-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Eye on Wednesday Supercore CPI

- MNI US FED: Fed's Barr: 9% Capital Hike For Top Banks In Re-Proposal

- MNI US: Speaker Johnson's Government Funding Plan On Brink Of Collapse

- MNI US CPI Preview: Potential Tiebreaker For 25bp vs 50bp Cut

- MNI US OUTLOOK/OPINION: Supercore CPI Seen At Least Repeating July’s Pace

US

US FED (MNI): Fed's Barr: 9% Capital Hike For Top Banks In Re-Proposal

The Federal Reserve's top banking regulator Michael Barr on Tuesday said the biggest U.S. banks would face a 9% increase in capital requirements in a re-proposal of Basel endgame and G-SIB surcharge rules.

- For other large banks that are not G-SIBs, Barr said the impact from the re-proposal would mainly result from the inclusion of unrealized gain and losses on their securities in regulatory capital, estimated to be equivalent to a 3% to 4% increase in capital requirements over the long run, according to prepared remarks. The remainder of the re-proposal would increase capital requirements for non-GSIB firms still subject to the rule by 0.5%.

US CPI Preview (MNI): Potential Tiebreaker For 25bp vs 50bp Cut

Consensus sees core CPI at 0.2% M/M in August after a slightly softer than expected 0.165% M/M in July. MNI’s survey of analysts, including multiple unrounded estimates, suggests it is firmly centered at 0.20%.

- Headline CPI is primed for a ‘low’ 0.2% M/M reading but note an almost even split between 2.5/2.6% Y/Y reading which could easily drive what appears a beat for the 2.5 Bloomberg consensus.

- We expect rental inflation and especially the smaller weighted primary tenants’ rent category to play a particularly big role this month, with analysts looking for an almost full reversal of last month’s surprise strength. We feel there could be some upside risk here.

US OUTLOOK/OPINION (MNI): Supercore CPI Seen At Least Repeating July’s Pace

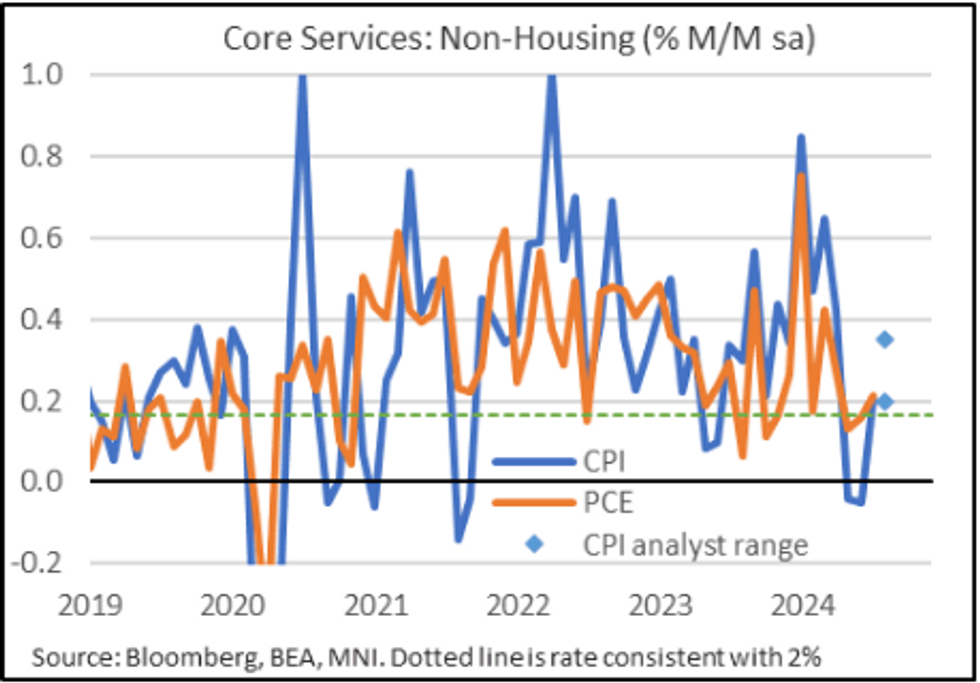

Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July, with six analysts between 0.20-0.35% M/M.

- This CPI “supercore” happened to be exactly in line with its PCE counterpart in July (also 0.21% M/M prior to typical monthly revisions) although that is rare. CPI supercore was far weaker before that, averaging -0.05% through May-June vs 0.145% M/M for PCE supercore but as the chart shows there is no typical spread between the two on a M/M basis.

NEWS

US (MNI): Speaker Johnson's Government Funding Plan On Brink Of Collapse- House Speaker Mike Johnson’s (R-LA) plan to fund the government for six months, paired with the SAVE Act bill - a Trump-endorsed bill that requires citizenship ID to register to vote, appears on the brink of collapse. The plan, which is under a veto threat from the White House, now faces unclear support from a diverse group of House Republicans, including hardline conservatives who oppose short-term funding measures on principle and defense hawks who see a Pentagon budget shortfall as a national security risk.

SECURITY (MNI): WH NSC Spox Kirby: Iran-Russia Partnership Threatens European Security

- White House National Security Council Spokesperson John Kirby has delivered a press briefing on Iran's recent transfer of close-range ballistic missiles to Russia. Kirby says, without speculating on the number of missiles transferred: "We know these missiles have been delivered, but that's really as far as I'm going to be able to go right now."

- Finance Minister Christian Lindner has just finished speaking in the Bundestag regarding the 2025 budget and the gov'ts 2024-28 fiscal plan. There has been focus on the German gov'ts response to former Italian PM Mario Draghi's reporton EU competitiveness published on 9 September.

- The German luxury-car maker said that costs from a recall of more than 1.5 million vehicles with problematic braking systems will land in the high three-digit million euros. That, along with headwinds in China, has prompted BMW to cut its forecasts for earnings margin and return on capital employed, the company said Tuesday.

US Tsy Futures Near Late Highs, Rate Cut Projections Gradually Gaining

- Treasuries climbed steadily off early session lows Tuesday, late profit taking sees futures 2-3 points off session highs. Projected rate cuts through year end have regained some ground after receding Monday into early Tuesday (*): Sep'24 cumulative -33.5bp (-32.7bp), Nov'24 cumulative -73.3bp (-71.8bp), Dec'24 -115.4bp (-112.0bp).

- Dec'24 10Y futures currently trade +12 at 115-13.5 vs. 115-16 high, shy of 115-19 technical resistance (High Aug 5 and the bull trigger). 10Y yield -.0563 at 3.6442%. Curves mildly steeper after disinverting last Friday (climbing to highest level since June 2022 early Monday at 7.405), 2s10s currently +.805 at +3.765.

- No economic data on today, markets await Wednesday's CPI, PPI inflation measure on Thursday. Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July, with six analysts between 0.20-0.35% M/M.

- The Federal Reserve's top banking regulator Michael Barr on Tuesday said the biggest U.S. banks would face a 9% increase in capital requirements in a re-proposal of Basel endgame and G-SIB surcharge rules.

- For other large banks that are not G-SIBs, Barr said the impact from the re-proposal would mainly result from the inclusion of unrealized gain and losses on their securities in regulatory capital, estimated to be equivalent to a 3% to 4% increase in capital requirements over the long run, according to prepared remarks.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 117.05 points (-0.29%) at 40711.76

- S&P E-Mini Future up 22.25 points (0.41%) at 5501.75

- Nasdaq up 137.1 points (0.8%) at 17021.27

- US 10-Yr yield is down 5.6 bps at 3.6442%

- US Dec 10-Yr futures are up 13/32 at 115-14.5

- EURUSD down 0.0008 (-0.07%) at 1.1027

- USDJPY down 0.84 (-0.59%) at 142.34

- WTI Crude Oil (front-month) down $2.59 (-3.77%) at $66.12

- Gold is up $8.62 (0.34%) at $2514.91

- European bourses closing levels:

- EuroStoxx 50 down 31.46 points (-0.66%) at 4747.2

- FTSE 100 down 64.86 points (-0.78%) at 8205.98

- German DAX down 177.64 points (-0.96%) at 18265.92

- French CAC 40 down 17.71 points (-0.24%) at 7407.55

US TREASURY FUTURES CLOSE

- 3M10Y +0.194, -133.232 (L: -136.612 / H: -126.957)

- 2Y10Y +1.219, 4.179 (L: 1.988 / H: 5.222)

- 2Y30Y +2.758, 35.726 (L: 31.656 / H: 36.459)

- 5Y30Y +1.929, 53.126 (L: 49.938 / H: 53.813)

- Current futures levels:

- Dec 2-Yr futures up 3.875/32 at 104-12.75 (L: 104-06.75 / H: 104-13.625)

- Dec 5-Yr futures up 9/32 at 110-21.75 (L: 110-08.5 / H: 110-23)

- Dec 10-Yr futures up 12.5/32 at 115-14 (L: 114-27.5 / H: 115-16)

- Dec 30-Yr futures up 22/32 at 126-27 (L: 125-23 / H: 127-00)

- Dec Ultra futures up 26/32 at 137-2 (L: 135-23 / H: 137-11)

US 10YR FUTURE TECHS: (Z4) Key Resistance Remains Exposed

- RES 4: 116-16 High May 11 2023 (cont)

- RES 3: 116-00 Round number resistance

- RES 2: 115-19 High Aug 5 and the bull trigger

- RES 1: 115-16 High Sep 10

- PRICE: 115-14 @ 1513 ET Sep 10

- SUP 1: 114-02+ 20-day EMA

- SUP 2: 113-12 Low Sep 3

- SUP 3: 113-00+/113-00 50-day EMA / Low Aug 8

- SUP 4: 111-28+ High Jul 17

The trend needle in Treasuries continues to point north. Sights are on the key resistance and bull trigger at 115-19, Aug 5 high. Clearance of this level would confirm a resumption of the uptrend. Key short-term support has been defined at 113-12, the Sep 3 low, and this level is below support at the 20-day EMA, at 114-02+. A clear breach of the 20-day EMA and the Sep 3 low, would signal scope for a deeper correction.

SOFR FUTURES CLOSE

- Sep 24 +0.010 at 95.115

- Dec 24 +0.035 at 95.945

- Mar 25 +0.050 at 96.595

- Jun 25 +0.065 at 96.950

- Red Pack (Sep 25-Jun 26) +0.065 to +0.070

- Green Pack (Sep 26-Jun 27) +0.055 to +0.060

- Blue Pack (Sep 27-Jun 28) +0.050 to +0.055

- Gold Pack (Sep 28-Jun 29) +0.050 to +0.055

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00684 to 5.11077 (+0.00093/wk)

- 3M +0.02334 to 4.94886 (+0.01022/wk)

- 6M +0.02067 to 4.57888 (-0.01311/wk)

- 12M -0.00101 to 3.99443 (-0.05917/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.094T

- Broad General Collateral Rate (BGCR): 5.32% (-0.01), volume: $800B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $768B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

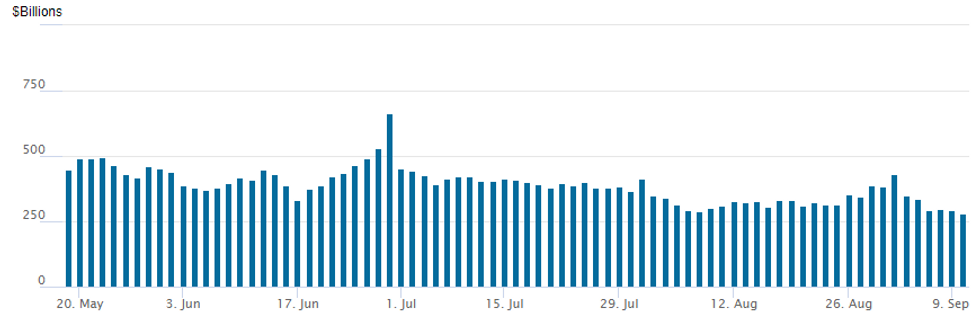

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage falls to new multi-year low of $281.392B (early May 2021 levels) vs. $292.158B on Monday. Number of counterparties rises to 60 from 57.

PIPELINE: $22.05B High Grade Corporate Debt to Price Tuesday

Still waiting for $800M Wynn Resorts and Provence of Ontario to launch, however:- Date $MM Issuer (Priced *, Launch #)

- 9/10 $7B #Oneok $1.25B 3Y +80, $600M 5Y +100, $1.25B 7Y +130, $1.6B 10Y +145, $1.5B 30Y +175, $800M 40Y +190

- 9/10 $2B #Bunge Ltd Finance $400M +3Y +65, $800M 5Y +80, $800M 10Y +105

- 9/10 $2B *IADB 7Y SOFR+52

- 9/10 $2B *AfDB 5Y SOFR+41

- 9/10 $1.25B #APA Infrastructure $750M 10Y +165, $500M 20Y +182

- 9/10 $1.25B #Helmerich & Payne $350M 3Y +120, $350M 5Y +145, $550M 10Y +190

- 9/10 $1B #Nissan Motor Acceptance Co $400M 3Y +185, $300M 3Y SOFR+205, 400M $5Y +215

- 9/10 $1B #CK Hutchinson $500M 5.5Y +95, $500M 10Y +115

- 9/10 $1B *Kommuninvest WNG 2027 SOFR+36

- 9/10 $1B *Blue Owl Credit +5Y +260

- 9/10 $800M Wynn Resorts 8.5NC3

- 9/10 $750M *IDB Invest +2Y SOFR+35

- 9/10 $500M #MassMutual 7Y +85

- 9/10 $500M #Macquarie Airfinance 5.5Y +172

- 9/10 $Benchmark Provence of Ontario 5Y SOFR+57

BONDS: EGBs-GILTS CASH CLOSE: Curve Bellies Outperform As Gains Extend

Core European instruments extended gains to a 6th consecutive session Tuesday.

- After an slightly weak start to the day, Gilts and Bunds gained in afternoon trade on apparent global growth concerns, as broad-based weakness in commodities led by oil boosted safe-haven assets.

- Earlier, a largely in-line UK labour market report did not provide much to move expectations for the BoE, while final German CPI was inline.

- Curve bellies outperformed in Germany and the UK. Periphery EGB spreads were little changed.

- Most attention Wednesday will be on US CPI, but before that we get monthly UK activity data.

- Looking beyond that, a 25bps cut at Thursday's ECB meeting is unanimously expected (and priced in), leaving focus on the policy guidance and revised projections. (MNI's ECB preview is here.)

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.6bps at 2.178%, 5-Yr is down 4.1bps at 1.993%, 10-Yr is down 3.7bps at 2.131%, and 30-Yr is down 2.6bps at 2.406%.

- UK: The 2-Yr yield is down 2.9bps at 3.86%, 5-Yr is down 3.8bps at 3.685%, 10-Yr is down 3.7bps at 3.819%, and 30-Yr is down 2.6bps at 4.398%.

- Italian BTP spread unchanged at 145.2bps / Spanish bond spread down 0.2bps at 82.7bps

FOREX: USDJPY Reverts Lower with US Yields as CPI Awaited

- Another day, another volatile session for the Japanese yen. Continuing to be steered by core fixed income markets, a treasury led rally on Friday boosted the Japanese yen substantially. USDJPY fell roughly 150 pips from session highs, falling as low as 142.20 as US two-year yields dipped below 3.6%. Price action sees the gap narrow to the key support area around 141.70, an area of critical focus heading into tomorrow’s US data.

- In similar vein across the low yielders/funders, the Swiss Franc has been on the front foot, with EURCHF currently down 0.45% as we approach the APAC crossover. The cross looks set to close at the lowest level since Aug 06 and takes us closer to the year’s lowest levels, where some market analysts believed the SNB may have stepped in to curb excessive CHF strength.

- The very front-end of the USD vol curve is unsurprisingly bid headed into tomorrow's US inflation print, with overnight EUR/USD implied cresting at 9.5 points this morning. That's still comfortably north of the running August average (6.1 points), but not far off half the prevailing levels ahead of Friday's NFP print.

- This gels well with the view that the Fed are leaning more heavily on the employment aspect of the dual mandate - likely making markets less sensitive to tomorrow's inflation print relative to Friday's labour market report.

- Today's pick up in vols pushes the break-even on an overnight straddle to ~40 pips, meaning a hawkish CPI print tomorrow would press the pair toward the key area of support identified on the 15min candle charts at 1.0970-77. Below here, Fibonacci retracement support resides at 1.0878.

- All the focus Wednesday on US inflation data and note that the releases will land firmly within the Fed’s blackout period ahead of the Sep 17-18 meeting.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 11/09/2024 | 0600/0700 | ** |  | UK Monthly GDP |

| 11/09/2024 | 0600/0700 | ** |  | Trade Balance |

| 11/09/2024 | 0600/0700 | ** |  | Index of Services |

| 11/09/2024 | 0600/0700 | *** |  | Index of Production |

| 11/09/2024 | 0600/0700 | ** |  | Output in the Construction Industry |

| 11/09/2024 | 0900/1000 | ** |  | Gilt Outright Auction Result |

| 11/09/2024 | 1100/0700 | ** |  | MBA Weekly Applications Index |

| 11/09/2024 | 1230/0830 | *** |  | CPI |

| 11/09/2024 | 1230/0830 | * |  | Intl Investment Position |

| 11/09/2024 | 1400/1000 | * |  | Services Revenues |

| 11/09/2024 | 1400/1000 |  | MNI Connect Video Conference on ‘Fed Balance Sheet – Comparison with Other Central Banks’ | |

| 11/09/2024 | 1430/1030 | ** |  | DOE Weekly Crude Oil Stocks |

| 11/09/2024 | 1700/1300 | ** |  | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.