-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jan Employment Focus Post Policy Risk

EXECUTIVE SUMMARY

- MNI US Payrolls Preview: Watching AHE For Rate Cut Direction

- MNI INTERVIEW: Fed Could Need To Hike Again After Pause-Ireland

- MNI Fed Review - Feb 2023: Only As Hawkish As The Data Allow

- MNI WHITE HOUSE: Statement: Deese To Depart As Economic Council Director

- MNI: BOE Hikes 50bp; Further Action If Price Pressures Persist

- UK: BOE: Ups Employment Outlook, But Highlights Stagnant Growth Projection

- MNI WATCH: ECB Points To Another 50Bps Hike In March

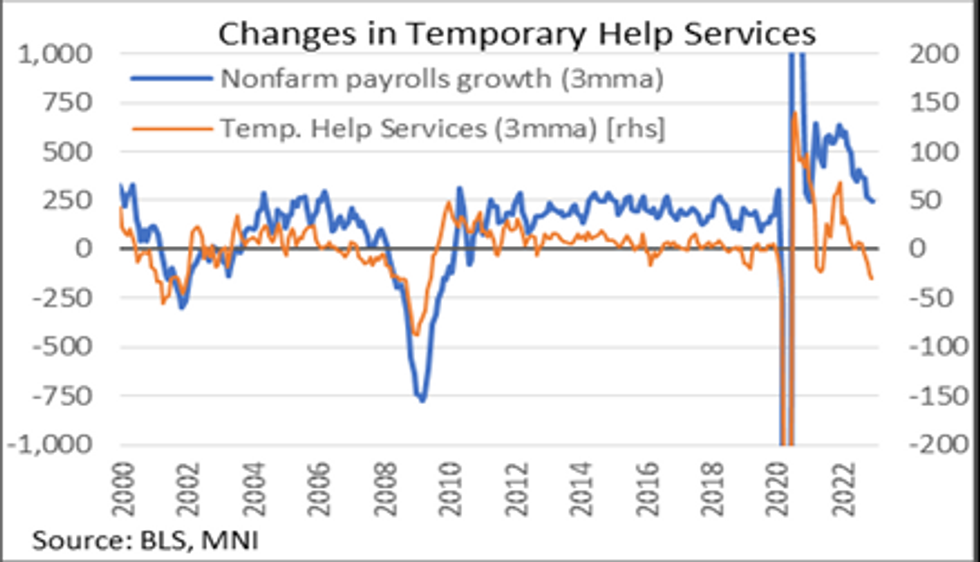

Doves vs Hawks On Falling Temporary Help Services

- The fall in temporary help services has increasingly come into focus from analysts and FOMC members alike, declining for five consecutive months into December.

- The extent to which it might be a leading indicator for a potential broader deterioration sees two schools of thought from FOMC members at either end of the dove-hawk spectrum:

- Vice Chair Brainard on labour market (Jan 19): “Recent declines in average weekly hours, temporary-help services, and monthly payrolls growth suggest tentative signs that labor demand is cooling. Employment at temporary-help services firms—a good leading indicator—peaked in July 2022 and has been declining since then, ending the year only slightly above its December 2019 level.”

- Gov. Waller: it “may be due at least in part to employers opting to hire full-time workers in place of temps to help keep jobs filled” (Jan 20).

US

US: MNI US Payrolls Preview: Watching AHE For Rate Cut Direction: As has been the case for many months now, consensus looks for a slight moderation in payrolls growth in January to a still stronger than sustainable pace after last month’s broadly in line outcome.

- Annual benchmark revisions could make the initial read more complicated, but barring large surprises we suspect focus will be on AHE, which has abated a bit in the words of Powell after its own large revisions.

- Primary dealer analysts have an unusually distinct skew to a hawkish surprise from both AHE growth and the unemployment rate.

- That’s against a post-FOMC backdrop of 20bp priced for the Mar 22nd decision and one final hike fully priced for May despite Powell indicating a desire to see a couple more hikes to a restrictive level.

- “Now FOMC members as a group feel like they’re on top of the problem and that gives them the luxury of going back to a gradual approach,” said Ireland, a professor at Boston College, in an interview with MNI’s FedSpeak podcast Thursday.

- “I definitely believe at least a couple more rate increases are needed. I’m concerned that additional rate increases may be necessary in the summer and in the fall but we’ll just have to see,” he said. Fore more see MNI Policy main wire at 1451ET.

- While the Statement leaned hawkish, and the message overall was that another “couple” of 25bp hikes were the central expectation, Chair Powell cracked open the door to potential rate cuts in H2 2023.

- In a “mixed message” press conference, Powell repeated that the Fed would “stay the course until the job is done”, but also sounded optimistic on the inflation front and did not push back as forcefully against easier financial conditions as he did previously.

- While Powell did not give a green light to potential rate cuts, nor did he provide an outright denial of that possibility, in contrast to previous meetings – and he implied that the Fed could ease if inflation pulls back more than they expect.

- Expectations are that Fed Vice Chair Lael Brainard is in pole position to take over from Deese, which would leave a seat open on the Board of Governors.

UK

BOE: The Bank of England Monetary Policy Committee voted for a 50 basis point hike at its February meeting, lifting Bank Rate to 4.0% and softened its guidance on future hikes, removing the reference to taking "forceful" action if need be in future.

- Bank economists carried out an extensive review of the economy's supply side. cutting the estimate of potential supply growth to close to, but under, 1% over the three year forecast period compared to its most recent estimate of 1.5%, suggesting that the economy would have to grow below 1% to avoid generating inflationary pressure.

- The MPC split seven-to-two in support of the 50 bps hike with Swati Dhingra and Silvana Tenreyro voting for no change. They argued that there were continuing signs of the economic downturn hitting the labour market and they noted that the full effect of previous rate hikes was yet to come through.

- The latest projection for unemployment (market rates) is 5.3% by the end of the forecast period, a substantial 1.1pp downwards revision from November. The MPC now sees NAIRU 'just above 4%' in the long term. The stronger labour market outlooks are largely based on reduced supply due to falling participation rates, in part connected to higher levels of long-term illness post-covid.

- The BOE stated that both domestic price and wage pressures have outpaced expectations, implying upside risks to to core CPI. A continuation of this trend would imply an active response in the Bank Rate: "If there were to be evidence of more persistent pressures, then further tightening ... would be required."

- The forthcoming rise in unemployment is anticipated to be a transitory effect of weak productivity, with the BOE anticipating five quarters of negative growth commencing in Q1 2023.

- Growth outlooks were largely seen as more stable in the short term. The UK economy is expected to fall -0.7% in Q1 2024 (vs -1.97% in Nov estimate). 2024 growth is seen contracting to -0.25% (vs -1% in Nov), whilst 2025 outlooks were more muted at +0.25% (vs +0.5% in Nov).

EUROPE

ECB: The European Central Bank raised key interest rates by 50 bps and expects to hike by another half-point in March, ECB President Christine Lagarde said on Thursday, though she also stressed that future policy action will be data-dependent and acknowledged differences between Governing Council members.

- February’s monetary policy meeting saw a “very, very large consensus” in favour of two 50bps moves - with today's increase taking the deposit rate to 2.5%, the main refinancing rate to 3.0% and the marginal lending facility to 3.25%, but Lagarde said there was not full agreement on how the ECB should communicate its likely near-term rate path.

- “We know we have ground to cover, we know we are not done,” Lagarde told a news conference, adding that the ECB was prepared to keep rates in restrictive territory for as long as necessary to bring inflation back to the 2% target.

- In a statement, the Governing Council said it “intends” to carry out another half-point hike in March, when it will evaluate the subsequent path of its monetary policy. for more see MIN Policy main wire at 1216ET.

US TSYS: European Mkts Discount Policy Hawks Too

Tsys finish steady (10s) to mildly higher - well off early session highs as markets surged in the aftermath of the BOE and ECB both hiking rates 50bp following Wed's 25bp hike from the FOMC.

- Focus turns to Fri's employment read for January (+190k est vs. +223k prior), Fed out of Blackout w/ SF Fed Daly first "scheduled" speaker on Fox Business at 1430ET.

- Similar to Wed's post-FOMC reaction, European yields marching lower in anticipation of the BoE/ECBs policy pivot sooner than later. (Bund 10Y yld -23.5bp post ECB, for second largest decline on record, while Italian BTP 10Y yield saw largest decline in nearly 3 years to 3.9).

- Additional impetus, ECB Pres Lagarde said “the economy has proved more resilient than expected and should recover over the coming quarters,” as higher wages, falling energy costs and government support programs will boost real incomes from depressed levels.

- Policy annc's clouded any market react to US data: Initial jobless claims came in lower than expected once again, down from an unrevised 186k to 183k (cons 195k) in the week to Jan 28; Stronger than expected labor productivity in Q4 (and Q3 after an upward revision) pushes unit labor costs to the softest quarterly growth rate since 1Q21.

- Large 5s30s flattener block (-18,300 FVH3 110-02.5, sell-through 110-03.25 post-time bid vs. +6,000 USH3 132-04, buy through 132-03 offer added to long end support; over 15,000 FHH sale blocks follow (110-02 to 109-20.

OVERNIGHT DATA

- US CHALLENGER JAN. JOB CUTS RISE 440% Y/Y

- US JOBLESS CLAIMS -3K TO 183K IN JAN 28 WK

- US PREV JOBLESS CLAIMS REVISED TO 186K IN JAN 21 WK

- US CONTINUING CLAIMS -0.011M to 1.655M IN JAN 21 WK

- US DEC FACTORY ORDERS +1.8%; EX-TRANSPORT NEW ORDERS -1.2%

- US DEC DURABLE ORDERS +5.6%

- US DEC NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT -0.1%

- CANADIAN DEC BUILDING PERMITS -7.3% MOM

- CANADA RESIDENTIAL BUILDING PERMITS -8.4%; NON-RESIDENTIAL -5.3%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 208.34 points (-0.61%) at 33882.6

- S&P E-Mini Future up 34.25 points (0.83%) at 4167

- Nasdaq up 274.6 points (2.3%) at 12090.17

- US 10-Yr yield is down 2.6 bps at 3.3909%

- US Mar 10-Yr futures are up 2.5/32 at 115-18

- EURUSD down 0.0081 (-0.74%) at 1.0909

- USDJPY down 0.3 (-0.23%) at 128.69

- WTI Crude Oil (front-month) down $0.53 (-0.69%) at $75.88

- Gold is down $37.67 (-1.93%) at $1912.81

- EuroStoxx 50 up 69.68 points (1.67%) at 4241.12

- FTSE 100 up 59.05 points (0.76%) at 7820.16

- German DAX up 328.45 points (2.16%) at 15509.19

- French CAC 40 up 89.16 points (1.26%) at 7166.27

US TSY FUTURES CLOSE

- 3M10Y -0.259, -124.763 (L: -132.848 / H: -123.667)

- 2Y10Y -0.325, -69.912 (L: -72.649 / H: -68.214)

- 2Y30Y +0.365, -54.304 (L: -56.644 / H: -52.015)

- 5Y30Y +2.079, 6.774 (L: 4.381 / H: 9.597)

- Current futures levels:

- Mar 2-Yr futures up 1.375/32 at 103-1.75 (L: 103-00 / H: 103-05)

- Mar 5-Yr futures up 2.25/32 at 109-30.25 (L: 109-24.5 / H: 110-08.5)

- Mar 10-Yr futures up 2/32 at 115-17.5 (L: 115-10 / H: 116-00)

- Mar 30-Yr futures up 3/32 at 131-24 (L: 131-08 / H: 132-22)

- Mar Ultra futures up 4/32 at 144-25 (L: 143-30 / H: 146-05)

US 10YR FUTURE TECHS: (H3) Approaching Key Resistance

- RES 4: 117-00 61.8% retracement of the Aug - Oct bear leg (cont)

- RES 3: 116-28 0.618 proj of the Dec 30 - Jan 19 - 30 price swing

- RES 2: 116-11+ 0.50 proj of the Dec 30 - Jan 19 - 30 price swing

- RES 1: 116-08 High Jan 19 and the bull trigger

- PRICE: 115-27 @ 14:13 GMT Feb 2

- SUP 1: 115-10/114-19+ Intraday low / 20-day EMA

- SUP 2: 114-05+ Low Jan 30 and a key short-term support

- SUP 3: 114-02+ 50-day EMA

- SUP 4: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

Treasury futures are firmer today, extending Wednesday's strong rally. The latest recovery eases a recent bearish threat and a key support has been defined at 114-05+, the Jan 30 low. A break of this level is required to reinstate a bearish theme. On the upside, the continuation higher has exposed the bull trigger at 116-08, the Jan 19 high. A move above 116-08, would confirm a resumption of the uptrend that started Oct 21 last year.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.015 at 95.050

- Jun 23 +0.025 at 94.975

- Sep 23 +0.010 at 95.065

- Dec 23 +0.020 at 95.440

- Red Pack (Mar 24-Dec 24) +0.010 to +0.035

- Green Pack (Mar 25-Dec 25) -0.005 to +0.005

- Blue Pack (Mar 26-Dec 26) -0.01 to -0.01

- Gold Pack (Mar 27-Dec 27) -0.02 to -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.24971 to 4.54657% (+0.24186/wk)

- 1M +0.00500 to 4.58000% (+0.00113/wk)

- 3M +0.00985 to 4.80614% (-0.01915/wk)*/**

- 6M -0.02800 to 5.05986% (-0.04243/wk)

- 12M -0.03543 to 5.27986% (-0.03628/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $106B

- Daily Overnight Bank Funding Rate: 4.32% volume: $276B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.199T

- Broad General Collateral Rate (BGCR): 4.27%, $487B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $472B

- (rate, volume levels reflect prior session)

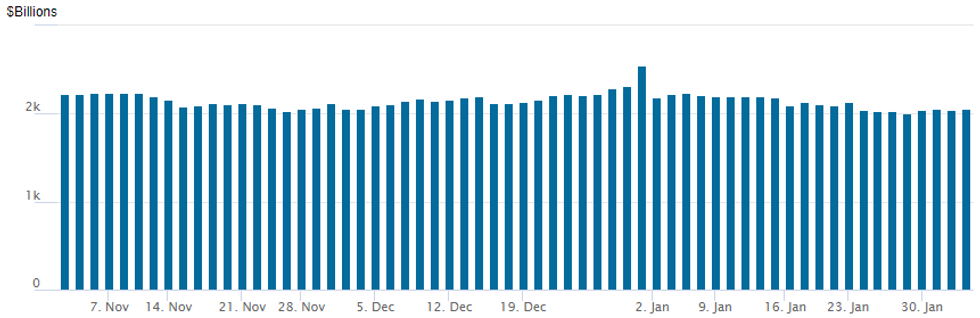

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,050.063B w/ 101 counterparties vs. prior session's $2,038.262B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: Oracle the Lion's Share of $7.45B To Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 02/02 $5.25B #Oracle $750M 5Y +110, $750M 7Y +130, $1.5B 10Y +155, $2.25B 30Y +203

- 02/02 $1.6B *MPLX $1.1B 10Y +170, $500M 30Y +212.5

- 02/02 $1.5B #PNC Financial PerpNC7 6.25%

- 02/02 $1.1B #National Rural Utilities $600M 3Y +70, $200M tap 5Y +95, $300M tap 10Y +123

- 02/02 $1B #Alexandria Real Estate $500M 12Y +137.5, $500M 30Y +160

- Expected Friday:

- 02/03 $1.75B Uniti 5NC2.5 11%a

EGBs-GILTS CASH CLOSE: Massive Rally On ECB And BoE Doubts

Bunds had a historic rally but were outperformed by Gilts and periphery EGBs Thursday as the BoE and ECB meetings suggested potential for more dovish rate hike paths ahead than previously expected.

- Following on from a dovish-leaning Fed press conference Wednesday, the BoE delivered a 50bp hike but didn't fully commit to further raises. And the ECB, which also hiked 50bp, was seen as wavering in its previous guidance to hike another half-point at the March meeting.

- The bond market moves appeared disproportionate given policymakers' overall cautious tone, but the rally accelerated in the afternoon in what appeared to be panic buying.

- 10Y Bund yields at one point were set to have their 2nd-biggest daily rally in the euro era (it ended as the 4th biggest), and yet were easily outperformed by BTPs which saw spreads drop ~19bp.

- Not to be outdone, 10Y Gilt yields had their biggest drop since 1994 (outside of last year's mini-budget related volatility).

- The US employment report will be Friday's focus, capping a busy week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 17.5bps at 2.497%, 5-Yr is down 22.1bps at 2.097%, 10-Yr is down 20.4bps at 2.08%, and 30-Yr is down 12.6bps at 2.101%.

- UK: The 2-Yr yield is down 23.8bps at 3.201%, 5-Yr is down 30.4bps at 2.875%, 10-Yr is down 30.1bps at 3.006%, and 30-Yr is down 18.9bps at 3.523%.

- Italian BTP spread down 18.9bps at 182.4bps / Spanish down 8.1bps at 91.6bps

FOREX: Safe Haven Demand As Global Yields Fall Sharply, GBP Under Pressure

- Historic rallies for European/UK Government bonds on Thursday weighed heavily on the Euro and GBP as the BoE and ECB meetings suggested potential for more dovish rate hike paths ahead than previously expected.

- Following on from a dovish-leaning Fed press conference on Wednesday, US yields also shifted lower, however, the more moderate moves worked in favour of the greenback overall, with the USD index rising roughly 0.5%.

- Lower core yields also benefitted the Japanese yen which sits just behind the USD as one of the top G10 performers. The weakness in cross/JPY was certainly a yield play on Thursday as the dovish interpretations of major policy meetings kept global equity indices on an overall buoyant trajectory.

- The likes of EUR, AUD and CHF all fell between 0.6-0.9%, slowly erasing the post FOMC gains seen yesterday. GBP declines of 1.14% standout with 1.24 capping the topside in cable and the pair breaking below initial firm support at 1.2264, the Jan 24 low.

- EURGBP continues to trade with a stealthy bid tone and this week’s bull run reinforces a technically bullish theme and the cross has pierced resistance at 0.8897, the Jan 13 high and a bull trigger. A clear break of this level would confirm a resumption of the uptrend that started early December last year.

- Focus turns to Friday’s US employment report for January, where the Bloomberg median sees nonfarm payrolls rising 190k after a broadly in line 223k December print. The Fed will also come out of blackout with SF Fed Daly the first scheduled speaker at 1900GMT/1430ET.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/02/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/02/2023 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 03/02/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/02/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 03/02/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 03/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/02/2023 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2023 | 1215/1215 |  | UK | BOE Pill & Shortall MPR National Agency Briefing | |

| 03/02/2023 | 1300/1400 |  | EU | ECB Elderson Speech at Climate Outreach Event | |

| 03/02/2023 | 1330/0830 | *** |  | US | Employment Report |

| 03/02/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.