-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Month End Buoys Bonds

EXECUTIVE SUMMARY

US

US: U.S. workers in some interest-rate rate sensitive sectors are insulated from the Federal Reserve's rate hikes because of President Joe Biden's trillions in investments, although workers' leverage is moderating, Aaron Sojourner, a former member of the White House Council of Economic Advisers, told MNI.

- "The federal investments that have been made in infrastructure, manual manufacturing and innovation have made a lot of businesses optimistic about the future," said Sojourner, also a former visiting scholar at the Minneapolis Fed. "They see specific public investments and public-private partnership investments on the horizon as an opportunity that are very unusual because they haven't been made in a long time."

- Biden's trillions of spending on infrastructure, energy, climate change projects and funding of chip research and expanded manufacturing facilities is historic and helps to explain overall construction growth that has continued apace despite recent monetary tightening, he said. For more see MNI Policy main wire at 1254ET.

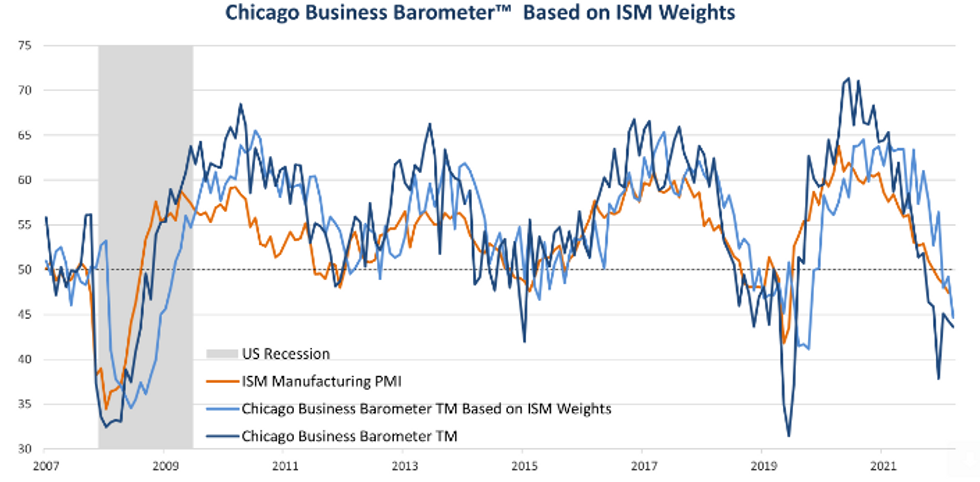

US: The Chicago Business BarometerTM, produced with MNI, declined by a further 0.7 points in February to 43.6, the lowest since November ’22. The headline index signaled a sixth consecutive month of contractionary business activity.

- Production, Employment and Prices Paid indicators declined over the month in February, with Production recording the steepest deterioration. All indicators barring Supplier Deliveries and Prices Paid were in contractive territory (sub-50).

CANADA

BOC: The Bank of Canada will likely see weak fourth quarter GDP data released Tuesday as pointing to a welcome soft landing that will allow policymakers to follow through on the conditional commitment to pause after eight straight interest-rate hikes, former government economist Glen Hodgson told MNI.

- “This is what a healthy slowdown looks like, what a soft landing looks like,” said Hodgson, a consultant who has worked at the federal finance department and trade finance bank, and advised governments as former chief economist at the Conference Board. Canadian output was 0.0% at an annualized pace, far less than than the market consensus for around 1.5% and the Bank of Canada's 1.3% estimate.

- Investors have overstated the economy's downshift in recent months and the latest GDP figures continue to show resilience to the jump in interest rates and a shaky U.S. economy, Hodgson said. Canada's consumer spending rebounded in Q4, a weaker dollar supported exports and the inventory run-down that stalled GDP is more about a few industries anticipating slower growth than a genuine slump, he said. For more see MNI Policy main wire at 1405ET.

US TSYS: Bonds Near Highs Into Month End

Trading mixed after the bell, yield curves flatter after 30s extended highs on late month end buying. Note, 30s scaling off highs last couple minutes on late month end sales. Current 10YY at 3.9220% (+.0079) after tapping 3.9806% high in the first half (highest level since Nov 10 when rates surged on back of lower than expected Oct CPI: +0.4% MoM vs. 0.6% est, core +0.27% unrounded vs forecast of 0.5%, cooling rate hike expectations at the time).

- US FI mkts opened weaker following higher than expected inflation data for France and Spain overnight, see-sawed lows on spate mixed US data. Tsy futures ultimately rebounded off lows following drop in consumer confidence (102.9 vs. 106.0 prior) and weaker Chicago PMI (43.6 vs. 45.5 est.).

- Corporate debt and option-tied hedging added to early pressure, while markets remain skittish ahead month end rebalancing expected to draw selling in stocks vs. FI.

- STIR: Fed funds implied hike for Mar'23 at 29.4bp, May'23 cumulative 55.4bp to 5.133%, Jun'23 74.0bp to 5.318%, terminal at 5.415% in Aug-23-Oct'23.

OVERNIGHT DATA

- U.S. ADVANCE JAN GOODS TRADE BALANCE -$91.50B

- U.S. ADVANCE JAN WHOLESALE INVENTORIES -0.4%

- U.S. ADVANCE JAN RETAIL INVENTORIES EXCLUDING AUTOS +0.2%

- US REDBOOK: FEB STORE SALES +4.9% V YR AGO MO

- US REDBOOK: STORE SALES +5.3% WK ENDED FEB 25 V YR AGO WK

- US Q4 FHFA HPI Q/Q SA +0.3% V +8.4% Q4 2022

- US DEC FHFA HPI SA -0.1% V -0.1% NOV; +6.6% Y/Y

US DATA: MNI Chicago Business Barometer™ Weakened to 43.6 in February. The Chicago Business BarometerTM, produced with MNI, declined by a further 0.7 points in February to 43.6, the lowest since November ’22. The headline index signaled a sixth consecutive month of contractionary business activity.

- Employment decreased for a third month, slipping -4.7 points to 37.3. This is the weakest since June ’20 and outside of the April-June 2020 period the lowest since 2009.

- Prices Paid sank -7.2 points to 65.3, returning to late 2022 levels after having briefly surged in January.

- Production fell by 10.2 points to 38.4 in February, more than reversing last month’s 8.5 point jump higher.

- New Orders increased by 3.0 points. Despite being the highest since August ’22, the index remains contractive.

- Order Backlogs grew by 4.5 points after falling 19.2 points in January as easing supply chain pressures allowed for significant backlog catch-up.

- Supplier Deliveries gained 3.6 points.

- US CONF BOARD CONSUMER CONFIDENCE 102.9 IN FEB V JAN 106.0

- US FEB. RICHMOND FED FACTORY INDEX -16; EST. -5

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 186.11 points (-0.57%) at 32705.99

- S&P E-Mini Future down 2.75 points (-0.07%) at 3985.5

- Nasdaq up 28.5 points (0.2%) at 11495.28

- US 10-Yr yield is up 0 bps at 3.9142%

- US Mar 10-Yr futures are up 0.5/32 at 111-5

- EURUSD down 0.0027 (-0.25%) at 1.0582

- USDJPY down 0.07 (-0.05%) at 136.12

- WTI Crude Oil (front-month) up $1.14 (1.51%) at $76.82

- Gold is up $11.33 (0.62%) at $1828.50

- EuroStoxx 50 down 9.63 points (-0.23%) at 4238.38

- FTSE 100 down 58.83 points (-0.74%) at 7876.28

- German DAX down 16.29 points (-0.11%) at 15365.14

- French CAC 40 down 27.62 points (-0.38%) at 7267.93

US TREASURY FUTURES CLOSE

- 3M10Y -3.487, -92.203 (L: -96.624 / H: -84.715)

- 2Y10Y -1.875, -88.916 (L: -89.305 / H: -83.79)

- 2Y30Y -2.253, -88.074 (L: -88.536 / H: -83.993)

- 5Y30Y -0.726, -25.046 (L: -27.02 / H: -23.007)

- Current futures levels:

- Jun 2-Yr futures down 1.125/32 at 101-26.875 (L: 101-25.125 / H: 101-28.75)

- Jun 5-Yr futures down 1.5/32 at 107-0.5 (L: 106-25.75 / H: 107-03.75)

- Jun 10-Yr futures steady at 111-19.5 (L: 111-06.5 / H: 111-23)

- Jun 30-Yr futures down 2/32 at 125-8 (L: 124-09 / H: 125-13)

- Jun Ultra futures down 1/32 at 135-4 (L: 133-27 / H: 135-10)

US 10YR FUTURE TECHS: (M3) Bearish Outlook

- RES 4: 113-22 50-day EMA

- RES 3: 113-03 High Feb 15

- RES 2: 112-31+ 20-day EMA

- RES 1: 112-03 High Feb 24

- PRICE: 111-17 @ 16:08 GMT Feb 28

- SUP 1: 110-21 Low Feb 24

- SUP 2: 111-00 2.618 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-16 Lower 2.0% Bollinger Band

- SUP 4: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

Treasury futures remain in a clear downtrend and price is trading close to its recent lows. Last week’s extension lower maintains the current bearish sequence of lower lows and lower highs. Potential is seen for a move towards the 111.00 handle next, a Fibonacci projection. Moving average studies are in a bear mode position, highlighting current market sentiment. Initial resistance is seen at 112-03, the Feb 24 high.

EURODOLLAR FUTURES CLOSE

- Mar 23 steady at 94.925

- Jun 23 -0.015 at 94.465

- Sep 23 -0.010 at 94.325

- Dec 23 steady at 94.485

- Red Pack (Mar 24-Dec 24) -0.035 to -0.01

- Green Pack (Mar 25-Dec 25) -0.015 to +0.005

- Blue Pack (Mar 26-Dec 26) +0.005 to +0.005

- Gold Pack (Mar 27-Dec 27) +0.005 to +0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00314 to 4.55329% (-0.00842/wk)

- 1M +0.00743 to 4.66943% (+0.03457/wk)

- 3M +0.00857 to 4.97100% (+0.01757/wk)*/**

- 6M -0.00771 to 5.26343% (+0.02829/wk)

- 12M -0.00986 to 5.68157% (+0.04286/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $108B

- Daily Overnight Bank Funding Rate: 4.57% volume: $297B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.145T

- Broad General Collateral Rate (BGCR): 4.51%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $445B

- (rate, volume levels reflect prior session)

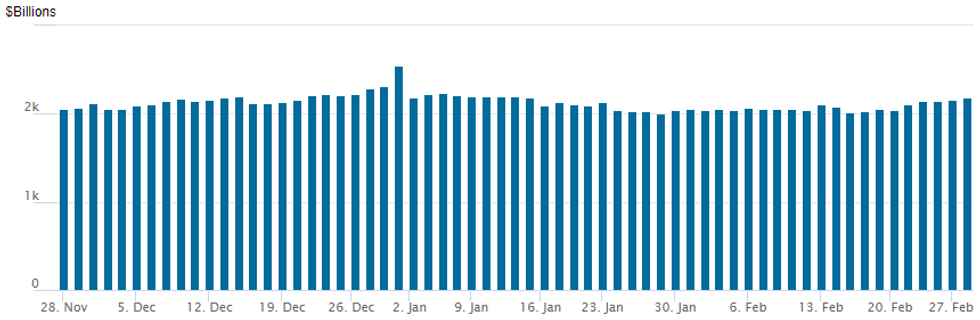

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,188.035B w/ 107 counterparties vs. prior session's $2,162.435B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.25B AstraZeneca 3Pt Launched

No confirmation of BOE's $2B 3Y issuance, otherwise $12.3B issued Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 02/28 $2.5B #Florida Power & Light $1B 5Y +90, $750M 10Y +120, $750M 30Y +140

- 02/28 $2.25B #AstraZeneca $1.1B 5Y +75, $650M 7Y +90, $500M 10Y +100

- 02/28 $2B #HSBC PerpNC5.5 sub AT1 8%

- 02/28 $2B Bank of England 3Y +13

- 02/28 $1.5B #CIGNA $700M 3NC1 +117, $800M 10Y +150

- 02/28 $1.5B #American Tower $700M 5Y +140, $800M 10Y +180

- 02/28 $1.3B #SMFG taps: $300M 3Y +105, $400M 5Y +140, $500M 7Y +155, $250M 10Y +170

- 02/28 $1.25B #Citigroup PerpNC5 7.375%

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/03/2023 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 01/03/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/03/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 01/03/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 01/03/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 01/03/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 01/03/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 01/03/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/03/2023 | 1000/1000 |  | UK | BOE Bailey Speech at Cost of Living Crisis Conference | |

| 01/03/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/03/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2023 | 1400/0900 |  | US | Minneapolis Fed's Neel Kashkari | |

| 01/03/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.