-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Flash Mfg PMI Inflation Build

- MNI Fed Review - Mar 2024: Soft Landing Story Remains The Same

- MNI INTERVIEW: Fed's Powell Tries To Corral Hawks By June-Sahm

- MNI SOURCES: ECB Wary Of Any "Significant Divergence" With Fed

- MNI BOE WATCH: MPC On Hold As Hawks Fold But Fractures Remain

- MNI BOE: BOE MPC On Hold With Mann, Haskel Dropping HIke Call

- MNI US DATA: Minimal Surprises In Latest Jobless Claims Data

US

FED (MNI): Fed Review - Mar 2024: Soft Landing Story Remains The Same: The main takeaway from the March FOMC is that the Fed remains willing to start cutting rates at an upcoming meeting even in the face of an apparent stalling of disinflation progress to start the year.

- In describing a “bumpy road” to getting inflation back to 2% on a sustainable basis, Chair Powell said the January-February CPI/PCE data “haven't really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road toward 2%. I don't think that story has changed."

- Judging from the new economic projections and Dot Plot, that “story” is part of a soft landing scenario, with robust growth and stable unemployment alongside disinflation – allowing rates to be cut 3 times this year (the same median outlook as at end-2023).

INTERVIEW (MNI): Fed's Powell Tries To Corral Hawks By June-Sahm: Federal Reserve Chair Jerome Powell’s remarks at this week's policy meeting suggest he wants to cut interest rates in June, though FOMC projections show he will have to work to get some of his more hawkish colleagues on board, former Fed economist Claudia Sahm told MNI.

- “He’s June, his outlook for the economy would make June the most appropriate timing for the first cut,” Sahm, a former section chief at the Fed board, said in an interview.

- The problem for Powell is "there are more than two voting members that don't want to," she said, indicating the often hawkish Governor Miki Bowman is likely among these.

NEWS

SOURCES (MNI): ECB Wary Of Any "Significant Divergence" With Fed: European Central Bank policymakers would be wary of permitting a “significant divergence” in interest rates with the Federal Reserve during their widely-expected easing cycles, sources told MNI.

US (MNI): $78B Bipartisan Tax Deal On Brink Of Collapse: The USD$78 billion bipartisan and bicameral tax bill negotiated by Senate Finance Committee Chair Ron Wyden (D-OR) and House Way and Means Chair Jason Smith (R-MO) appears on the brink of collapse. Punchbowl News reports that Senator Mike Crapo (R-ID), “told GOP colleagues privately [at a GOP policy lunch] on Wednesday that he doesn’t want to pass a tax bill this year," adding, "Crapo made a 'chopping' motion with his hand while declaring he wouldn’t do a deal with Democrats on taxes this year.”

BOE WATCH (MNI): MPC On Hold As Hawks Fold But Fractures Remain: The Bank of England's Monetary Policy Committe voted eight-to-one for unchanged policy at its March meeting, with no member voting for a rate hike for the first time since September 2021 as Jonathan Haskel and Catherine Mann dropped their previous call for a 25-basis-point rise and Swati Dhingra again backed a cut.

BOE (MNI): BOE MPC On Hold With Mann, Haskel Dropping HIke Call: The Bank of England Monetary Policy Committee voted eight-to-one for unchanged policy at its March meeting, with Jonathan Haskel and Catherine Mann, who had both previously voted for a hike, joining the majority no change camp and Swati Dhingra again backing a 25 basis point cut.

UK (MNI): PM Sunak Committed To Pensions Triple Lock In Election Manifesto-Express: The Daily Express has reportedthat according to a source within the governing Conservative party, PM Rishi Sunak is committed to the 'pensions triple lock' ahead of the next general election.

MIDEAST (MNI): GCC & Turkey Sign Statement To Initiate FTA Talks: The Gulf Cooperation Council (GCC) and Turkey have announced the signing of a joint statement that will initiate free trade negotiations between the two parties.

SECURITY (MNI): Israel To Proceed With Rafah Operation, Despite US Concerns: Israeli Strategic Affairs Minister Ron Dermer, speaking on a podcast today, has declared that Israel will proceed with a ground invasion of the Gazan city of Rafah despite opposition from key allies, including the US.

US TSYS Data Dependent

- Treasury futures look to finish mixed Thursday with 2s-10s weaker, curves unwinding a good portion of the post FOMC steepening as today's data tempered post-FOMC rate cut projections.

- Rates actually opened stronger across the board, extending gains after the bank of England delivered a dovish hold policy announcement this morning. Short end support evaporated in stages, initially on slightly lower than estimated weekly jobless claims data: 210k vs. 213k est (prior up-revised to 212k from 209k, however).

- Treasury futures gapped lower after the S&P Global US PMI releases saw manufacturing beat (52.5 vs cons 51.8 after 52.2) but services miss (51.7 vs cons 52.0 after 52.3) in the preliminary March PMI. Overall input cost inflation hit a six-month high. “Service providers indicated that higher operating expenses generally reflected increasing wages, while rising oil and gasoline costs were often mentioned by manufacturers."

- After the flash data, Treasuries traded sideways through the rest of the session, Jun'24 10Y futures -3 at 110-11 vs. 110-08.5L/110-26.5H, 2s10s curve -3.603 at -36.766. Moving average studies are in a bear-mode position and this highlights a downtrend. Key short-term resistance to watch is 111-01+, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. On the downside, the bear trigger lies at 109-24+.

OVERNIGHT DATA

US DATA (MNI): Inflationary Pressures Build In March Prelim PMI: The S&P Global US PMI releases saw manufacturing beat (52.5 vs cons 51.8 after 52.2) but services miss (51.7 vs cons 52.0 after 52.3) in the preliminary March PMI.

- The composite meanwhile was as expected at 52.2 (cons 52.2) for a small dip from 52.5 in Feb.

- However, price components showed a clear sign of firming:

- Overall input cost inflation hit a six-month high. “Service providers indicated that higher operating expenses generally reflected increasing wages, while rising oil and gasoline costs were often mentioned by manufacturers."

- Selling price inflation was the highest in just under a year and stronger than the series average. “Respective rates of output price inflation accelerated sharply across both manufacturing and services, quickening to 13- and eight-month highs as companies passed through higher input costs to their customers."

US DATA (MNI): Minimal Surprises In Latest Jobless Claims Data: Initial jobless claims dipped to a seasonally adjusted 210k (cons 213k) in the week to Mar 16 – covering a payrolls reference period – after an upward revised 212l (initial 209k).

- The 210k compares to the 200k from the previous payrolls reference period.

- The four-week average increased by 2k but remains very low at 211k.

- Continuing claims meanwhile increased by less than expected to a seasonally adjusted 1807k (cons 1820k) in the week to Mar 9 after a downward revised 1803k (initial 1811k).

- Continuing claims remain in the newly found, particularly flat seasonally adjusted trend after last week’s annual revisions.

- NSA continuing claims data are still above 2022 and 2023 readings for this time of year but on the low side compared to pre-pandemic years.

- Of note, new orders lifted from -5.2 to +5.4 (highest since Aug’23) and shipments inched higher from +10.7 to +11.4 (highest since Aug’22), whilst there was moderation in prices paid (16.6 to 3.7) and prices received (6.2 to 4.6).

- The six-months ahead measure meanwhile jumped 31.4pts to 38.6, the largest single month increase since at least 2000 to leave it at its highest level since Jul’21.

- “The future new orders index climbed 26 points to 49.9, and the future shipments index rose 17 points to 43.6. On balance, the firms expect an increase in employment over the next six months [and] the index for future capital expenditures rose 11 points to 23.6, its highest reading since March 2022.

US DATA (MNI): Existing Home Sales Jump Despite Pending Sales Weakness: Existing home sales were far stronger than expected in February at 4.38m (cons 3.95m) after 4.00m in Jan.

- The 9.5% M/M rise after 3.1% M/M in Jan goes firmly against the latest pending home sales data which fell a surprisingly large -4.9% in Jan after +5.7%.

- What’s more, there was strength across most regions, with only the smallest northeast region not growing: West (16.4%), South (9.8%), Midwest (8.4%), Northeast (flat).

- Months of supply meanwhile dipped a tenth to 2.9 months in February. It remains high compared to latest years, most recently 2.6 in Feb’23, but still below the 3.5-3.7 months in February’s of 2017-19.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 300.83 points (0.76%) at 39812.43

- S&P E-Mini Future up 19.5 points (0.37%) at 5306.5

- Nasdaq up 45.3 points (0.3%) at 16414.78

- US 10-Yr yield is up 0 bps at 4.2729%

- US Jun 10-Yr futures are down 2.5/32 at 110-11.5

- EURUSD down 0.0064 (-0.59%) at 1.0858

- USDJPY up 0.45 (0.3%) at 151.71

- Gold is down $4.55 (-0.21%) at $2181.90

- European bourses closing levels:

- EuroStoxx 50 up 52 points (1.04%) at 5052.31

- FTSE 100 up 145.17 points (1.88%) at 7882.55

- German DAX up 164.12 points (0.91%) at 18179.25

- French CAC 40 up 18.31 points (0.22%) at 8179.72

US TREASURY FUTURES CLOSE

- 3M10Y +0.346, -112.78 (L: -123.715 / H: -110.999)

- 2Y10Y -3.603, -36.766 (L: -36.826 / H: -31.904)

- 2Y30Y -4.677, -19.803 (L: -19.881 / H: -13.106)

- 5Y30Y -2.129, 18.417 (L: 18.257 / H: 22.602)

- Current futures levels:

- Jun 2-Yr futures down 2/32 at 102-9.375 (L: 102-09.125 / H: 102-14.375)

- Jun 5-Yr futures down 2.75/32 at 106-27.25 (L: 106-25.5 / H: 107-05.75)

- Jun 10-Yr futures down 3/32 at 110-11 (L: 110-08.5 / H: 110-26.5)

- Jun 30-Yr futures up 4/32 at 118-30 (L: 118-19 / H: 119-20)

- Jun Ultra futures up 8/32 at 126-17 (L: 126-01 / H: 127-11)

US 10Y FUTURE TECHS: (M4) Snaps Off Highs

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-01+ 50-day EMA

- RES 1: 110-26+ High Mar 21

- PRICE: 110-12 @ 16:48 GMT Mar 21

- SUP 1: 109-24+ Low Mar 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasury prices snapped lower off highs during Thursday trade to maintain a softer tone after last week’s sell-off. Moving average studies are in a bear-mode position and this highlights a downtrend. Key short-term resistance to watch is 111-01+, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. On the downside, the bear trigger lies at 109-24+.

SOFR FUTURES CLOSE

- Jun 24 -0.015 at 94.895

- Sep 24 -0.015 at 95.195

- Dec 24 -0.030 at 95.485

- Mar 25 -0.040 at 95.740

- Red Pack (Jun 25-Mar 26) -0.04 to -0.015

- Green Pack (Jun 26-Mar 27) -0.015 to -0.01

- Blue Pack (Jun 27-Mar 28) -0.01 to -0.005

- Gold Pack (Jun 28-Mar 29) -0.005 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00059 to 5.32941 (+0.00066/wk)

- 3M -0.00853 to 5.31996 (-0.01252/wk)

- 6M -0.02582 to 5.24578 (-0.02936/wk)

- 12M -0.04276 to 5.03684 (-0.04175/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.736T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $685B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $673B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $248B

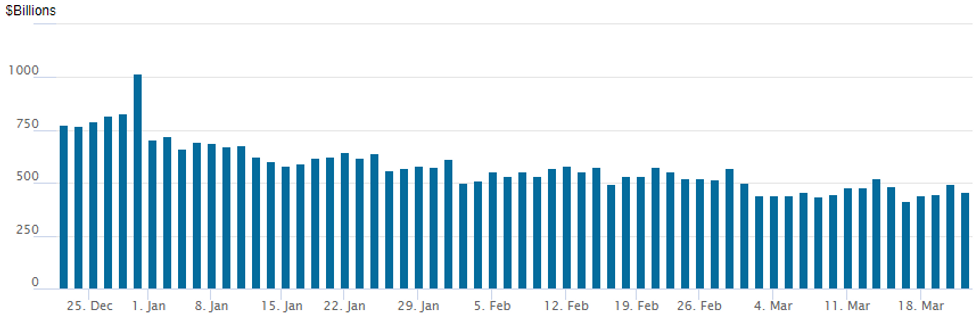

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage recedes to $460.631B after a potential influx of GSE flows saw usage jump to $496.245B yesterday. Last Friday saw usage fall to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 74 vs. 78 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE: $1.4B Athene 2Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 3/21 $1.4B #Athene $1B 3Y +110, $400M 3Y SOFR+121

- 3/21 $1B #AIB Group 11NC10 +160

EGBs-GILTS CASH CLOSE: Core FI Gains On Dovish Central Bank Developments

Short-end UK instruments outperformed German counterparts Thursday following a dovish BoE decision, but long-end Bunds outperformed Gilts.

- European FI started on the front foot following the dovish Fed late Wednesday, with further upside early in the session spurred by a surprise rate cut by the SNB and softer-than-expected Eurozone flash manufacturing data (UK PMIs were mixed and had little impact).

- The BoE decision brought a significant dovish shift, including no more hawkish dissenters, and Gilts hit session highs.

- In the afternoon, gains retraced as US data came in on the strong side and the US dollar and stocks strengthened.

- The UK curve twist steepened on the day, with Germany's bull steepening. Periphery spreads tightened, but closed off intraday tights.

- Friday's schedule includes UK retail sales and German IFO data, with multiple ECB speakers including Nagel, Holzmann, and Lane.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 2.875%, 5-Yr is down 4.1bps at 2.405%, 10-Yr is down 2.7bps at 2.405%, and 30-Yr is down 1.1bps at 2.578%.

- UK: The 2-Yr yield is down 5.6bps at 4.178%, 5-Yr is down 3.7bps at 3.878%, 10-Yr is down 2.1bps at 3.995%, and 30-Yr is up 1.4bps at 4.493%.

- Italian BTP spread down 1.1bps at 127bps / Spanish down 0.9bps at 80.6bps

FOREX Greenback Registers Post-FOMC Reversal Higher Amid Stronger-Than-Expected Data

- The greenback completed a V-shaped recovery on Thursday, with the USD index trading back through the pre-FOMC levels and extending above 104 in late trade.

- A dovish Swiss National Bank and Bank of England are providing significant headwinds for CHF (-1.25%) and GBP (-0.98%), the notable underperformers on the session, which are likely assisting the latest upswing for the dollar.

- In addition, firmer than expected US data is likely providing an additional greenback tailwind. Higher-than-expected Philly Fed business outlook and Manufacturing PMIs were then complemented by lower initial jobless claims and a jump in existing home sales, all underpinning the dollar bid.

- The close proximity of major resistance in USDJPY will likely continue to garner attention and could provide an obstacle for further protracted dollar strength as we approach the weekend.

- USDJPY extended the overnight recovery and tracks close to 151.70, now up 0.28% on the day. The cluster of significant resistance starts at yesterday’s highs of 151.82, which precedes the multi-decade highs at 151.91/95. Clearance of this resistance would confirm a resumption of the long-term USDJPY uptrend, with a break opening 152.66, a Fibonacci projection.

- Separately, AUD remains an outperformer following the strong post-holiday rebound in jobs, confirmed by data overnight. Earlier in the session, AUDJPY briefly printed above 100.00, a level that hasn’t traded since late 2014.

- Japan National core CPI crosses overnight on Friday, before UK retail sales headlines the European data docket.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/03/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 22/03/2024 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 22/03/2024 | 0730/0730 |  | UK | DMO to release calendar for FQ1 (Apr-Jun) Ops | |

| 22/03/2024 | 0800/0900 |  | EU | ECB's Lagarde in Euro Summit | |

| 22/03/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/03/2024 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/03/2024 | 1300/0900 |  | US | Fed Listens event | |

| 22/03/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/03/2024 | 1600/1200 |  | US | Fed Vice Chair Michael Barr | |

| 22/03/2024 | 1630/1630 |  | UK | BOE to announce APF sales schedule for Q2-24 | |

| 22/03/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 22/03/2024 | 1700/1800 |  | EU | ECB's Lane lecture on inflation and MonPol at AMSE | |

| 22/03/2024 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.