-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Budget Office Says Trade War Cuts Output 2%

MNI POLITICAL RISK -Trump Notes Possible Tariff "Disturbances"

MNI ASIA OPEN: Implied Hikes on the Rise Second Half of 2023

EXECUTIVE SUMMARY

US

FED: Fed tightening is working its way through the economy with varying lags and there's still "some way to go" to restore a balance of supply and demand, Federal Reserve Bank of New York President John Williams said Tuesday.

- GDP growth is expected to come in around 1% this year while the unemployment rate will likely edge up to between 4% and 4.5% from the current half-century low of 3.4% as the Fed pushes rates higher, he said. PCE inflation should fall to 3% this year and back to target over the next few years, he said.

- "We need all the gears turning at the right pace to restore balance between demand and supply in the entire economy. We still have some way to go to achieve that goal. And it will likely entail a period of subdued growth and some softening of labor market conditions," Williams said in remarks prepared for the New York Bankers Association. For more see MNI Policy main wire at 1405ET.

FED: U.S. interest rates need to continue rising gradually until policymakers are confident the U.S. labor market is cooling and aggregate demand is coming into better balance with supply, Federal Reserve Bank of Dallas President Lorie Logan said Tuesday.

- Inflation data should show sustained improvement and "we need to see the economy evolving more or less as forecasts predict," she said. But with hiring in January coming more than twice as high as analysts had expected, "it is hard to have confidence in any outlook."

- "I anticipate we will need to continue gradually raising the fed funds rate until we see convincing evidence that inflation is on track to return to our 2% target in a sustainable and timely way," Logan said in remarks prepared for Prairie View A&M University, adding, "We shouldn't lock in on a peak interest rate or a precise path of rates." For more see MNI Policy main wire at 1101ET.

- “At some point this year, I expect that the policy rate will be restrictive enough that we will hold rates in place and let monetary policy do its work. We are also shrinking our balance sheet, which is removing a significant amount of accommodation.” For more see MNI Policy main wire at 1300ET.

FED: Americans may have developed more European preferences for leisure over work during the Covid pandemic, squeezing labor supply amid elevated wage inflation that will keep the Fed hiking interest rates, Cleveland Fed and ECB academic consultant Michael Weber told MNI.

- Weaker labor force participation is due to more than just the common diagnosis of an acceleration of early retirements, Weber said Monday. Americans now appear less eager to work long hours or full-time positions, the associate professor at University of Chicago's Booth business school said.

- "Recently there are some people who are referring to a ‘Europe-ification’ of the U.S. labor market, and that people partially changed their preferences trading off leisure and labor," said Weber, who is also a visiting researcher at the Bureau of Labor Statistics. Americans on average worked 1,777 hours a year in 2019 compared with 1,382 in Germany and 1,518 hours in France according to the latest OECD figures. For more see MNI Policy main wire at 1109ET.

- Two-thirds of the CPI, by expenditure weight, rose at annualized rates greater than 5%, the highest share since August. Looking at unweighted prices, 60% rose at rates greater than 5%, compared to an average of 49% over the past three months. In a typical pre-pandemic month, just 20% of the unweighted market basket would post increases that high, Meyer said.

US TSYS: Implied Hikes for Second Half of 2023 Rising

Volatile post-CPI trade after the open followed by hawkish leaning Fed speak that rates to session lows by midday. Tsy futures gap lower/extend lows (30YY 3.7888% initial high) after Jan CPI climbed 0.5 percent, seasonally adjusted, +6.4% YoY - not seasonally adjusted. Tsys futures gap higher/extend highs just as quickly (30YY 3.7162% low) as mkts digested seventh consecutive decline for headline YoY CPI.

- Surge to new session highs post data more flow driven than data or headline, followed shortly after with Block sales in 5s and 10s through respective offers that started Tsys on a path to new session lows by midday.

- Equities rebound after selling off on hawkish Fed speak from Dallas Fed Logan on danger of not hike rates enough to combat inflation tempered risk appetite.

- Implied rate hikes for 2H'23 climb after -20,000 SFRU3 97.76, sell through 97.77 post-time bid at 1033:28ET, 94.76 last (-0.090). Note, lead SFRH3 holding steady while balance of quarterlies pricing in more rate hikes through year end.

- Similarly, Fed funds implied hike for Mar'23 holds at 26.1bp, May'23 cumulative at 47.4bp (+1.0) to 5.053%, Jun'23 62.7bp (+4.8) to 5.209%, terminal at 5.27% in Aug'23 - off midday high of 5.295%.

OVERNIGHT DATA

- US JAN CPI 0.5%, CORE 0.4%; CPI Y/Y 6.4%, CORE Y/Y 5.6%

- US JAN ENERGY PRICES 2.0%

- US JAN OWNERS' EQUIVALENT RENT PRICES 0.7%

- Unrounded % M/M (SA): Headline 0.517%; Core: 0.412% (from 0.399%)

- Unrounded % Y/Y (NSA): Headline 6.41%; Core: 5.583% (from 5.708%)

US DATA: OER and Primary Rents Inflation Broadly Within Expected Range OER and primary rents both moderate slightly on the month, still within recent (very strong) ranges.

- OER at 0.67% M/M in Jan after 0.79 in Dec. Analysts seen beforehand looked for an average of 0.70 (range of 0.65-0.78).

- Primary rents 0.74% M/M in Jan after 0.79% in Dec. Analyst average of 0.73 (range 0.70-0.75)

US DATA: Core Goods Push Back On Recent Deflation Trend. An unchanged core CPI print (0.41% after 0.40%) comes as an uptick in core goods inflation (0.07 after -0.13) is offset by softer services (0.545 after 0.61).

- Core goods inflation was surprisingly strong at 0.07% M/M considering used cars contracted -1.94% M/M after December's -1.99%, with analysts looking for closer to flat or a small decline for used cars.

- Indeed, core goods ex used vehicles accelerated from 0.27% M/M to 0.46% M/M, the fastest monthly pace since August, following a stalling in the previously solid decline in the NY Fed's supply chain index

- MNI: US REDBOOK: FEB STORE SALES +4.6% V YR AGO MO

- US REDBOOK: STORE SALES +4.9% WK ENDED FEB 11 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 90.4 points (-0.26%) at 34159.49

- S&P E-Mini Future up 4 points (0.1%) at 4152.25

- Nasdaq up 69.6 points (0.6%) at 11962.97

- US 10-Yr yield is up 6.5 bps at 3.7664%

- US Mar 10-Yr futures are down 15.5/32 at 112-9.5

- EURUSD up 0.0013 (0.12%) at 1.0736

- USDJPY up 0.64 (0.48%) at 133.06

- WTI Crude Oil (front-month) down $0.95 (-1.19%) at $79.19

- Gold is up $1.84 (0.1%) at $1855.35

- EuroStoxx 50 down 2.6 points (-0.06%) at 4238.76

- FTSE 100 up 6.25 points (0.08%) at 7953.85

- German DAX down 16.78 points (-0.11%) at 15380.56

- French CAC 40 up 5.22 points (0.07%) at 7213.81

US TSY FUTURES CLOSE

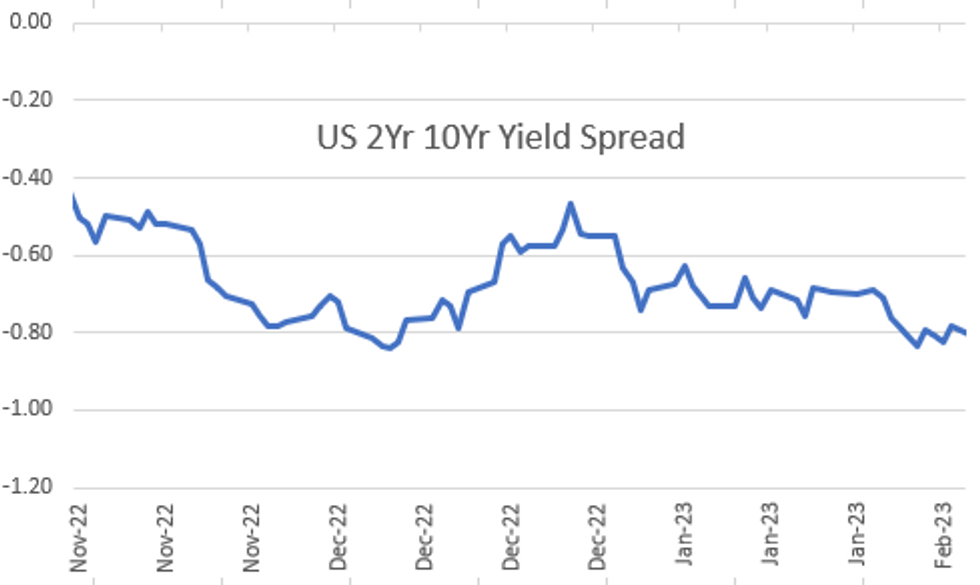

- 3M10Y +6.89, -101.782 (L: -120.69 / H: -101.232)

- 2Y10Y -3.518, -85.744 (L: -90.374 / H: -80.266)

- 2Y30Y -6.608, -81.712 (L: -83.702 / H: -70.439)

- 5Y30Y -6.368, -20.486 (L: -21.934 / H: -8.164)

- Current futures levels:

- Mar 2-Yr futures down 6.125/32 at 101-31.625 (L: 101-30.5 / H: 102-12.75)

- Mar 5-Yr futures down 13/32 at 107-14.25 (L: 107-10.25 / H: 108-13)

- Mar 10-Yr futures down 16/32 at 112-9 (L: 112-03 / H: 113-17.5)

- Mar 30-Yr futures down 15/32 at 126-29 (L: 126-14 / H: 128-26)

- Mar Ultra futures down 18/32 at 138-14 (L: 137-22 / H: 140-23)

US 10YR FUTURE TECHS: (H3) Cracks Trendline Support

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-06+ 20-day EMA

- RES 1: 114-00+ 50-day EMA

- PRICE: 112-11 @ 15:55 GMT Feb 14

- SUP 1: 112-09 Low Feb 13

- SUP 2: 112-00 Round number support

- SUP 3: 111-28+ 61.8% Oct - Jan Upleg

- SUP 4: 111-28 Low Dec 30 and a key support

Treasury futures remain bearish and showed below trendline support on the back of the US CPI release Tuesday. The low of the day at 112-09 marks the weakest for the contract since early January, and puts the contract below the 112-14 trendline. This strengthens the current bearish theme and exposes 111-28, the Dec 30 low. Key short-term resistance is seen at the 50-day EMA which intersects at 114-00+. A break of this EMA would ease bearish pressure.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.005 at 94.938

- Jun 23 -0.060 at 94.565

- Sep 23 -0.110 at 94.480

- Dec 23 -0.165 at 94.70

- Red Pack (Mar 24-Dec 24) -0.215 to -0.18

- Green Pack (Mar 25-Dec 25) -0.16 to -0.095

- Blue Pack (Mar 26-Dec 26) -0.08 to -0.05

- Gold Pack (Mar 27-Dec 27) -0.035 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.55943% (+0.00014/wk)

- 1M +0.00214 to 4.59000% (+0.01200/wk)

- 3M +0.00800 to 4.87157% (+0.00214/wk)*/**

- 6M +0.00643 to 5.15843% (+0.03129/wk)

- 12M -0.00586 to 5.49914% (+0.01457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $294B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.153T

- Broad General Collateral Rate (BGCR): 4.52%, $467B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $452B

- (rate, volume levels reflect prior session)

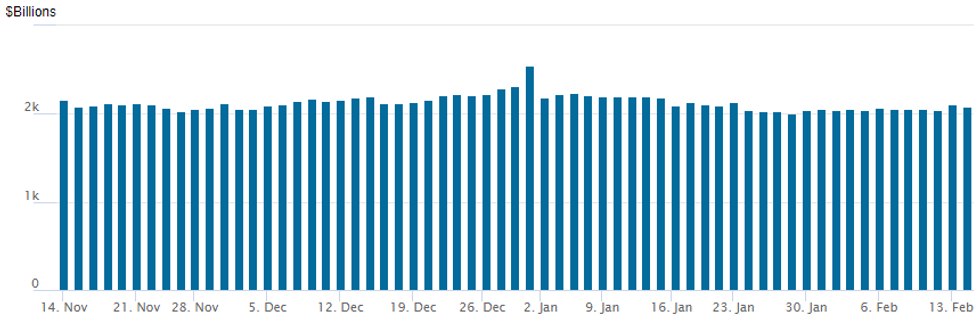

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,076.548B w/ 109 counterparties vs. prior session's $2,107.775B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

Corporate debt issuers sidelined around Jan CPI data, should resume Wednesday.

EGBs-GILTS CASH CLOSE: Gilts Underperform In Bear Flattening Move

European bonds weakened Tuesday in response to stronger-than-expected UK wage data and another robust US inflation reading.

- The UK's bear flattening move stood out, with 2Y yields having their 2nd biggest daily rise of 2023 and 2s10s closing at the most inverted since September.

- This came as BoE terminal hike pricing rose 10bp on the day, following data showing UK wages posted record (ex-pandemic) growth in January, while a largely in-line US CPI print reinforced the global "higher for longer" narrative.

- ECB peak rate pricing hit a cycle high at 3.68% for September; ECB's Makhlouf said he could see rates above 3.5% this year.

- Periphery spreads tightened slightly, led by Greece.

- UK CPI is Wednesday's early highlight.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.6bps at 2.858%, 5-Yr is up 8.2bps at 2.505%, 10-Yr is up 7bps at 2.438%, and 30-Yr is up 5.6bps at 2.378%.

- UK: The 2-Yr yield is up 19.1bps at 3.83%, 5-Yr is up 16.1bps at 3.51%, 10-Yr is up 11.9bps at 3.521%, and 30-Yr is up 7.6bps at 3.89%.

- Italian BTP spread down 1.8bps at 178.6bps / Greek down 3.7bps at 179.9bps

FOREX: USD Index Unchanged, Higher Yields Place Pressure On JPY

Despite the initial and very volatile spin-cycle following the US inflation data, the greenback traded on a surer footing approaching the end of the European session amid pressure on the front-end of the US curve. The USD index remains close to unchanged on the day approaching the APAC crossover, claiming back pre-data declines.

- Some weakness in equities acted as an additional USD tailwind in the aftermath of the data although markets have stabilised in late US trade amid a plethora of Fed speakers.

- The higher US yields are naturally weighing on the Japanese Yen and USDJPY (+0.52%) is currently consolidating above 133. As highlighted, a sustained break of the 50-day EMA (intersects today at 132.71) is required to suggest scope for an extension higher that would target 134.77 on the topside, the Jan 6 high.

- In EURUSD, prices remains above support at 1.0674, the 50-day EMA, for now. This represents a key short-term level and a clear break of the average would instead strengthen the bearish cycle and initially expose 1.0634, the Jan 9 low.

- With cross/JPY trading with an upward bias and extending yesterday’s supportive price action, attention for EURJPY is on 142.99, the Feb 06 high, where a break would confirm a continuation of the recovery that started on Jan 3. The technical outlook remains bullish and resistance levels/targets above include 144.53, the 76.4% retracement of the Dec 15 - Jan 3 bear leg and 145.83, High Dec 20.

- NZDUSD (-0.33%) continues to be one of the weakest pairs in G10 following inflation expectations data overnight. 2y inflation is seen at 3.30% for Q1, down from 3.62% late last year - feeding into the view that domestic inflation may have peaked for now.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 15/02/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 15/02/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 15/02/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/02/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/02/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/02/2023 | 1400/1500 |  | EU | ECB Lagarde at Plenary Debate on ECB Annual Report | |

| 15/02/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 15/02/2023 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.