-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: JOLTS Job Opening Drop Ahead Fri NFP

- MNI INTERVIEW: Fed Should Restore Simple 2% Goal-Brunnermeier

- MNI INTERVIEW: ISM Services Consistent With Below Trend Growth

- MNI FED: Key Inter-Meeting FedSpeak – Dec 2023

- MNI SOURCES: ECB Needs Sub-3% Core Inflation To Consider Cuts

- US DATA: ISM Shows Pickup In Services Activity, But Overshadowed By Jobs Data

- MNI DATA: Sharp Job Openings Drop Another Signal Of Labor Market Loosening

BLS/MNI

BLS/MNI

US

FED: FOMC Doves Emphasize Caution. The post-November FOMC communications theme has been hawkish participants shifting in a dovish direction, and doves underlining that their medium-term rate outlooks are still relatively hawkish versus market expectations.

- FOMC speakers have re-emphasized lingering upside inflation risks and potential for further cuts - which suggests that the FOMC is unlikely to remove its tightening bias despite the apparent progress in the October jobs/inflation data released since the Nov 1 decision. That being said though, the idea that risks of over- versus under-tightening had come into better balance, suggesting an underlying bias to hold.

- Some commentary that arguably leaned surprisingly hawkish given that they came after the surprisingly soft October CPI data included multiple FOMC participants who have a dovish reputation: For instance, Boston Fed's Collins "I wouldn't take additional firming off the table"; SF's Daly "we are not certain whether inflation is on track to return to 2%...I wouldn't want to declare victory"; and Gov Cook "I see risks as two sided, requiring us to balance the risk of not tightening enough against the risk of tightening too much".

EUROPE

ECB: The European Central Bank will need to see a consistent fall in core inflation below 3% before it considers rate cuts, officials told MNI, with several in broad agreement with market pricing for the first cuts by the end of the first quarter.

- “The first thing you have to see is an appropriate projection horizon, and the second is that underlying inflation is going below 3% consistently", one official said, adding that wage increases should remain modest and energy prices and the exchange rate relatively stable.

- Another official agreed that 3% core inflation would be a necessary if not sufficient condition for discussing cuts. “I wouldn't think it's a trigger exactly. Is it fair to say cuts are off the table with core inflation above 3%? Yeah, but it’s not a trigger to open discussions,” the second official said. “If the economy slows, but core is close to but above 3%, albeit trending the right way, discussions may intensify. If core is under 3% but the economy is gathering steam, talks may become less urgent.”

NEWS

INTERVIEW (MNI): Fed Should Restore Simple 2% Goal-Brunnermeier

The Federal Reserve should abandon its policy of targeting averaging inflation over some undefined period of time and restore a simpler 2% goal, Markus Brunnermeier, former adviser to the U.S. central bank and co-author of a new G30 paper, told MNI.

INTERVIEW (MNI): ISM Services Consistent With Below Trend Growth

U.S. service sector activity remains consistent with below-trend economic growth despite a pickup in November, and will likely stay moderate for the foreseeable future, Institute for Supply Management chair Anthony Nieves told MNI.

FED (MNI): Key Inter-Meeting FedSpeak – Dec 2023

We've just published our compilation and analysis of post-November FOMC communications, ahead of next week's meeting. PDF Analysis Here

US (MNI): Schumer Appears To Abandon Vote On Ukraine Aid Package

Senate Majority Leader Chuck Schumer (D-NY) has appeared to abandoned a planned procedural vote in the Senate tomorrow on President Biden's USD$106 billion national security supplemental package, which includes ~USD$60 billion for Ukraine.

SECURITY (MNI): Hamas: No Hostage Exchange Until "Aggression Against Gaza Stops"

Reuters carrying comments from a Hamas official stating that, "there will be no negotiations or exchange of detainees until the aggression against Gaza stops."

SECURITY (MNI): Zelenskyy To Pitch Ukraine To Senate As US-Mexico Border Talks Stall

Ukrainian President Volodymyr Zelenskyy will deliver a virtual address to US Senators today as Democrats attempt to force movement on President Biden’s USD$106 billion national security supplemental request.

MIDEAST (MNI): GCC Statement Warns Of 'Expanding Confrontations' Amid Israel-Hamas War

The Supreme Council of the Gulf Cooperation Council (GCC) has released a statement following the conclusion of its latest summit in Doha, Qatar.

US TSYS Drop in Jobs Opening JOLTS Markets

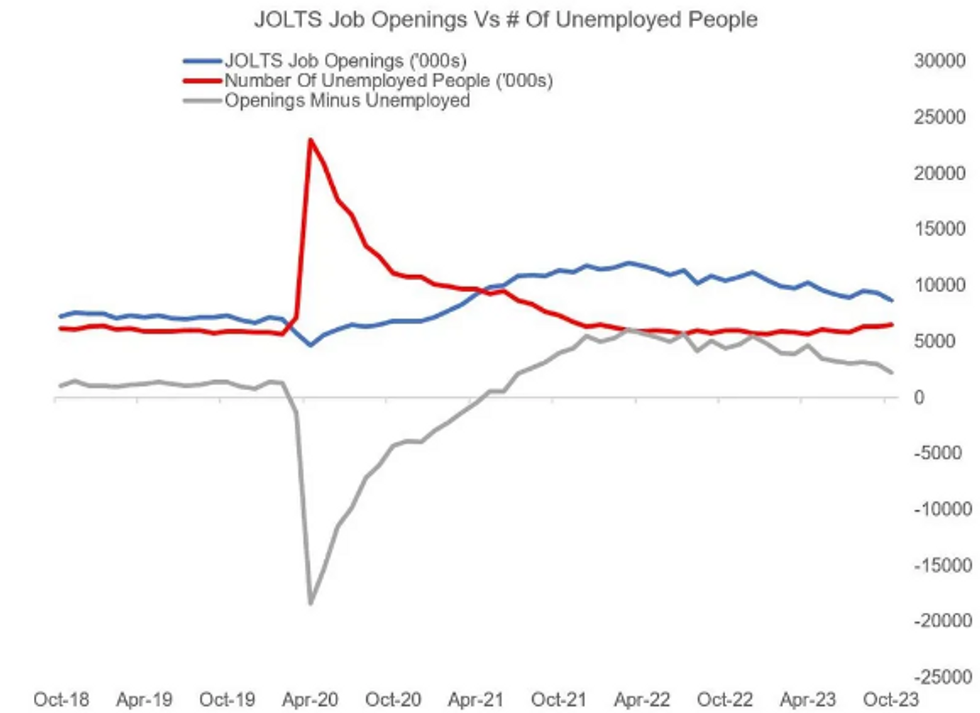

- Active session Tuesday as Tsy futures gapped higher after lower than expected JOLTS Job Openings (8.733M vs. 9.3M est, 9.350M prior down-revised from 9.553M) - the biggest monthly drop since May 2023 and marks the lowest level of job openings since March 2021, with the ratio of openings/unemployed dropping to 1.34, the lowest since Aug 2021.

- Underlying futures rallied back to early September levels following lower than expected JOLTS data while markets reprice 2024 rate cut projections: December steady at -.3bp at 5.333%, January 2024 cumulative -3.8bp at 5.298%, March 2024 chance of rate cut climbs to -60.0% (vs. -55.2% this morning) with cumulative at -18.8bp at 5.148%, May 2024 pricing in -72.4% (-71.2% this morning) with cumulative -36.9bp at 4.967%. Fed terminal at 5.33% in Feb'24.

- Additional data saw less of a reaction: ISM Services Index higher than est (52.7 vs. 52.3, 51.8 prior), Prices Paid (58.3 vs. 58.0 est, 58.6 prior), Employment lower (50.7 vs. 51.4 est, 50.2 prior), New Orders higher (55.5 vs. 54.9 est, 55.5 prior). Tsy futures pared support briefly after in-line S&P Global US Services PMI (50.8 vs. 50.8 est, 50.8 prior); S&P Global US Composite PMI (50.7 vs. 50.7 est, 50.7 prior).

- Wednesday Data Calendar: ADP, Nonfarm Productivity, Unit Labor Cost. Main focus still on Friday's employment data for November.

OVERNIGHT DATA

US BLS: JOLTS OPENINGS RATE 8.733M IN OCT; JOLTS QUITS RATE 2.3% IN OCT.

- The JOLTS job openings figure of 8.733mln badly missed expectations (9.3mln) in October, with September revised lower (9.35mln from 9.553mln).

- This was the biggest monthly drop since May 2023 and marks the lowest level of job openings since March 2021, with the ratio of openings/unemployed dropping to 1.34, the lowest since Aug 2021.

- The closely eyed quits rate remained steady for the 4th consecutive month at 2.3% /2.6% overall/private sector respectively.

- Notable reductions in job openings were in health care and social assistance (-236k), finance and insurance (-168k), and real estate and rental and leasing (-49k); information saw a rise (+39).

- Overall the report signals that labor market conditions continue to loosen - a key component of the progress the FOMC needs to see before more clearly signaling that it's done tightening. While of course Friday's payrolls data for November carries more weight, expect this data point to come up at next week's post-meeting press conference.

- US ISM NOV SERVICES COMPOSITE INDEX 52.7

- US ISM NOV SERVICES BUSINESS INDEX 55.1

- US ISM NOV SERVICES PRICES 58.3

- US ISM NOV SERVICES EMPLOYMENT INDEX 50.7

- US ISM NOV SERVICES NEW ORDERS 55.5

US DATA: ISM Shows Pickup In Services Activity, But Overshadowed By Jobs Data. November's ISM Services report came in better than expected across the headline figure and subcategories - with the notable exception of Employment.

- The Services PMI accelerated to 52.7 (52.3 expected, 51.8 prior), with new orders steady at 55.5 (54.9 expected, 55.5 prior), and prices paid dipping to 58.3 (58.0 expected, 58.6 prior).

- The Employment gauge improved from October but failed to beat consensus at 50.7 (51.4 expected, 50.2 prior). That reading - when taken in conjunction with a much sharper-than-expected drop in JOLTS job openings data released concurrently - probably helped trigger a softening in US rates, in the context of Friday's November nonfarm payrolls report.

- US REDBOOK: NOV STORE SALES +3.0% V YR AGO MO

- US REDBOOK: STORE SALES +3.0% WK ENDED DEC 02 V YR AGO WK

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 59.72 points (-0.17%) at 36144.68

- S&P E-Mini Future up 0.5 points (0.01%) at 4576.25

- Nasdaq up 44.9 points (0.3%) at 14230.51

- US 10-Yr yield is down 8.6 bps at 4.1668%

- US Mar 10-Yr futures are up 24/32 at 110-30

- EURUSD down 0.0052 (-0.48%) at 1.0784

- USDJPY up 0.03 (0.02%) at 147.23

- WTI Crude Oil (front-month) down $0.59 (-0.81%) at $72.45

- Gold is down $9.11 (-0.45%) at $2020.35

- European bourses closing levels:

- EuroStoxx 50 up 37.82 points (0.86%) at 4452.77

- FTSE 100 down 23.12 points (-0.31%) at 7489.84

- German DAX up 128.35 points (0.78%) at 16533.11

- French CAC 40 up 54.4 points (0.74%) at 7386.99

US TREASURY FUTURES CLOSE

- 3M10Y -7.786, -121.458 (L: -122.954 / H: -114.015)

- 2Y10Y -2.348, -40.789 (L: -44.869 / H: -37.98)

- 2Y30Y -4.497, -27.357 (L: -29.971 / H: -21.913)

- 5Y30Y -3.434, 16.611 (L: 15.583 / H: 21.317)

- Current futures levels:

- Mar 2-Yr futures up 5.25/32 at 102-16.25 (L: 102-11.75 / H: 102-17.125)

- Dec 5-Yr futures up 13.75/32 at 107-17.25 (L: 107-05.75 / H: 107-19.25)

- Mar 10-Yr futures up 24/32 at 110-30 (L: 110-10 / H: 110-31.5)

- Mar 30-Yr futures up 1-28/32 at 119-14 (L: 117-27 / H: 119-17)

- Mar Ultra futures up 2-25/32 at 127-9 (L: 124-27 / H: 127-11)

US 10Y FUTURE TECHS: (H4) Bull Cycle Remains In Play

- RES 4: 112-03 1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 111-19 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 111-00 Round number resistance

- RES 1: 110-28 High Dec 1

- PRICE: 110-15 @ 11:09 GMT Dec 5

- SUP 1: 109-06 20-day EMA

- SUP 2: 108-18+ Low Nov 27 and a key short-term support

- SUP 3: 107-22 Low Nov 14

- SUP 4: 107-11+ Low Nov 13 and a reversal trigger

The trend direction in Treasuries remains up and Monday’s pullback is considered corrective. Price has pierced 110-25, the 1.00 projection of the Oct 19 - Nov 3 - Nov 13 price swing. A resumption of gains would open the 111-00 handle. Last week’s rally confirmed an extension of the positive price sequence of higher highs and higher lows - the definition of an uptrend. Initial key support is at 108-18+, the Nov 27 low.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 steady00 at 94.620

- Mar 24 +0.035 at 94.895

- Jun 24 +0.055 at 95.270

- Sep 24 +0.065 at 95.650

- Red Pack (Dec 24-Sep 25) +0.085 to +0.110

- Green Pack (Dec 25-Sep 26) +0.105 to +0.115

- Blue Pack (Dec 26-Sep 27) +0.110 to +0.115

- Gold Pack (Dec 27-Sep 28) +0.120 to +0.130

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.01374 to 5.35961 (+0.01295/wk)

- 3M +0.01326 to 5.37623 (+0.00100/wk)

- 6M +0.01407 to 5.31665 (-0.02425/Wk)

- 12M +0.01183 to 5.05096 (-0.06745/wk)

- Secured Overnight Financing Rate (SOFR): 5.37% (-0.02), volume: $1.631T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $618B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $602B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

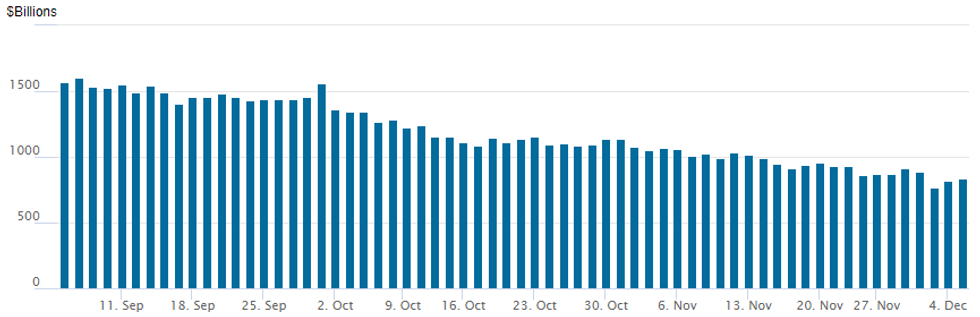

FED REVERSE REPO OPERATION

The NY Fed Reverse Repo operation usage rebounds to $834.428B w/ 82 counterparties vs. $815.847B yesterday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

PIPELINE: $1.5B BMO 2Pt Launched

Still waiting for JP Morgan 3Y fix/3Y SOFR to launch- Date $MM Issuer (Priced *, Launch #)

- 12/05 $1.5B *IADB 3Y SOFR+35

- 12/05 $1.5B #Bank of Montreal $1.15B 3Y +93, $350M 3Y SOFR+116

- 12/05 $750M Corebridge Financial 10Y +160

- 12/05 $750M #Cantor Fitzgerald 5Y +310

- 12/05 $600M #Stryker Corp 5Y +73

- 12/05 $525M #Protective Life 5Y +132

- 12/05 $Benchmark JP Morgan 3Y +78, 3Y SOFR+100

- Later in the week:

- 12/06 $500M Credit Acceptance Corp 5NC2 9%

- 12/?? $750M Alliant Holdings 7NC3

EGBs-GILTS CASH CLOSE: Dovish Schnabel Reloads The Rally

The German and UK curves bull flattened sharply Tuesday as the overall fixed income rally continued.

- The main catalyst for lower yields was an interview published overnight with ECB's Schnabel who showed surprising confidence on the inflation front ("the recent inflation print has given me more confidence that we will be able to come back to 2% no later than 2025"), translating to making further hikes "rather unlikely" - and when specifically asked about a rate-cut before mid-2024, she did not rule it out.

- The bond rally extended in the afternoon as US job openings data came in much softer than expected. Softer oil prices also helped.

- Gilts outperformed Bunds, with UK yields down double digits across the curve.

- Periphery EGBs saw spreads tighten, shrugging off Schnabel's comments that echoed Pres Lagarde's on PEPP reinvestments being re-assessed sooner rather than later.

- Attention early Wednesday will be on German factory orders for October.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.5bps at 2.61%, 5-Yr is down 8.5bps at 2.19%, 10-Yr is down 10.7bps at 2.247%, and 30-Yr is down 14.2bps at 2.448%.

- UK: The 2-Yr yield is down 10.4bps at 4.514%, 5-Yr is down 13bps at 4.056%, 10-Yr is down 16.9bps at 4.025%, and 30-Yr is down 15.7bps at 4.567%.

- Italian BTP spread down 3.1bps at 174.1bps / Greek down 4.2bps at 115.8bps

FOREX Greenback Extends Recovery, AUDUSD Sinks Post-RBA

- The greenback extended on its most recent recovery on Tuesday, shrugging off the weaker-than-expected US JOLTS data. Further weakness for the Euro amid some dovish ECB speak underpinned the 0.4% rally for the USD index.

- With the greenback bid extending in late US trade, EURUSD slid back below 1.0800 for the first time since US inflation data was released on November 14. With the EURUSD trend outlook remaining bullish for now, recent weakness appears to be a correction. Note that the trend condition is overbought, and the move lower is allowing this set-up to unwind. Support to watch is 1.0770, the 50-day EMA and 1.0756, the Nov 6 high.

- The Australian dollar is the weakest performer in the G-10 space. AUD/USD was pressured in early APAC trade as regional equities ticked lower before extending losses as the RBA held rates steady and noted that inflation is continuing to moderate. AUD/USD is down 1.00% heading into the Wednesday crossover and price has narrowed in on initial support at the 20-Day EMA (0.6539), before pivot support at 0.6522.

- There was some volatile price action around the US data, most notable in USDJPY which saw a quick blip lower of around 65 pips to 146.57 lows. However, this proved to be short-lived and the pair had an impressive bounce to eventually trade at a fresh session high of 147.39. On the topside, yesterday’s highs at 147.45 represent a short-term target, however, more notable key short-term resistance does not come in to play until 148.51, the Nov 30 high.

- Australian GDP will cross overnight before the UK construction PMI and potential comments from Governor Bailey. US ADP employment will play second fiddle to the Bank of Canada rate decision. Remarks from Gov. Macklem two weeks ago could heavily dictate the message we receive from the single page statement, including that excess demand is now gone and policy may now be restrictive enough.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/12/2023 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 06/12/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/12/2023 | 1030/1030 |  | UK | BOE FPC Summary and Record | |

| 06/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/12/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/12/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/12/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 06/12/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/12/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.