-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Hawkish Hold Mirrored By BOE

- MNI INTERVIEW: Fed Should Raise Inflation Target To 3%-Gagnon

- MNI Fed Review - Sep 2023: Economy Too Strong For Comfort

- MNI: BOE MPC KEEPS POLICY RATE ON HOLD ON 5-4 VOTE

- MNI BOE WATCH: Split Vote To Hold Puts Spotlight On Plateau

- MNI BRIEF: ECB At Peak, As Policy Bites On Demand - Stournaras

- MNI Jobless Claims Lower Than Expected With Potential Favorable Seasonal Adjustment

US

FED: Federal Reserve officials should consider raising their inflation target to 3% from 2% in order to keep the economy humming without needlessly raising unemployment, Joseph Gagnon, a former Fed board economist who has long advocated such a change, told MNI.

- “I am interested by the upcoming framework review and whether a change in the target will be taken off the table as before,” Gagnon said. Fed Chair Jerome Powell “explicitly said in December that a change in the target could be something to revisit in the longer term and I would think the five-year review may be that time.”

- MNI reported in June that central bank policymakers would likely consider moving to a less pinpointed inflation target band, potentially ranging from 1.5% to 2.5%, in their upcoming framework review. For more see MNI Policy main wire at 1149ET.

FED: The FOMC’s September meeting decision was a “hawkish hold”, with the communications making clear that “higher for longer” now means “longer” if not “higher” than the FOMC thought a few months ago.

- The Fed’s shift was based on much stronger-than-expected economic growth in recent months, not renewed concerns about inflation per se, with Chair Powell calling a soft landing a “primary objective” though not necessarily his base case.

- Markets took the message seriously, with 2024 rate cut expectations pulled back sharply.

- However, the FOMC’s data-dependent approach still leaves upcoming decisions in the balance, with softening inflation opening the door to a rate hold through end-2023 versus the hike in the Dot Plot.

UK

BOE: The Bank of England Monetary Policy Committee split five-to-four in deciding to leave Bank Rate on hold at 5.25%, with all the senior Bank insiders on the committee, with the exception of departing Deputy Governor Jon Cunliffe, backing no change.

- External MPC members Megan Greene, at her second meeting, Jonathan Haskel and Catherine Mann, along with Cunliffee, voted for a 25 basis point rate hike.

- While keeping Bank Rate steady, the MPC stuck to its previous guidance, stating that further tightening would be required if there was evidence of more persistent inflationary pressures and that policy would stay restrictive for long enough to get inflation back to target. The vote and the minutes highlighted just how close the vote was. For more see MNI Policy main wire at 0702ET.

BOE: The Bank of England’s Monetary Policy Committee split five-to-four as it left Bank Rate unchanged at 5.25% at its September meeting, with the knife-edge vote leaving doubts over whether the tightening cycle peak has now been reached.

- Four members voted for a 25-basis-point hike and there was no change to guidance that further monetary tightening would be needed if there was evidence of more persistent price pressures and that policy would stay restrictive for sufficiently long to get inflation sustainably back to target. This both leaves a door ajar to a further hike while floating the idea of rates staying high, and stable for an extended period in a so-called “Table Mountain” approach. (See MNI INTERVIEW:Credibility Key To "Table-Mountain" Rates Pledge).

- But the vote split highlighted uncertainty over what comes next. Of the MPC’s nine members all the Bank insiders, with the exception of Deputy Governor Jon Cunliffe, voted for unchanged policy while of the four external members three, Megan Greene, Jonathan Haskel and Catherine Mann opted for a 25bp increase, while Swati Dhingra backed no change and warned of the risks of overtightening. For more see MNI Policy main wire at 0917ET.

EUROPE

ECB: European Central Bank interest rates peaked with last week’s 25bp hike, Bank of Greece governor Yannis Stournaras said in an interview Thursday, adding that while a cut is still months away at least, policymakers should not succumb to German “alarmism” based on backward-looking inflation assessments.

- “Our impression is that the interest rate level we have reached now, if we maintain it for some time, will lead to inflation being back at our target level of 2.0% by the end of 2025. Maybe it will even be a little earlier,” Stournaras told Borsen-Zeitung, with rates staying at their current level for at least “ about a few months.”

- Financing conditions have tightened “considerably”, a fact that was becoming increasingly evident in stagnating euro growth, he said. For more see MNI Policy main wire at 0915ET.

US TSYS Yields Climb to New Highs After BoE Follows Fed With Hawkish Hold

- Tsy futures bounced briefly but remained under pressure after the BoE left rate unchanged at 5.25%. Split five-to-four in deciding to leave the Bank Rate on hold. All the senior Bank insiders on the committee, with the exception of departing Deputy Governor Jon Cunliffe, backing no change.

- Rate futures extended lows (yields at new 16Y highs: 10YY marking 4.881%) after weekly claims came out lower than expected at 201k vs. 225k (small up-revision in prior to 221k from 220k), broad decline in Philadelphia Fed Business Outlook, however, -13.5 vs -1.0 est, 12.0 prior.

- Rates held near lows after Existing Home Sales came out a little softer than expected (4.04M vs 4.1M est), MoM (-0.7% vs 0.7% est), Leading Index (-0.4% vs. -0.5 est, prior up-revised to -0.3% from -0.4%).

- Thursday session low of 108-08 put focus on 108-00 and 107-23, the 1.236 projection of the Jul 18 - Aug 4 - Aug 10 price swing.

- Cross asset summary: Greenback near flat (DXY +.015 at 105.343), Gold weaker (-9.56 at 1920.74), crude weaker (WTI -.08 at 89.58) and stocks extending late lows: DJIA is down 218.24 points (-0.63%) at 34223.35, S&P E-Mini Futures down 55.5 points (-1.25%) at 4392, Nasdaq down 184.6 points (-1.4%) at 13285.99.

- Friday focus: S&P Global PMIs, while Fed speakers return from policy blackout: both at 1300ET, separate events: SF Fed Daly on economy, policy and MN Fed Kashkari fireside chat, audience Q&A, livestreamed.

OVERNIGHT DATA

US DATA: Initial jobless claims were lower than expected at a seasonally adjusted 201k in the week to Sep 16, covering the payrolls reference period, after a minimally upward revised 221k (initial 220k) the week prior.

- The four-week average takes another notable step lower to 217k (-7k) for its lowest since February and back in line with the 2019 average.

- The drop in the SA figure looks on the generous side considering the NSA data were unchanged at 176k – see chart.

- Continuing claims were also lower than expected, falling to 1662k (cons 1692k) in the week to Sep 9 from a downward revised 1683k (initial 1688k). This at a first glance also appears favorable compared to the NSA data only falling to 1651k from 1656k.

US DATA: The Philly Fed manufacturing index was weaker than expected in Sept as it fell to -13.5 (cons -1.0) to fully reverse what had been a surprise increase to +12.0 in August.

- It marks a particularly volatile two months for the index: the 25.5pt increase in Aug was the largest since at least 2000 when looking outside of initial pandemic re-opening, whilst the -25.5pt reversal is the largest single monthly drop since Dec’21.

- It also continues a string of doing the opposite of what’s seen in the typically more volatile NY Fed counterpart, which has swung from +1.1 to -19.0 and most recently back to +1.9.

- Other measures will be required to get a better sense of latest trends in manufacturing, with tomorrow’s flash S&P Global PMIs before next week’s MNI Chicago PMI.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 218.06 points (-0.63%) at 34221.37

- S&P E-Mini Future down 54.5 points (-1.23%) at 4392.25

- Nasdaq down 181.8 points (-1.4%) at 13286.62

- US 10-Yr yield is up 6.9 bps at 4.4759%

- US Dec 10-Yr futures are down 25/32 at 108-14

- EURUSD up 0.0002 (0.02%) at 1.0663

- USDJPY down 0.8 (-0.54%) at 147.54

- Gold is down $10.53 (-0.55%) at $1919.79

European bourses closing levels:

- EuroStoxx 50 down 63.39 points (-1.48%) at 4212.59

- FTSE 100 down 53.03 points (-0.69%) at 7678.62

- German DAX down 209.73 points (-1.33%) at 15571.86

- French CAC 40 down 116.89 points (-1.59%) at 7213.9

US TREASURY FUTURES CLOSE

- 3M10Y +8.797, -100.048 (L: -110.613 / H: -99.09)

- 2Y10Y +10.089, -67.008 (L: -77.589 / H: -64.886)

- 2Y30Y +13.591, -59.727 (L: -74.243 / H: -57.112)

- 5Y30Y +7.867, -6.334 (L: -15.455 / H: -4.603)

- Current futures levels:

- Dec 2-Yr futures down 1.75/32 at 101-8.5 (L: 101-05.125 / H: 101-10.125)

- Dec 5-Yr futures down 12.5/32 at 105-8.5 (L: 105-02.5 / H: 105-12.75)

- Dec 10-Yr futures down 25/32 at 108-14 (L: 108-08 / H: 108-25.5)

- Dec 30-Yr futures down 2-08/32 at 116-10 (L: 116-04 / H: 117-28)

- Dec Ultra futures down 3-07/32 at 121-31 (L: 121-21 / H: 124-11)

US 10Y FUTURE TECHS: (Z3) Clears Support

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-29+ 50-day EMA

- RES 2: 110-07+ High Sep14

- RES 1: 109-30 20-day EMA

- PRICE: 108-14 @ 1100 ET Sep 21

- SUP 1: 108-08 Intraday low

- SUP 2: 108-00 Round number support

- SUP 3: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasuries have traded lower today. This week’s move down has resulted in a breach of support at 109-03, the Sep 13 / 19 low. The move below 109-03 cancels a recent reversal signal - a hammer candle on Sep 13, and this reinforces a bearish theme. A continuation lower would open 108-00 and 107-23, the 1.236 projection of the Jul 18 - Aug 4 - Aug 10 price swing. Key short-term resistance has been defined at 110-07+, the Sep 14 high.

SOFR FUTURES CLOSE

- Sep 23 +0.003 at 94.613

- Dec 23 steady at 94.520

- Mar 24 +0.010 at 94.595

- Jun 24 +0.010 at 94.770

- Red Pack (Sep 24-Jun 25) -0.095 to -0.015

- Green Pack (Sep 25-Jun 26) -0.12 to -0.10

- Blue Pack (Sep 26-Jun 27) -0.15 to -0.13

- Gold Pack (Sep 27-Jun 28) -0.16 to -0.155

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00373 to 5.31972 (-0.00732/wk)

- 3M +0.00396 to 5.40009 (-0.00169/wk)

- 6M +0.00378 to 5.47283 (+0.00699/wk)

- 12M +0.00710 to 5.46596 (+0.04452/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% volume: $253B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.492T

- Broad General Collateral Rate (BGCR): 5.30%, $568B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $554B

- (rate, volume levels reflect prior session)

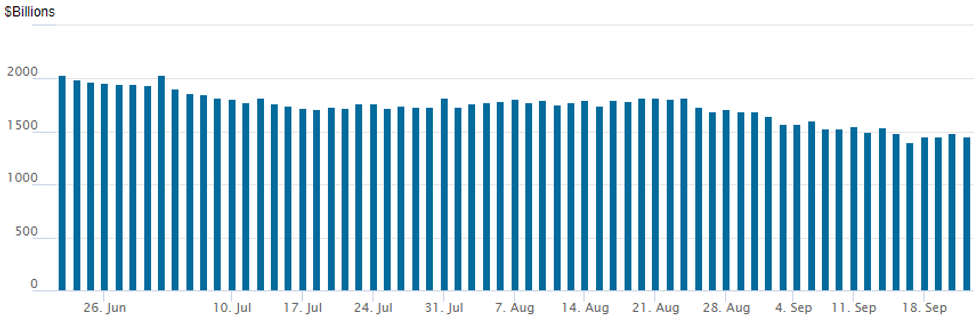

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation recedes to 1,454.115B w/99 counterparties, compared to $1,486.984B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE Corporate Debt Issuers Remain Sidelined After FOMC/BOE

No new supply since $4.75B priced Tuesday, $20B running total for the week.

- Date $MM Issuer (Priced *, Launch #)

- 09/19 $3.5B *World Bank (IBRD) 5Y SOFR+34

- 09/19 $1.25B *Danske Bank 3NC2 +118

- 09/19 $Benchmark Five Holdings Ltd 5NC2 investor calls

EGBs-GILTS CASH CLOSE: UK Curve Steepens As BoE Holds

The Bank of England's decision to hold rates saw the UK curve steepen Thursday, with the German curve following suit.

- After global bonds sold off overnight in the wake of the Fed's hawkish rate hold, a dovish tone was restored in early European trade with the SNB's unexpected hold and in-line hikes by the Riksbank and Norges Bank. The BoE's 5-4 decision to hold rates - which was only 45% priced in vs a 25bp hold - marked the peak for European core FI for the day.

- After selling off in the afternoon, UK and German yields fell back and finished off session highs.

- Helping the recovery were multiple comments by ECB participants across the hawk-dove spectrum pointing to prospects of an extended hold including Stournaras, Wunsch, and Knot.

- The UK curve finished sharply bear steeper with Germany's modestly twist steepening.

- Periphery EGB spreads widened, led by Italy, amid a broader risk-off move that accelerated in the afternoon as equities dropped and curves re-steepened.

- Friday sees UK retail sales data and September flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at 3.257%, 5-Yr is up 2.2bps at 2.756%, 10-Yr is up 3.5bps at 2.737%, and 30-Yr is up 2.8bps at 2.87%.

- UK: The 2-Yr yield is up 2.5bps at 4.873%, 5-Yr is up 3.3bps at 4.426%, 10-Yr is up 9bps at 4.305%, and 30-Yr is up 7.7bps at 4.709%

- .Italian BTP spread up 5.5bps at 180.4bps / Greek up 4.6bps at 142bps

FOREX Greenback Rally Fails To Extend Following Fed-Inspired Impulse

- Early on Thursday, the greenback showed initial strength, extending on topside momentum following the hawkish hold from the FOMC. The USD index narrowed in on the best levels for 2023, reaching a high print of 105.74.

- However, a reversal lower for front-end US yields and considerable weakness for US equity indices dampened the initial greenback optimism which now sees the DXY trade at unchanged levels as we approach the APAC crossover. It is worth noting that we still remain roughly half a percent above pre-FOMC levels.

- Remaining the underperformer on the session is the Swiss Franc following the surprise hold by the SNB at 1.75%. While Chairman Jordan pointed to the potential for further hikes and noted that the inflation battle is not yet over, some of the language deployed and the SNB playing down the idea of a hawkish pause has also weighed on the CHF, prompting EURCHF to establish a new range around 0.9640, up ~0.60%.

- Cable remains down 0.4% on the session, although is unchanged from the surprise decision by the Bank of England to hold rates at 5.25%. Initial pressure did see GBPUSD print a fresh near-six month low at 1.2239 before consolidating back around the 1.2300 mark in late Thursday trade.

- One of the more interesting moves across US hours was the decline for USDJPY, posting an impressive turnaround and reversing the entirety of the Fed inspired gains overnight. The pair printed as high as 148.46 overnight, briefly piercing noted resistance at the Nov 4 2022 high but failed to garner any momentum across the APAC session. A subsequent move back below the 148.00 handle has kept the short-term path of least resistance as lower, with pressure on equities and the lower front-end US yields providing additional JPY tailwinds, that saw a move down to 147.32 as we approach the Bank of Japan decision overnight.

- The BOJ meeting caps off a busy week for major central bank decisions. Considering the adjustments made to the BOJ’s YCC framework in July, our analysis aligns with the prevailing consensus, anticipating that the BOJ will maintain its existing policies in the upcoming announcement, including the short-term interest rate remaining at -0.1%.

- Elsewhere on Friday, UK retail sales and Eurozone flash PMI’s will provide the latest signals regarding the health of the Eurozone economy.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/09/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 22/09/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/09/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 22/09/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 22/09/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/09/2023 | 0700/0900 | *** |  | ES | GDP (f) |

| 22/09/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/09/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/09/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/09/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/09/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/09/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/09/2023 | 1100/1300 |  | EU | ECB's de Guindos Speaks at Event | |

| 22/09/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/09/2023 | 1250/0850 |  | US | Fed Governor Lisa Cook | |

| 22/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/09/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/09/2023 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 22/09/2023 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 22/09/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.