-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Home Sales/Build Permits, Consumer Conf Strong

- MNI: Canada Inflation Is Slowest In 2 Years As Gasoline Slides

- MNI US DATA: Surprise Beat For Consumer Confidence, Labor Differential Also Stronger

- MNI New Home Sales Surge Back To Pre-Pandemic Levels

Markets Roundup: Tsys Hug Lows After Strong Data

- Treasury futures are trading weaker after the bell, drifting near session lows since late morning after a mildly volatile open. Treasury futures extended highs (TYU3 113-13, +5.5) after the equity open as stocks marched higher through late trade (SP Eminis +41.75 at 4422.00). No specific headline driver for the early support, trading desks suggest early month end buying while bounce in Canadian FI post data may be a contributing factor.

- FI support was short lived as Treasury futures sold-off (TYU3 marking 112-24.5 low, yield 3.7601%) in reaction to stronger than expected data (May durable goods orders, April home prices, May new home sales, and June consumer confidence) that contributed to modest gain in projected rate hike expectations in the second half of 2023.

- Market confidence of a hike at the July 26 FOMC has climbed to 76% from 69% early Monday, implied rate of +19.1bp to 5.267%. September cumulative of +23.6bp at 5.313% while November is fully pricing in a 25bp hike with cumulative at 27.7 at 5.354%. Fed terminal at 5.355% in Nov'23.

- Focus on ECB Central Bank Forum underway in Sintra. Fed Chair Powell, ECB Lagarde, BOJ Ueda and BOE Bailey on policy panel event Wednesday at 0930ET.

- Also of interest, the Federal Reserve Board annual bank stress tests results will be tomorrow afternoon at 1630ET.

CANADA

CANADA: Canada’s inflation rate slowed as expected to 3.4% in May from 4.4% in April as past gasoline price hikes fell out of the index, Statistics Canada said Tuesday, while core rates slowed by about half as much.

- The moderation in headline prices matched the forecasts of economists, who said before the release it may not be enough to deter the Bank of Canada from raising borrowing costs again next month. Governor Tiff Macklem has cited dangers of stickier core prices leaving inflation stuck above his 2% target even as he forecasts CPI slowing to 3% in the near term.

- The trim core inflation rate slowed to 3.8% from 4.2% and the median core rate to 3.9% from 4.3%. The trim rate is now the slowest since November 2021.

OVERNIGHT DATA

- US MAY DURABLE NEW ORDERS +1.7%; EX-TRANSPORTATION +0.6%

- US APR DURABLE GDS NEW ORDERS REV TO +1.2%

- US MAY NONDEF CAP GDS ORDERS EX-AIR +0.7% V APR +0.6%

- US REDBOOK: JUN STORE SALES +0.6% V YR AGO MO

- US REDBOOK: STORE SALES +0.5% WK ENDED JUN 24 V YR AGO WK

- US APRIL FHFA HOME PRICE INDEX RISES 0.7% M/M; EST. 0.5% - bbg

- APRIL S&P CORELOGIC CS 20-CITY ADJUSTED INDEX UP 0.9% M/M - bbg est. 0.35%

- US JUNE RICHMOND FED REGIONAL BUSINESS CONDITIONS -12

- US CONF BOARD CONSUMER CONFIDENCE 109.7 IN JUN V MAY 102.5

- The Conference Board consumer confidence index saw a surprisingly large beat in June as it increased from 102.5 to 109.7 (cons 103.9) takes it to its highest since Jan’22.Sizeable gains were seen in both present situation and expectations.

- Within the details and notably ahead of next week's payrolls report, the labor differential also unwound much of May’s decline, rising from 30.7 to 34.4 mainly on an increase in the perception of "jobs plentiful".

- US MAY NEW HOME SALES +12.2% TO 0.763M SAAR; APR SALES REVISED TO 0.680M SAAR

- New home sales were far stronger than expected in May, rising to 763k (cons 675k) from 680k (initially 683k), translating to a 12.2% M/M increased after 3.5%. There wasn’t a standalone region, with sizeable monthly increases across the four major regions.

- The continued pop higher in sales takes them back to pre-pandemic levels, after a much sharper recovery than that seen in the existing home sales segment.

- New home sales were far stronger than expected in May, rising to 763k (cons 675k) from 680k (initially 683k), translating to a 12.2% M/M increased after 3.5%. There wasn’t a standalone region, with sizeable monthly increases across the four major regions.

- CANADA’S MAY INFLATION RATE IS SLOWEST SINCE JUNE 2021:

- CANADA MAY CPI +3.4% YOY VS FORECAST +3.4%, PRIOR +4.4%

- CANADA MAY CPI +0.4% MOM VS FORECAST +0.4%, PRIOR +0.7%

- CANADA MAY CPI EX FOOD & ENERGY +0.4% MOM; +4.0% YOY

- CANADA CORE TRIM CPI +3.8% YOY, MEDIAN +3.9%

- CANADA INFLATION SLOWS AS GASOLINE -0.8% MOM, -18.3% YOY

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 238.91 points (0.71%) at 33952.06

- S&P E-Mini Future up 50 points (1.14%) at 4419.75

- Nasdaq up 222 points (1.7%) at 13557.75

- US 10-Yr yield is up 4.5 bps at 3.7659%

- US Sep 10-Yr futures are down 13.5/32 at 112-26

- EURUSD up 0.0054 (0.5%) at 1.096

- USDJPY up 0.53 (0.37%) at 144.03

- WTI Crude Oil (front-month) down $1.81 (-2.61%) at $67.56

- Gold is down $9.25 (-0.48%) at $1913.98

- EuroStoxx 50 up 24.69 points (0.58%) at 4305.26

- FTSE 100 up 7.88 points (0.11%) at 7461.46

- German DAX up 33.8 points (0.21%) at 15846.86

- French CAC 40 up 31.23 points (0.43%) at 7215.58

US TREASURY FUTURES CLOSE

- 3M10Y +6.094, -154.238 (L: -167.645 / H: -151.628)

- 2Y10Y +3.135, -99.578 (L: -102.884 / H: -94.85)

- 2Y30Y +0.89, -92.306 (L: -93.773 / H: -85.415)

- 5Y30Y -3.808, -19.367 (L: -20.624 / H: -14.563)

- Current futures levels:

- Sep 2-Yr futures down 5.75/32 at 101-29.5 (L: 101-28.75 / H: 102-04.25)

- Sep 5-Yr futures down 10.25/32 at 107-18.5 (L: 107-16.75 / H: 108-00)

- Sep 10-Yr futures down 13.5/32 at 112-26 (L: 112-24.5 / H: 113-13)

- Sep 30-Yr futures down 17/32 at 127-18 (L: 127-12 / H: 128-18)

- Sep Ultra futures down 17/32 at 136-25 (L: 136-16 / H: 138-01)

US 10YR FUTURE TECHS: (U3) Bear Threat Holds Sway

- RES 4: 115-00 High Jun 1 and a key resistance

- RES 3: 114-06+/09 High Jun 6 / 50-day EMA

- RES 2: 114-00 High Jun 13

- RES 1: 113.18 High Jun 15

- PRICE: 112-27 @ 1200 ET Jun 27

- SUP 1: 112-12+ Low Jun 14 and the bear trigger

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures are consolidating and continue to trade inside the recent range. The trend outlook is unchanged and a bear threat remains present. Recently, support at 112-29+, the May 26 / 30 low was cleared. This exposes 112-00, the Mar 10 low. Further out, potential is seen for a move towards 110-27+, the Mar 2 low and a key support. Short-term gains are considered corrective. Initial firm resistance is at 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Sep 23 -0.020 at 94.635

- Dec 23 -0.055 at 94.715

- Mar 24 -0.095 at 94.985

- Jun 24 -0.115 at 95.385

- Red Pack (Sep 24-Jun 25) -0.12 to -0.105

- Green Pack (Sep 25-Jun 26) -0.095 to -0.06

- Blue Pack (Sep 26-Jun 27) -0.05 to -0.035

- Gold Pack (Sep 27-Jun 28) -0.035 to -0.025

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01805 to 5.10536 (+.02169/wk)

- 3M +0.00461 to 5.23932 (+.00062/wk)

- 6M +0.00391 to 5.32433 (-.00475/wk)

- 12M +0.00553 to 5.26322 (-.02038/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06386%

- 1M +0.01385 to 5.19171%

- 3M +0.00771 to 5.52871% */**

- 6M +0.04614 to 5.71971%

- 12M +0.02958 to 5.91429%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $138B

- Daily Overnight Bank Funding Rate: 5.06% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.429T

- Broad General Collateral Rate (BGCR): 5.03%, $610B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $596B

- (rate, volume levels reflect prior session)

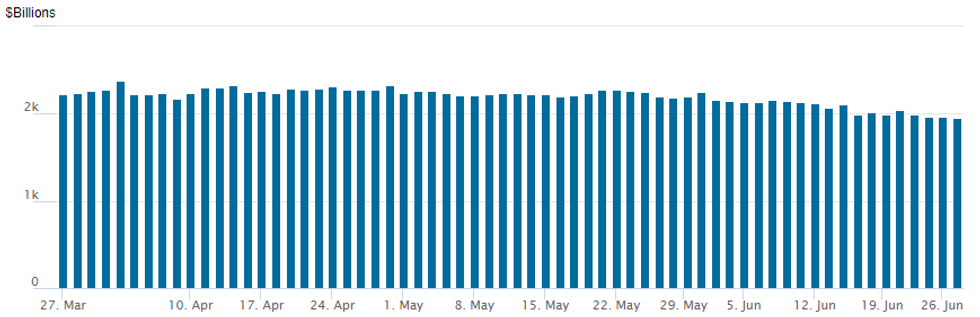

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,951.098B w/ 101 counterparties, compared to $1,961.027B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B Credit Agricole 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/27 $3B *IADB 3Y SOFR+24

- 06/27 $2.5B #Credit Agricole $1.25B 3Y +120, $500M 3Y SOFR+129, $750M 10Y +175

- 06/27 $2.25B *British Columbia 10Y SOFR+70

- 06/27 $2.25B #Rep of Chile $1.15B +12Y +123, $1.1B +30Y +148

- 06/27 $500M *Korea Gas 5Y +88

- 06/27 $500M #Mitsubishi 5Y +100

EGBs-GILTS CASH CLOSE: Bear Flatter As Sintra Comments, US Data Weigh

Gilts led a European core FI sell-off Tuesday, with central bank hiking expectations rising.

- Both the German and UK curves bear flattened, with UK yields up double-digits through the 5Yr tenor as BoE peak rate pricing rose 6bp and exceeded 6.25%. ECB peak is again seen above 4% after a 4bp rise today.

- Rhetoric from the ECB's annual Sintra event has been mostly on the hawkish side. Highlights included Lagarde's comment that the ECB won’t be able to “state with full confidence” in the near future that the peak for rates has been reached; MNI interviewed Belgium's Wunsch in Sintra: he sees a September hike absent a fall in core inflation.

- Stronger-than-expected US data in the afternoon helped relieve recession concerns and cemented the European selloff into the cash close.

- Periphery EGB spreads tightened (combo of higher bund yields and a risk asset rally), with 10Y Greece/Germany at fresh post-2021 lows.

- Italy kicks off the June eurozone inflation readings Wednesday - our preview for that release and the EZ numbers was published today (available here). We also get commentary from BoE's Pill and Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.3bps at 3.16%, 5-Yr is up 6.7bps at 2.516%, 10-Yr is up 4.7bps at 2.356%, and 30-Yr is up 1.7bps at 2.391%.

- UK: The 2-Yr yield is up 11.3bps at 5.273%, 5-Yr is up 11.8bps at 4.675%, 10-Yr is up 7.4bps at 4.375%, and 30-Yr is down 0.9bps at 4.376%.

- Italian BTP spread down 1.3bps at 162.8bps / Greek down 1.9bps at 121.7bps

FOREX: EUR Bolstered Ahead Of Eurozone Inflation Prints, JPY Extends Downtrend

- The Euro continued its grind higher from late on Friday as the single currency was buoyed by some moderate hawkish ECB rate re-pricing and reports of potentially supportive month-end flows. This prompted EURJPY to approach the 158 handle, advancing 0.85% on the day.

- Despite the pair oscillating either side of 150 in late May and early June, the sharp rally across the last eleven trading sessions equates to around a +5.2% surge, as it eats into the sharp decline witnessed in 2008.

- EURJPYprice action reinforces the current technical bullish theme after recently clearing key resistance at 151.61, the May 2 high and an important bull trigger. Moving average studies are in a bull mode position too, highlighting positive market sentiment and the topside focus is on 158.72, a Fibonacci projection.

- Elsewhere, a slew of positive data surprises was unable to spark a broad US dollar revival, with the USD index sitting 0.20% lower on the session as we approach the APAC crossover.

- However, USDJPY did surge from the lows, breaking above 144.00 in the process, as the upward pressure on front-end yields further hampered the struggling yen.

- The run higher in USD/CNH stopped just in front 7.2500 during Asia-Pac hours, with a slightly more forceful PBoC lean against further weakness (albeit not large by historic terms) and Reuters reports suggesting that “state banks sold dollars against the yuan” providing the most meaningful signs yet that authorities have started to get a little uncomfortable with at least the speed of the recent run lower in the value of the yuan. Spot deals around 7.2250 as of writing.

- On Wednesday, CPI data for Australia and Italy will receive attention. Likely the market focus will be on the ECB Forum in Sintra, where Fed’s Powell, ECB’s Lagarde, BOJ’s Ueda and BoE’s Bailey all have a joint event.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 28/06/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/06/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/06/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/06/2023 | 0800/1000 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/06/2023 | 0900/1100 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 1030/1130 |  | UK | BOE Pill Panels ECB Forum | |

| 28/06/2023 | 1030/1230 |  | EU | ECB Lane Panels ECB Forum | |

| 28/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/06/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2023 | 1330/1430 |  | UK | BOE Bailey Panels ECB Forum | |

| 28/06/2023 | 1330/1530 |  | EU | ECB Lagarde Panels ECB Forum | |

| 28/06/2023 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 28/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.