-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains Buoy Tsy Yields Ahead FOMC

- MNI Fed Preview - Dec 2023: All Downhill From Here

- MNI INTERVIEW: Five Fed Cuts In 2024 Are 'Plausible' -Wilcox

- MNI INTERVIEW: US Demand Still Too Hot For Soft Landing

- MNI INTERVIEW: No BOC Rate Cuts Until Later In 2024-Conf Board

- MNI DATA: Surprise, Large Declines In U.Mich Inflation Expectations

- MNI US DATA: Stronger Than Expected NFP Report But Less Hawkish Than Rounded Figures Suggested

US

Fed Preview (MNI) - Dec 2023: All Downhill From Here

- The FOMC will hold rates in December for a 3rd consecutive meeting and the 4th in the past 5, further cementing expectations that the hiking cycle is over.

- But while the updated projections will acknowledge scope for cuts in 2024 alongside lower inflation forecasts, the FOMC will likely attempt a modest pushback against the recent loosening of financial conditions.

- Meaningful changes to the Statement’s tightening bias are unlikely until least one or two more meetings from now, while Chair Powell is likely to warn that the FOMC is proceeding carefully and is prepared to tighten further if required.

- With senior FOMC officials pointing out that rate cuts are consistent with maintaining restrictive policy in real terms as inflation falls, the "spread" between participants’ rate and inflation forecasts will be of increasing interest.

NEWS

INTERVIEW (MNI): Five Fed Cuts In 2024 Are 'Plausible' -Wilcox

Smaller rent increases alone can see core inflation fading to 2.1% by the second half of 2024, creating a path for the Fed to slowly dial back interest rates as soon as March, former Fed Board research director David Wilcox told MNI, and market bets on five reductions next year is plausible.

INTERVIEW (MNI): US Demand Still Too Hot For Soft Landing

Total nominal demand in the U.S. continues to grow too fast for achieving a soft landing, and monetary policy will need to remain restrictive for some time yet to kill off inflation, former Dallas Fed principal policy advisor Evan Koenig told MNI.

INTERVIEW (MNI): No BOC Rate Cuts Until Later In 2024-Conf Board

The Bank of Canada will likely refrain from raising interest rates further but will also remain cautious about reducing them until at least later next year amid stubborn pockets of inflation and a possible soft landing, Conference Board of Canada chief and former BOC economist Pedro Antunes told MNI.

EU (MNI): German Fin Min-Deal On Fiscal Rules Possible Before Christmas

EU Finance Ministers failed to reach an agreement on new fiscal rules after marathon talks in Brussels on 7 Dec and into 8 Dec. While reports suggest a number of issues held up the talks, the main schism remains between Germany and the 'frugals' on one side, demanding tighter rules for more highly indebted nations to trim deficits, and France, Italy and other southern countries in favour of more relaxed rules to allow for spending on defence and green transition while remaining within the rules.

ISRAEL (MNI): PA Head Abbas Calls For International Peace Conference

Speaking in an interview with Reuters, Palestinian Authority (PA) President Mahmoud Abbas states that an international peace conference is necessary to both end the Israel-Hamas war and find a lasting peace that could lead to Palestinian statehood.

US TSYS Markets Roundup: Surprise Jobs Gain Tempered by Down-Revisions

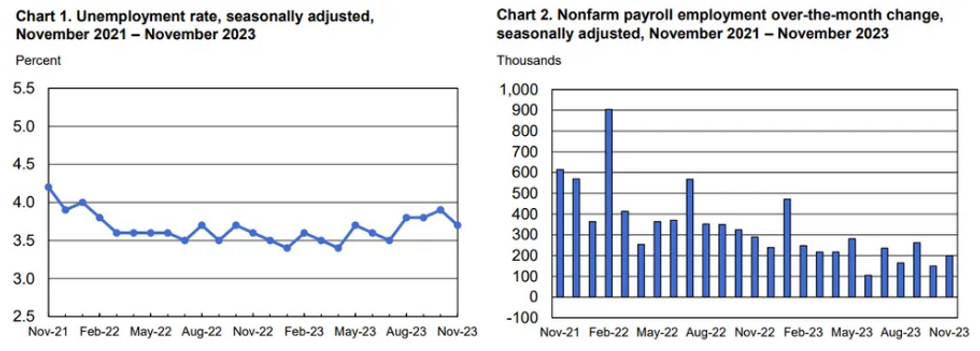

- Tsy futures gap lower after slightly stronger than expected Change in Nonfarm Payrolls (+199k vs. 183k est, +150k prior), Change in Private Payrolls softer (+150k vs.158k est, 99k prior), Unemployment Rate dips to 3.7% vs. 3.9% est.

- Futures quickly scaled back appr half the initial post-data sell-off as markets digested the down-revisions to prior and unrounded releases.

- U.S. employers added more jobs than expected in November and average hourly earnings growth was also hotter than expected, which could add to the Federal Reserve's resolve to keep rates higher for longer to cool the labor market and rein in inflation. Projected rate cut for March 2024 consolidated from -55.2% pre-data to -44.5% by the close, May 2024 down to -63.5% vs. -70.1% pre-data.

- Average hourly earnings added 0.4% in November, a tenth higher than expected and marking a gain of 4.0% over the past 12 months. The employment-to-population rate rose 0.3 percentage point as the labor force continued to expand.

- Tsys held off lows following higher than expected U. of Mich. Expectations that climbed to 66.4 vs. 57.0 est, (56.8 prior), Sentiment 69.4 vs. 62.0 est, while 1 Yr Inflation est fell to 3.1% vs. 4.3% est (4.5% prior), 5-10 Yr Inflation 2.8% vs. 3.1% est (3.2% prior).

- All relevant ahead of next Wednesday's FOMC policy announcement while markets get to see final CPI and PPI inflationary figures on Tuesday and Wednesday respectively.

OVERNIGHT DATA

- US NOV NONFARM PAYROLLS +199K; PRIVATE +150K, GOVT +49K

- US PAYROLLS NET REVISIONS TO AUG, SEPT -101K

- US PRIOR MONTHS PAYROLLS REVISED: OCT +150K; SEP +262K

- US NOV AVERAGE HOURLY EARNINGS +0.4% Vs OCT +0.2%; +4.0% YOY

- US NOV AVERAGE WEEKLY HOURS 34.4 HRS

- US NOV UNEMPLOYMENT RATE 3.7%

US DATA: U.S. employers added more jobs than expected in November and average hourly earnings growth was also hotter than expected, which could add to the Federal Reserve's resolve to keep rates higher for longer to cool the labor market and rein in inflation.

- There was a gain of 199,000 jobs in November, more than the 183,000 analysts had expected, the unemployment rate unexpectedly fell two-tenths to 3.7%, and more people entered the labor market.

- November job gains were led by healthcare (+77,000) and government (+49,000), and the end of a six-week strike against the three largest U.S. carmakers boosted motor vehicles and parts manufacturing jobs by 30,000, the Bureau of Labor Statistics said. Retail employment fell by 38,000.

- Average hourly earnings added 0.4% in November, a tenth higher than expected and marking a gain of 4.0% over the past 12 months. The employment-to-population rate rose 0.3 percentage point as the labor force continued to expand.

US DATA: AHE Unrounded And Trends - Nov'23 Total AHE:

- M/M (SA): 0.353% in Nov from 0.206% in Oct (initial 0.206%)

- Y/Y (SA): 3.963% in Nov from 4.042% in Oct AHE Non-Supervisory:

- M/M (SA): 0.411% in Nov from 0.344% in Oct (initial 0.344%)

- Y/Y (SA): 4.308% in Nov from 4.363% in Oct

AHE surprised with 0.35% M/M (rounded 0.4 vs cons 0.3) whilst the non-supervisory measure was again stronger than the overall measure, rising 0.41% M/M after 0.34% M/M.

It leaves 3-month annualized rates at 3.4% and 4.2% annualized, although recent extremely strong productivity growth has taken the edge off those from an inflationary pressure aspect.

US DATA: U.Mich consumer sentiment was much stronger than expected in the preliminary December report, at 66.4 (cons 57.0) after 56.8.

- 1Y inflation expectations slumped to 3.1% (cons 4.3%), its lowest since Mar 2021 having touched 3.2% in September before jumping to 4.5% in Oct.

- 5-10Y inflation expectations also fell much more than expected to 2.8% (cons 3.1) after the surprise increase to 3.2% pushed it to the highest since 2011. Instead, it now reads the lowest since Sep 2022 and before that Jul’21.

US TREASURY FUTURES CLOSE

- 3M10Y +8.378, -117.001 (L: -127.657 / H: -113.363)

- 2Y10Y -4.615, -49.52 (L: -50.149 / H: -43.674)

- 2Y30Y -7.793, -41.932 (L: -42.528 / H: -33.125)

- 5Y30Y -5.786, 6.093 (L: 5.865 / H: 12.672)

- Current futures levels:

- Mar 2-Yr futures down 10.125/32 at 102-5.375 (L: 102-04.75 / H: 102-14.625)

- Mar 5-Yr futures down 21/32 at 106-30.75 (L: 106-26.5 / H: 107-17.25)

- Mar 10-Yr futures down 28.5/32 at 110-8.5 (L: 110-00.5 / H: 111-01)

- Mar 30-Yr futures down 1-8/32 at 119-0 (L: 118-14 / H: 120-04)

- Mar Ultra futures down 1-24/32 at 126-26 (L: 126-09 / H: 128-12)

US 10Y FUTURE TECHS: (H4) Trading Closer To Its Recent Highs

- RES 4: 112-16 1.50 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 112-03 1.382 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 111-19 1.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 1: 111-09+ High Dec 7

- PRICE: 110-08+ @ 1500 ET Dec 8

- SUP 1: 109-21+ 20-day EMA

- SUP 2: 108-18+ Low Nov 27 and a key short-term support

- SUP 3: 107-22 Low Nov 14

- SUP 4: 107-11+ Low Nov 13 and a reversal trigger

The trend direction in Treasuries remains up. The contract has pulled back, however, price is still trading closer to its recent highs. The contract has cleared 110-25, the 1.00 projection of the Oct 19 - Nov 3 - Nov 13 price swing. This reinforces the bull theme and a continuation higher would open 111-19, the 1.236 projection. Note that moving average studies are also in a bull-mode position. Initial key support is at 108-18+, the Nov 27 low.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.020 at 94.615

- Mar 24 -0.085 at 94.810

- Jun 24 -0.140 at 95.115

- Sep 24 -0.180 at 95.445

- Red Pack (Dec 24-Sep 25) -0.205 to -0.185

- Green Pack (Dec 25-Sep 26) -0.17 to -0.15

- Blue Pack (Dec 26-Sep 27) -0.14 to -0.13

- Gold Pack (Dec 27-Sep 28) -0.125 to -0.115

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00241 to 5.35498 (+0.00832/wk)

- 3M -0.00579 to 5.36604 (-0.00919/wk)

- 6M -0.00947 to 5.29211 (-0.04879/Wk)

- 12M -0.00915 to 5.02012 (-0.09829/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.702T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $615B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $603B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

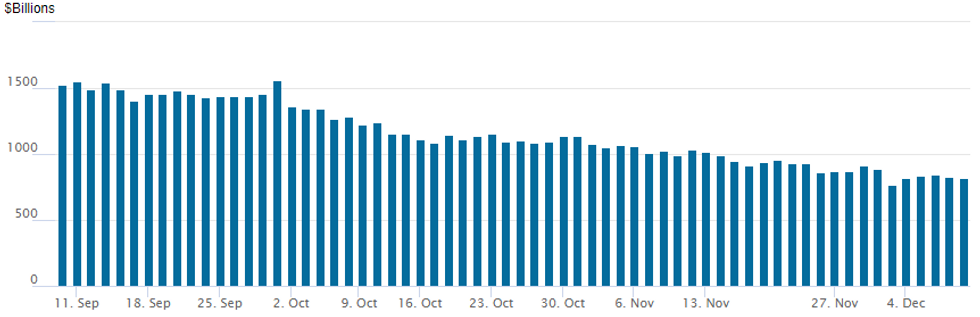

FED REVERSE REPO OPERATION

The NY Fed Reverse Repo operation usage slips to $821.408B w/ 82 counterparties vs. $825.734B yesterday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

PIPELINE: Over $24B High Grade Debt Issued on Week

- Date $MM Issuer (Priced *, Launch #)

- 12/08 No new high grade corporate issuance Friday, $24.175 total on week

- $1.6B Priced Thursday

- 12/07 $1B *Republic Services $350M 2029 tap +75, $650M 10Y +95

- 12/07 $600M *Athene 10Y +200

EGBs-GILTS CASH CLOSE: Core FI Gains Pared In Otherwise Strong Week

European yields rose sharply Friday, paring gains made earlier in the week but still mostly ending the week lower.

- After trending higher for most of the morning session, Bund and Gilt yields jumped in the afternoon as the highly anticipated US jobs report came in stronger than expected on both the unemployment rate and hourly earnings measures.

- ECB and BoE cut pricing for 2024 was reduced, sharply in the case of the ECB's (135bp of 2024 reductions implied, vs 143bp Thursday).

- The German curve closed bear flatter, with the UK's relatively flat. Periphery EGB spreads widened as ECB cut pricing was pared back.

- On the week, spurred by dovish ECB commentary for the most part, 10Y Bund yields dropped 9bp, having dropped 19bp at one point. Gilt yields fell 10bp on the week, vs 20bp at the lows.

- Next week's schedule is extraordinarily busy: in addition to the ECB and BoE decisions, we also get the Fed and US CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.7bps at 2.693%, 5-Yr is up 9.7bps at 2.234%, 10-Yr is up 8.5bps at 2.276%, and 30-Yr is up 6.6bps at 2.468%.

- UK: The 2-Yr yield is up 7.3bps at 4.59%, 5-Yr is up 8.1bps at 4.11%, 10-Yr is up 7.3bps at 4.041%, and 30-Yr is up 6.6bps at 4.526%.

- Italian BTP spread up 5.1bps at 179.7bps / Spanish up 2.1bps at 102.4bps

FOREX USD Index Firms, Underpinned by Solid Jobs Report

- The USD index has rallied the best part of half a percent on Friday, underpinned by both a recovery/stabilisation for USDJPY and a firm US jobs report that saw a higher-than-expected change in nonfarm payrolls and the unemployment rate edge down to 3.7%.

- The daily changes do not do justice to the aggressive intra-day price action across the G10 FX space. In particular USDJPY traded in a very volatile manner once more, although the 271-pip range fortunately stayed well within Thursday’s extremes. Over the data, the higher jobs figure and average hourly earning prompted USDJPY to trade as highs as 145.21, although the pair swiftly reversed course as the finer details of the rounded earnings data was not as hawkish as on first glance. With thoughts of yesterday’s collapse fresh on the mind, USDJPY sold off down to 143.76 in short order before stabilising.

- UMich data saw sentiment rise and inflation expectations fall which offered a further reprieve for the greenback and has translated into the 0.5% advance for the index. Overall, this equals the rally on the week as the dollar extends its recovery from the late-November lows.

- Underperfoming on the session was NZD (-0.71%), whereas the Canadian dollar showed relative resilience, rising 0.1% against the USD. The recent break of trendline support for USDCAD, drawn from the Jul 14 low, strengthens the current downtrend and signals scope for a continuation lower near-term.

- A busy macro calendar next week with three major central bank decisions (Fed, ECB & BOE) alongside US CPI, US Nov retail sales, Euro area & US December Flash PMI's.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/12/2023 | 0700/0800 | *** |  | NO | CPI Norway |

| 11/12/2023 | - | *** |  | CN | Money Supply |

| 11/12/2023 | - | *** |  | CN | New Loans |

| 11/12/2023 | - | *** |  | CN | Social Financing |

| 11/12/2023 | 1600/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 11/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/12/2023 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.