MNI ASIA OPEN: Late Short End Rally on 50Bp Cut Speculation

- MNI US OUTLOOK/OPINION: 50bp Cut Blackout Talk Contrasts With 2022 Episode

- MNI US: Schumer To Force Senate GOP Into Tough Vote On Trump IVF Pledge

- MNI ECB WATCH: ECB Cuts 25BP, Does Not Commit To Rate Path

- MNI SECURITY: UK, US, France, Germany Warn Of Accelerating Iranian Nuclear Program

- MNI US DATA: Revisions And Less So Rounding Take Gloss Of PPI Beat

US

US OUTLOOK/OPINION (MNI): 50bp Cut Blackout Talk Contrasts With 2022 Episode

How seriously should markets regard today's article by the Wall Street Journal's Nick Timiraos ("The Fed's Rate-Cut Dilemma: Start Big or Small?") as a steer to markets of the Fed signalling a surprise 50bp cut next week? The article notes re next week’s meeting that the FOMC “are confronting questions over whether to cut by a traditional 0.25 percentage point or by a larger 0.5 point.” Most attention seems to be on the article quoting ex-Powell adviser Jon Faust saying it's a "close call" between 25bp and 50bp. Pricing has shifted to around 20% probability of a 50bp cut, vs <10% earlier today, basically reversing the pricing out seen after yesterday's stronger-than-expected core CPI data.

NEWS

US (MNI): Schumer To Force Senate GOP Into Tough Vote On Trump IVF Pledge

Senate Majority Leader Chuck Schumer (D-NY) intends to force Senate Republicans into a tricky vote on legislation mirroring Trump's campaign pledge to mandate insurance coverage of IVF treatments. The bill is likely to hit the Senate over the next two weeks, offering Democrats an opportunity for a messaging win on one of their electoral strengths.

ECB WATCH (MNI): ECB Cuts 25BP, Does Not Commit To Rate Path

The European Central Bank cut its key interest rate by 25 basis points on Thursday but said it was not committing to a predetermined rate path. The direction of the central bank is obvious but not predetermined “in terms of sequence or volume,” President Christine Lagarde told a news conference, when was asked about another possible cut in October, adding that the ECB will persist with its meeting-by-meeting, data-dependent approach.

SECURITY (MNI): UK, US, France, Germany Warn Of Accelerating Iranian Nuclear Program

France, Germany, the United Kingdom, and the United States, (the Quad) have issued a joint statement warning that Iran's failure to implement guidelines outlined by the UN nuclear watchdog, the International Atomic Energy Agency, could indicate that Iran is developing nuclear weapons capabilities.

UKRAINE (MNI): Polish FM Calls For US To Lift Restrictions On Long-Range Missile Use:

Polish Foreign Minister Radek Sikorski has said that 'Poland remains in favour of increasing pressure on the Russian gov't', and that 'Restrictions on Ukraine using long-range weapons should be lifted'. The stance is nothing new, with the gov't of PM Donald Tusk one of the most hawkish among Ukraine's allies calling for a tougher stance towards Moscow

FRANCE (MNI): Le Pen Maintains Lead In Polling After Chaotic Political Summer:

Marine Le Pen from the far-right National Rally has maintained her lead in the latest Ifop presidential election opinion poll. At present Le Pen leads the way in the first round with 34-35% of the vote according to the poll conducted 6-9 Sep.

FRANCE (MNI): Long Serving Econ Min Stands Down As PM Meets w/Les Republicans:

Minister of the Economy, Finance, Industrial and Digital Sovereignty Bruno Le Maire, who held the position for a record seven consecutive years, has stepped down paving the way for a major shift in portfolios within the incoming gov't of PM Michel Barnier.

CHINA-EU (MNI): Commission Rejects Chinese EV Makers Offers To Avoid Tariffs:

The EU has rejected offers from Chinese electric vehicle manufacturers to adjust their prices in an effort to avoid the imposition of tariffs at the end of October.

US TSYS: Rate Cut Speculation Alive and Well

- Interesting day on net - Short end rates pared losses in late trade, after a WSJ article rekindled hope over a debatable 50bp rate cut at next week's FOMC meeting. Short end SOFR futures gapped higher (SFRU4 +.0425 at 95.095).

- Still off early week highs projected rate hikes have drifted off morning lows (*) : Sep'24 cumulative -31.5bp (-29.4bp), Nov'24 cumulative -68.6bp (-65.9bp), Dec'24 -107.5bp (-104.5bp).

- Earlier, Treasuries showed little reaction to expected ECB deposit rate cut, drawing brief two way flow as futures hold inside narrow overnight range.

- Fast two-way trade reported as Treasury futures gapped higher (TYZ4 to 115-17.5, +7) then quickly reverse to mildly lower pre-data levels following latest PPI data w/down-revisions to prior, weekly claims slightly higher than expected: 230k (sa, cons 227k) in the week to Sep 7 after a marginally upward revised 228k (initial 227k).

- Treasury futures drifted near lows (USZ4 126-04, -21) after the $22B 30Y auction re-open (912810UC0) tails slightly: 4.015% high yield vs. 4.000% WI; 2.38x bid-to-cover vs. 2.31x in the prior month.

- Focus turns to Friday's Import/Export prices data and UofM Inflation Expectations.

OVERNIGHT DATA

US DATA (MNI): Revisions And Less So Rounding Take Gloss Of PPI Beat

PPI ex food & energy: 0.32% M/M (cons 0.2) after net downward revisions worth -0.15pps. Note that the downward revision for July was slightly smaller than the rounding on screens suggests, down to -0.17% vs an initial -0.05%.

- The beat for the steadier PPI ex food, energy & trade services was exaggerated by rounding. It printed 0.25% (cons 0.2) after a net downward revised -0.04pps, including -0.05pps to July with 0.25% vs an initial 0.30%.

- The difference lies from trade services, rising 0.6% M/M after an even larger than first though -1.7% M/M in July following the 1.3% jump before that.

US DATA (MNI): Jobless Claims Broadly Track Sideways

Weekly jobless claims again ruled out a sharper labor market deterioration, especially with continuing claims holding a shift away from recent highs (albeit still relatively elevated on a NSA basis). Initial jobless claims 230k (sa, cons 227k) in the week to Sep 7 after a marginally upward revised 228k (initial 227k).

- The four-week moving average inched 1k higher to 231k having recently peaked at 241k in early Aug. It continues to compare favorably with the 234k the week before Hurricane Beryl.

- There don't look to be any particularly unusual moves in the largest states.

- Continuing claims were exactly as expected at 1850k (sa, cons 1850k) in the week to Aug 31 after an upward revised 1845k (initial 1838k).

- Continuing claims continue to maintain a pullback from a recent high of 1871k in late July that had marked the highest since Nov 2021.

- Non-seasonally adjusted continuing claims once again look in keeping with recent patterns, i.e. still sitting right at the top end of the years shortly before the pandemic but not pushing relatively higher.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 186.33 points (0.46%) at 41047.27

- S&P E-Mini Future up 38.75 points (0.7%) at 5599.75

- Nasdaq up 174.2 points (1%) at 17569.9

- US 10-Yr yield is up 2.6 bps at 3.6796%

- US Dec 10-Yr futures are down 5/32 at 115-5.5

- EURUSD up 0.0056 (0.51%) at 1.1068

- USDJPY down 0.43 (-0.3%) at 141.94

- WTI Crude Oil (front-month) up $1.88 (2.79%) at $69.18

- Gold is up $43.77 (1.74%) at $2555.44

- European bourses closing levels:

- EuroStoxx 50 up 50.5 points (1.06%) at 4814.08

- FTSE 100 up 47.03 points (0.57%) at 8240.97

- German DAX up 188.12 points (1.03%) at 18518.39

- French CAC 40 up 38.24 points (0.52%) at 7435.07

US TREASURY FUTURES CLOSE

- 3M10Y +5.544, -130.069 (L: -136.538 / H: -128.567)

- 2Y10Y +1.598, 2.586 (L: -0.818 / H: 3.258)

- 2Y30Y +2.286, 34.496 (L: 30.22 / H: 35.458)

- 5Y30Y +0.909, 52.935 (L: 50.709 / H: 54.012)

- Current futures levels:

- Dec 2-Yr futures down 1/32 at 104-9.125 (L: 104-06 / H: 104-12)

- Dec 5-Yr futures down 3.5/32 at 110-15.25 (L: 110-10.75 / H: 110-24)

- Dec 10-Yr futures down 5/32 at 115-5.5 (L: 114-31.5 / H: 115-17.5)

- Dec 30-Yr futures down 16/32 at 126-9 (L: 125-30 / H: 127-00)

- Dec Ultra futures down 26/32 at 136-7 (L: 135-23 / H: 137-06)

US 10YR FUTURE TECHS: (Z4) Remains Above Support

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-23+ High Sep 11

- PRICE: 115-04 @ 1415 ET Sep 12

- SUP 1: 114-27+/10 Low Sep 10 / 20-day EMA

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-12 Low Sep 3

- SUP 4: 113-06+ 50-day EMA

The trend needle in Treasuries continues to point north and this week’s gains reinforce this theme. Wednesday’s initial rally resulted in a print above key resistance and the bull trigger at 115-19, the Aug 5 high. The move higher confirms a resumption of the uptrend and paves the way for a climb towards the 116.00 handle. MA studies remain in a bull-mode position, highlighting a clear M/T uptrend. Firm support is seen at 114-10, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.040 at 95.093

- Dec 24 +0.030 at 95.880

- Mar 25 +0.005 at 96.530

- Jun 25 -0.020 at 96.885

- Red Pack (Sep 25-Jun 26) -0.04 to -0.03

- Green Pack (Sep 26-Jun 27) -0.04 to -0.04

- Blue Pack (Sep 27-Jun 28) -0.04 to -0.035

- Gold Pack (Sep 28-Jun 29) -0.04 to -0.035

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00059 to 5.09651 (-0.01333/wk)

- 3M +0.01535 to 4.94664 (-0.00800/wk)

- 6M +0.01691 to 4.57048 (-0.02151/wk)

- 12M +0.01890 to 3.97243 (-0.08117/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.01), volume: $2.308T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $805B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $769B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

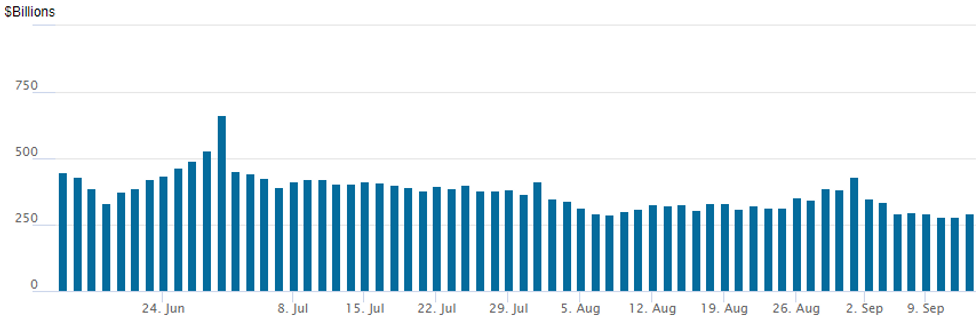

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage inches up to $294.464B from yesterday's multi-year low of $279.215B (early May 2021 levels). Number of counterparties steady at 58.

$9B Hewlett Packard Multi-Tranche Launched

$9B HP jumbo well over $6.5B estimated earlier, while the 3Y SOFR leg was dropped.- Date $MM Issuer (Priced *, Launch #)

- 9/12 $9B #HP Enterprises $1.25B 2Y +80, $1.25B 3Y +90, $1.75B 5Y +110, $1.25B 7Y +130, $2B 10Y +145, $1.5B 30Y +175

- 9/12 $4.1B #Citigroup $3B 6NC5 +108, $1.1B 15NC10 +173

- 9/12 $1B #Raizen Fuels Finance +10Y +218

- 9/12 $800M Service Corp 8NC3 5.75%a

- 9/12 $500M #Kimco Realty +10Y +118

BONDS: EGBs-GILTS CASH CLOSE: Curves Bear Flatten With ECB October Cut Fading

Core European yields rose for the first time in 8 sessions Thursday, as the ECB meeting outcome was seen as a little less dovish than expected.

- Bunds had posted nascent gains going into the as-expected ECB decision to cut the depo rate by 25bp, but had reached session lows by the end of the press conference.

- Lagarde noted downside growth risks but did not convey any urgency to cut rates again in October, highlighting data dependence, while her commentary on Eurozone wages was read somewhat hawkishly.

- October ECB cut pricing dipped to 5bp from 8bp, and cumulative in the remaining meetings through March 2025 to 86bp from 91bp.

- The German curve bear flattened on the day, underperforming Gilts (the UK curve bear flattened in sympathy).

- Periphery EGB spreads tightened amid the pronounced backup in Bund yields and a stabilisation in equities.

- Friday's calendar is highlighted by multiple ECB speakers (Nagel, Rehn, Lagarde), but data-wise is fairly light, with French final CPI and Q2 wages, and UK BoE/Ipsos inflation expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.3bps at 2.225%, 5-Yr is up 5.4bps at 2.025%, 10-Yr is up 3.8bps at 2.15%, and 30-Yr is up 3bps at 2.425%.

- UK: The 2-Yr yield is up 2.7bps at 3.818%, 5-Yr is up 2.5bps at 3.64%, 10-Yr is up 2bps at 3.781%, and 30-Yr is up 0.4bps at 4.376%.

- Italian BTP spread down 3.9bps at 139.1bps / Spanish down 1.4bps at 81.1bps

FOREX: Equity Sentiment Boosts AUD, Higher Core Yields Weigh on CHF

- Major equity indices continue to consolidate at their weekly highs and this is providing a more stable backdrop across currency markets. This is allowing risk sensitive pairs to outperform with the likes of GBP, AUD and NZD are all rising around 0.4% against the greenback on Thursday.

- Despite bearish conditions prevailing for AUDUSD, price action this week narrows the gap to initial firm resistance, which has been defined at 0.6767, the Jun 6 high. Clearance of this level is required to highlight a stronger reversal and expose key resistance at 0.6824, the Aug 29 high.

- Comparatively, firmer sentiment combined with higher core yields is weighing on the likes of JPY and CHF, with the latter the poorest performing major. EURCHF looks to extend its recovery from the 0.93 handle, a level the cross has been unable to close below since January.

- EURUSD is also firmer, following a central bank meeting that failed to rock the boat. The European Central Bank cut its key interest rate by 25bps on Thursday but said it was not committing to a predetermined rate path. A more optimistic global backdrop allowed EURUSD to rise around 30 pips to 1.1050, although daily ranges remain contained. Initial resistance is not seen until 1.1091, the Sep 9 high.

- In emerging markets, the Mexican peso has continued to rally through Thursday’s session, supported by the rebound in commodities and buoyant equities. USDMXN dipped as low as 19.5416 in recent trade, below initial support at 19.5897, the 20-day EMA, leaving the pair over 1.3% lower on the day.

- The data calendar is light on Friday, with US UMich sentiment and inflation expectations the highlight to round off the week.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 13/09/2024 | 0430/1330 | ** |  | Industrial Production |

| 13/09/2024 | 0645/0845 | *** |  | HICP (f) |

| 13/09/2024 | 0830/0930 | ** |  | Bank of England/Ipsos Inflation Attitudes Survey |

| 13/09/2024 | 0900/1100 | ** |  | Industrial Production |

| 13/09/2024 | - |  | ECB's Lagarde in Eurogroup meeting | |

| 13/09/2024 | 1230/0830 | ** |  | Import/Export Price Index |

| 13/09/2024 | 1230/0830 | ** |  | Wholesale Trade |

| 13/09/2024 | 1400/1000 | ** |  | U. Mich. Survey of Consumers |

| 13/09/2024 | 1700/1300 | ** |  | Baker Hughes Rig Count Overview - Weekly |

| 14/09/2024 | 0200/1000 | *** |  | Fixed-Asset Investment |

| 14/09/2024 | 0200/1000 | *** |  | Retail Sales |

| 14/09/2024 | 0200/1000 | *** |  | Industrial Output |

| 14/09/2024 | 0200/1000 | ** |  | Surveyed Unemployment Rate M/M |