-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: JOLT to the System, Job Opening Recede

EXECUTIVE SUMMARY

US

FED: The Federal Reserve should stop raising interest rates as credit to small and medium sized businesses is already freezing up due to turmoil affecting U.S. regional banks, and because the rapid tightening of conditions could prove a long-lasting drag on the economy, former Dallas Fed president Robert Kaplan told MNI.

- An aggressive emergency response from the Fed and other regulators has calmed the immediate banking panic, Kaplan said, but lack of clarity over the extent of federal guarantees for depositors – after those at Silicon Valley Bank and Signature Bank were made whole – is keeping smaller lenders on edge.

- “While things are calmer and the Fed has given a lifeline to the banks, the cost of this right now is that small and mid-sized credit is pretty much frozen,” Kaplan said in an interview. “Small to mid-sized banks are nervous that the deposit run is calm but they’re nervous that it’s not over.”

- Many such banks have few options other than imposing more stringent lending requirements, he said. For more see MNI Policy main wire at 0942ET.

EUROPE

ECB: The European Central Bank is conscious of the dangers of moving too fast in cutting reinvestments from its asset purchase programme, particularly after seeing last year’s UK gilt market volatility, National Bank of Austria Governor Robert Holzmann told MNI in an interview.

- While APP reinvestments have already declined by EUR15 billion per month from March 1, with the future pace of quantitative tightening up for review at the end of June, even those Governing Council hawks most enthusiastic about shrinking the balance sheets recognise the risks in unwinding, Holzmann said. (see: MNI EXCLUSIVE: ECB Should Hike As Market Fears Wane - Kazaks).

- “I think we all want to have a smaller balance sheet, but we are all still a bit unsure how much the financial system can support, and at what speed?” he said, “Even the people who continue to be more on the hawkish side take this seriously, because it’s difficult to anticipate what's going to happen. The UK experience is something which is in our minds there.” For more see MNI Policy main wire at 1230ET.

US TSYS: Near Post-Data Highs, Yld Curves Bull Steepen

- Treasury futures holding narrow range near session highs since midday. After a slow start to the NY session, decent two way flow followed lower than expected JOLTS job openings to 9.93M (cons 10.50M) after a downward revised 10.56M.

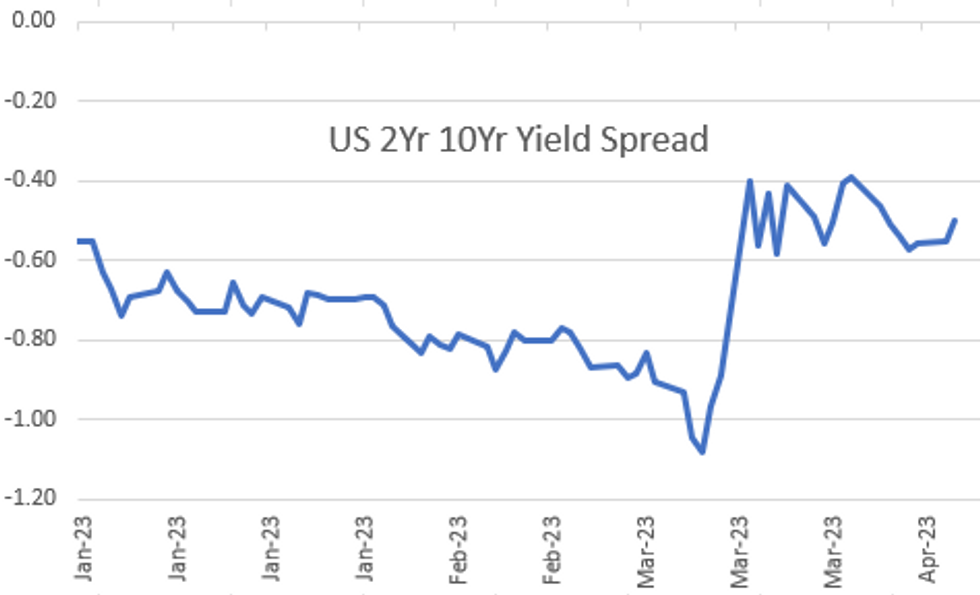

- Yield curves broadly steeper but off highs (2s10s now at -49.753 vs. -45.578 high) as the short-end saw a pick-up in selling, discounting a rebound in implied rate hikes for year end..

- At the moment, Fed funds implied hike for May'23 is currently at 12.3bp vs. 17.3bp on the open, Jun'23 +6.0bp vs. +15.9bp earlier cumulative at 4.876%.

- Projected rate cuts later in the year surged on the post-data gap bid but pared the move slightly by late morning: Sep'23 cumulative currently -29.1 vs. -34.6bp high (-11.0bp on the open) to 4.525%, to -66.4bp vs. -71.5bp high for Dec'23 (-46.0bp on the open) at 4.153.

- Front month 10Y futures, TYM3 currently 116-05.5 vs. session high of 116-08.5 (10Y yield 3.3331% low). For a technical perspective, today's strong bounce undermines recent bearish signals and price has pierced resistance at 116-06+, the Mar 27 high. A continuation higher would signal scope for gains towards 117-01+, the Mar 24 high and a key short-term resistance. Key support has been defined at 114-07, the Mar 29 and 30 low.

OVERNIGHT DATA

- US DATA: Surprisingly Weak Openings But Quits Rate Ticks Back Higher A surprisingly large decline for JOLTS job openings to 9.93M (cons 10.50M) after a downward revised 10.56M

- It leaves 1.67 openings per unemployed, down from a peak 2.01 in March and just below the prior recent low of 1.69 in August prior to the recent surprise resilience for the latest since Nov’21.

- Quit rates on the other hand bounce a tenth to 2.59% total and 2.88% private, reversing most of January’s dip although still maintaining a trend move lower with 2019 averages of 2.3 and 2.6 respectively.

- US FEB FACTORY ORDERS -0.7%; EX-TRANSPORT NEW ORDERS -0.3%

- US FEB DURABLE ORDERS -1.0%

- US FEB NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT -0.1%

- CANADA FEB. BUILDING PERMITS RISE 8.6% M/M; EST. +2.0%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 228.16 points (-0.68%) at 33372.95

- S&P E-Mini Future down 27.5 points (-0.66%) at 4126

- Nasdaq down 80.5 points (-0.7%) at 12108.32

- US 10-Yr yield is down 7.3 bps at 3.3387%

- US Jun 10-Yr futures are up 24.5/32 at 116-7

- EURUSD up 0.0057 (0.52%) at 1.0956

- USDJPY down 0.84 (-0.63%) at 131.61

- WTI Crude Oil (front-month) up $0.2 (0.25%) at $80.60

- Gold is up $37.21 (1.87%) at $2021.94

- EuroStoxx 50 up 4.27 points (0.1%) at 4315.32

- FTSE 100 down 38.48 points (-0.5%) at 7634.52

- German DAX up 22.55 points (0.14%) at 15603.47

- French CAC 40 down 1 points (-0.01%) at 7344.96

US TREASURY FUTURES CLOSE

- 3M10Y -17, -155.468 (L: -157.249 / H: -138.04)

- 2Y10Y +5.534, -50.105 (L: -57.368 / H: -45.578)

- 2Y30Y +9.561, -24.489 (L: -36.439 / H: -22.33)

- 5Y30Y +7.695, 20.33 (L: 10.005 / H: 20.671)

- Current futures levels:

- Jun 2-Yr futures up 9.125/32 at 103-21.5 (L: 103-08.625 / H: 103-22.25)

- Jun 5-Yr futures up 20.5/32 at 110-17.25 (L: 109-21.5 / H: 110-18.25)

- Jun 10-Yr futures up 24.5/32 at 116-7 (L: 115-02.5 / H: 116-08.5)

- Jun 30-Yr futures up 36/32 at 133-2 (L: 131-05 / H: 133-07)

- Jun Ultra futures up 40/32 at 143-15 (L: 141-06 / H: 143-30)

Recovery Extends

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 117-01+ High Mar 24 and bull trigger

- RES 1: 116-08+ Intraday high

- PRICE: 116-05 @ 1540ET Apr 4

- SUP 1: 115-02+ Intraday low

- SUP 2: 114-13/07 20-day EMA / Low Mar 29 and 30

- SUP 3: 113-29+ 50-day EMA

- SUP 4: 113-26 Low Mar 22

Treasury futures started the week on a firmer note and have traded higher again today, as the contract extends the recovery from last week’s low. The strong bounce undermines recent bearish signals and price has pierced resistance at 116-06+, the Mar 27 high. A continuation higher would signal scope for gains towards 117-01+, the Mar 24 high and a key short-term resistance. Key support has been defined at 114-07, the Mar 29 and 30 low.

EURODOLLAR FUTURES CLOSE

- Jun 23 +0.140 at 94.870

- Sep 23 +0.175 at 95.295

- Dec 23 +0.185 at 95.665

- Mar 24 +0.205 at 96.125

- Red Pack (Jun 24-Mar 25) +0.145 to +0.20

- Green Pack (Jun 25-Mar 26) +0.115 to +0.145

- Blue Pack (Jun 26-Mar 27) +0.090 to +0.110

- Gold Pack (Jun 27-Mar 28) +0.080 to +0.10

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00542 to 4.81171% (+0.01085/wk)

- 1M +0.01343 to 4.87114% (+0.01343/wk)

- 3M -0.00371 to 5.21886% (+0.02615/wk)*/**

- 6M +0.01685 to 5.33671% (+0.02371/wk)

- 12M -0.03500 to 5.29614% (-0.00915/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.22257% on 4/3/23

- Daily Effective Fed Funds Rate: 4.83% volume: $105B

- Daily Overnight Bank Funding Rate: 4.82% volume: $261B

- Secured Overnight Financing Rate (SOFR): 4.84%, $1.477T

- Broad General Collateral Rate (BGCR): 4.80%, $509B

- Tri-Party General Collateral Rate (TGCR): 4.80%, $494B

- (rate, volume levels reflect prior session)

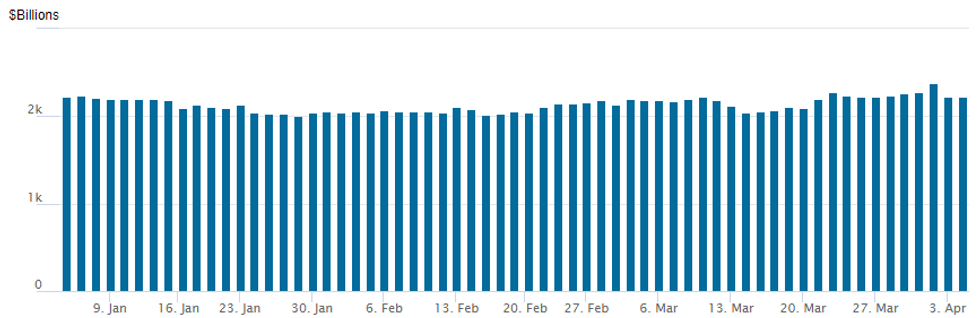

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,219.375B w/ 103 counterparties, compares to yesterday's $2,221.010B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $3.84B Citrix Note Expected Today

- Date $MM Issuer (Priced *, Launch #)

- 04/04 $5B *World Bank (IBRD) 5Y SOFR+37 (book > $85B)

- 04/04 $3.84B Citrix 6.5Y NC 2.5Y appr 9%

- 04/04 $3B #KFW 2026 SOFR+20 (book > $10.5B at the close)

- 04/04 $2.25B *IADB 10Y SOFR +53 (book > $3B)

- 04/04 $1.25B0 #Kingdom of Jordan +5Y 7.875%

- 04/04 $600M #CNH Industrial 5Y +140

- 04/04 $Benchmark ZF North America 5Y, 7Y

- Expected to launch Wednesday:

- 04/05 $Benchmark Quebec 5Y SOFR+58a

EGBs-GILTS CASH CLOSE: Impressive Rally As Rate Hike Pricing Fades

In a near-repeat of Monday's price action, early losses in core European FI were erased in the second half of Tuesday's session after the release of weaker-than-expected US job openings data.

- Yields rose in the morning with moderate bear steepening as equities gained and the euro and sterling pushed to multi-month highs versus the dollar.

- The outsized reaction to the 600k US job openings miss was exaggerated by thin volumes throughout the session.

- Regardless, curves twist steepened sharply with short-ends rallying as ECB and BoE hikes were priced out in sympathy with rising expectations of Fed cuts.

- Periphery EGB spreads widened moderately throughout the session.

- Little reaction to European data, with Eurozone PPI in line. BoE Chief Econ Pill's gave a speech that tilted to the hawkish side, but market reaction was limited as it was released amid the JOLTS rally.

- German factory orders and French industrial production data feature early Wednesday, with Spain/Italy Services PMIs eyed later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.3bps at 2.601%, 5-Yr is down 4.5bps at 2.242%, 10-Yr is down 0.6bps at 2.249%, and 30-Yr is up 3bps at 2.336%.

- UK: The 2-Yr yield is down 3.7bps at 3.353%, 5-Yr is down 2.6bps at 3.274%, 10-Yr is up 0.4bps at 3.434%, and 30-Yr is down 0.7bps at 3.751%.

- Italian BTP spread up 2bps at 186.6bps / Spanish up 1.1bps at 103.1bps

FOREX: US Dollar Weakness Extends, GBPAUD Rallies 1.30%

- Bull steepening across the US yield curve following the surprisingly large decline for US JOLTS job openings to 9.93M (cons 10.50M) prompted further greenback weakness on Tuesday. The USD index has declined another 0.5% and is now trading below the March lows of 102.00 turning the focus to the February lows at 100.82.

- The broad dollar weakness has prompted strength across the majority of G10 currencies, with GBP and CHF the notable outperformers. GBP spent the US session consolidating its prior advance after cable broke a confluence of resistance points between 1.2425-50.

- On the other end of the spectrum, AUD is the notable laggard, falling after the RBA held rates at 3.6%. The RBA board watered down previously hawkish forward guidance as the bank noted in the final paragraph that some further tightening "may" be needed, at the previous meeting the board had noted further tightening will be needed. GBPAUD has erased the entirety of yesterday’s decline, rallying an impressive 1.3% to trade at the highest level since February 2022.

- The lower US yields assisted a very strong rebound for the Japanese yen. USDJPY fell over 1% from the earlier 133.17 high to trade just north of 131.50 ahead of the APAC crossover.

- EURUSD continued to make ground above noted 1.0930 resistance which represents a key short-term hurdle for bulls. A clear break would reinstate the recent bull theme and signal scope for a move towards 1.1033, the Feb 2 high. Worth noting there is currently 4.266B worth of options expiries at 1.0900 for tomorrow's NY cut which could potentially limit the topside momentum.

- A step down to 25bp from February’s 50bp is widely expected for the RBNZ overnight. Focus will then be on US ADP employment data and the US ISM Services PMI.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 05/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/04/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 05/04/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/04/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/04/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/04/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/04/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.