-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed In No Hurry to Cut Rates

- MNI INTERVIEW: Inflation Upturn Could Complicate Fed Cuts-ECRI

- MNI FED: Fed’s Barkin Sees No Hurry To Cut Rates, Bbg TV

- MNI: US Shelter Inflation Cooldown Seen Limited In 2024

- MNI INTERVIEW: BOC Stays Restrictive Through 2024- Ex Adviser

- MNI: Jobless Claims Mostly In Line, Continuing Hold NSA Relative Climb

US

INTERVIEW (MNI): Inflation Upturn Could Complicate Fed Cuts-ECRI

U.S. inflation could be on the verge of a rebound that, even if modest, could delay the start of Federal Reserve interest rate cuts that markets hope will come in May, Lakshman Achuthan, co-founder of the Economic Cycle Research Institute, told MNI.

US FED (MNI): Fed’s Barkin Sees No Hurry To Cut Rates, Bbg TV

The Federal Reserve has time to wait before cutting interest rates as the economy remains strong even as inflation falls, Richmond Fed President Thomas Barkin said Thursday. “You don’t have to be in any particular hurry. We’ve got some time to be patient,” Barkin said in an interview with Bloomberg TV. (See MNI INTERVIEW: Fed Could Cut By May, Inflation Lingers-Kaplan)

NEWS

US (MNI): US Shelter Inflation Cooldown Seen Limited In 2024

Sharp declines in market rent indexes in recent months would suggest U.S. rent inflation will fade quickly over 2024, dragging down core inflation measures and bringing forward the timing of interest rate cuts -- but there are good reasons to be skeptical, Labor Department and former Federal Reserve economists told MNI.

INTERVIEW (MNI): BOC Stays Restrictive Through 2024- Ex Adviser

The Bank of Canada will remain in tight policy territory through this year with a resilient economy frustrating efforts to tame wage and price gains, former BOC adviser and Queen's University professor Thorsten Koeppl told MNI. “They have a job to do, and the job is not over,” he said. “It’s great that they are holding off on the discussion of when to cut.”

CHINA-RUSSIA (MNI): Xi & Putin Hold First Call Of 2024

Chinese state-media CCTV has confirmed that President Xi Jinping held a telephone call with his Russian counterpart Vladimir Putin earlier on 8 Feb.

MIDEAST (MNI): Houthis & US Exchange Strikes As Warnings Mount On Undersea Cables

US Central Command (CENTCOM) has confirmed that at around 2100 local time on 7 Feb, US forces "conducted self-defense strikes against two Houthi mobile anti-ship crusie missiles prepared to launch against ships in the Red Sea."

US TSYS Markets Roundup: Yields Climb Ahead Friday's CPI Revisions

- Tsy futures are extending session lows since gradually reversing post-30Y Bond auction support. Currently, Mar'24 10Y futures tap 110-23.5 low (-14.5; 10Y yield 4.1696% high) - nears initial technical support of 110-22+ (Low Feb 5 and the bear trigger) followed by 110-16 Low Dec 13).

- TYH4 had bounced to 110-31.5 after the strong $25B 30Y auction (912810TX6) stopped through for the third consecutive time: 4.360% high yield vs. 4.380% WI. Decent to strong demand all week, all three coupon auctions stopping through- which hasn't occurred since January 2023.

- Rates ticked lower following this mornings Initial jobless claims recorded a seasonally adjusted 218k (cons 220k) in the week to Feb 3 after last week’s surprise increase was revised a little higher to 227k (initial 224k).

- Fed speak: the Federal Reserve has time to wait before cutting interest rates as the economy remains strong even as inflation falls, Richmond Fed President Thomas Barkin said Thursday. “You don’t have to be in any particular hurry. We’ve got some time to be patient,” Barkin said in an interview with Bloomberg TV.

- Otherwise, Thursday was a generally quiet session as market awaits CPI revisions from the BLS early Friday: BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”.

- This won’t impact the underlying NSA data, but will sway near-term trends and has been flagged by both Fed Governor Waller and Chair Powell referencing the upside surprise in last year’s annual revision. Analysts are mixed, seeing either very little impact or modest uplift in recent trend rates.

OVERNIGHT DATA

MNI US DATA: Initial jobless claims record a seasonally adjusted 218k (cons 220k) in the week to Feb 3 after last week’s surprise increase was revised a little higher to 227k (initial 224k).

- The four-week average pushes to 212k, +3k on the week and up from a latest low of 203k in Jan 19. It’s still historically low though vs the 2019av 218k and 2019 single week low 197k for comparison.

- The -31k decline in the NSA data to 233k is sharp on the week, taking the level back to a low figure for this time of year as it reverses the prior week's push higher.

- Continuing claims also close to expectations at a seasonally adjusted 1871k (cons 1875k) in the week to Jan 27 after a large push higher to 1894k (initial 1898k).

- NSA continuing claims also pulled back (-44k to 2137k) but it’s not enough to unwind the sharp increase the prior week, with claims still tracking above 2022 and 2023 equivalent levels even if they’re still at the low end of pre-pandemic ranges.

US DEC WHOLESALE INV 0.4%; SALES 0.7%

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 36.38 points (0.09%) at 38716.27

- S&P E-Mini Future up 0.5 points (0.01%) at 5016

- Nasdaq up 41.7 points (0.3%) at 15798.61

- US 10-Yr yield is up 4.3 bps at 4.1637%

- US Mar 10-Yr futures are down 13.5/32 at 110-24.5

- EURUSD up 0.0005 (0.05%) at 1.0777

- USDJPY up 1.18 (0.8%) at 149.36

- WTI Crude Oil (front-month) up $2.65 (3.59%) at $76.51

- Gold is down $2.14 (-0.11%) at $2033.24

- European bourses closing levels:

- EuroStoxx 50 up 31.93 points (0.68%) at 4710.78

- FTSE 100 down 33.27 points (-0.44%) at 7595.48

- German DAX up 41.87 points (0.25%) at 16963.83

US TREASURY FUTURES CLOSE

- 3M10Y +3.822, -122.649 (L: -133.029 / H: -122.066)

- 2Y10Y +1.737, -29.237 (L: -32.599 / H: -28.385)

- 2Y30Y +1.689, -8.935 (L: -10.768 / H: -6.777)

- 5Y30Y -0.876, 24.427 (L: 24.115 / H: 27.168)

- Current futures levels:

- Mar 2-Yr futures down 2.375/32 at 102-11.5 (L: 102-11 / H: 102-14.375)

- Mar 5-Yr futures down 8.75/32 at 107-9.25 (L: 107-08.5 / H: 107-19.25)

- Mar 10-Yr futures down 13.5/32 at 110-24.5 (L: 110-23 / H: 111-07.5)

- Mar 30-Yr futures down 1-03/32 at 119-24 (L: 119-20 / H: 120-28)

- Mar Ultra futures down 1-07/32 at 126-0 (L: 125-22 / H: 127-08)

US 10Y FUTURE TECHS: (H4) Support Remains Exposed

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-18+/113-06+ 20-day EMA / High Feb 1

- PRICE: 110-26+ @ 1430 ET Feb 8

- SUP 1: 110-22+ Low Feb 5 and the bear trigger

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries remain in a bear-mode set-up following the reversal and pullback from 113-06+, the Feb 1 high. The bear trigger at 110-26, the Jan 19 low, has been pierced. A clear break would highlight a stronger reversal and open 110-16, the Dec 13 low, ahead of 109-31+, Dec 11 low. Initial key resistance has been defined at 113-06+, Feb 1 high, where a breach would reinstate a bullish theme and expose the bull trigger at 113-12, Dec 27 high.

SOFR FUTURES CLOSE

- Mar 24 -0.005 at 94.780

- Jun 24 -0.025 at 95.145

- Sep 24 -0.035 at 95.525

- Dec 24 -0.045 at 95.860

- Red Pack (Mar 25-Dec 25) -0.07 to -0.05

- Green Pack (Mar 26-Dec 26) -0.08 to -0.07

- Blue Pack (Mar 27-Dec 27) -0.085 to -0.08

- Gold Pack (Mar 28-Dec 28) -0.08 to -0.075

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00311 to 5.31800 (-0.00411/wk)

- 3M -0.01291 to 5.30135 (+0.01089/wk)

- 6M -0.02111 to 5.17233 (+0.07623/wk)

- 12M -0.02704 to 4.84630 (+0.15350/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.797T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $688B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $673B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

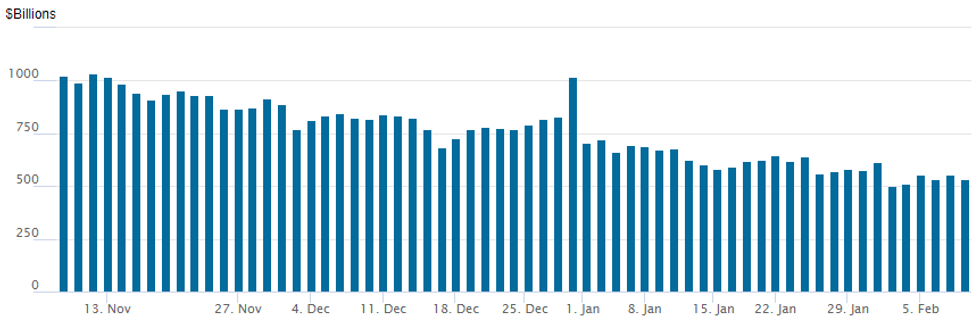

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage slips back to $535.705B vs. $553.055B Wednesday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 78 from 75 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $3B Turkiye +10Y Launched

- Date $MM Issuer (Priced *, Launch #

- 2/8 $3B #Turkiye Gov international bond +10Y 7.875

- 2/8 $Benchmark Boardwalk Pipelines +10Y +170a

- $14.25B Priced Wednesday, $57.875B/wk

- 2/7 $6.5B *Eli Lilly $1B 3Y +30, $1B 5Y +45, $1.5B 10Y +60, $1.5B 30Y +70, $1.5B 40Y +77 (for comparison, Eli Lilly issued $4B on Feb 23 last year: $750M 3NC1 +65, $1B 10Y +85, $1.25B 30Y +100, $1B 40Y +115)

- 2/7 $2.5B *Rogers Communications $1.25B 5Y +100, $1.25B 10Y +130

- 2/7 $1.25B *Dow Chemical $600M 10Y +105, $650M 30Y +130

- 2/7 $1B *Constellation Software $500M 5Y +110, $500M 10Y +135

- 2/7 $1B *Inter-American Inv Bank (IDB) 5Y SOFR+51

- 2/7 $1B *UBS WNG Perp NC7.2 7.75%

- 2/7 $500M *NEDC 5Y Sukuk +160

- 2/7 $500M *Turkiye Wealth Fund (Varlik Fonu) WNG 5Y

EGBs-GILTS CASH CLOSE: 4th Down Day in 5 Sees Bellies Underperform

Bunds and Gilts weakened for the 4th session in 5 Thursday with curve bellies undeperforming, as central bank speakers maintained a cautious tone on the rate cut trajectory.

• ECB's Lane reiterated that more disinflation will need to be seen before having confidence that inflation will sustainably return to target. Wunsch, and - after the close, Holzmann - were unsurprisingly hawkish. All of the above eyed wage growth dynamics in particular.

• BoE's Mann said little to suggest she would soon change her vote after opting for a hike in February, and noted she "can't say whether there will be rate cuts this year".

• On the day, 2024 ECB and BoE cut pricing were each pared by 4-5bp.

• Gilts underperformed Bunds, with both the UK and German curves leaning bear flatter (though as mentioned, the bellies of the curves performed weakest, as rate cuts got priced out).

• Periphery spreads were largely unchanged, with GGBs outperforming.

• Friday morning's schedule includes Italian industrial production and final German inflation data.

FOREX Japanese Yen Remains On Backfoot, Substantial Moves In EM FX

- Mixed price action across G10 on Thursday saw the USD index tilt marginally into positive territory, rising 0.1% as we approach the APAC crossover. This was dominated by a strong 0.75% move higher in USDJPY, on the back of some dovish leaning rhetoric from Bank of Japan’s Uchida.

- The policymaker acknowledged the likely need for tighter policy in Japan in the near-term, but played down the prospect of a more protracted tightening cycle after a first theoretical rate hike. He stated that it is hard to see Japan requiring a sharp hiking pace after rate lift-off, helping boost USDJPY back to the best levels of 2024 above 148.89.

- JPY weakness then persisted across the US session with the slightly better-than-expected jobless claims data providing additional impetus for USDJPY above 149.00. The pair rose to a high of 149.48 and will now focus on 149.75, the Nov 22 high.

- The higher US yields also weighed on the likes of AUD and NZD, however, the Euro remained more resilient throughout Thursday’s session. A bearish theme in AUDUSD remains intact and any short-term gains continue to be considered corrective. The latest break to fresh cycle lows confirmed a resumption of the downtrend and signals scope for weakness towards 0.6453, the Nov 17 low and 0.6412, a Fibonacci retracement level.

- In emerging markets, divergence in communication between the central banks of the CE3 economies has led to some interesting moves across CE3 FX.

- A dovish CNB vote split and relatively hawkish NBP press conference by Governor Glapinski has led to a 1.6% surge in PLNCZK, which pierced the 5.8000 handle for the first time since March 2021, and is currently at its highest since December 2020.

- Additionally, USDCLP brushed off a higher inflation release and has extended its powerful move higher, rising 1.2% on the session.

- US inflation revisions in focus Friday. BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2024 | 0700/0800 | *** |  | DE | HICP (f) |

| 09/02/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 09/02/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 09/02/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 09/02/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 09/02/2024 | 1415/1515 |  | EU | ECB's Cipollone speaks at Assiom Forex Annual Congress | |

| 09/02/2024 | 1530/1030 |  | CA | BOC Senior Loan Officer Survey | |

| 09/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 09/02/2024 | 1830/1330 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.