-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Steady, Acknowledges 2023 Inflation Eased

- MNI FED: Dovish Powell Acknowledges FOMC Is Thinking About Thinking About Cuts

- MNI FED BRIEF: Powell-Focused On Not Waiting Too Long To Cut Rates

- MNI FED: Statement Changes: Dec vs Nov

- MNI US Inflation Insight, Dec'23: Strong Supercore Modestly Trims Cut Expectations

- MNI US DATA: Core PPI Misses In November Along With Net Softer Revisions

US TSYS Fed Leaves Rate Steady, Projected 2024 Rate Cuts Reignited

- Tsy futures gap higher/extend highs well past pre-NFP levels after Fed held rate steady, acknowledging inflation has eased but reiterated the Fed is "prepared to tighten policy further, if appropriate". FOMC-dated OIS for March fell 8.5bps to 5.108%, back to pre-payrolls levels pricing in a cumulative 22.4bp of easing.

- "Achieving a stance of monetary policy that is sufficiently restrictive to bring inflation sustainably down to 2% over time and to keeping policy restrictive until we're confident that inflation is on a path to that objective" Powell added.

- Tsy 10Y yield fell to 4.0051% low -- last seen on September 1, while March'24 10Y futures tapped 112-03 high (+1-18), tapping technical resistance 112-03 (1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing) before settling at 111-31.

- Futures had gapped higher following this morning's in-line to slightly lower PPI measures for November: Final Demand MoM (0.0% vs. 0.0% est, -0.4% prior revised from -0.5%), YoY (0.9% vs. 1.0% est, 1.2% prior revised from 1.3).

- The combination of the solid supercore print overall core running well above target, and the unexpected dip in the unemployment rate in the past week.

- Thursday Data Calendar: Weekly Claims, Retail Sales and Import/Export index data

NEWS

FED (MNI): Dovish Powell Acknowledges FOMC Is Thinking About Thinking About Cuts

In the press conference, Chair Powell delivered little to no pushback to market expectations of significant rate cuts next year, and in fact ensured that future easing was the main topic of the day. Whereas in previous press conferences he has dismissed questions about rate cut speculation out of hand, he entertained several of them today.

FED BRIEF (MNI): Powell-Focused On Not Waiting Too Long To Cut Rates

Federal Reserve Chair Jerome Powell said policymakers are aware of the risk that they could unduly hurt the economy by waiting too long to cut interest rates, after the FOMC said it expects three rate reductions next year.

FED (MNI): Statement Changes: Dec vs Nov

Comparison of December's statement to prior (November) below - limited changes mostly confined to the first paragraph, but that includes a somewhat important acknowledgment that inflation has eased.

FED: Fed Is Aware Of The Risk Of Waiting Too Long Before Easing

We'd look at the totality of the data - certainly the labor data would be important in that. Certainly, if there were the beginning of a recession or something like that, it would weigh heavily in that decision [whether to cut].

FED: Powell Reiterates FOMC Will Look At Totality Of The Data

We'll look at the totality of the data... it's ultimately all about the outlook and the balance of risks as well. [Above-trend growth] is only a problem insofar as it makes it difficult for us to achieve our goals. If it keeps the labor market very strong, it probably will place upward pressure on inflation, meaning need to keep rates higher for longer or ultimately would need to hike again.

FED: Powell Implies Very Soft M/M For Core PCE In November

Powell saying that based on CPI and other data, the Fed estimates core PCE inflation of 3.1% Y/Y in November.

FED: Powell Acknowledges Easing Inflation, Remains Above Target

Inflation has eased over the past year but remains above our target. The lower inflation readings over the past several months are welcome, but we need to see further evidence to be confident that inflation is moving down sustainably toward target.

US Inflation Insight (MNI), Dec'23: Strong Supercore Modestly Trims Cut Expectations

Core CPI inflation was in line with expectations in November as it accelerated to 0.285% M/M from 0.23%. “Supercore” CPI meanwhile accelerated to a strong 0.44% M/M, close to what some analysts had expected but nevertheless cementing uncomfortable run rates at 5.2% and 3.7% annualized over 3- and 6-months.

US DATA (MNI): Core PPI Misses In November Along With Net Softer Revisions

Core PPI inflation rates missed in November but didn't see the same level of weakness as seen in core goods ex used cars in yesterday's CPI.

US (MNI): GOP Senators Report Progress In US-Mexico Border Talks

Manu Raju at CNN reporting on X that, "things are moving on [US-Mexico] border policy talks but unclear if deal will be reached," adding the White House has, "made some key concessions, GOP senators are saying major progress. [Senator Thom] Tillis [R-SC] believes a deal in principle is within reach over next few days. McConnell and Schumer meeting now. Many Ds unhappy."

CANADA BRIEF (MNI): Canada Consumer Debt Costs At Record High

Canadians paid a record 15.2% of disposable income on debt service costs in the third quarter in a reflection of the sting from the central bank's 10 interest-rate hikes, the federal statistics office said Wednesday.

BOE WATCH (MNI): MPC On Hold, Too Early To Consider Cuts

The Bank of England is expected to leave its policy rate on hold at 5.25% this week, with a majority within the Monetary Policy Committee convinced that the persistence of inflation means it is too early to consider cuts even as support for more hikes ebbs.

GERMANY (MNI): Scholz Confirms Debt Brake In Place For 2024 Budget

Chancellor Olaf Scholz, Economy Minister Robert Habeck, and Finance Minister Christian Lindner giving statements to the press following the tripartite 'traffic light' coalition reaching an agreement on the 2024 federal budget.

CBR Preview (MNI) - December 2023: Another Hike Justified

Headline inflation has continued to increase toward the upper bound of the CBR’s medium-term forecast while inflation expectations have also continued to trend upward, supporting the case for another rate hike from the central bank rather than a hold at 15.00%.

JAPAN (MNI): Kyodo-Factionless Saitō To Replace Nishimura As Economy & Trade Minister

Kyodo News reporting that former Justice Minster Ken Saitō has been lined up to replace the outgoing Economy, Trade and Industry Minister Yasutoshi Nishimura. Saitō served as justice minister under PM Fumio Kishida from Nov 2022-Sep 2023, and prior to that as Agriculture, Forestry and Fisheries minister under the late Shinzo Abe from Aug 2017-Oct 2018.

US-CHINA (MNI): Yellen To Deliver Remarks On US-China Economic Relationship Tomorrow

Treasury Secretary Janet Yellen will deliver remarks on the U.S.-China economic relationship December 14, and, "preview Treasury’s priorities for the U.S-China economic relationship going into next year."

OVERNIGHT DATA

- US NOV FINAL DEMAND PPI +0.0%, EX FOOD, ENERGY +0.0%

- US NOV FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

- US NOV FINAL DEMAND PPI Y/Y +0.9%, EX FOOD, ENERGY Y/Y +2.0%

- US NOV PPI: FOOD +0.6%; ENERGY -1.2%

- US NOV PPI: GOODS +0.0%; SERVICES +0.0%; TRADE SERVICES -0.2%

US DATA: Core PPI Misses In November Along With Net Softer Revisions. Core PPI inflation rates missed in November but didn't see the same level of weakness as seen in core goods ex used cars in yesterday's CPI.

- PPI ex food & energy - miss with a net downward revision: 0.03% M/M (cons 0.2) in Nov. It follows an almost unrevised -0.01% M/M (initial -0.03%) in Oct but a net downward revision of -0.1% (most of which came far back in July).

- PPI ex food, energy & trade services - smaller miss with larger net downward revision: 0.10% M/M (cons 0.2) after 0.06% M/M (initial 0.14%) in Oct as part of net downward revision worth -0.2%.

- It leaves the ex food & energy metric running at 0.9% annualized over three months (softest since Jun'20), and ex food, energy & trade services at 1.85% annualized (softest since June).

- US MBA: MARKET COMPOSITE +7.4% SA THRU DEC 08 WK

- US MBA: REFIS +19% SA; PURCH INDEX +4% SA THRU DEC 8 WK

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.07% VS 7.17% PREV

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 464.94 points (1.27%) at 37025.52

- S&P E-Mini Future up 57.75 points (1.23%) at 4753

- Nasdaq up 167.2 points (1.2%) at 14692.28

- US 10-Yr yield is down 17.3 bps at 4.0277%

- US Mar 10-Yr futures are up 44.5/32 at 111-30

- EURUSD up 0.0082 (0.76%) at 1.0875

- USDJPY down 2.32 (-1.6%) at 143.13

- WTI Crude Oil (front-month) up $0.96 (1.4%) at $69.60

- Gold is up $41.12 (2.08%) at $2020.30

- European bourses closing levels:

- EuroStoxx 50 down 6.42 points (-0.14%) at 4530.19

- FTSE 100 up 5.67 points (0.08%) at 7548.44

- German DAX down 25.69 points (-0.15%) at 16766.05

- French CAC 40 down 12.33 points (-0.16%) at 7531.22

US TREASURY FUTURES CLOSE

- 3M10Y -17.209, -136.853 (L: -139.11 / H: -120.713)

- 2Y10Y +9.589, -43.642 (L: -56.116 / H: -42.179)

- 2Y30Y +13.766, -28.723 (L: -44.577 / H: -25.894)

- 5Y30Y +9.748, 18.402 (L: 6.876 / H: 20.832)

- Current futures levels:

- Mar 2-Yr futures up 17.125/32 at 102-21.875 (L: 102-04.5 / H: 102-24.125)

- Mar 5-Yr futures up 1-01/32 at 108-3.5 (L: 107-01.75 / H: 108-08.5)

- Mar 10-Yr futures up 1-12.5/32 at 111-30 (L: 110-16 / H: 112-03.5)

- Mar 30-Yr futures up 2-06/32 at 121-22 (L: 119-13 / H: 121-29)

- Mar Ultra futures up 2-23/32 at 130-2 (L: 127-03 / H: 130-11)

(H4) Pullback Considered Corrective

- RES 4: 112-16 1.50 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 112-03 1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 111-19 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 1: 111-09+ High Dec 7 and the bull trigger

- PRICE: 110-21+ @ 11:04 GMT Dec 13

- SUP 1: 109-27+ 20-day EMA

- SUP 2: 108-18+ Low Nov 27 and a key short-term support

- SUP 3: 107-22 Low Nov 14

- SUP 4: 107-11+ Low Nov 13 and a reversal trigger

Treasuries continue to trade below recent highs. The latest pullback is considered corrective and the trend direction remains up. Moving average studies remain in a bull-mode position and this highlights an uptrend. 110-25, the 1.00 projection of the Oct 19 - Nov 3 - Nov 13 price swing, has recently been cleared. This reinforces the bull theme and a continuation higher would open 111-19, the 1.236 projection. First support is 109-27+, the 20-day EMA.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 +0.018 at 94.628

- Mar 24 +0.170 at 94.965

- Jun 24 +0.280 at 95.385

- Sep 24 +0.330 at 95.765

- Red Pack (Dec 24-Sep 25) +0.250 to +0.340

- Green Pack (Dec 25-Sep 26) +0.180 to +0.225

- Blue Pack (Dec 26-Sep 27) +0.160 to +0.175

- Gold Pack (Dec 27-Sep 28) +0.145 to +0.160

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00302 to 5.36181 (+0.00178/wk)

- 3M -0.00143 to 5.38463 (+0.01859/wk)

- 6M -0.01426 to 5.33224 (+0.04013/wk)

- 12M -0.02558 to 5.10516 (+0.08504/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.713T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $617B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $602B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $257B

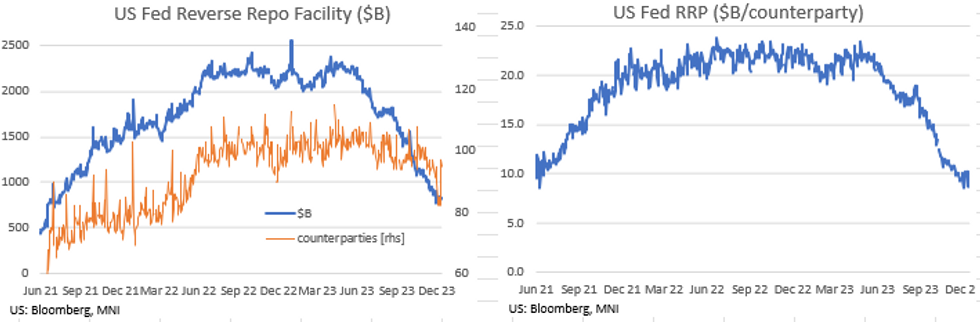

FED RRP Usage Recedes

- RRP usage was receded today to $823B (-$15B) for still close to last week’s average of $829B.The recent low still stands at $769B on Dec 1.

- The number of counterparties down to 95 from 97 yesterday - highest since Nov 22.

PIPELINE: Corporate Debt Issuance Stalls Ahead FOMC

- Date $MM Issuer (Priced *, Launch #)

- 12/13 No new high grade issuance Wednesday, running total for week at $3.25B

- $500M Priced Tuesday

- 12/12 $500M Icahn Enterprises 5NCL 9.75%

EGBs-GILTS CASH CLOSE: UK Belly Outperforms Ahead Of BoE / ECB Decisions

Gilts rallied sharply Wednesday with the belly of the UK curve outperforming, with EGBs gaining in their wake.

- Weaker-than-expected UK economic activity/GDP data kicked off a strong session for Gilts, which gained for most of the session ahead of Thursday's BoE decision.

- BoE cut pricing ramped up: rates are expected to end 2024 101bp below current levels and 105bp below the February 2024 peak.

- Conversely, Bunds started the day on the back foot but regained ground on multiple factors, getting a tailwind from Gilt and Treasury gains, and softer-than-expected Eurozone industrial production data helping. While

- Bunds temporarily weakened on comments by German Chancellor Scholz that while a budget deal has been reached, the "debt brake" could be suspended again in 2024. However, Bunds ended on the session highs.

- Periphery EGBs traded mostly tighter to Bunds, with Greece the outlier, widening for a 2nd consecutive session.

- The Federal Reserve decision and communications take focus after the European close, with attention then swiftly turning to the ECB (MNI preview here) and BoE (MNI preview here) decisions on Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.2bps at 2.667%, 5-Yr is down 4.3bps at 2.167%, 10-Yr is down 5.3bps at 2.173%, and 30-Yr is down 5.5bps at 2.346%.

- UK: The 2-Yr yield is down 14.8bps at 4.381%, 5-Yr is down 15.4bps at 3.886%, 10-Yr is down 13.7bps at 3.83%, and 30-Yr is down 14.1bps at 4.333%.

- Italian BTP spread down 2.2bps at 175.6bps / Greek up 3.1bps at 125bps

FOREX Sharp Greenback Weakness As Fed Projections See 3 Cuts Next Year

- The US dollar sold off aggressively in the direct aftermath of the Fed rate decision and release of its summary of economic projections. With the median dot plot forecasting three rate cuts in 2024 and an acknowledgement that inflation is easing, the greenback remained under pressure throughout the late US session, with the USD index down roughly 0.85% as we approach the APAC crossover. Broad greenback weakness consolidated as Chair Powell delivered little to no pushback to market expectations of significant rate cuts next year.

- USDJPY extended losses to as much as 1.95% on the session, briefly breaking back below the 143.00 handle and printing a low of 142.65. As a reminder, last week’s impulsive sell-off confirmed the break of trendline support drawn from the Mar 24 low. This strengthens a bearish threat and signals scope for a continuation lower towards 140.71 next, a Fibonacci retracement point. In between that level and the current spot rate, attention should be paid to 142.50 & 141.71, the Dec 8 low and the bear trigger respectively.

- The beneficial price action for equities and waning greenback sees AUD among the best performers on the G10 leaderboard, registering gains of roughly 1.65% on the session.

- The uptrend in AUDUSD remains intact, and moving average studies remain in a bull-mode set-up, highlighting this bullish theme. The bull trigger has been defined at 0.6691, the Dec 4 high. Clearance of this level would confirm a resumption of the uptrend. Above here, markets will focus on 0.6747, the 76.4% retracement of the Jul 13 - Oct 26 bear leg.

- New Zealand GDP and Australia employment data kicks off Thursday’s docket. Focus then turns to central bank decisions from the SNB, Norges Bank, BOE and ECB. Additionally, US retail sales data is scheduled.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/12/2023 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 14/12/2023 | 0430/1330 | ** |  | JP | Industrial production |

| 14/12/2023 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/12/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 14/12/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2023 | 0830/0930 | *** |  | CH | SNB Interest Rate Decision |

| 14/12/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 14/12/2023 | 1230/1230 |  | UK | MPR Press Conference MPR Press Conference | |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/12/2023 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 14/12/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/12/2023 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/12/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 14/12/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2023 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 14/12/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 14/12/2023 | 1500/1000 | * |  | US | Business Inventories |

| 14/12/2023 | 1515/1615 |  | EU | ECB Lagarde participates in MP Podcast | |

| 14/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 14/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/12/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.