-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Late Week Respite From Bond Rout

- MNI INTERVIEW: Fed's Garriga Urges Stay Tough On Inflation

- MNI INTERVIEW: Risk Of Clunky Supercore Unwind- SF Fed’s Leduc

- MNI CANADA: Teranet-National Bank House Prices See Second Strongest M/M Increase

US

FED: The Federal Reserve needs to stay tough on tightening policy as necessary because the longer high inflation persists, the more positive income effects from improved household balance sheets are likely to linger, fueling demand and generating further price pressures, St. Louis Fed research director Carlos Garriga told MNI.

- Americans accumulated more than USD2 trillion in excess savings during the pandemic, some of which has yet to be spent. Many households also improved their cash flow by locking in rock-bottom mortgage rates during Covid, a benefit that grows over time as high inflation reduces the real value of debt and real wage growth stays positive.

- "For the borrower, it's less money in real terms that they have to take out of their paycheck. If wages are keeping up with inflation, the gap keeps getting bigger over time the longer you have inflation above target. That’s why we need to get at it quick, because we want to make sure that effect doesn’t play out for a long time," Garriga said in an interview.

- "My perspective for the last two-plus years has been: let’s be aggressive with inflation, and we’ll be able to drive rates to a neutral level when inflation has clearly converged to target. And that view hasn’t changed." For more see MNI Policy main wire at 0835ET.

FED: The U.S. economy still faces the risk that “supercore” inflation remains stubborn even as the job market moderates, San Francisco Fed Research Director Sylvain Leduc told MNI.

- Inflation in services outside of energy, food and housing appeared to have become more sensitive to labor market strength during the pandemic, as people shied away from close-contact work, according to research by Leduc and his colleagues. The problem is that as the economy normalizes it may be harder to unwind that pricing buildup, if inflation returns to its old pattern of being less sensitive to the job market.

- Put another way, it comes down to whether the slope of the Phillips Curve mapping out the relationship between inflation and unemployment has flattened out again. The return of a flatter curve would mean in general that more unemployment is needed to pull down inflation.

- “The question is then, where are we now, are we on the flatter part of the relationship or still on the steep part. And there’s a risk that we’re back to where we were pre-pandemic, in a relationship that’s much more muted between supercore inflation and the unemployment rate.” For more see MNI Policy main wire at 0723ET.

CANADA

- The Teranet-National Bank house price index saw a “sharp” 2.4% M/M increase in July in seasonally adjusted terms.

- Its the second-highest growth rate recorded in a single month (strongest was 3.1% in Jul’06), and follows 2.0% M/M in June.

- The series corroborates the sharp increases seen in the existing home sales data, and helps close the gap to just 4% below the Apr’22 peak (for Teranet, -10% for existing home sales after a deeper decline).

- The strong rebound in prices comes with supply struggling to rebound as activity closes with high interest rates.

US TSYS Markets Roundup: Rates Off Week Lows, Focus on Eco-Summit Next Week

- US Rates are holding moderately firmer levels after the bell late Friday, inside a relatively narrow range following Thursday's sell-off to new contract lows. A quiet end to the week with no economic data Friday, or next Monday for that matter, or Fed speakers until next week.

- Chicago Fed President Goolsbee returns with opening remarks at a Fed listens event on youth employment at 1430ET Tuesday, followed by a fireside chat with Gov Bowman at 1530ET Tuesday.

- Markets eager for details on next week's KC Fed Economic Policy Symposium in Jackson Hole: ‘Structural Shifts in the Global Economy,’ from August 24 to August 26 (schedule/attendees list likely announced the evening of the 24th).

- Treasury futures bounced off early session lows to new session highs in midmorning trade, shy of overnight highs with obvious headline or block/cross driver. Cross-market/asset: Bunds inched higher after the cash open in stocks, Gilts off session lows; West Texas crude climbed .88 to 81.27 while Gold recede -1.45 to 1887.99..

- USD index held marginal negative territory. The Japanese Yen is the strongest performer in G10, with USDJPY slowly gravitating back towards session lows and the important pivotal support around 145.10.

OVERNIGHT DATA

- No economic data Friday, or next Monday for that matter.

- No scheduled Fed speakers Friday or Monday, Chicago Fed President Goolsbee returns with opening remarks at a Fed listens event on youth employment at 1430ET Tuesday, followed by a fireside chat with Gov Bowman at 1530ET Tuesday.

- Markets eager for details on next week's KC Fed Economic Policy Symposium in Jackson Hole: ‘Structural Shifts in the Global Economy,’ from August 24 to August 26 (schedule/attendees list likely announced the evening of the 24th).

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 9.77 points (-0.03%) at 34464.29

- S&P E-Mini Future down 5 points (-0.11%) at 4379.5

- Nasdaq down 26.3 points (-0.2%) at 13289.61

- US 10-Yr yield is down 2.5 bps at 4.2487%

- US Sep 10-Yr futures are up 12/32 at 109-21

- EURUSD up 0.0007 (0.06%) at 1.0879

- USDJPY down 0.56 (-0.38%) at 145.28

- WTI Crude Oil (front-month) up $0.78 (0.97%) at $81.17

- Gold is down $0.65 (-0.03%) at $1888.76

- EuroStoxx 50 down 14.88 points (-0.35%) at 4212.95

- FTSE 100 down 47.78 points (-0.65%) at 7262.43

- German DAX down 102.64 points (-0.65%) at 15574.26

- French CAC 40 down 27.63 points (-0.38%) at 7164.11

US TREASURY FUTURES CLOSE

- 3M10Y +0.832, -119.389 (L: -128.667 / H: -118.387)

- 2Y10Y -3.024, -68.742 (L: -69.643 / H: -65.733)

- 2Y30Y -1.546, -56.001 (L: -57.446 / H: -53.278)

- 5Y30Y +1.937, -0.398 (L: -3.209 / H: 1.394)

- Current futures levels:

- Sep 2-Yr futures up 1.25/32 at 101-12.5 (L: 101-11.625 / H: 101-14.75)

- Sep 5-Yr futures up 6.5/32 at 105-30.75 (L: 105-27.25 / H: 106-03.5)

- Sep 10-Yr futures up 11.5/32 at 109-20.5 (L: 109-14 / H: 109-28.5)

- Sep 30-Yr futures up 18/32 at 119-7 (L: 118-27 / H: 119-28)

- Sep Ultra futures up 19/32 at 124-14 (L: 123-29 / H: 125-10)

Note, the latest Tsy quarterly futures roll volume from Sep'23 to Dec'23 remains modest. "First Notice" date, when the current lead quarterly passes the honor to the following quarterly, is only two weeks away on August 31. Current markets:

- TUU/TUZ 17,500 from -14.12 to -13.62, -14.0 last, 3% complete

- FVU/FVZ 57,900 from -16.25 to -15.5, -15.75 last, appr 6% complete

- TYU/TYZ 15,200 from -14.75 to -14.25, -14.75 last, appr 3% complete

- UXYU/UXYZ 2,400 from -18.5 to -17.75, -18.0 last, appr 1% complete

- USU/USZ 31,200 from -6.0 to -5.25, -5.5 last, appr 8% complete

- WNU/WNZ 21,900 from -117.25 to -115.25, -115.75 last, appr 9% complete

- Reminder, September futures won't expire until next month: 10s, 30s and Ultras on September 20, September 29 for 2s and 5s.

US 10Y FUTURE TECHS: (U3) Short-Term Gains Considered Corrective

- RES 4: 112-07 High Jul 27

- RES 3: 111-29 High Aug 10

- RES 2: 111-27+ 50-day EMA

- RES 1: 110-07/110-25 High Aug 15 / 20-day EMA

- PRICE: 109-23 @ 15:10 BST Aug 18

- SUP 1: 109-03+ Low Aug 17

- SUP 2: 109-00 Round number support

- SUP 3: 108-26+ Low Oct 21 2022 (cont) and a major support

- SUP 4: 108-08+ 2.0% 10-dma envelope

The trend direction in Treasuries remains down and the contract traded lower Thursday. Today’ gains are considered corrective. This week’s move lower resulted in a break of 109.24, the Aug 4 low, that confirmed a resumption of the bear cycle. The move down signals scope for 108-26 next, the Oct 21 2022 low (cont). Moving average studies are in a bear mode condition, highlighting a downtrend. Firm resistance is at 110-28, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 23 +0.015 at 94.603

- Dec 23 +0.015 at 94.620

- Mar 24 +0.020 at 94.815

- Jun 24 +0.025 at 95.120

- Red Pack (Sep 24-Jun 25) +0.030 to +0.050

- Green Pack (Sep 25-Jun 26) +0.060 to +0.075

- Blue Pack (Sep 26-Jun 27) +0.075 to +0.080

- Gold Pack (Sep 27-Jun 28) +0.075 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00029 to 5.31427 (+.00377/k)

- 3M +0.00341 to 5.38317 (+0.01860/wk)

- 6M +0.00342 to 5.44454 (+0.02946/wk)

- 12M +0.00693 to 5.38338 (+0.07756/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $98B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.343T

- Broad General Collateral Rate (BGCR): 5.28%, $564B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $548B

- (rate, volume levels reflect prior session)

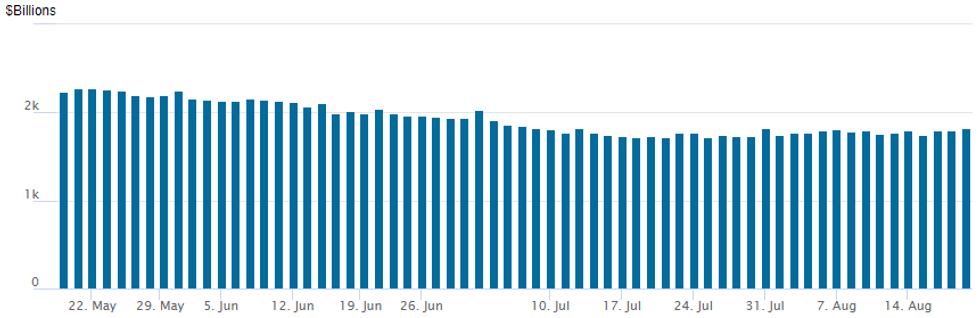

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation climbs to $1,819.201B w/98 counterparties, compared to $1,794.120B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS: UK Yields Sharply Higher On Week, But Bunds Steady

Gilts continued to underperform Bunds Friday despite soft UK retail sales data.

- After gapping stronger at the open, Gilt futures faded somewhat over the course of the session. Bunds continued higher for the most part, with some early morning strength after a Corriere report that the ECB would rebuke the Italian government for its windfall bank tax.

- The UK curve leaned bull steeper, with Germany's bull flattening.

- There were no major catalysts (final July Eurozone CPI was unrevised, no other data / speakers of note), with cross-market moves of greater note, particularly for European equities which hit multi-month lows.

- Despite the risk-off move and the move lower in Bund yields, periphery EGB spreads largely held their ground.

- Looking back on the week, price action reflected the market focus on mostly inflationary UK data (including CPI and wage growth): UK 2Y yields rose 17bp vs flat for Schatz; UK 10Y yields were up 15bp vs unch for Bund.

- Next week starts off with a relatively quiet schedule, picking up on Wednesday with flash PMIs, with the Fed's Jackson Hole symposium starting on Thursday and German IFO on Friday.

Friday Cash Yield Levels:

- Germany: The 2-Yr yield is down 5.9bps at 3.048%, 5-Yr is down 8.1bps at 2.623%, 10-Yr is down 9.4bps at 2.615%, and 30-Yr is down 7.8bps at 2.714%.

- UK: The 2-Yr yield is down 7.9bps at 5.197%, 5-Yr is down 6.6bps at 4.689%, 10-Yr is down 6.7bps at 4.679%, and 30-Yr is down 5.9bps at 4.873%.

- Italian BTP spread up 0.3bps at 170.8bps / Spanish up 0.5bps at 105.6bps

FOREX USDJPY Gravitates Back To Prior Breakout Level Around 145.00

- Greenback strength over the European session was reversed during US trade on Friday, leaving the USD index in marginal negative territory. The Japanese Yen is the strongest performer in G10, with USDJPY slowly gravitating back towards session lows and the important pivotal support around 145.10. Overall, sentiment remains unchanged and the uptrend in USDJPY remains intact, with short-term pullbacks considered corrective at this juncture. Initial firm support is 143.74, the 20-day EMA.

- On the other end of the spectrum the Swiss Franc is the weakest on the board. EURCHF was unable to match the July lows of 0.9522 and has since edged higher to levels close to unchanged on the week.

- Despite briefly trading below 1.2700 on the back of weaker UK retail sales, GBPUSD has bounced around 40 pips and remains only moderately lower on the session with the week’s earlier wage data maintaining hawkish bets on the Bank of England’s policy path ahead.

- Overall, the USD index has risen around half a percent this week, mainly reflecting the concerns over the Chinese economy and the associated higher yields and lower equity benchmarks.

- Focus turns swiftly to next week where markets will receive the latest European Flash PMIs to indicate the health of Eurozone economies. The main event will be the Jackson Hole Symposium where Fed Chair Powell and ECB’s Lagarde are already slated to speak.

MONDAY-WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/08/2023 | 0600/0800 | ** |  | DE | PPI |

| 22/08/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/08/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 22/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 22/08/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2023 | - | * |  | FR | Retail Sales |

| 22/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/08/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/08/2023 | 1830/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 23/08/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.