-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jobs Gain, Unemployment Dips; CPI Up Next

- MNI INTERVIEW: Fed Likely Done, Cuts Possible Before Year-End

- MNI: Fed’s Bullard Says Rates Still Need To ‘Grind Higher’

- MNI BRIEF: US April Jobs Beats Expectations; Jobless Rate Dips

- MNI: Canada Job Market Stays Hot In April, Wages Top BOC Wish

US

FED: The Federal Reserve is most likely finished raising interest rates and it could be prompted to cut them before year-end if inflation falls sharply as it may well do, former Boston Fed research director Jeff Fuhrer told MNI.

- “We’re probably getting to the end of rate hikes. I’d be surprised if they continue raising next time,” Fuhrer said in an interview. “Inflation has already started coming down – that has little to do with the Fed’s actions so far, it’s too soon.”

- The Fed raised interest rates to a 5%-5.25% range and Fed Chair Jerome Powell hinted at a possible pause in hikes as early as the June meeting.

- Fuhrer said that elevated but lagging shelter costs are adding about 2 percentage points to CPI, and once those pressures ebb the true pace of inflation will prove much more subdued than the 5.9% April reading. For more see MNI Policy main wire at 1046ET.

FED: The Federal Reserve needs to raise interest rates further because growth and employment are likely to remain resilient and inflation is set to decline but only slowly, St. Louis Fed President James Bullard told reporters Friday.

- “Because of those factors I think we are going to have to grind higher in terms of the policy rate,” he said in press briefing from Minneapolis. “The thing to do here is to wait and see what the data shows before the June meeting.”

- Asked if he still saw the need for 50 basis points of more hikes as he had before the May meeting, Bullard said: “I have an open mind on June and will review my SEP projections when I get closer to the meeting.” For more see MNI Policy main wire at 1449ET.

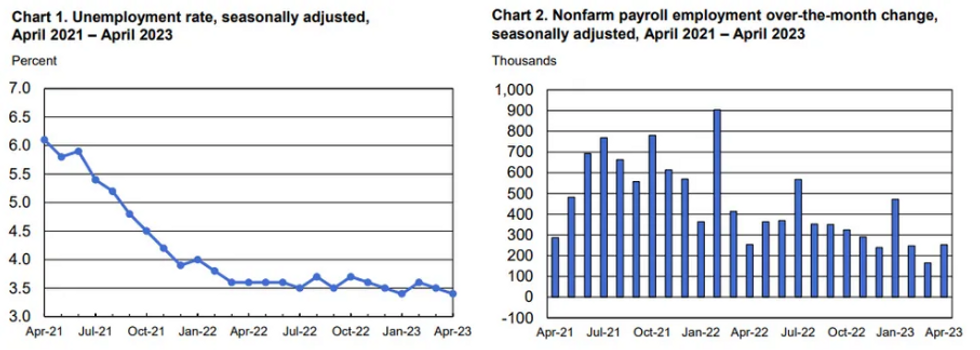

US DATA:U.S. employers added 253,000 jobs in April, higher than analysts expected, as the unemployment rate sank to 3.4% again and wage growth picked up. Wall Street had forecast payrolls growth of 185,000, a jobless rate of 3.6% and average hourly earnings of 0.3%. AHE grew 0.5% last month, bringing the year-on-year rate a tenth higher to 4.4%.

- Treasury yields fell and the U.S. dollar rallied on the data. Futures markets still expected to the Fed to hold rates steady at its June meeting.

- April payrolls growth slowed from its average monthly gain of 290,000 over the past six months and employment in February and March were revised down by a combined 149,000. Hiring was led by professional and business services (+43k), health care (+40k) and leisure and hospitality (+31k) sectors.

CANADA

DATA: Canada's job market stayed hot in April with wage gains topping the 5% mark the central bank says is unsustainable and unemployment holding just above a record low for a fifth month on stronger-than-expected hiring.

- Employment rose 41,400 on the month and the eighth consecutive gain exceeded the median forecast of 17,000. Statistics Canada also reported Friday a jobless rate of 5.0% versus expectations it would rise to 5.1%.

- Hourly wages rose 5.2% from a year ago, a major concern for BOC Governor Tiff Macklem who said Thursday he could raise interest rates a ninth time because of upside inflation risks such as big pay increases. Wage growth is higher than consumer price inflation, which slowed to 4.3% in March.

US TSYS: Risk Appetite Improved Following Strong April Employment Data

Treasury futures remain weaker after the bell, drifting near the middle of a wide session range after stronger than expected April employment data took some of the hot air out of rate pause/cuts expectations.- Treasury futures marked session lows after stronger than expected April jobs gain of +253k vs. +185k est: TYM3 hit 115-13.5 low, 10Y yield initially hit 3.4521% high before tapping 3.4635% around noon - is currently at 3.4351% +.0564.

- April's headline household survey stats included the labor force contracting by a modest 43k (of 166.7M), with the participation rate unchanged at 62.6% (including - as we noted earlier - a fresh post-2008 high for prime-age participation). A strong if slightly odd breakdown in the unemployment rate figure though, which was down 0.1pp to 3.4%.

- Treasury futures quickly recovered to near mid-range, trading sideways for the rest of the session. Risk appetite improved as stocks, lead by regional banks (PacWest rallied over 80% this morning!), rallied (SPX eminis +78.25 at 4154.0).

- Fed Funds implied rates are holding close to earlier highs post-payrolls with Bullard supporting them. Now showing zero cuts for the June FOMC (+3.5bp on the day), 10bp of cuts to 4.98% July (+7bp), 26bp of cuts to 4.82% Sep (+11bp) and building to a cumulative 75bp of cuts to 4.33% Dec (+15bp), with the latter from 85bps pre-payrolls.

- Slow start to next week, focus is on CPI read for April on Wednesday, while President Biden and House speaker McCarthy are expected to discuss the debt limit on Tuesday.

OVERNIGHT DATA

- US APR NONFARM PAYROLLS +253K; PRIVATE +230K, GOVT +23K

- US PRIOR MONTHS PAYROLLS REVISED: MAR +165K; FEB +248K (-149k total)

- US APR UNEMPLOYMENT RATE 3.4%

- US APR AVERAGE HOURLY EARNINGS +0.5% Vs MAR +0.3%; +4.4% YOY

- US APR AVERAGE WEEKLY HOURS 34.4 HRS

- US DATA: AHE Unrounded - Apr'23:

- Total AHE: M/M (SA): 0.482% in Apr from 0.272% in Mar

- Y/Y (SA): 4.446% in Apr from 4.304% in Mar

- AHE Non-Supervisory: M/M (SA): 0.386% in Apr from 0.352% in Mar

- Y/Y (SA): 4.95% in Apr from 5.125% in Mar

- MANHEIM USED-VEHICLE INDEX -3.0% SA MOM IN APRIL TO 230.8

- APRIL USED-VEHICLE VALUES DOWN 4.4% FROM A YEAR AGO

- CANADA'S ECONOMY ADDS 41.4K JOBS IN APRIL, BEATING 20K EST

- CANADA FULL-TIME EMPLOYMENT FALLS 6.2K, PART-TIME UP 47.6K

- UNEMPLOYMENT RATE HOLDS AT 5% IN CANADA VS. ESTIMATE 5.1%

Sharp Pullback In Job Losers Underpins Drop In Unemp Rate

April's headline household survey stats included the labor force contracting by a modest 43k (of 166.7M), with the participation rate unchanged at 62.6% (including - as we noted earlier - a fresh post-2008 high for prime-age participation).

- A strong if slightly odd breakdown in the unemployment rate figure though, which was down 0.1pp to 3.4%.

- Along with the minimal change in labor force size, and 139k gain in the number of employed, was a big drop in number of unemployed (-182k).

- Within the unemployed, job losers = lowest since 2021 (negative 307k). A key reason we didn't see a bigger unemp rate drop was the 135k re-entrants to the workforce and new entrants.

- Permanent job losers dropped 107k, the biggest drop since September 2022.

- This is potentially only a temporary reversal of recent trends which have seen new entrants and re-entrants slow and job losers contribute increasingly to the unemployment rate.

- But notable nonetheless, with the trend consistent with a labor market that may be softening too slowly for the Fed's taste.

- Unemployment rates by group were of note too in the household survey: All-time low (since data begins 1972) Black/African American unemp rate, dropped 0.3pp to 4.7%. And the lowest teenage unemployment since 1953 (down 0.6pp to 9.2%).

MARKETS SNAPSHOT

Key late session levels:

- DJIA up 596.52 points (1.8%) at 33725.31

- S&P E-Mini Future up 83 points (2.04%) at 4159.75

- Nasdaq up 286.9 points (2.4%) at 12253.97

- US 10-Yr yield is up 6.2 bps at 3.4408%

- US Jun 10-Yr futures are down 26.5/32 at 115-23.5

- EURUSD up 0.0009 (0.08%) at 1.1022

- USDJPY up 0.51 (0.38%) at 134.8

- WTI Crude Oil (front-month) up $2.86 (4.17%) at $71.42

- Gold is down $34.46 (-1.68%) at $2015.98

- EuroStoxx 50 up 53.4 points (1.25%) at 4340.43

- FTSE 100 up 75.74 points (0.98%) at 7778.38

- German DAX up 226.78 points (1.44%) at 15961.02

- French CAC 40 up 92.16 points (1.26%) at 7432.93

TREASURY FUTURES CLOSE

- 3M10Y +4.95, -180.238 (L: -192.104 / H: -177.047)

- 2Y10Y -6.966, -48.353 (L: -48.741 / H: -39.964)

- 2Y30Y -10.326, -16.81 (L: -17.106 / H: -4.929)

- 5Y30Y -6.044, 33.89 (L: 33.401 / H: 41.876)

- Current futures levels:

- Jun 2-Yr futures down 12.5/32 at 103-10.875 (L: 103-09.625 / H: 103-19.75)

- Jun 5-Yr futures down 22.25/32 at 110-9.75 (L: 110-06.25 / H: 110-26.25)

- Jun 10-Yr futures down 26.5/32 at 115-23.5 (L: 115-13.5 / H: 116-12)

- Jun 30-Yr futures down 1-02/32 at 131-2 (L: 130-13 / H: 131-30)

- Jun Ultra futures down 1-01/32 at 139-28 (L: 138-30 / H: 140-26)

US 10YR FUTURE TECHS: (M3) Bias Remains Higher Despite Friday Dip

- RES 4: 118-00 Round number resistance

- RES 3: 117-29+ High Aug 26 2022 (cont)

- RES 2: 117-01+ High Mar 24 and bull trigger

- RES 1: 117-00 High May 4

- PRICE: 115-25+ @ 15:48 BST May 5

- SUP 1: 115-13+ Low May 5

- SUP 2: 115-07+ 20-day EMA

- SUP 3: 114-10 Low May 1

- SUP 4: 113-30+ Low Apr 19 and key short-term support

Treasury futures broke lower Friday on the back of the better-than-expected payrolls release, however major support remains in tact for now. This keeps the outlook bullish and attention is on key resistance at 117-01+, the Mar 24 high and bull trigger. A break of this hurdle would strengthen current trend conditions. Initial firm support is at 115-07+, the 20-day EMA. Key support is far-off at 113-30+, the Apr 19 low. Short-term pullbacks are considered corrective.

SOFR FUTURES CLOSE

- Jun 23 -0.085 at 94.955

- Sep 23 -0.170 at 95.305

- Dec 23 -0.215 at 95.760

- Mar 24 -0.245 at 96.290

- Red Pack (Jun 24-Mar 25) -0.245 to -0.185

- Green Pack (Jun 25-Mar 26) -0.165 to -0.12

- Blue Pack (Jun 26-Mar 27) -0.115 to -0.09

- Gold Pack (Jun 27-Mar 28) -0.085 to -0.07

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00681 to 5.05026 (+.03156/wk)

- 3M -0.03397 to 5.03873 (-.04259/wk)

- 6M -0.08292 to 4.94551 (-.13406/wk)

- 12M -0.16456 to 4.55360 (-.25548/wk)

- O/N +0.00115 to 5.05986%

- 1M +0.00572 to 5.10443%

- 3M +0.01315 to 5.33686% */**

- 6M -0.03814 to 5.35286%

- 12M -0.06043 to 5.19971%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.33686% on 5/5/23

- Daily Effective Fed Funds Rate: 5.08% volume: $114B

- Daily Overnight Bank Funding Rate: 5.06% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.590T

- Broad General Collateral Rate (BGCR): 5.03%, $575B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $566B

- (rate, volume levels reflect prior session)

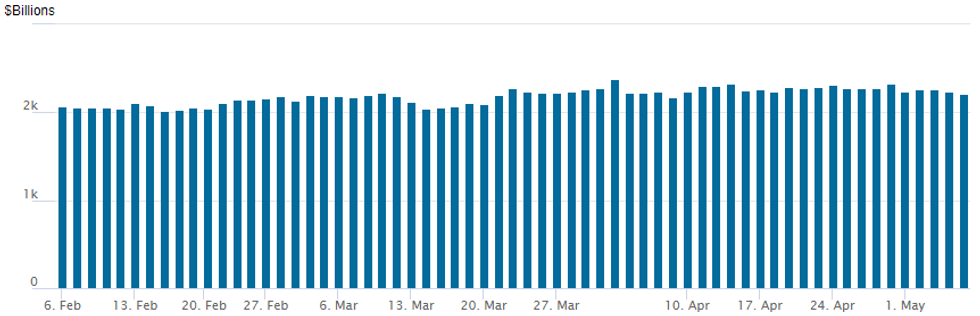

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,207.415B w/ 101 counterparties, compares to prior $2,242.399B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Verizon 10Y, Equifax 5Y on Tap

Absent since Tuesday, Verizon kicked off Friday with 10Y WNG issuance followed by Equifax 5Y:- Date $MM Issuer (Priced *, Launch #)

- 05/05 $1B Verizon WNG 10Y Green +190a

- 05/05 $Benchmark Equifax 5Y +175a

EGBs-GILTS CASH CLOSE: Gilts Underperform Bunds Post-ECB, Pre-BoE

Gilts underperformed Bunds in a risk-on session Friday, with both the German and UK curves bear steepening.

- Following a sharp drop at the open (aligning with a bounce in equities overnight as US bank fears dissipated), the rise in UK and German yields was fairly steady, with the exception of a stronger-than-expected US jobs report that saw yields spike to session highs.

- Periphery EGB spreads tightened, with Greece leading the way, with 10Y GGBs closing at the tightest level to Bunds since January 2022.

- ECB hike pricing stabilised after Thursday's fall (our review of the decision went out today), flat on the day with terminal depo at 3.65%. ECB speakers didn't make much difference, nor did softer-than-expected economic data (retail sales, German industrial orders).

- Looking ahead to next week, UK markets are closed Monday due to holidays, but the BoE decision takes centre stage Thursday, BoE terminal pricing rose 7bptoday to 4.89%, though there is room for a surprise either way in next week's decision with just 80% pricing for a 25bp raise vs a pause.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.3bps at 2.572%, 5-Yr is up 10.9bps at 2.231%, 10-Yr is up 10.1bps at 2.291%, and 30-Yr is up 9.7bps at 2.463%.

- UK: The 2-Yr yield is up 11.4bps at 3.792%, 5-Yr is up 11.2bps at 3.594%, 10-Yr is up 12.8bps at 3.781%, and 30-Yr is up 11.3bps at 4.182%.

- Italian BTP spread down 3.1bps at 190.1bps / Greek down 12.5bps at 174.7bps

FOREX: Greenback Reverses Post-NFP Strength, CAD Surges

- Following the release of the US employment data the greenback had a knee-jerk higher. However, notable revisions took the shine off the headline beat for the change in non-farm payrolls and the USD steadily lost favour over the course of the US session.

- Additionally, better performing US regional banks and a corresponding firming of major equity indices weighed on the USD index, which finds itself sitting 0.2% in the red approaching the close.

- The uptick for US yields has kept pressure on the Japanese yen, with USDJPY consolidating modest gains on the day, just below the 135 handle. However, there have been strong USD reversals elsewhere in G10 with GBP and AUD notable performers.

- A very decent climb for cable sees the pair at fresh trend highs, narrowing the gap with the May 2022 highs at 1.2667. The trend outlook in GBPUSD remains bullish and this fresh cycle high reinforces current conditions. Above those highs, attention will shift to 1.2733, the 2.0% 10-dma envelope and 1.2759, a Fibonacci retracement.

- The best performers on Friday have been the Canadian dollar and the Norwegian Krone, both benefitting from the firmer risk sentiment which translated into a solid 4% recovery for crude futures to end the week.

- For CAD in particular, an additional tailwind came with the April jobs report. Net change in employment of +41.4k doubled the surveyed median estimate. Despite the balance being toward part-time job creation, a lower unemployment rate and higher hourly wage rates underpinned a substantial 1% rally for the Canadian dollar on Friday. Price action resumes the bear leg that started Apr 28. Note too that price has breached both the 20- and 50-day EMAs and this suggests scope for a deeper retracement. Immediate sights are on 1.3385, the April 19 low.

- A quiet start to next week with a lack of tier-one data and Monday’s holiday in both the UK and France. Focus swiftly turns to US CPI data on Wednesday and the Bank of England rate decision on Thursday.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/05/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 08/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 08/05/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/05/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/05/2023 | 1400/1600 |  | EU | ECB Lane Speech/Q&A at Forum New Economy | |

| 08/05/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.