-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: List of Fed Gov Brainard Replacement Narrows

EXECUTIVE SUMMARY

US TSYS: Real Yields Gradually Decline

Tsy futures trade near late session highs, yield curves flatter with short end underperforming. Generally muted second half after whip-saw action this morning. Several underlying factors to consider

- Tsys gap bid after headlines that WH narrowing choices over Fed Gov Brainard: "GOOLSBEE, DALY, CARPENTER ALSO UNDER SERIOUS CONSIDERATION" Bbg. Desks see less hawks in the roost as bond positive.

- Some trading desks suggest early month-end positioning a factor, though hard to tell with massive March/June Tsy futures roll volume so far (TYH/TYM>1.3M already, TYH3 total volume >2.2M) as well as large curve flattener Block (-38,200 TUM3 102-01.62, sell through 102-03 post-time bid vs. +20,200 TYM3 111-21 post-time offer) and outright selling in 2s.

- Rate locks and pre-auction short sets into support: corporate bond issuance returns after plying sidelines ahead morning data. Tsys pared support briefly following weak $35B 7Y note auction (91282CGO8) tails: 4.062% high yield vs. 4.047% WI; 2.49x bid-to-cover vs. 2.69x last month.

- Risk appetite improved late as real yield recede (10Y -4.5bp to 1.46% - pre FOMC minutes levels).

CANADA

BOC: Canada has good cause to keep interest rates steady for the rest of the year as past hikes drag inflation close to target and the cumulative tightening by global central banks slows demand, Bill Robson, head of the CD Howe Institute think-tank and its shadow monetary policy council, told MNI.

- “I’m quite optimistic about the path of inflation—and I’m paid to worry,” said Robson, whose organization often hosts events with top central bankers and economic policy officials.

- Investors haven't been so resolute about a long pause, betting earlier this year on a rate cut and more recently some saying a final quarter-point hike is possible in the next few months. Bank Governor Tiff Macklem says he expects to hold his 4.5% rate for a while unless there's an accumulation of evidence his forecast is off track for inflation to slow to 3% around mid-year and return to the 2% target in 2024. For more see MNI

EUROPE

EU: The European Union’s Swedish presidency is trying to draft guidelines for overhauling the bloc’s fiscal rules which are both sufficiently detailed for the European Commission to prepare concrete legislative proposals and vague enough not to antagonise states like Germany, with officials telling MNI that failure to strike the right balance could scuttle hopes for approval of a new regime in 2023.

- With Germany and other so-called “frugal” states already bristling at the Commission’s initial proposals, which would grant Brussels powers to design bespoke debt-reduction programmes for countries exceeding borrowing guidelines, failure by the Swedes to forge consensus in their draft communique for the crunch finance ministers’ meeting on March 14 would make it difficult for officials to prepare the detailed legislative plans by early April, the officials said. (See MNI: Sweden Tries To Push EU Fiscal Reform Back To Commission)

- Any further delay in the legislative blueprint would dash chances the Stability and Growth Pact reforms could be approved by the European Parliament in time for new rules to be in force when the current fiscal regime comes back into force next year, following the expiry of the waiver granted to help governments respond to the economic challenges of first Covid and then surging energy prices in the wake of Russia’s invasion of Ukraine.

OVERNIGHT DATA

- US WEEKLY JOBLESS CLAIMS AT 192,000 LAST WEEK; EST. 200,000

- US 4Q Prelim GDP +2.7% Vs Advance GDP +2.9%

- US 4Q CORE PCE PRICE INDEX RISES AT A 4.3% ANNUAL RATE

- US DATA: Q4 Real GDP Revised Down On Consumption: Real GDP was revised down from 2.9% to 2.68% annualized in the 2nd Q4 estimate, after Q3’s 3.24%.

- There was a solid downward revision from personal consumption (down from 2.09 to 1.37% annualized) although there was a notable offset from stronger than first thought non-residential investment.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 128.68 points (0.39%) at 33174.42

- S&P E-Mini Future up 24 points (0.6%) at 4022.75

- Nasdaq up 94.5 points (0.8%) at 11601.66

- US 10-Yr yield is down 3.7 bps at 3.8788%

- US Mar 10-Yr futures are up 6.5/32 at 111-13

- EURUSD down 0.0007 (-0.07%) at 1.0598

- USDJPY down 0.16 (-0.12%) at 134.6

- Gold is down $1.69 (-0.09%) at $1823.68

- EuroStoxx 50 up 15.28 points (0.36%) at 4258.16

- FTSE 100 down 22.91 points (-0.29%) at 7907.72

- German DAX up 75.8 points (0.49%) at 15475.69

- French CAC 40 up 18.17 points (0.25%) at 7317.43

US TREASURY FUTURES CLOSE

- 3M10Y -4.138, -96.393 (L: -97.621 / H: -86.846)

- 2Y10Y -3.683, -81.865 (L: -82.239 / H: -74.734)

- 2Y30Y -3.83, -82.242 (L: -83.262 / H: -75.356)

- 5Y30Y +0.65, -23.523 (L: -24.585 / H: -20.55)

- Current futures levels:

- Mar 2-Yr futures down 0.25/32 at 101-25.625 (L: 101-23.75 / H: 101-26.875)

- Mar 5-Yr futures up 2.75/32 at 106-29.5 (L: 106-18.75 / H: 107-00.25)

- Mar 10-Yr futures up 7/32 at 111-13.5 (L: 110-25.5 / H: 111-17)

- Mar 30-Yr futures up 16/32 at 125-2 (L: 123-26 / H: 125-12)

- Mar Ultra futures up 31/32 at 135-26 (L: 133-26 / H: 136-13)

US TSY 10YR FUTURE TECHS: (H3) Near-Term Weakness Persists

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 113-11+ 50-day EMA

- RES 1: 112-24 20-day EMA

- PRICE: 111-12 @ 11:24 GMT Feb 23

- SUP 1: 110-30+ Low Feb 22

- SUP 2: 110-13 Lower 2.0% Bollinger Band

- SUP 3: 109-24+ 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extended across Treasury futures this week, putting prices at new pullback lows of 110-30+. The price action opens medium-term losses toward levels not seen since November. The strengthening bearish theme exposes 109-22 over the medium-term, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-15. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.013 at 94.893

- Jun 23 +0.030 at 94.510

- Sep 23 +0.015 at 94.40

- Dec 23 -0.005 at 94.595

- Red Pack (Mar 24-Dec 24) -0.025 to +0.045

- Green Pack (Mar 25-Dec 25) +0.040 to +0.055

- Blue Pack (Mar 26-Dec 26) +0.040 to +0.050

- Gold Pack (Mar 27-Dec 27) +0.055 to +0.060

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00771 to 4.56457% (+0.00771/wk)

- 1M +0.01271 to 4.61700% (+0.02571/wk)

- 3M +0.02972 to 4.95786% (+0.04257/wk)*/**

- 6M +0.00600 to 5.27700% (+0.03400/wk)

- 12M +0.02243 to 5.64186% (-0.00100/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.95786% on 2/23/23

- Daily Effective Fed Funds Rate: 4.58% volume: $109B

- Daily Overnight Bank Funding Rate: 4.57% volume: $298B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.129T

- Broad General Collateral Rate (BGCR): 4.52%, $457B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $445B

- (rate, volume levels reflect prior session)

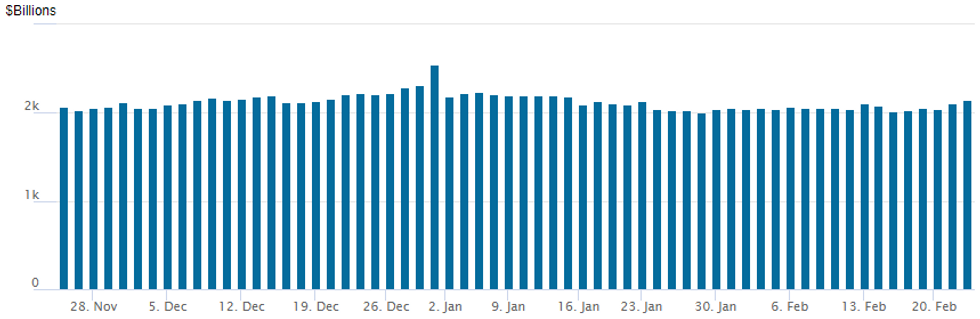

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,147.417B w/ 102 counterparties vs. prior session's $2,113.849B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: Over $13B Corporate Bond Issuance

Wrapping up today's corporate bond issuance, total of $13.3B to price, most issued well after today's 7Y auction tailed. Rate-lock unwinds helping underpin Tsys in late trade

- Date $MM Issuer (Priced *, Launch #)

- 02/23 $4B #Eli Lilly $750M 3NC1 +65, $1B 10Y +85, $1.25B 30Y +100, $1B 40Y +115

- 02/23 $3B #Raytheon $500M 3y +60, $1.25B 10Y +130, $1.25B 30Y +150

- 02/23 $2.75B #BHP Billiton $1B 3Y +55, $1B 5Y +75, $750M 10Y +105

- 02/23 $2B #UPS 10Y +100, 30Y +120

- 02/23 $800M #Trimble 10Y +225

- 02/23 $750M #AON Corp 10Y +147

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/02/2023 | 0700/0800 | *** |  | DE | GDP (f) |

| 24/02/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/02/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 24/02/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/02/2023 | - |  | EU | ECB Lagarde & Panetta at G20 Finance Minister Meet | |

| 24/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 24/02/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 24/02/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/02/2023 | 1515/1015 |  | US | Fed Governor Philip Jefferson | |

| 24/02/2023 | 1515/1015 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/02/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 24/02/2023 | 1630/1630 |  | UK | BOE Tenreyro Panellist at NY Fed | |

| 24/02/2023 | 1830/1330 |  | US | Boston Fed's Susan Collins | |

| 24/02/2023 | 1830/1330 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.