedule includes Eurozone flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.8bps at 3%, 5-Yr is up 1.2bps at 2.524%, 10-Yr is up 0.3bps at 2.5%, and 30-Yr is down 0.4bps at 2.623%.

- UK: The 2-Yr yield is down 10.2bps at 4.383%, 5-Yr is down 6.1bps at 4.128%, 10-Yr is down 4.2bps at 4.23%, and 30-Yr is down 2.1bps at 4.7%.

- Italian BTP spread up 0.3bps at 143.2bps / Spanish down 0.7bps at 81.2bps

FOREX FX Markets Stabilise as Middle-East Tensions Simmer

- Despite the heightened level of uncertainty overnight, and the subsequent significant volatility spike, currency markets have stabilised as the weekend close approaches. The USD index has recouped the majority of its overnight losses and emerging market currencies have also recovered.

- With the missile strike appearing limited in nature and closer to a warning shot rather than a declaration of protracted hostilities, markets bottomed out to put USD/JPY a big figure above the overnight low and hovering just shy of the multi-decade highs registered earlier in the week.

- Recent USDJPY gains have confirmed a resumption of the primary uptrend and this maintains the bullish price sequence of higher highs and higher lows. The trend is overbought, however, this is clearly not a concern for bulls at this stage.

- GBP is a relative underperformer on Friday as any bullish sentiment following the week’s firmer inflation and labour market data appears to have faded. The trend condition in GBPUSD remains bearish and the pair has traded to a fresh cycle low today.

- The recent breach of 1.2519, the Feb 5 low, strengthens a downtrend and highlights a stronger reversal with scope seen for an extension towards 1.2364, a Fibonacci retracement.

- Data heats up next week with Eurozone flash PMI’s Tuesday and US GDP figures on Thursday. The Bank of Japan will also meet where no policy adjustment is anticipated at the upcoming two-day meeting ending Friday.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2024 | 2301/0001 | * |  | UK | Rightmove House Prices Index |

| 22/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/04/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 22/04/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/04/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 22/04/2024 | 1530/1730 |  | EU | ECB's Lagarde Lecture at Yale | |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/04/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.