-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Fed Enters Policy Blackout

EXECUTIVE SUMMARY

- MNI BRIEF: Daly Says Could Be More Work To Do On Fed Goals

- MNI SOURCES: Hawks Aim For ECB Hike Before Data Ties Hands

- MNI: Canada Job Gain Doubles Forecast And Wage Gains Stay Hot

- MNI Atlanta Fed GDP Tracker Doesn’t Budge From 5.6%

US

FED: San Francisco Fed President Mary Daly signaled Friday she's still considering the potential to raise interest rates again to make sure inflation comes down to the central bank's 2% target.

- “We all know it’s too early to declare victory on achieving our goals mandated by Congress, and there could be more work to do,” she said while introducing a panel discussion on labor markets and the future of work.

FED: Daly "More Work To Be Done" As Partly Conflicting Fedspeak Continues Ahead Of Blackout. San Francisco Fed’s Daly (’24 voter) says it’s too early to declare victory on the Fed’s goals and that there may be more work to do.

- It’s a similar stance to that taken by a typically more hawkish Dallas Fed’s Logan (’23) late yesterday with her base case that there is more work left to do but it will require a “carefully calibrated approach” (skip may be apporpopriate at Sept FOMC), and more surprisingly Atlanta Fed’s Bostic (’24) also seeing more work still to be done.

- Coming towards a potential end of the hiking cycle, there is some discrepancy amongst FOMC participants. NY Fed’s Williams (voter) offered a typically balanced view yesterday that Fed policy is in a very good place albeit an open question whether we're sufficiently restrictive.

- More notably though it's a view that was unusually provided by Gov. Waller (voter) early this week with uncharacteristically dovish comments noting latest data allows us to proceed carefully, with nothing indicating that we have to do anything imminently as we can sit and watch the data. The way the data's coming in right now is looking pretty good for a soft landing scenario.

EUROPE

ECB: ECB policy hawks are circling for what could be their last data-based window to move the key deposit rate higher, pushing back against Governing Council members arguing for a pause to take stock of the nine consecutive hikes and their impact on the now-slowing eurozone economy, well-placed sources told MNI.

- Exchanges are expected among top ECB policymakers over the weekend to fashion a winning proposal that Chief Economist Philip Lane can present to the Governing Council. In addition to the actual rate decision, securing coherence among policymakers over future policy signaling and the relationship to the current data-dependent approach is seen as crucial.

- The debate centers on the speed of slowing inflation and whether to go for a hawkish pause at 3.75% or a hike to 4% “with a less hawkish twist”, as one source put it, reflecting an emerging recognition that Governing Council members are not that far apart with relatively few nailing their colors to the mast. For more see MNI Policy main wire at 0849ET.

CANADA

JOBS DATA: Canada's job gain more than doubled market forecasts in August while annual wage increases held close to 5%, government figures showed Friday, indicating further economic resilience two days after the central bank held interest rates and said policy makers can hike again if needed to tackle stubborn inflation.

- Employment climbed by 39,900 in Statistics Canada's report from Ottawa versus a Bloomberg consensus for a 17,500 gain, more than reversing July's 6,400 job loss. The unemployment rate remained 5.5% versus the consensus it would rise to 5.6%, holding in pace after climbing half a percentage point over the prior several months. Unemployment slid to a record low 4.9% last year.

- Bank of Canada Governor Tiff Macklem said in a speech Thursday he's watching wage gains closely as he considers whether to raise interest rates beyond the highest since 2001 at his next meeting in October, and StatsCan said wages rose 4.9% from a year earlier in August following July's 5% increase. That suggests worker compensation is catching up in real terms with wages running ahead of CPI at 3.3% after a phase when pay gains lagged well behind. For more see MNI Policy main wire at 0831ET.

US Tsys Late Market Roundup, Short End Underperforming

- Treasury futures are trading mostly weaker: 2s through 10s holding to a narrow range for much of the second half, paring early gains after Wholesale Inventories came out softer (-0.2% MoM vs. -0.1% est) Trade Sales firmer than expected (0.8% MoM vs. 0.2% est).

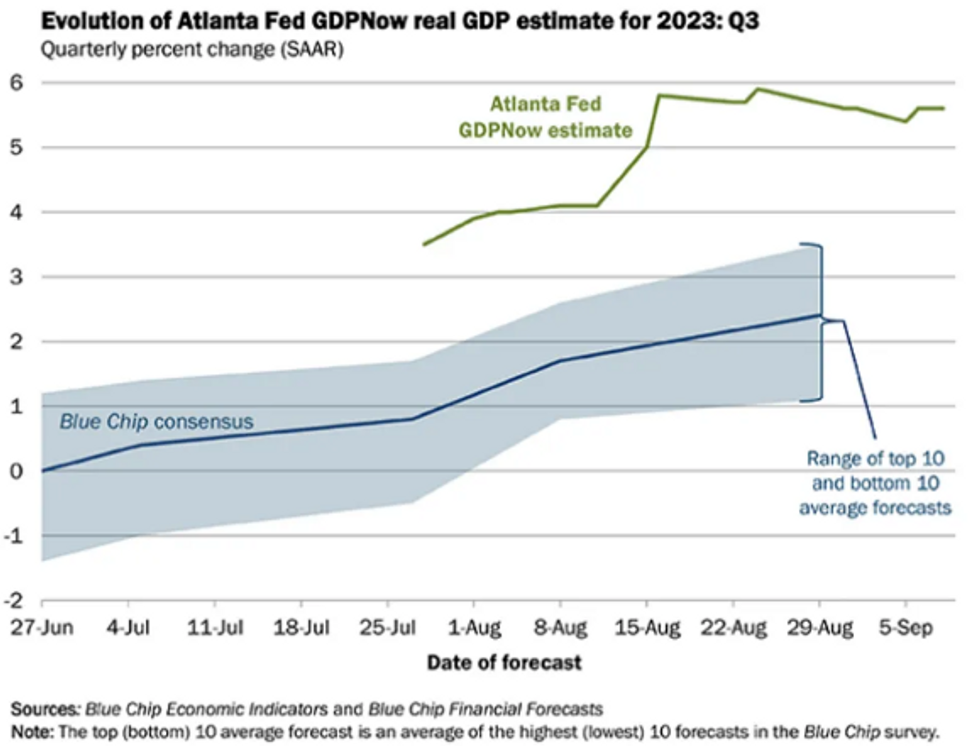

- The Atlanta Fed GDPNow tracker for Q3 was unrevised at 5.6% in today’s latest estimate, with near zero impact from today’s wholesale trade report (changes in inventories are still seen providing a strong 1.4pps to quarterly growth).

- The second unrevised estimate at 5.6% sees some stability having pulled back from earlier vintages of 5.9%, but it’s clearly still incredibly strong after 2.1% in Q2 -- particularly strong when compared to other regional Fed trackers as well, with today’s relaunching of the NY Fed’s take at 2.25% for Q3 and the St Louis Fed’s economic news index at just -0.1% as of last week.

- Consumer Credit figures for July climbed +10.4B with revolving credit +9.6B.

- Cross asset, equities reversed midmorning gains, SPX holding near steady in late trade (4455.0 -1.25); Crude +.50 at 87.37; Gold -1.42 at 1918.26.

- Scant data kicks off the week ahead, Fed in policy blackout, while US Treasury supply resumes with 3Y Note Monday.

OVERNIGHT DATA

US JUL WHOLESALE INV -0.2%; SALES 0.8%

US: The Atlanta Fed GDPNow tracker for Q3 was unrevised at 5.6% in today’s latest estimate, with near zero impact from today’s wholesale trade report (changes in inventories are still seen providing a strong 1.4pps to quarterly growth).

- The second unrevised estimate at 5.6% sees some stability having pulled back from earlier vintages of 5.9%, but it’s clearly still incredibly strong after 2.1% in Q2.

- It’s particularly strong when compared to other regional Fed trackers as well, with today’s relaunching of the NY Fed’s take at 2.25% for Q3 and the St Louis Fed’s economic news index at just -0.1% as of last week.

MARKETS SNAPSHOT

Key late session market levels- DJIA up 35.11 points (0.1%) at 34534.68

- S&P E-Mini Future up 1 points (0.02%) at 4457.25

- Nasdaq up 6.6 points (0%) at 13755.44

- US 10-Yr yield is up 1.2 bps at 4.2562%

- US Dec 10-Yr futures are down 2.5/32 at 109-29

- EURUSD up 0.0003 (0.03%) at 1.0699

- USDJPY up 0.5 (0.34%) at 147.8

- WTI Crude Oil (front-month) up $0.63 (0.73%) at $87.48

- Gold is down $0.67 (-0.03%) at $1919.00

- EuroStoxx 50 up 16.17 points (0.38%) at 4237.19

- FTSE 100 up 36.47 points (0.49%) at 7478.19

- German DAX up 21.64 points (0.14%) at 15740.3

- French CAC 40 up 44.67 points (0.62%) at 7240.77

US TREASURY FUTURES CLOSE

- 3M10Y +1.195, -120.99 (L: -127.753 / H: -120.072)

- 2Y10Y -2.536, -73.446 (L: -73.446 / H: -68.965)

- 2Y30Y -4.898, -66.169 (L: -66.169 / H: -58.456)

- 5Y30Y -3.522, -7.226 (L: -7.307 / H: -0.614)

- Current futures levels:

- Dec 2-Yr futures down 2.5/32 at 101-19.5 (L: 101-19.375 / H: 101-24.125)

- Dec 5-Yr futures down 3.5/32 at 106-6.5 (L: 106-06.25 / H: 106-16.5)

- Dec 10-Yr futures down 2.5/32 at 109-29 (L: 109-28.5 / H: 110-10.5)

- Dec 30-Yr futures up 8/32 at 119-18 (L: 119-07 / H: 120-05)

- Dec Ultra futures up 15/32 at 126-24 (L: 126-02 / H: 127-15)

US 10Y FUTURE TECHS (Z3) Moving Average Studies Remain Bearish

- RES 4: 112-24+ High Jul 27

- RES 3: 112-14 High Aug 10 and a key short-term resistance

- RES 2: 112-00 Round number resistance

- RES 1: 110-15+/111-12+ 20-day EMA / High Sep 1

- PRICE: 110-03 @ 11:19 BST Sep 8

- SUP 1: 109-19 Low Sep 7

- SUP 2: 109-18+/09+ Low Aug 25 / 22 and the bear trigger

- SUP 3: 108-20 1.000 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

A bear threat in Treasuries remains present. The latest move lower highlights a potential short-term reversal and 111-12+ marks the key short-term resistance, the Sep 1 high. Moving average studies continue to highlight a medium-term downtrend. An extension lower would signal scope for 109-09+, Aug 22 low and a bear trigger. A break of this level would strengthen a bearish theme.

SOFR FUTURES CLOSE

Sep 23 steady00 at 94.583

Dec 23 -0.005 at 94.550

Mar 24 -0.025 at 94.690

Jun 24 -0.045 at 94.950

Red Pack (Sep 24-Jun 25) -0.07 to -0.055

Green Pack (Sep 25-Jun 26) -0.04 to -0.02

Blue Pack (Sep 26-Jun 27) -0.01 to +0.005

Gold Pack (Sep 27-Jun 28) +0.010 to +0.010

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00013 to 5.32946 (+.00059/wk)

- 3M -0.00052 to 5.41047 (+0.00817/wk)

- 6M -0.00404 to 5.47197 (+0.01873/wk)

- 12M -0.00088 to 5.42392 (+0.06318/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.31% volume: $266B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.479T

- Broad General Collateral Rate (BGCR): 5.30%, $574B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $565B

- (rate, volume levels reflect prior session)

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

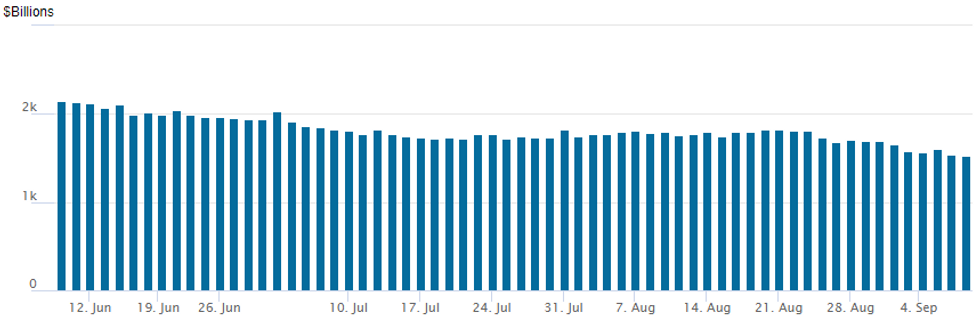

Repo operation falls to new low of $1,525.403B (last seen early March 2022) w/97 counterparties, compared to $1,535.289B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE

No new issuance Friday after $68.73B priced between Tuesday-Thursday. The backlog of corporate issuance should resume next week

EGBs-GILTS CASH CLOSE: Gilts Outperform Again As ECB Hike Seen Possible

Gilts outperformed Bunds for a 3rd consecutive session Friday, with Eurozone core yields relatively steady amid continued uncertainty over the ECB's next move.

- ECB's decision next Thursday, with analysts and market pricing split on whether the Governing Council will deliver a 25bp hike.

- Pricing briefly neared 40% probability of that outcome (vs closer to 33% Thursday) after MNI's latest ECB Exclusive sources piece out today pointed to the decision remaining in the balance, with hawks pushing for what could be their last data-based window to hike.

- This contrasted with a continued pullback in BoE hike pricing, with no particular catalyst but an extension of the recent post-BoE TSC and DMP pricing.

- The net result was a modest bull flattening in the German curve versus fairly sizeable bull steepening in the UK's.

- Greece sees a ratings review by DBRS after the market close Friday. Apart from the ECB meeting next week, UK data will be in focus, starting with the labour market report on Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at 3.081%, 5-Yr is unchanged at 2.615%, 10-Yr is down 0.4bps at 2.61%, and 30-Yr is down 1bps at 2.735%.

- UK: The 2-Yr yield is down 6.8bps at 5.069%, 5-Yr is down 5.3bps at 4.663%, 10-Yr is down 3.1bps at 4.423%, and 30-Yr is down 0.2bps at 4.704%.

- Italian BTP spread up 1.1bps at 173.9bps / Greek down 0.6bps at 135.4bps

FOREX: Greenback Reverses Losses To Consolidate Underlying Uptrend

- The USD regained ground in the second half of the session to lift off lows as Treasuries sold-off with a rare helping hand from higher inflation breakevens. The move saw the USD index reverse at one point a -0.4% decline for back near unchanged on the day, consolidating a strong climb over the week which has continued the medium-term uptrend posted off the mid-July lows. This keeps resistance in the USD Index at 105.157, a break above which resumes the uptrend to target 105.883, the early March highs.

- Meanwhile, the JPY returned lower into the Friday close, wholly shrugging off this week's verbal intervention headlines from cabinet members Matsuno and Kanda. USD/JPY erased an overnight dip to recover close to 147.75 and narrow the gap with the bull trigger of 147.87.

- CAD outperformed, gaining on the back of the solid August jobs release (which saw the unemployment rate dip, net change in employment top expectations and the wage rate top forecast) and further WTI gains. USD/CAD reversed further off the September high in response, making 1.3576 the next downside level of note. Clearance here opens 1.3553 for direction.

- Focus in the coming week turns to US CPI and the ECB rate decision, at which markets remain on a knife edge, split between seeing no change in policy from the Governing Council, or a 25bps rate hike. Scandi CPIs also cross, providing the last look at inflation ahead of rate decisions from both the Norges Bank and Riksbank on September 21st.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/09/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 11/09/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 11/09/2023 | - | *** |  | CN | Money Supply |

| 11/09/2023 | - | *** |  | CN | New Loans |

| 11/09/2023 | - | *** |  | CN | Social Financing |

| 11/09/2023 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 11/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/09/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/09/2023 | 2300/0000 |  | UK | BOE's Mann to Speak in Canada |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.