MNI ASIA OPEN: Modest Tsy Yld Rise Ahead Expected Cut From Fed

- MNI US FED: NatWest The Most Dovish On September Meeting

- MNI US: Speaker Johnson To Hold House Vote On Stopgap Funding Measure Wednesday

- MNI US DATA: Retail Sales Momentum Continues To Pick Up, Probably Won't Sway Fed

US

US FED (MNI): NatWest The Most Dovish On September Meeting

Further to our Analyst Outlook for the September FOMC circulated Monday (PDF Link), overnight we received NatWest's updated Fed call which is the most dovish on the meeting that we have seen. They join JPMorgan and Wrightson ICAP (and the MNI Markets Team) in previewing a 50bp cut, but in addition to that have the most aggressive 2024 overall Fed rate cut and Dot Plot outlook:

- NatWest sees the FOMC penciling in a 4.1% end-2024 rate in the Dot Plot, implying another 75bp of cuts in Nov and Dec beyond NWM's 50bp expectation in September. In contrast, most analysts see a 4.6% median, with the lowest few otherwise seeing 4.4%.

- Their base case is for the Fed to end up exceeding the easing implied by even that dovish Dot Plot, with 50bp cuts in both Nov and Dec for 150bp of cuts in 2024: only a couple of analysts (Citi, CIBC) had as many as 125bp of cuts. (It's unclear what their 2025 forecast is from their preview but previously they'd seen 2 25bp cuts in early 2025 after the front-loading in 2024.).

NEWS

US (MNI): Harris Leads Trump In Bellwether PA Counties, Suffolk/USA Today

A new Suffolk University/USA Today poll shows Vice President Kamala Harris narrowly leading former President Donald Trump 49%-46% in the critical battleground state of Pennsylvania and “two of the state's key bellwether counties,” Erie County and Northampton County, which voted for Trump in 2016 and Biden in 2020 by narrow margins. The poll found, “a wide gender gap that is benefiting the vice president. Harris leads female voters in Pennsylvania 56%-39%, while Trump tops male voters by a slimmer 53%-41%, according to the poll. Harris edged Trump among Pennsylvania's independent voters 43%-38%.”

US (MNI): Speaker Johnson To Hold House Vote On Stopgap Funding Measure Wednesday:

Punchbowl News reports that House Speaker Mike Johnson (R-LA) will hold a vote on his short-term Continuing Resolution (CR) to fund the federal government on Wednesday. Without a short-term funding patch in place, the government will partially shutdown on October 1. Punchbowl notes the package will track closely with the one that was pulled last week, calling for a six-month extension paired with a partisan bill to require citizenship ID when registering to vote (The SAVE Act).

SECURITY (MNI): Hezbollah Says Israel Carried Out Pager Attack, Promises 'Retribution'

The Lebanon-based militant group Hezbollah has promised "retribution" on Israel for a major attack on its personnel today that it claims was carried out by Israel. Lebanon’s health minister said at least eight people had been killed and more than 2,700 others injured in the attack, which appears to have been conducted through rigged pager devices. The group said in a second statement on the attack: “After examining all the facts, data, and information regarding the sinful attack that occurred this afternoon, we hold the Israeli enemy fully responsible for this criminal aggression..."

CORPORATE (BBG): Microsoft Plans New $60 Billion Buyback, Raises Dividend 10%

Microsoft Corp. raised its quarterly dividend 10% and unveiled a new $60 billion stock-buyback program, matching the size of a repurchase plan three years ago. The software company said shareholders as of Nov. 21 will receive a quarterly dividend of 83 cents a share, compared with the current 75 cents.

US TSYS: Modest Pre-FOMC Consolidation

- Treasuries look to finish weaker but off lows Tuesday, this after climbing briefly to one week highs on the open. Generally quiet position squaring ahead of tomorrow's FOMC policy announcement where markets still project closer to a 50bp cut than a 25bp move from the Fed.

- Projected rate hikes through year end gain slightly vs. late Monday levels (*): Sep'24 cumulative -42.3bp (-41.5bp), Nov'24 cumulative -78.8bp (-78.2bp), Dec'24 -118.3bp (-119.8bp).

- Retail Sales headline beat and a slight upward revision to prior data (0.1% M/M (vs -0.2% expected, 1.1% prior rev up 0.1pp) -- was slightly on the strong side of consensus, should do little to persuade or dissuade the Fed from cutting either 25bp or 50bp on Wednesday.

- Meanwhile, Industrial production was much stronger than expected in August at 0.8% M/M (cons 0.2) but with some of the gloss taken off by a downward revision to -0.9% (initial -0.6%). Manufacturing production led the increase with 0.9% M/M (cons 0.2) but it also drove the downward revision with -0.7% (initial -0.3%).

- Volumes accelerated in the second half, Dec'24 10Y over 1.6M as the contract dipped 7.5 to 115-10.5, still well above initial technical support of 114-31.5 (Low Sep 12). Curves flattened but were off lows, 2s10s -1.575 at 4.890 at the bell vs. 1.898 low.

- Tomorrow's FOMC announcement includes the Summary of Economic projections.

OVERNIGHT DATA

US DATA (MNI): Retail Sales Momentum Continues To Pick Up, Probably Won't Sway Fed

The August retail sales report came in remarkably in-line with expectations considering recent volatility in the data. A headline beat and a slight upward revision to prior data mean the report was on the slightly strong side of consensus, overall it should do little to persuade or dissuade the Fed from cutting either 25bp or 50bp on Wednesday. Headline retail sales printed 0.1% M/M (vs -0.2% expected, 1.1% prior rev up 0.1pp), with ex-auto and ex-auto/gas missing expectations by 0.1% (0.2% and 0.3% respectively, 0.4% prior for each unrevised). Control Group sales, which are closely eyed as an input to GDP, came in line with expectations at 0.3% (0.4% prior rev up 0.1pp).

US DATA (MNI): NAHB Homebuilder Sentiment Further Lags Price/Book Multi-Year Highs

The NAHB survey was in line with expectations in September at 41, reversing a 2pt drop in August but only to its second lowest of the year to date. Expectations for future sales six months ahead outperformed for a third month running, rising 4pts to 53 vs +1pts for present sales and +2pts for prospective buyer traffic.

US DATA (MNI): IP Lifts But Only Broadly Tracking Sideways

Industrial production was much stronger than expected in August at 0.8% M/M (cons 0.2) but with some of the gloss taken off by a downward revision to -0.9% (initial -0.6%). Manufacturing production led the increase with 0.9% M/M (cons 0.2) but it also drove the downward revision with -0.7% (initial -0.3%).

- Utilities, a typical source of volatility in the release, were near flat on the month after -3% in July.

- Trend growth remains tepid, with 3m/3m run rates of 0.7% annualized for overall IP and -0.3% for manufacturing. Weak core durable goods orders of -1.9% annualized on the same basis suggest further weakness ahead.

- Capacity utilization meanwhile was a tick higher than expected at 78.0% (cons 77.9) after a deeper than first thought decline in July to 77.4%. It has held similar levels in 2024 to date after a trend decline in late 2022 through 2023.

CANADA DATA (MNI): Canada Aug CPI Back To BOC Target +2% YOY, Slowest Since Feb 2021

Canada August CPI eases back to BOC's target at +2% YOY, slowest since February 2021. That is below the +2.1% forecast. Month-on-month -0.2%, better than +0.0% expected. BOC preferred core measures remained at slowest pace since April 2021, median +2.3% and trim +2.4%. Headline deceleration was due in part to lower prices for gasoline, due to a combination of lower prices and a base-year effect. Excluding gasoline, the CPI rose 2.2% in August, down from 2.5% in July.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 15.9 points (-0.04%) at 41606.18

- S&P E-Mini Future up 2.5 points (0.04%) at 5702.25

- Nasdaq up 35.9 points (0.2%) at 17628.06

- US 10-Yr yield is up 2.8 bps at 3.6456%

- US Dec 10-Yr futures are down 8/32 at 115-10

- EURUSD down 0.0017 (-0.15%) at 1.1116

- USDJPY up 1.67 (1.19%) at 142.29

- WTI Crude Oil (front-month) up $1.24 (1.77%) at $71.33

- Gold is down $13.75 (-0.53%) at $2568.66

- European bourses closing levels:

- EuroStoxx 50 up 33.15 points (0.69%) at 4860.78

- FTSE 100 up 31.42 points (0.38%) at 8309.86

- German DAX up 92.97 points (0.5%) at 18726.08

- French CAC 40 up 37.98 points (0.51%) at 7487.42

US TREASURY FUTURES CLOSE

- 3M10Y +6.043, -120.097 (L: -131.545 / H: -119.578)

- 2Y10Y -2.179, 4.286 (L: 1.898 / H: 7.093)

- 2Y30Y -1.962, 35.588 (L: 29.975 / H: 38.511)

- 5Y30Y -0.754, 51.732 (L: 46.758 / H: 53.013)

- Current futures levels:

- Dec 2-Yr futures down 3.625/32 at 104-10.875 (L: 104-10 / H: 104-15)

- Dec 5-Yr futures down 6/32 at 110-17.25 (L: 110-15.25 / H: 110-25)

- Dec 10-Yr futures down 7.5/32 at 115-10.5 (L: 115-08 / H: 115-21.5)

- Dec 30-Yr futures down 14/32 at 126-24 (L: 126-22 / H: 127-22)

- Dec Ultra futures down 16/32 at 137-3 (L: 136-31 / H: 138-14)

US 10YR FUTURE TECHS: (Z4) Holding On To Its Recent Gains

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-23+ High Sep 11

- PRICE: 115-17 @ 11:22 BST Sep 17

- SUP 1: 114-31+/19 Low Sep 12 / 20-day EMA

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-12 Low Sep 3

- SUP 4: 113-06+ 50-day EMA

Treasuries maintain a bullish theme and the contract is holding on to its latest gains. Last Wednesday’s push higher resulted in a print above key resistance and the bull trigger at 115-19, the Aug 5 high. The move higher confirms a resumption of the uptrend and paves the way for a climb towards the 116.00 handle. Moving average studies remain in a bull-mode position, highlighting a clear medium-term uptrend. Firm support is seen at 114-19, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 steady at 95.168

- Dec 24 -0.045 at 95.955

- Mar 25 -0.075 at 96.595

- Jun 25 -0.075 at 96.930

- Red Pack (Sep 25-Jun 26) -0.07 to -0.055

- Green Pack (Sep 26-Jun 27) -0.045 to -0.025

- Blue Pack (Sep 27-Jun 28) -0.02 to -0.01

- Gold Pack (Sep 28-Jun 29) -0.005 to +0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.04947 to 4.96482 (-0.11791/wk)

- 3M -0.04374 to 4.81963 (-0.12155/wk)

- 6M -0.04522 to 4.43627 (-0.14265/wk)

- 12M -0.04277 to 3.84556 (-0.14629/wk)

- Secured Overnight Financing Rate (SOFR): 5.38% (+0.05), volume: $2.212T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $818B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $783B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $249B

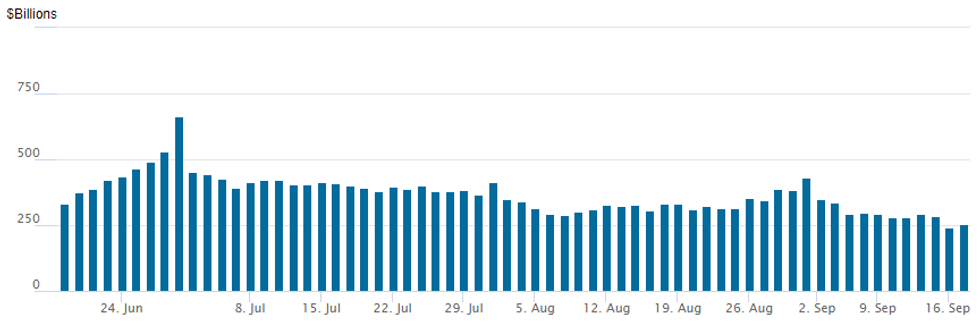

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage bounced to $256.337B from $239.386B Monday -- lowest since early May 2021. Number of counterparties rebounds to 55 from 44 on Monday.

PIPELINE: $4.95B Corporate Debt to Issue Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 9/17 $1.8B #Sonoco $500M 2Y +90, $600M 5Y +118, $700M 10Y +143

- 9/17 $1.5B #CFE $500M +5Y 5.75%, $1B +10Y 6.5%

- 9/17 $1B #Universal Health $500M 5Y +120, $500M 10Y +145

- 9/17 $650M #Atmos Energy 30Y +108

BONDS: EGBs-GILTS CASH CLOSE: Intraday Reversal Sees Modest Bear Flattening

European curves flattened Tuesday, with relatively pronounced weakness at the short end of curves.

- Futures peaked in early trade, as Federal Reserve 50bp cut pricing ticked higher

- But Bunds and Gilts pulled back sharply after 1300UK as oil and equities picked up, while US retail sales data came in slightly stronger than expected on balance, helping keep pressure on the space.

- The main European data release was German ZEW which surprised to the downside, but it was not a market mover.

- Bunds underperformed Gilts, with both curves flattening on the day on a short-end yield backup as implied 2024 BoE and ECB cuts ticked up 2-3bp from intraday lows.

- Periphery EGB spreads closed basically unchanged, reversing early tightening.

- While the Fed decision after the European cash close takes top billing Wednesday, the early highlight is UK CPI which the BoE will have in hand ahead of its decision release Thursday. An uptick in services prices is expected, though the BoE will likely look through any surprises - MNI's preview is here (PDF).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.4bps at 2.227%, 5-Yr is up 3.8bps at 2.033%, 10-Yr is up 2.1bps at 2.143%, and 30-Yr is down 0.2bps at 2.398%.

- UK: The 2-Yr yield is up 3.6bps at 3.824%, 5-Yr is up 2.4bps at 3.638%, 10-Yr is up 0.9bps at 3.768%, and 30-Yr is up 0.3bps at 4.353%.

- Italian BTP spread down 0.1bps at 135.5bps / Spanish up 0.2bps at 79.7bps

FOREX: US Data & Profit Taking Dynamics Support Greenback Pre-FOMC

- Downside momentum for the US dollar lost steam on Tuesday, with the USD index unable to breach the previous lows seen in August. A firmer US advanced retail sales number and stronger-than-expected IP have supported a moderate correction higher for the DXY as we approach the pivotal FOMC decision on Wednesday.

- USDJPY (+0.95%) has had the most notable correction, with an impressive bounce from the 139.58 lows on Monday. Spot resides just below session highs of 142.00 as we approach the APAC crossover and firm resistance is not seen until 143.95, the 20-day EMA.

- GBP is underperforming on the session, declining 0.45% to trade back at 1.3160 against the dollar. We noted yesterday that overall, GBPUSD maintains a firmer tone having recovered from last week’s low around 1.3000. A stronger reversal higher would refocus attention on key short-term resistance ahead of the BOE decision this week. This resides at 1.3266, the Aug 27 high.

- A late dip lower for major equity benchmarks has also weighed on the likes of NZD and the Euro, although most G10 ranges remain relatively contained given the proximity to the Fed decision tomorrow.

- In emerging markets, the Mexican peso is rallying once more, assisted by an impressive 2.5% off the lows in MXNJPY, taking advantage of the higher yields and a calmer political backdrop in comparison to last week.

- UK Inflation data kicks off the docket on Wednesday ahead of Thursday’s BOE decision. However, all the focus will be on the highly anticipated FOMC decision and accompanying press conference.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 18/09/2024 | 2350/0850 | ** |  JP JP | Trade |

| 18/09/2024 | 2350/0850 | * |  JP JP | Machinery orders |

| 18/09/2024 | 0600/0700 | *** |  GB GB | Consumer inflation report |

| 18/09/2024 | 0600/0700 | *** |  GB GB | Producer Prices |

| 18/09/2024 | 0600/0800 | ** |  SE SE | Unemployment |

| 18/09/2024 | 0900/1100 | *** |  EU EU | HICP (f) |

| 18/09/2024 | 0900/1100 | ** |  EU EU | Construction Production |

| 18/09/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 18/09/2024 | 1230/0830 | * |  CA CA | International Canadian Transaction in Securities |

| 18/09/2024 | 1230/0830 | *** |  US US | Housing Starts |

| 18/09/2024 | 1300/1500 |  EU EU | MNI Connect Video Conference on Euro Area Macro Projections | |

| 18/09/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 18/09/2024 | 1730/1330 |  CA CA | BOC Minutes (Summary of Deliberations) | |

| 18/09/2024 | 1800/1400 | *** |  US US | Fed Rate Decision / FOMC Statement |

| 18/09/2024 | 2000/1600 | ** |  US US | TICS |