-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI ASIA OPEN: Fed Bostic Sees Soft Landing

- MNI: Powell Says Nearly All FOMC Members See More Rate Hikes

- MNI BRIEF: Fed's Bostic Says Bar Higher For Further Hikes

- MNI BRIEF: Fed's Goolsbee Says June Rate Hold Was Close Call

- MNI FED: Prospective New FOMC Voter Kugler Assumed "Neutral"

US

FED: Nearly all FOMC members think the Federal Reserve will have to raise interest rates "somewhat" further this year in order to bring inflation down to the central bank's 2% target over time, Fed Chair Jerome Powell will testify before the House Financial Services Committee Wednesday.

- "Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year," Powell said in prepared remarks. He said last week's decision to hold rates steady for the first time since March 2022 reflected "how far and how fast we have moved," adding that future decisions will be made on a meeting-by-meeting basis. The Fed kept rates steady at 5-5.25% but revised up the median forecast for the peak federal funds rate to 5.6%, from 5.1% in March.

- Powell said inflation has moderated since the middle of last year but price pressures remain too high and that the Fed "has a long way to go" in getting back to the official 2% target.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Wednesday he supports holding the fed funds rate at the current 5%-5.25% target range and letting past rate increases work their way through the economy, adding the bar to justify further rate hikes is higher than it was a few months ago.

- "I think we are in a place where we should let the hard work the Committee has already done work its way through the economy and see if it continues to bring inflation closer to our goal," Bostic said in his most recent Message from the President. "We have good reasons to expect our policy tightening will be increasingly effective in coming months, which would accelerate progress to that end."

- The Atlanta Fed chief said monetary policy has been restrictive for only eight to nine months and the real economic effects of tighter monetary policy are only just beginning to take hold. The first 325 to 350 basis points of increases removed accommodation and the subsequent 150 to 175 basis points have moved policy into what "may now be sufficiently restrictive," Bostic said.

FED: Holding off raising the Fed's benchmark interest rate last week was a "close call" but it's appropriate to wait to judge how much further to tighten, Chicago President Austan Goolsbee said Wednesday, adding he hasn't yet made a decision about a July hike.

- "We're in this weird, foggy environment where it's hard to figure out where the road is, and I felt like a reconnaissance mission is perfectly appropriate thing to do after you've had 10 raises in a row," he told a Wall Street Journal forum. "It takes some time for that to work its way through the economy, and just trying to figure out whether we've done enough, how much more needs to be done."

- "Over the next several months, we're going to get some markers" of whether the job market and inflation are cooling enough, he said. "If you don't see progress, that is an answer. If you do see progress, that is also an answer."

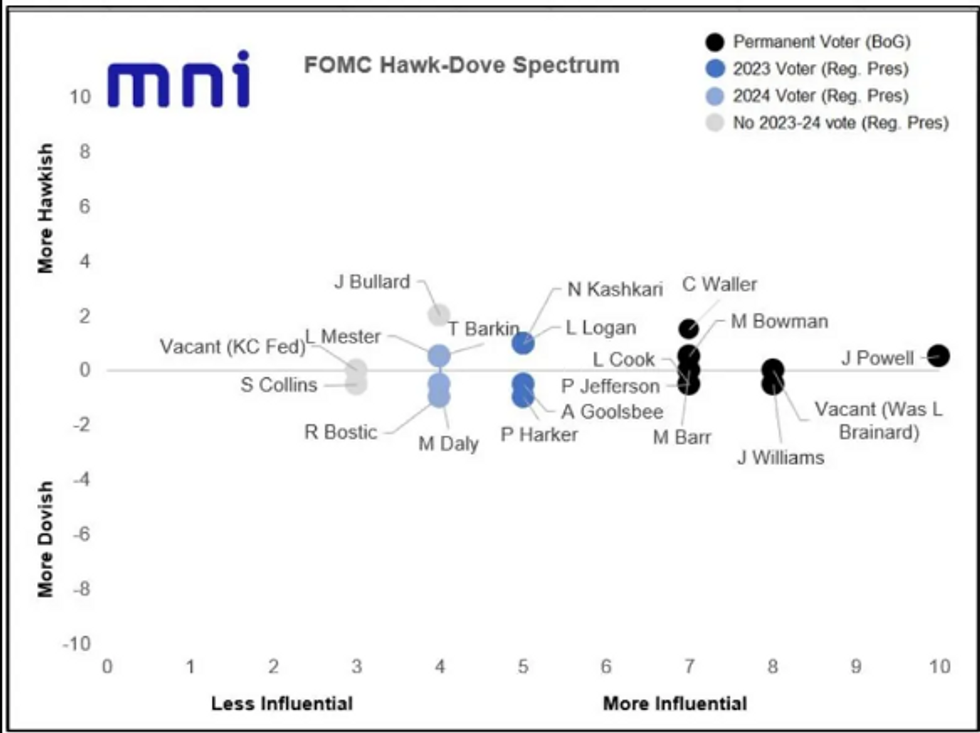

FED: Concurrent with the Powell Q&A, there's a lesser-watched confirmation hearing in the Senate for Lisa Cook, Philip Jefferson, and Adriana Kugler.

- Two of those are already on the FOMC and "known quantities": Cook's term expires in 2024 but she's been nominated for a 14-year extension; Jefferson is set to take Brainard's Vice Chair spot. But Kugler (a labor economist, and US representative to the World Bank) will be a new FOMC voter if she is confirmed as a Governor as expected.

- It's doubtful there will be any major revelations as to her hawkish-dovish leanings today, in keeping with previous Senate hearings (she's quoted by wires as saying both sides of the Fed's mandate are critical).

- Kugler will probably enter our Hawk-Dove matrix as a "neutral" dot upon her confirmation, with the Board already fairly well-balanced between the more hawkish leaning (Waller, Bowman) and those who lean dovish (Williams, Jefferson).

US TSYS: FED Non-Voter Bostic Underpins Tsy Bid

- Treasury futures rebounded off midmorning lows, are drifting near the top end of the range with curves extending inversion: 2s10s marking -99.634 low.

- Second half support arrived after 20Y Bond auction re-open stopped through, strong auction drawing 4.01% high yield vs. 4.03% WI; 2.87x bid-to-cover vs. prior month's 2.56x.

- Meanwhile, Atlanta Fed Bostic (non-voter) supports holding the fed funds rate at the current 5%-5.25% target range and letting past rate increases work their way through the economy, adding the bar to justify further rate hikes is higher than it was a few months ago.

- Not too much of a reaction to Fed Chairman Powell semi-annual testimony to Congress earlier, reiterating talking points from last week's hawkish hold. He said last week's decision to hold rates steady for the first time since March 2022 reflected "how far and how fast we have moved," adding that future decisions will be made on a meeting-by-meeting basis.

- Chairman Powell reappears at Senate Banking Committee tomorrow at 1000ET.

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE +0.5% SA THRU JUN 16 WK

- US MBA: REFIS -2% SA; PURCH INDEX +2% SA THRU JUNE 16 WK

- US MBA: UNADJ PURCHASE INDEX -32% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.73% VS 6.77% PREV

- US REDBOOK: JUN STORE SALES +0.7% V YR AGO MO

- US REDBOOK: STORE SALES +0.9% WK ENDED JUN 17 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 12.71 points (-0.04%) at 34040.01

- S&P E-Mini Future down 11.25 points (-0.25%) at 4423

- Nasdaq down 102.4 points (-0.7%) at 13564.37

- US 10-Yr yield is down 0.2 bps at 3.7189%

- US Sep 10-Yr futures are steady at at 113-10 at 113-10

- EURUSD up 0.0068 (0.62%) at 1.0986

- USDJPY up 0.35 (0.25%) at 141.82

- Gold is down $2.12 (-0.11%) at $1934.36

- EuroStoxx 50 down 20.39 points (-0.47%) at 4322.75

- FTSE 100 down 10.13 points (-0.13%) at 7559.18

- German DAX down 88.19 points (-0.55%) at 16023.13

- French CAC 40 down 33.2 points (-0.46%) at 7260.97

US TREASURY FUTURES CLOSE

- 3M10Y -6.637, -158.341 (L: -160.351 / H: -151.551)

- 2Y10Y -2.167, -99.205 (L: -99.226 / H: -95.465)

- 2Y30Y -2.969, -90.723 (L: -91.085 / H: -86.413)

- 5Y30Y -1.004, -15.326 (L: -17.132 / H: -13.108)

- Current futures levels:

- Sep 2-Yr futures down 0.75/32 at 102-4.875 (L: 102-02.375 / H: 102-06.75)

- Sep 5-Yr futures up 1/32 at 107-31 (L: 107-22 / H: 108-02.25)

- Sep 10-Yr futures up 0.5/32 at 113-10.5 (L: 112-27.5 / H: 113-13.5)

- Sep 30-Yr futures up 4/32 at 128-6 (L: 127-01 / H: 128-09)

- Sep Ultra futures up 8/32 at 137-24 (L: 136-05 / H: 137-24)

US 10Y FUTURE TECHS:: (U3) Bear Threat Remains Present

- RES 4: 115-19 High May 18

- RES 3: 115-00 High Jun 1 and a key resistance

- RES 2: 114-06+ / 114-15+ High Jun 6 / 50-day EMA

- RES 1: 114-00 High Jun 13

- PRICE: 113-09+ @ 1545ET Jun 21

- SUP 1: 112-12+ Low Jun 14 and the bear trigger

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures are consolidating. The contract remains in a downtrend and last week’s move lower confirmed a continuation of the current bear cycle. Support at 112-29+, the May 26 / 30 low has been cleared. This signals scope for 112-00, the Mar 10 low. Further out, bearish price action suggests scope for a move towards 110-27+, the Mar 2 low and a key support. Gains are considered corrective. Initial firm resistance is at 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Jun 23 -0.008 at 94.770

- Sep 23 -0.010 at 94.660

- Dec 23 -0.015 at 94.790

- Mar 24 -0.010 at 95.110

- Red Pack (Jun 24-Mar 25) steady to +0.015

- Green Pack (Jun 25-Mar 26) +0.005 to +0.020

- Blue Pack (Jun 26-Mar 27) -0.005 to +0.005

- Gold Pack (Jun 27-Mar 28) steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00534 to 5.08247 (+.00618/wk)

- 3M +0.00888 to 5.22913 (+.02229/wk)

- 6M +0.00313 to 5.31173 (+.02235/wk)

- 12M -0.01681 to 5.24977 (+.01945/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01258 to 5.06271%

- 1M -0.00657 to 5.14757%

- 3M +0.01928 to 5.53957% */**

- 6M +0.00843 to 5.68243%

- 12M +0.00071 to 5.89857%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $134B

- Daily Overnight Bank Funding Rate: 5.06% volume: $295B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.427T

- Broad General Collateral Rate (BGCR): 5.03%, $625B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $610B

- (rate, volume levels reflect prior session)

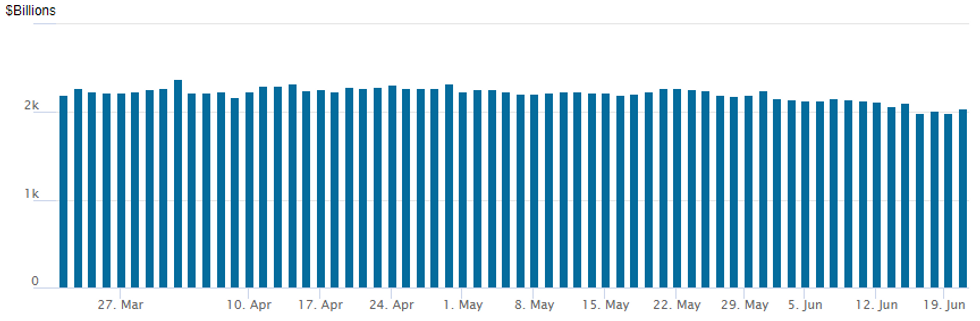

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,037.102B w/ 106 counterparties, compared to $1,989.489B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3B Hyundai Capital 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/21 $3B #Hyundai Capital AM $750M 2Y +115, $750M 3Y +145, $1B 5Y +178, $500M 7Y +188

- 06/21 $2B #Export Development Canada 3Y SOFR+25

- 06/21 $750M Element Fleet 3Y +200

- 06/21 $Benchmark Bank of Montreal 5Y SOFR+92a

EGBs-GILTS CASH CLOSE: High UK CPI Hits Short-End Gilts Ahead Of BoE

Gilts bear flattened yet again Wednesday after a higher-than-expected UK inflation print pushed up Bank of England hike pricing for tomorrow and beyond.

- After core CPI came in at 7.1% (vs 6.8% survey), hike pricing for Thursday's BoE decision neared 50% of a 50bp (vs 25bp hike) before settling down (our preview published pre-CPI is here). Terminal Bank rate pricing remained above 6%.

- The UK cash curve in turn hit its flattest levels in post-open trade, partially reversing the move over the course of the session but ending up bear flatter on the day once again. 2s10s hit a fresh post-2000 low (-70.5bp before closing a little less inverted than that).

- Bunds easily outperformed Gilts, in turn, with the belly underperforming on the German curve.

- Periphery spreads tightened modestly, with Greece outperforming following a well-received GGB auction.

- Focus Thursday is of course on the BoE, though the SNB and Norges Bank decisions could also have an impact early in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at 3.133%, 5-Yr is up 3.7bps at 2.562%, 10-Yr is up 3bps at 2.435%, and 30-Yr is down 0.6bps at 2.482%.

- UK: The 2-Yr yield is up 9.3bps at 5.046%, 5-Yr is up 8.2bps at 4.591%, 10-Yr is up 6.8bps at 4.405%, and 30-Yr is up 5.9bps at 4.513%.

- Italian BTP spread down 1bps at 161.6bps / Greek down 1.6bps at 130.4bps

FOREX: Volatile GBP Following CPI, BOE Decision Now Takes Focus

- An initial knee jerk higher for sterling, on the back of stronger than expected inflation, was quickly pared as markets weighed the potential impact of more aggressive tightening from the BOE going forward as well as short-term positioning adjustments ahead of tomorrow’s rate decision. GBPUSD traded as low as 1.2691 from a 1.2802 peak but late greenback weakness has seen the pair rise back to around 1.2775 ahead of the APAC crossover.

- GBPUSD technical bulls remain in the driver’s seat and short-term pullbacks are considered corrective. The rally last week confirmed a clear break of 1.2680, the May 10 high and a bull trigger. This strengthens bullish conditions and opens 1.2849, a Fibonacci projection.

- Elsewhere in G10, the Swedish Krona is the strongest performer, marking a swift reversal from the fresh all-time lows against the Euro on Tuesday. NZDUSD has also risen 0.75% on Wednesday.

- The modest greenback weakness in the aftermath of Fed Chair Powell’s semi-annual monetary policy report bolstered EURUSD to fresh six-week highs. The broad-based single currency strength also saw EURJPY print fresh trend highs and extend the move above the 155 mark. The 0.77% advance stands out in G10 fx, with the pair having recently confirmed a resumption of the longer-term uptrend. The focus remains on a material break of 155.59, a Fibonacci projection. 156.23 is the next topside target, the 2.00 projection of the Mar 20 - 21 - Apr 6 price swing.

- A packed central bank schedule on Thursday with the SNB, Norges Bank and the Bank of England all deciding on rates.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/06/2023 | 0730/0930 | *** |  | CH | SNB PolicyRate |

| 22/06/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 22/06/2023 | 0800/0400 |  | US | Fed Governor Chris Waller | |

| 22/06/2023 | 0915/1115 |  | EU | ECB Panetta Speech at Buba/ECB/Chicago Fed Conference | |

| 22/06/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/06/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 22/06/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 22/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 22/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/06/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 22/06/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/06/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2023 | 1400/1000 |  | US | Fed's Michelle Bowman, Loretta Mester | |

| 22/06/2023 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/06/2023 | 1430/1630 |  | EU | ECB de Guindos at Financial Journalists' Roundtable | |

| 22/06/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/06/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 22/06/2023 | 1900/1500 |  | US | Atlanta Fed's Raphael Bostic | |

| 22/06/2023 | 2030/1630 |  | US | Richmond Fed's Tom Barkin | |

| 23/06/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.