-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: OPEC Cuts Discounted After Soft ISM Data

EXECUTIVE SUMMARY

US

ISM: U.S. manufacturing contracted further in March as demand for goods declined and factories appear to be laying off workers, downgrading the view of growth this year, Institute for Supply Management economist Tim Fiore said Monday.

- "We're probably now 46 to 49 for probably Q2," he said in a call with reporters, cutting his estimate for the manufacturing PMI from a range of 48 to 52 over the next few months. "The probability of July and August being strong months is probably being pushed out. We're looking now at a Q4 increase in activity levels."

- "Companies are taking a much more conservative look than where they were in January in February and they're deciding that they need to bring that headcount down," he said. Manufacturing prices declined in March 2.1 percentage points to 49.2. "We've kind of stabilized on the pricing side and I don't think that we've gotten to the level that the Fed was hoping to get to, which is at 2%."

CANADA

BOC: Households and executives surveyed by the Bank of Canada see inflation remaining stubborn and well above target even with a mild recession expected in the next year, underlining why officials have said it's premature to think about lowering borrowing costs after pausing rate hikes last month.

- Most firms continue to see inflation running much faster than 2% until at least 2025, the Bank reported Monday. A separate survey showed households saw the current inflation rate at 7.1% and at 6% in a year. Those figures compare with recent record highs of 8% and 7.2% in the last quarterly report.

- "Most consumers think the Bank’s ability to get inflation back to target is hampered by high government spending and challenges with supply chains," according to the Survey of Consumer Expectations. Families struggling with inflation and higher interest rates are planning to cut back on discretionary purchases as their wages fail to keep up even in a strong job market, the report said. For more, see MNI Policy main wire at 1031ET.

US Tsys Near Highs, Weaker ISMs Outweigh Surge in Oil

- Tsys near midday highs after the bell, wide range for the week opener as lower than expected ISM data leavened concerns over higher inflation tied to a surge in crude prices overnight.

- Tsys gapped lower Sunday evening after OPEC+ announced over 1M bbl/day production cut, surprising markets and underscoring inflation concerns (read: prospect for renewed rate hikes).

- Tsy futures gapped higher after lower than expected ISMs quashed the oil-tied inflation/rate hike concerns. Drops in ISM sub-indices across the board (with the exceptions of production and customer inventories), with every one in below-50 territory. New orders, prices paid, and Employment down sharply.

- Fed funds implied hike for May'23 at 16.2bp, Jun'23 +13.8bp cumulative at 4.954% late. Meanwhile, projected rate cuts later in the year gained: Sep'23 cumulative -14.7bp (-11.1bp earlier) to 4.674%, to -50.4bp (40.6 earlier) for Dec'23 at 4.312.

- Front month Jun'23 10Y futures bounced back to March 27 level 115-21.5 (+24) , 115-16 after the bell, 10Y yield dropped to 3.3983% low vs. 3.4226% late. TYM3 through March 28 high resistance (115-07.5) put focus on key resistance of 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger.

- Markets may be more volatile this week due to thin liquidity w/ early Friday close ahead Easter weekend/spring holiday for some. Nevertheless, March employment data scheduled for Friday release (+240k est vs. +310k prior); ADP private employ this Wednesday (+210k est vs. +242k prior).

OVERNIGHT DATA

- US March Manufacturing PMI 49.2 vs Flash Reading 49.3

- US FEB PRIVATE CONSTRUCT SPENDING +0.0%

- US FEB PUBLIC CONSTRUCT SPENDING -0.2%

- US ISM MAR MANUF PURCHASING MANAGERS INDEX 46.3

- US ISM MAR MANUF PRICES PAID INDEX 49.2

- US ISM MAR MANUF NEW ORDERS INDEX 44.3

- US ISM MAR MANUF EMPLOYMENT INDEX 46.9

- While not as wide-ranging as the Senior Loan Officer Opinion Survey, today’s Dallas Fed Banking Conditions survey showed only a modest net tightening in credit standards and limited further deterioration in loan demand.

- Collected Mar 21-29 across 71 financial institutions headquartered in the Eleventh Federal Reserve District, credit standards were tightened across a net 36% of respondents vs 30% six weeks ago, but that’s still off the recent high of 37.5% in the Nov’22 survey.

MARKETS SNAPSHOT

Key late session market levels:

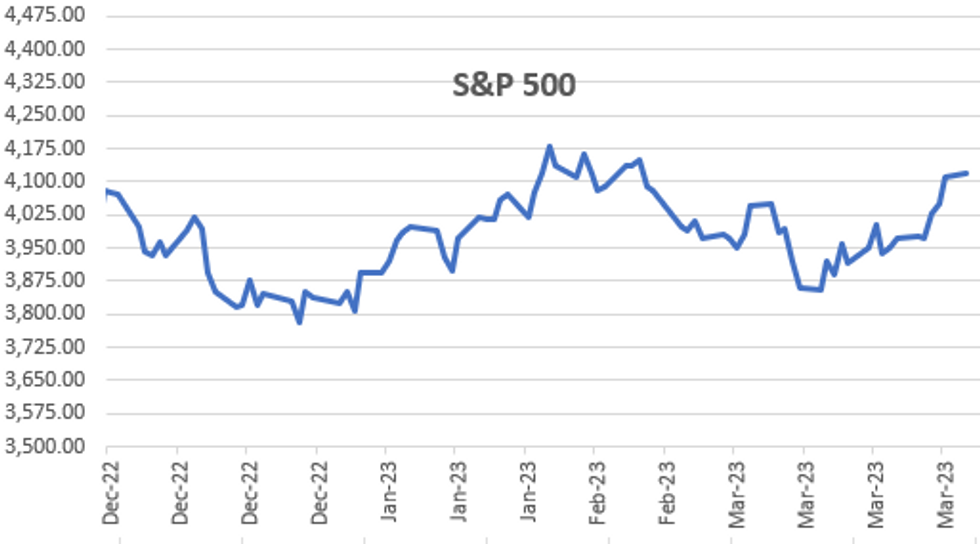

- DJIA up 323.66 points (0.97%) at 33593.21

- S&P E-Mini Future up 12.75 points (0.31%) at 4150

- Nasdaq down 60.7 points (-0.5%) at 12159.99

- US 10-Yr yield is down 4.3 bps at 3.4245%

- US Jun 10-Yr futures are up 17.5/32 at 115-15

- EURUSD up 0.0058 (0.54%) at 1.0897

- USDJPY down 0.51 (-0.38%) at 132.35

- WTI Crude Oil (front-month) up $4.91 (6.49%) at $80.57

- Gold is up $15.71 (0.8%) at $1984.98

- EuroStoxx 50 down 4 points (-0.09%) at 4311.05

- FTSE 100 up 41.26 points (0.54%) at 7673

- German DAX down 47.92 points (-0.31%) at 15580.92

- French CAC 40 up 23.57 points (0.32%) at 7345.96

US TREASURY FUTURES CLOSE

- 3M10Y -2.18, -135.862 (L: -144.618 / H: -127.488)

- 2Y10Y +0.833, -55.341 (L: -61.813 / H: -54.779)

- 2Y30Y +4.284, -33.668 (L: -44.389 / H: -33.408)

- 5Y30Y +4.64, 11.784 (L: 3.808 / H: 12.649)

- Current futures levels:

- Jun 2-Yr futures up 5.375/32 at 103-12.625 (L: 103-02.25 / H: 103-13.125)

- Jun 5-Yr futures up 13.25/32 at 109-29.5 (L: 109-08.75 / H: 110-01)

- Jun 10-Yr futures up 17.5/32 at 115-15 (L: 114-18 / H: 115-21.5)

- Jun 30-Yr futures up 26/32 at 131-31 (L: 130-12 / H: 132-14)

- Jun Ultra futures up 1-03/32 at 142-7 (L: 140-01 / H: 143-02)

US 10YR FUTURE TECHS: Is Recovering From Last Week’s Low

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger

- RES 1: 115-21+ Intraday high

- PRICE: 115-14+ @ 19:26 BST Apr 3

- SUP 1: 114-09+/07 20-day EMA / Low Mar 29

- SUP 2: 113-27+ 50-day EMA

- SUP 3: 113-26 Low Mar 22

- SUP 4: 113-08+ Low Mar 15

Treasury futures have started the week on a firm note as the contract recovers from last week’s 114-07 low on Mar 29 / 30. A bearish threat remains present following last week’s bearish signals - a shooting star on Mar 24 and a bearish engulfing candle on Mar 27. On the downside, the trigger for a resumption of weakness is 114-07. On the upside, a continuation higher would instead expose key resistance at 117-01+, the Mar 24 high.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.040 at 94.740

- Sep 23 -0.005 at 95.130

- Dec 23 +0.050 at 95.490

- Mar 24 +0.10 at 95.935

- Red Pack (Jun 24-Mar 25) +0.135 to +0.155

- Green Pack (Jun 25-Mar 26) +0.075 to +0.115

- Blue Pack (Jun 26-Mar 27) +0.060 to +0.070

- Gold Pack (Jun 27-Mar 28) +0.055 to +0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00543 to 4.80629% (-0.00800 total last wk)

- 1M +0.00000 to 4.85771% (+0.02714 total last wk)

- 3M +0.02986 to 5.22257% (+0.09128 total last wk)*/**

- 6M +0.00686 to 5.31986% (+0.32571 total last wk)

- 12M +0.02585 to 5.33114% (+0.46943 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.22257% on 4/3/23

- Daily Effective Fed Funds Rate: 4.83% volume: $86B

- Daily Overnight Bank Funding Rate: 4.82% volume: $175B

- Secured Overnight Financing Rate (SOFR): 4.87%, $1.408T

- Broad General Collateral Rate (BGCR): 4.80%, $479B

- Tri-Party General Collateral Rate (TGCR): 4.80%, $470B

- (rate, volume levels reflect prior session)

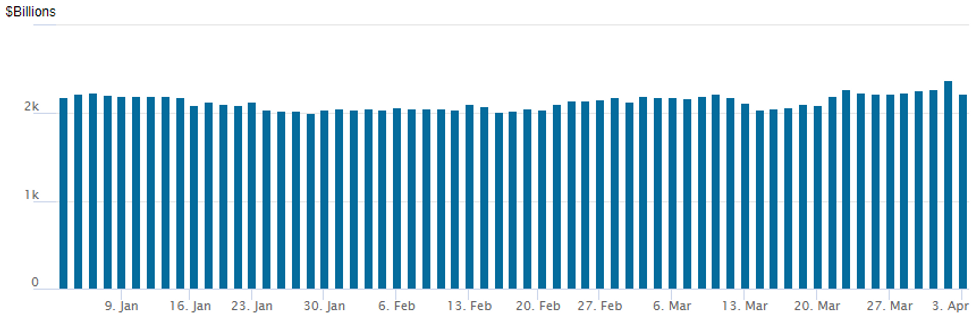

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,221.010B w/ 101 counterparties, compares to Friday's 2023 record high usage of $2,375.171B. Record high of $2,553.716B from December 30, 2022 remains intact.

PIPELINE: $1.5B Ford 5Y Debt Launched

April kicks off with $4.75B corporate issuance- Date $MM Issuer (Priced *, Launch #)

- 04/03 $2.25B #GM $1.25B 3Y +170, $1B 7Y +240 (3Y SOFR dropped)

- 04/03 $1.5B #Ford 5Y +6.8%

- 04/03 $500M *Shinhan Bank 5Y +107

- 04/03 $500M #McCormick WNG 10Y +153

- 04/03 $Benchmark Hashemite Kingdom of Jordan +5Y investor calls

- 04/03 $3.84B Citrix 6.5Y NC 2.5Y note roadshow Monday-Tuesday

- Expected to issue Tuesday:

- 04/04 $Benchmark World Bank (IBRD) 5Y SOFR+39a

- 04/04 $Benchmark KFW 2026 SOFR+22a

- 04/04 $Benchmark IADB 10Y SOFR +54a

EGBs-GILTS CASH CLOSE: From Bear Flattening To Bull Flattening

European bonds rallied after an early selloff, with Bunds and Gilts ending Monday's session stronger.

- Yields jumped on the open as oil prices shot higher on an unexpected OPEC+ output cut announcement made over the weekend. The German and UK curves bear flattened.

- But the move reversed later in the session, with curves ultimately bull flattening. A very weak US ISM manufacturing reading was a key driver in the European afternoon, with yields hitting session lows.

- ECB hawk Holzmann said a 50bp hike in May was "still on the cards", with the OPEC+ decision adding to inflation on the margin. That bumped up ECB May hike pricing slightly, but didn't have much of an impact further down the strip, and reversed alongside the broader rate move.

- ECB and BoE terminal pricing finished basically flat on the day, after early 5-6bp rises.

- Periphery EGB spreads widened, with the exception of Portugal (possibly follow-through from Friday's funding announcement).

- Comments by BoE's Pill are the highlight of Tuesday's docket.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.9bps at 2.674%, 5-Yr is down 2.3bps at 2.287%, 10-Yr is down 3.7bps at 2.255%, and 30-Yr is down 5.7bps at 2.306%.

- UK: The 2-Yr yield is down 5.4bps at 3.39%, 5-Yr is down 5.7bps at 3.3%, 10-Yr is down 6bps at 3.43%, and 30-Yr is down 8.1bps at 3.758%.

- Italian BTP spread up 4.1bps at 184.6bps / Portuguese down 0.9bps at 82.3bps

FOREX: Greenback Reverses Early Advance, AUD Soars Before RBA

- News from Opec+ regarding surprise crude output cuts inspired a firm rally for the US dollar in early trade on Monday. However, a sharp reversal lower for US yields, exacerbated by lower-than-expected US ISM Manufacturing data have prompted a substantial reversal lower for the USD index, which sits down 0.3% as we approach the APAC crossover.

- Leading the G10 charge on the rebound has been the Australian dollar. AUDUSD is currently up 1.36% on the day and is trading at the highest levels since February 24. The 50-day exponential moving average at 0.6751 has been breached, signalling scope for a stronger short-term recovery. The significant rally comes before Tuesday’s RBA decision where analysts remain split between an unchanged decision and a 25bp rate hike.

- USDJPY (-0.45%) weakness also prevailed amid the lower US yields with the pair reversing over 1% from the overnight 133.76 highs. Overall, trend conditions remain bearish with gains being seen as technically corrective to this point. The 50-day EMA, intersecting at 133.34, was breached earlier today but remains the key short-term hurdle for bulls.

- Similar half a percent gains have been seen for the likes of EUR, CAD, NZD and GBP.

- Cable has regained the 1.24 handle on Monday with recent gains exposing resistance at 1.2448, the Jan 23 high and this remains a key medium-term hurdle for bulls. A break of this level would highlight a 3-months range breakout and more importantly, a resumption of the uptrend.

- Following the RBA decision on Tuesday, JOLTS data highlights the US docket. Focus then turns to the RBNZ on Wednesday before the US ISM Services PMI data.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/04/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 04/04/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/04/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Keynote Speech at RES Conference | |

| 04/04/2023 | 1230/0830 | * |  | CA | Building Permits |

| 04/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/04/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 04/04/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/04/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/04/2023 | 1630/1730 |  | UK | BOE Pill Speech at ICMB | |

| 04/04/2023 | 1730/1330 |  | US | Fed Governor Lisa Cook | |

| 04/04/2023 | 2245/1845 |  | US | Cleveland Fed's Loretta Mester | |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.