-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: ECB Policy Pivot Chatter Lends Late Tsy Support

- MNI INTERVIEW: Ex-Fed's Lockhart Sees No Rush To Cut In 1H

- MNI BRIEF: 4Q US Growth Beats Estimates On Consumer Strength

- MNI ECB WATCH: ECB Holds Rates, Says Too Early To Discuss Cuts

- Initial Claims Surprise Higher But Trend Continues Pushing Lower

US

INTERVIEW (MNI): Ex-Fed's Lockhart Sees No Rush To Cut In 1H

- The Federal Reserve will put off interest rate cuts for as long as U.S. growth and employment stay solid to gather as much evidence on falling inflation as it can -- likely through the first half of the year, former Atlanta Fed President Dennis Lockhart told MNI.

- When the U.S. central bank does finally kick off the easing cycle, it would be reasonable to expect a quarter-point move every other meeting and three by year-end to match the FOMC's December projections, Lockhart said in an interview. That would mean investors have overestimated how soon and how quickly cuts will come. Traders are pricing in a first rate cut by May and five by December.

- "Policymakers want to get it right and will tend to delay as long as they can a major change in policy direction so as to have the most convincing evidence," Lockhart said. "They would not like to begin a cutting cycle and then have to reverse it."

NEWS

ECB WATCH (MNI): ECB Holds Rates, Says Too Early To Discuss Cuts

The European Central Bank kept its key interest rate on hold at 4% on Thursday for a third consecutive meeting, with President Christine Lagarde saying it was too early to discuss the timing of cuts but repeating that she saw no reason to disagree with a growing consensus for easing to begin by the summer.

ECB (MNI): Pres Lagarde: Labour Market Robust But Slowing, Growth Risks To Downside

ECB President Lagarde begins January's post-meeting press conference with the usual reading of the policy statement, followed by a discussion of the economic landscape and risks to outlook.

RUSSIA (MNI): Putin In Kaliningrad; Spox Warns Of Militaristic Sentiments From Baltics

President Vladimir Putin has arrived on a visit to the Russian exclave of Kaliningrad on the Baltic Sea, his first since September 2022.

MIDEAST (MNI): US & UK Sanction Houthi Officials In Further Step Towards FTO Status

A statement from the US Treasury Dep't confirms Bloomberg's earlier reportthat the US and UK are imposing sanctions on senior officials within Yemen's Houthi movement.

US TSYS 10Y Yield Back Near 4%

- After the knee-jerk sell-off reaction to 3.3% GDP, Treasury futures recovered, extended session highs in the last couple minutes, Mar'24 10Y taps 111-11.5 (+12.5), 10Y yield nears 4% to 4.0077% low.

- Reuters headlines providing lift for Treasury futures in late trade:

- ECB POLICYMAKERS OPEN TO START DISCUSSING FUTURE RATE CUTS IN MARCH IF DATA POINTS TO INFLATION HITTING 2% THIS YEAR: SOURCES

- ECB POLICYMAKERS SAY MARCH PIVOT WOULD PAVE WAY FOR RATE CUT MOST LIKELY IN JUNE: SOURCES - Reuters News

- Initial technical resistance at 111-21/112-26+ (20-day EMA / High Jan 12). Curves mildly flatter w/ 2s10s -0.706 at -21.281.

- Cross asset summary: Crude higher (WTI +2.17 at 77.26), Gold firmer (+4.83 at 2018.72), stocks firmer: SPX eminis +19.5 at 4919.5 - still off yesterday's contract high of 4933.25.

- Fast two reported earlier as Treasury futures broke upside AND downside range after Q4 advance GDP/core PCE, weekly claims data:

- GDP Price Index (1.5% vs. 2.2% est, 3.3% prior)

- GDP Annualized QoQ (3.3% vs. 2.0% est, 4.9% prior)

- Personal Consumption (2.8% vs. 2.5% est, 3.1% prior)

- Core PCE Price Index QoQ (2.0% vs. 2.0% est, 2.0% prior)

- Initial Jobless Claims (214k vs. 200k est, 189k prior rev)

- Continuing Claims (1.833M vs. 1.823M est, 1.806M prior)

OVERNIGHT DATA

BRIEF (MNI): 4Q US Growth Beats Estimates On Consumer Strength

U.S. GDP grew at a faster-than-expected 3.3% annual rate in the fourth quarter of 2023, driven by consumption growth at 2.8%, underscoring the resilience of the economy even as interest rates rose sharply. Wall Street had expected growth of 2.0%, down from a very hot 4.9% in the third quarter.

US DATA: GDP Surprises Higher On Consumption, But Also Inventories Not Dragging

Real GDP was clearly stronger than expected with 3.28% in Q4 (cons 2.0, AF GDPNow 2.4, highest analyst estimate 2.5) after 4.9%. Remember it follows the Real consumption drives some of the upside surprise: 2.83% (cons 2.5) after 3.1%. But changes in inventories also don’t drag, adding 0.1pps (GDPNow had seen -0.5pps) after 1.3pps in Q3.

US DATA: Initial Claims Surprise Higher But Trend Continues Pushing Lower

Initial jobless claims surprised higher with a seasonally adjusted 214k (cons 200k) in the week to Jan 20 after the surprisingly low 189k (initial 187k) was one of the lowest prints in the last twenty five years.

Despite the week-on-week increase, the four-week average pushed lower again to just 202k (a 220k in Dec 22 dropped out). Recall the lowest single print in 2019 was 197k.

Continuing claims saw a smaller surprise higher at a seasonally adjusted 1833k (cons 1823k) in the week to Jan 13, capturing the payrolls reference week, after an unrevised 1806k.

US DEC DURABLE NEW ORDERS +0.0%; EX-TRANSPORTATION +0.6%

US NOV DURABLE GDS NEW ORDERS REV TO +5.5%

US DEC NONDEF CAP GDS ORDERS EX-AIR +0.3% V NOV +1.0%

CANADA DATA: Canada Nov Payrolls -88.3K From Teacher Strikes, Earnings +4.1% YOY

Canada Nov Payroll Employment -88.3K MOM or -0.5% after -24K in Oct. The decline was led by education strikes in Quebec. Excluding education, payroll employment was -25.3K MOM or -0.1% Average weekly earnings +4.1% YOY in Nov. Average weekly hours +0.6% YOY, prior +0.9%. Job vacancies +5.5% to 653K after a 5M downward trend leveled off in Oct.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 88.6 points (0.23%) at 37899.28

- S&P E-Mini Future up 8.75 points (0.18%) at 4907.5

- Nasdaq down 7.4 points (0%) at 15476.29

- US 10-Yr yield is down 4.6 bps at 4.1299%

- US Mar 10-Yr futures are up 11/32 at 111-10

- EURUSD down 0.005 (-0.46%) at 1.0835

- USDJPY up 0.28 (0.19%) at 147.79

- WTI Crude Oil (front-month) up $2.32 (3.09%) at $77.43

- Gold is up $3.58 (0.18%) at $2017.38

- European bourses closing levels:

- EuroStoxx 50 up 18.15 points (0.4%) at 4582.26

- FTSE 100 up 2.06 points (0.03%) at 7529.73

- German DAX up 17 points (0.1%) at 16906.92

- French CAC 40 up 8.56 points (0.11%) at 7464.2

US TREASURY FUTURES CLOSE

- 3M10Y -3.436, -123.615 (L: -128.999 / H: -119.268)

- 2Y10Y +2.194, -18.381 (L: -23.195 / H: -17.269)

- 2Y30Y +4.108, 6.786 (L: -1.231 / H: 6.927)

- 5Y30Y +4.726, 36.573 (L: 29.816 / H: 36.573)

- Current futures levels:

- Mar 2-Yr futures up 4.125/32 at 102-22 (L: 102-15.5 / H: 102-22.5)

- Mar 5-Yr futures up 8.25/32 at 107-27.5 (L: 107-14.25 / H: 107-28.5)

- Mar 10-Yr futures up 11/32 at 111-10 (L: 110-26.5 / H: 111-11.5)

- Mar 30-Yr futures up 19/32 at 119-26 (L: 119-00 / H: 120-04)

- Mar Ultra futures up 24/32 at 125-21 (L: 124-21 / H: 126-07)

US TREASURY FUTURE TECHS: (H4) Bear Cycle Remains In Play

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-21/112-26+ 20-day EMA / High Jan 12

- PRICE: 111-10 @ 1455 ET Jan 25

- SUP 1: 110-26 Low Jan 19

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

The trend needle in Treasuries continues to point south and sights are on 110-26, the Jan 19 low. A break of this level would confirm a resumption of the current bear cycle and highlight a clear break of the 50-day EMA, at 111-03+. This would pave the way for a move towards 110-16, the Dec 13 low. Firm resistance is 112-26+, the Jan 12 high. Initial resistance is at 111-21, the 20-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.040 at 94.880

- Jun 24 +0.065 at 95.325

- Sep 24 +0.075 at 95.745

- Dec 24 +0.080 at 96.10

- Red Pack (Mar 25-Dec 25) +0.070 to +0.075

- Green Pack (Mar 26-Dec 26) +0.050 to +0.065

- Blue Pack (Mar 27-Dec 27) +0.045 to +0.050

- Gold Pack (Mar 28-Dec 28) +0.040 to +0.045

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00005 to 5.33659 (+0.00065/wk)

- 3M -0.00446 to 5.31959 (+0.00441/wk)

- 6M -0.01571 to 5.17225 (+0.01292/wk)

- 12M -0.02724 to 4.81968 (+0.02119/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.596T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $668B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $263B

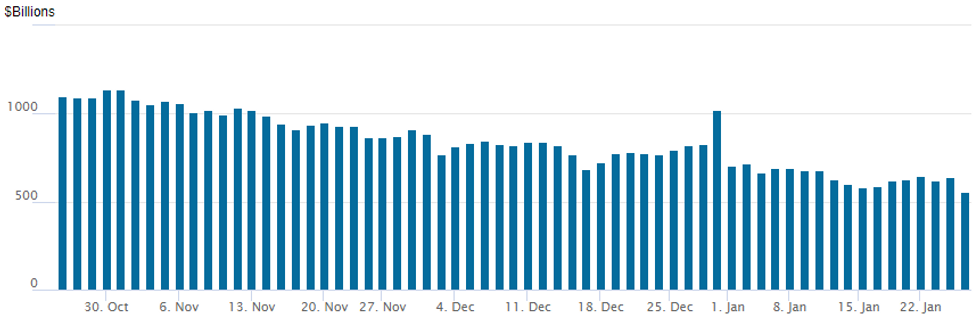

FED REVERSE REPO OPERATION: New Cycle Low

NY Federal Reserve/MNI

- RRP usage falls to new cycle low of $557.687B vs. $639.560B Wednesday. Compares to $583.103B on Tuesday, January 16 - prior lowest level since mid-June 2021.

- Meanwhile, the number of counterparties at 82 vs. 83 Wednesday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

PIPELINE: High-Grade Corporate Debt Issuance Over $51B on Wk

$7.55B to Price Thursday, $51B running total on the week

- Date $MM Issuer (Priced *, Launch #

- 1/21 $2.2B #NGL Energy $900M 5NC2 8.125%, $1.3B 8NC3 8.375%

- 1/25 $2B #Lockheed $650M 5Y +53, $600M +10Y +68, $750M 40Y +83

- 1/25 $1B #Swedish Export Credit 5Y SOFR+50

- 1/25 $1B #Comerica 6NC5 +195

- 1/25 $850M #Ashtead Capital 10Y +172

- 1/25 $500M *Tampa Electric WNG 5Y +87.5

- 1/25 $Benchmark Hyundai Capital investor calls

- Expected next week: $1B Rakuten 3NC

EGBs-GILTS CASH CLOSE: Bull Steepening As ECB Cut Pushback Proves Limited

European yields fell Thursday amid a lack of hawkish surprises from the ECB and soft economic data on both sides of the Atlantic.

- While weaker-than-expected German IFO data early in the session didn't have much immediate market impact, it set the tone for a constructive session for core FI.

- Mixed US data released between the unsurprising ECB statement and the Lagarde press conference was met with a dovish reaction, with focus on a very soft quarterly inflation reading and a tick higher in jobless claims.

- As for the Lagarde presser, the lack of significant pushback against market rate cut pricing was marginally dovish: there are now 142bp of reductions expected this year, 12bp more than pre-US data/Lagarde, with implied probability of nearly 84% that the first cut will arrive by April (up from 60%).

- Curves finished bull steeper, led by a German short-end rally amid a rebound in ECB rate cut expectations.

- Periphery EGB spreads tightened on the more dovish monetary policy outlook, led by GGBs.

- While there is only largely 2nd tier European data out Friday, we hear from ECB policymakers including Simkus, Kazaks, and Vujcic, and get the ECB Survey of Professional Forecasters.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 9.2bps at 2.617%, 5-Yr is down 7bps at 2.187%, 10-Yr is down 5.2bps at 2.29%, and 30-Yr is down 2.3bps at 2.499%.

- UK: The 2-Yr yield is down 3.4bps at 4.385%, 5-Yr is down 4.2bps at 3.916%, 10-Yr is down 2.7bps at 3.983%, and 30-Yr is down 1.3bps at 4.594%.

- Italian BTP spread down 2.2bps at 153.7bps / Greek down 3.4bps at 100.2bps

FOREX EUR Slips As ECB Acknowledges Balanced Risks For Inflation

- Despite a broadly as expected ECB decision and press conference, and President Lagarde saying it was too early to discuss the timing of cuts, the Euro came under pressure on Thursday. EURUSD currently sits around 0.50% in the red, with the pair hovering just above the year’s lows as we approach the APAC crossover.

- 1.0900 capped the topside as the press conference began, however, an acknowledgement that wage pressures have started to ease saw a quick 50 pip jolt lower and a breaching of the tight overnight range. Comments on the rate cut debate being premature failed to garner any support, with the single currency keeping a downward bias for the majority of the US session.

- On the downside, a break of 1.0822, Tuesday’s and today’s lows, would resume the recent bearish theme. Lower US yields in the aftermath of the mixed US GDP data briefly supported the Yen, prompting EURJPY to breach yesterday’s lows below 160.00 and print 159.70 before stabilising.

- With major equities tilted into positive territory, the likes of EURAUD, EURNZD and especially EURCAD (-0.75%) are showing particular underperformance, with the latter further weighed by a 3% rally for crude futures.

- Despite the lower yields in the US, the USD index looks set to post a 0.35% advance on the session as markets turn their focus to PCE Core Deflator and US personal spending data on Friday. It is worth noting that the Bank of Japan minutes are scheduled overnight in Asia.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 26/01/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/01/2024 | 0700/0800 | ** |  | SE | Unemployment |

| 26/01/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2024 | 0900/1000 | ** |  | EU | M3 |

| 26/01/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 26/01/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 26/01/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.