-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Not The October Surprise You Expected (test 2)

EXECUTIVE SUMMARY:

- MNI BRIEF: Trump Shows Mild Covid Symptoms After Positive Test

- MNI POLICY: Fed's Kaplan Says More QE May Distort Markets

- MNI POLICY: Kashkari Sees Grinding Recovery Even With Vaccine

- MN FED Kashkari: Job Report Disappointed, Recovery Long Way Off

- MNI DATA IMPACT: US September Payrolls Misses Expectations

- MNI EXCLUSIVE: Italy's ESM Deadlock Complicates Budget Plans

- PELOSI SAYS 'SIGNIFICANT DISAGREEMENT' REMAINS ON RELIEF BILL, Bbg

US

------------------------------------------------------------

Fed: Dallas Fed President Robert Kaplan said Friday keeping interest rates

around zero well into 2022 or 2023 should be enough monetary policy support, but

would reassess opposition to more QE if long yields surged. For more, see 10/02

main wire at 1411ET.

FED: The U.S. economy faces a "grinding" recovery even if a vaccine becomes

available in the next year, Minneapolis Fed President Neel Kashkari said, citing

Friday's payrolls report. For more, see 10/02 main wire at 1443ET.

US: U.S. President Donald Trump is experiencing "very light" COVID-19 symptoms,

Treasury Secretary Steven Mnuchin said Friday, while White House chief of staff

Mark Meadows says the President has "mild symptoms" and "continues to be

energetic" and "in good spirits." Vice President Mike Pence has tested negative

for coronavirus, his spokesman said on Friday, while Speaker Nancy Pelosi said

she was tested earlier in the morning and would receive results soon.

US DATA: U.S. payrolls growth slowed markedly in September, dipping below 1

million for the first time since the Covid-19 labor market recovery began in

May, the Bureau of Labor Statistics reported Friday.

EUROPE

------------------------------------------------------------

ITALY: Italy's governing coalition is unable to break a deadlock over reform of

the European Union's bailout fund, despite a strong performance in regional

elections and pressure from the EU, meaning that EUR37 billion in earmarked

funds are unlikely to be included in the upcoming budget law, lawmakers told

MNI. For more, see 10/02 main wire at 1205ET.

OVERNIGHT DATA

------------------------------------------------------------

US DATA: September Payrolls +661k; Unemployment Rate 7.9%

* U.S. nonfarm payrolls grew by 661,000 in September, below market expectations

for a 875,000 gain, according to figures released Friday by the Bureau of Labor

Statistics.

* August payrolls were revised up to 1.489 million (prev 1.371 million).

* Private payrolls rose by 877,000, slightly above expectations for a 875,000

increase. That was mostly led by service-producing industries like wholesale

trade (+784,000), leisure and hospitality (+318,000), and retail trade

(+142,400).

* Government payrolls fell by a larger-than-expected 216,000 after growing by

467,000 in August. That's mainly a reflection of a 213,000 drop in payrolls

growth among local educators.

* The unemployment rate continued to fall in September, dropping to 7.9% from

8.4% in August. Markets had expected a drop to 8.2%.

* The effects of a persistent misclassification error that has skewed

unemployment figures since March was minimal in September, and the unemployment

rate would have been 0.4 percentage points higher than reported, the BLS said.

* Average hourly earnings were up 0.1% after rising 0.3% in August. The average

workweek increased by one-tenth to 34.7 hours from 34.6 hours in August.

* Nonfarm payrolls were down 10.7 million from February.

US AUG FACTORY ORDERS +0.7%; EX-TRANSPORT NEW ORDERS +0.7%

US AUG DURABLE ORDERS +0.5%

US AUG NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +1.9%

MICHIGAN SEPT. CURRENT CONDITIONS AT 87.8 VS PRELIM. 87.5

New York Fed Staff Nowcast stands at 14.0% for 2020:Q3 and 4.8% for 2020:Q4

MARKETS SNAPSHOT

- DJIA down 38.7 points (-0.14%) at 27816.9

- S&P E-Mini Future down 18.25 points (-0.54%) at 3321.75

- Nasdaq down 216.7 points (-1.9%) at 11326.51

- US 10-Yr yield is up 1.7 bps at 0.694%

- US Dec 10Y are down 3/32 at 139-14.5

- EURUSD down 0.0034 (-0.29%) at 1.1717

- USDJPY down 0.15 (-0.14%) at 105.16

- WTI Crude Oil (front-month) down $1.79 (-4.62%) at $37.09

- Gold is down $2.43 (-0.13%) at $1908.93

European bourses closing levels:

- EuroStoxx 50 down 3.16 points (-0.1%) at 3165.16

- FTSE 100 up 22.67 points (0.39%) at 5835.35

- German DAX down 41.73 points (-0.33%) at 12610.53

- French CAC 40 up 0.84 points (0.02%) at 4784.79

US TSY SUMMARY: Data? What data? Headlines lead market moves Friday, not

headline jobs report: U.S. nonfarm payrolls grew by 661,000 in September, below

market expectations for a 875,000 gain, according to figures released Friday by

the Bureau of Labor Statistics.

- After a strong open, futures weaker across the curve but off mid-morning lows

after the bell. Overnight risk-off support after POTUS and FLOTUS contract

virus, reversed midmorning on hopes of stimulus bill being passed, sources

citing House Speaker Pelosi headline that lawmakers will "GET SOMETHING DONE ON

STIMULUS".

- Late rebound in rates after "Significant disagreement" remains said House

Speaker Pelosi, contributing to bounce off lows in rates.

- Some additional uncertainty over campaign related headlines underscoring

latest bounce in rates: "PENCE PLANS TO RESUME CAMPAIGN EVENTS" Bbg and "ALL

CAMPAIGN EVENTS WITH TRUMP BECOME VIRTUAL OR POSTPONED" Bbg.

- The 2-Yr yield is up 0.4bps at 0.1309%, 5-Yr is up 1bps at 0.2816%, 10-Yr is

up 1.7bps at 0.694%, and 30-Yr is up 2.7bps at 1.4821%.

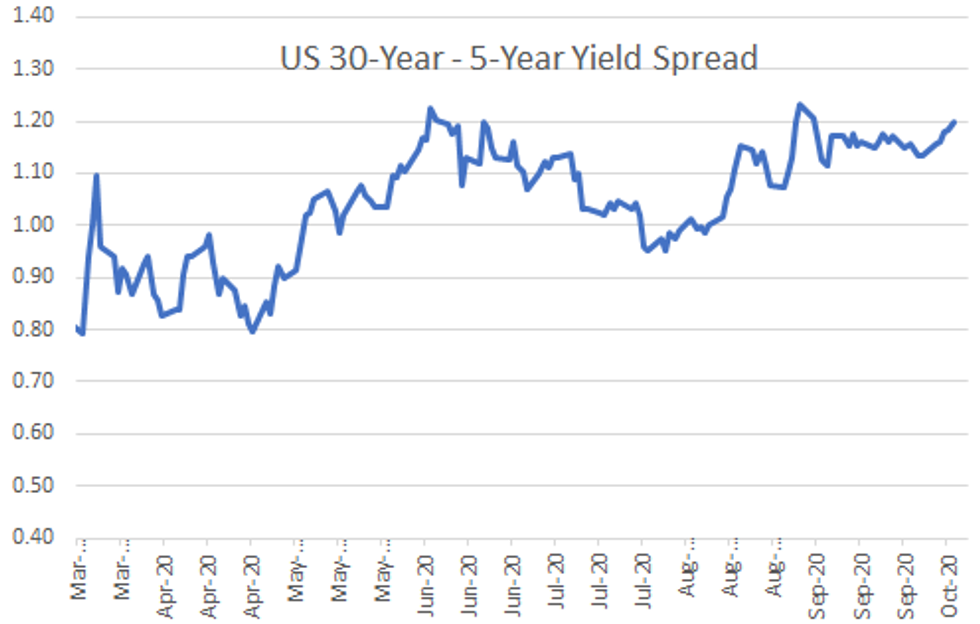

US TSY FUTURES CLOSE: Weaker, but off midmorning lows after a strong start. Yld

curves steeper, update:

3M10Y +1.740, 60.243 (L: 54.951 / H: 60.903)

2Y10Y +1.451, 56.107 (L: 52.785 / H: 56.767)

2Y30Y +2.429, 134.86 (L: 129.961 / H: 135.916)

5Y30Y +1.453, 119.608 (L: 116.42 / H: 120.98)

Current futures levels:

Dec 2Y -0.37/32 at 110-14.625 (L: 110-14.37 / H: 110-15.62)

Dec 5Y -2/32 at 125-30.75 (L: 125-29.5 / H: 126-03.5)

Dec 10Y -3.5/32 at 139-14 (L: 139-12 / H: 139-25)

Dec 30Y -15/32 at 175-28 (L: 175-19 / H: 177-00)

Dec Ultra 30Y down 1-4/32 at 220-22 (L: 220-02 / H: 223-03)

US TSYS/SUPPLY: Preview next week's auctions:

DATE TIME AMOUNT SECURITY (CUSIP)/ANNC

-------------------------------------------------

05-Oct 1130ET $54B 13W-Bill (9127963T4)

05-Oct 1130ET $51B 26W-Bill (9127964X4)

06-Oct 1130ET $30B 42D-Bill CMB (9127963A5)

06-Oct 1130ET $30B 119D-Bill CMB (9127963W7)

06-Oct 1300ET $34B 52W-Bill (9127964V8)

06-Oct 1300ET $52B 3Y-Note (91282CAP6)

07-Oct 1130ET TBA 105D Bill CMB 05-Oct

07-Oct 1130ET TBA 154D Bill CMB 05-Oct

07-Oct 1300ET $35B 10Y-Note/R/O (91282CAE1)

08-Oct 1130ET TBA 4W-Bill 06-Oct

08-Oct 1130ET TBA 8W-Bill 06-Oct

08-Oct 1300ET $23B 30Y-Bond/R/O (912810SP4)

US EURODLR FUTURES CLOSE: Futures trade steady to mildly bid in the short end

after the bell, most of Reds through Golds weaker, decent volumes with unusually

strong levels in Blue Mar'24-Jun'24 both >105k after heavy put option structure

buys.

Dec 20 steady at 99.755

Mar 21 steady at 99.80

Jun 21 +0.005 at 99.810

Sep 21 +0.010 at 99.810

Red Pack (Dec 21-Sep 22) -0.005 to +0.005

Green Pack (Dec 22-Sep 23) -0.01 to -0.005

Blue Pack (Dec 23-Sep 24) -0.02 to -0.015

Gold Pack (Dec 24-Sep 25) -0.025

US DOLLAR LIBOR: Latest settles

O/N -0.00050 at 0.08125% (+.00312/wk)

1 Month +0.00050 to 0.14000% (-0.00613/wk)

3 Month -0.00050 to 0.23350% (+0.01572/wk)

6 Month -0.00575 to 0.24475% (-0.02650/wk)

1 Year -0.00238 to 0.35750% (-0.01175/wk)

STIR: FRBNY EFFR for prior session:

Daily Effective Fed Funds Rate: 0.09% volume: $61B

Daily Overnight Bank Funding Rate: 0.08%, volume: $153B

US TSYS: REPO REFERENCE RATES

Secured Overnight Financing Rate (SOFR): 0.08%, $1.020T

Broad General Collateral Rate (BGCR): 0.05%, $374B

Tri-Party General Collateral Rate (TGCR): 0.05%, $338B

(rate, volume levels reflect prior session)

FED: Next Week's NY Fed Operational Purchase Schedule

Mon 10/05 1100-1120ET: Tsy 7Y-20Y, appr $3.625B

Tue 10/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

Wed 10/07 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

Thu 10/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

Fri 10/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: Issuers Remain Sidelined Pre/Post Data

Date $MM Issuer (Priced *, Launch #)

10/02 Nothing scheduled for Friday as yet

Only $950M priced Thursday

10/01 $550M *Union Electric 30Y +118

10/01 $400M *New England Power 30Y +135

FOREX: Trump Diagnosis Leaves Markets Pondering Stimulus Chances

* An aggressive wave of risk-off early Friday on the breaking news of President

Trump's COVID-19 diagnosis faded into the Friday close, with markets speculating

that the illness could catalyze lawmakers into making a deal on fiscal stimulus

sooner than previously expected. While JPY remained the strongest performer in

G10 throughout, the gains faded as equities recovered and bounced back to flat.

* GBP also firmed, with markets looking ahead to a scheduled call between UK PM

Johnson and EU's Von der Leyen on Saturday. Talks have been extended into the

coming weeks and markets clearly still see a decent chance of a last minute

deal.

* AUD, NZD and EUR were the weakest performers Friday, trimming the week's

gains.

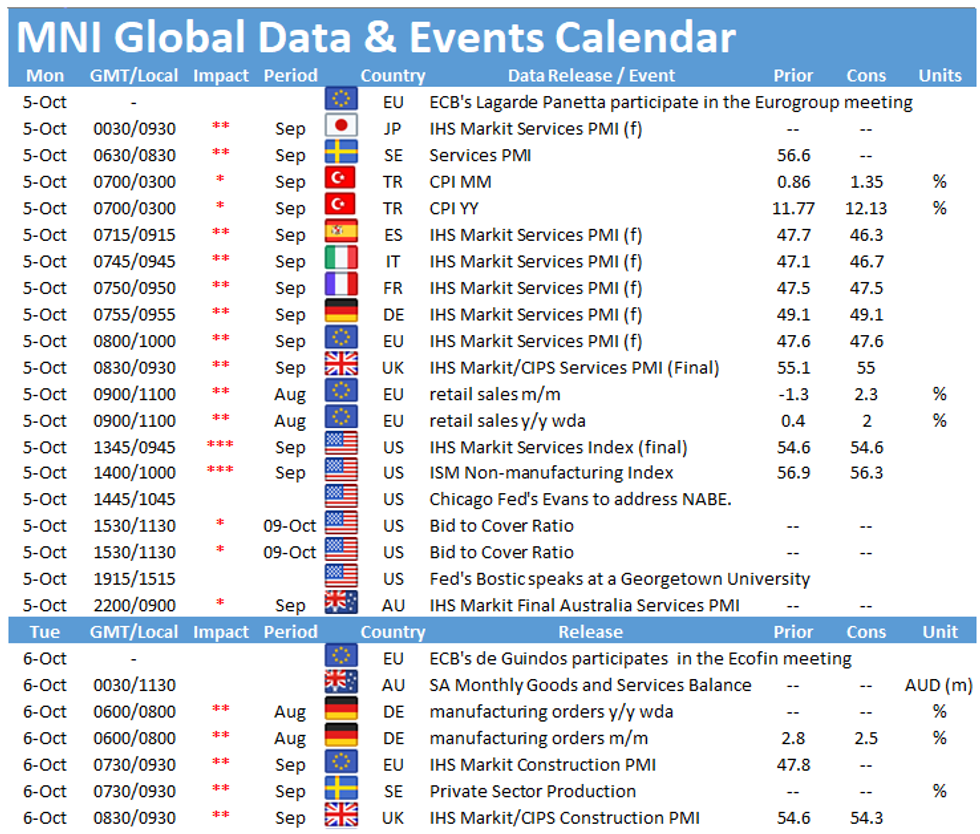

* Focus in the coming week turns to the US ISM Services Index, RBA rate

decision, FOMC & ECB minutes and the Canadian jobs report. Speeches from ECB's

Lagarde, BoE's Bailey and BoC's Macklem will also draw focus.

EGB: Weekend Brexit Discussions Eyed

A lack of clear direction today for Bunds as various headlines shifted sentiment

in both directions, though Gilts bear steepened on hopes of a UK-EU deal.

* Overnight the shock Trump COVID diagnosis boosted Core FI, which then reversed

on news early in London trading that UK PM Johnson would meet the EU's von der

Leyen on Saturday, boosting hopes of a breakthrough in talks; later, US fiscal

stimulus hopes pushed global yields higher.

* Downside surprises in Eurozone core/headline CPI for Sept had little impact.

* BTPs closed strongly, capping a very good week for Italian and periphery

spreads in general. Closing levels:

* Germany: The 2-Yr yield is down 0.2bps at -0.709%, 5-Yr is down 0.4bps at

-0.725%, 10-Yr is unchanged at -0.536%, and 30-Yr is up 0.3bps at -0.103%.

* UK: The 2-Yr yield is up 0.7bps at -0.037%, 5-Yr is up 0.5bps at -0.06%, 10-Yr

is up 1.2bps at 0.246%, and 30-Yr is up 1.8bps at 0.818%.

10-Yr Periphery EGB Spreads:

* Italian BTP spread down 3.7bps at 132bps

* Spanish bond spread down 1.1bps at 75.7bps

* Portuguese PGB spread down 2.7bps at 75.6bps

* Greek bond spread down 3.2bps at 152.3bps

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.