-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Projected 2024 Rate Cut Remains Muted

- MNI INTERVIEW: Kaplan Says Loose Fiscal Is Holding Up Fed Cut

- MNI EU: 5-10 EU States Seen Facing Excessive Deficit Procedures

- MNI SECURITY: Lavrov Escalates Nuclear Rhetoric Following US Movement On New UKR Aid

- MNI POLAND/NATO: Poland's Duda Raises Tensions With Comments On Nuclear Posture

US

INTERVIEW (MNI): Kaplan Says Loose Fiscal Is Holding Up Fed Cut: Former Dallas Fed President Robert Kaplan told MNI the central bank needs to refrain from cutting interest rates perhaps all the way through this year depending on incoming data, blaming the lack of relief on loose fiscal policy he says is propping up services inflation.

- "I would be kicking the can down the road and I would not be ready to cut rates until I saw more sustained improvement but I would also be keeping my options open," he said in an interview. "I would be prepared to consider that we might do a couple and I'd be prepared to do zero," he said about potential rate cuts. He saw little cause for any further increases in borrowing costs.

- The short-term neutral rate has probably climbed due to the strong and persistent boost to the economy from fiscal spending, Kaplan said. "Monetary policy is highly restrictive, however, fiscal policy is historically stimulative," he said. (See: MNI INTERVIEW: Fed Only Likely To Cut Once This Year - Giannoni)

US TSYS Rates Off Lows, Fed in Blackout, Earning Cycle Accelerates

- Mildly weaker after the bell, Treasury futures are see-sawing near the top end of the session range, curves steeper with the short end outperforming. Rebound partially tied to Middle East risk not gaining.

- Currently, Jun'24 10Y futures are trading 107-28 (-1), well below initial technical resistance of 108-22.5 (High Apr 19). The 2s10s curve is currently +1.479 at -35.458.

- No data or Fed speakers on the week open, the latter in Blackout through May 2.

- Corporate issuance rather muted as the latest earnings cycle gathers steam, though American Express issued $3.5B debt over 4 tranches that generated some rate lock hedging in the short end.

- Corporate earnings: Verizon and Albertsons announced ahead of the open, Nucor, Alexandria Real Estate, Globe Life after the close. Expected Tuesday: Pepsico, UPS, GM, Halliburton, Philip Morris, Pulte, Freeport McMoRan, Lockheed Martin, JetBlue, GE, Kimberly-Clark, Sherwin-Williams, Baker Hughes, Tesla, Texas Instruments, Visa, Enphase, Seagate.

- Projected rate cut pricing running steady to mildly lower vs. late Friday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at 11.6bp, Sep'24 cumulative -22.3bp.

- Look ahead: economic data picks up Tuesday with regional manufacturing data from Philly and Richmond Fed, S&P PMIs and New Home Sales.

NEWS

EU (MNI): 5-10 EU States Seen Facing Excessive Deficit Procedures: Between five and 10 European Union states are likely to face excessive deficit procedures based on 2023 deficit and debt data validated by Eurostat on Monday, EU sources told MNI. The European Commission told MNI it would not speculate on specific states at this stage but noted that governments had been told on numerous occasions of its intention to open EDPs in the spring on the basis of the Eurostat data.

ECB (Bbg): Lagarde Reiterates Europe, US Shouldn’t Engage in Subsidy Race: European Central Bank President Christine Lagarde reiterated that Europe and the US should avoid excessively offering economic perks in a bid to boost growth. “We should not become engaged in a subsidy race between our economies, which creates a zero-sum game,” Lagarde said Monday in a speech at Yale University.

SECURITY (MNI): Lavrov Escalates Nuclear Rhetoric Following US Movement On New UKR Aid: Wires carrying comments from Russian Foreign Minister Sergei Lavrov appearing to escalate nuclear rhetoric. The comments come after the United States House of Representatives approved a USD$60 bln package of aid to Ukraine, and ahead of a trip to China from US Secretary of State Antony Blinken where he is expected to warn of the consequences of Beijing's continued, "support for Russia’s defense industrial base."

POLAND/NATO (MNI): Poland's Duda Raises Tensions With Comments On Nuclear Posture: Polish President Andrzej Duda said in an interview today that Poland is “ready” to host nuclear weapons on its territory - A move which, although unlikely, would dramatically shrink the nuclear buffer zone between Russia and NATO. The remarks, taken with other recent comments from Moscow and Beijing suggests that nuclear risk may be increasing.

US-RUSSIA (MNI): Kremlin: Seizing Frozen Russian Assets Would Lead To Retaliation: Wires carrying comments from Kremlin spokesperson Dmitry Peskov on issues related to US Congress’ likely authorization of new aid to Ukraine. Peskov said that additional military aid to Ukraine, “will not change the situation at the front,” rather, “lead to more losses for Ukraine,” and noting that Russian President Vladimir Putin “expected” the decision.

OVERNIGHT DATA

No US economic data released Monday.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 329.89 points (0.87%) at 38315.61

- S&P E-Mini Future up 55 points (1.1%) at 5058.75

- Nasdaq up 206.3 points (1.3%) at 15487.52

- US 10-Yr yield is down 0.4 bps at 4.6167%

- US Jun 10-Yr futures are down 1/32 at 107-28

- EURUSD down 0.0003 (-0.03%) at 1.0653

- USDJPY up 0.2 (0.13%) at 154.84

- WTI Crude Oil (front-month) down $0.29 (-0.35%) at $82.85

- Gold is down $62.36 (-2.61%) at $2329.57

- European bourses closing levels:

- EuroStoxx 50 up 18.76 points (0.38%) at 4936.85

- FTSE 100 up 128.02 points (1.62%) at 8023.87

- German DAX up 123.44 points (0.7%) at 17860.8

- French CAC 40 up 17.95 points (0.22%) at 8040.36

US TREASURY FUTURES CLOSE

- 3M10Y +2.029, -79.639 (L: -87.378 / H: -74.789)

- 2Y10Y +1.479, -35.458 (L: -36.946 / H: -33.004)

- 2Y30Y +2.812, -25.136 (L: -28.163 / H: -22.799)

- 5Y30Y +2.181, 6.043 (L: 3.162 / H: 7.418)

- Current futures levels:

- Jun 2-Yr futures down 0.25/32 at 101-16.5 (L: 101-14.125 / H: 101-17.875)

- Jun 5-Yr futures down 0.25/32 at 105-1.75 (L: 104-27 / H: 105-04)

- Jun 10-Yr futures down 1/32 at 107-28 (L: 107-17.5 / H: 107-31)

- Jun 30-Yr futures down 2/32 at 114-18 (L: 113-31 / H: 114-22)

- Jun Ultra futures down 4/32 at 120-29 (L: 120-06 / H: 121-04)

US 10Y FUTURE TECHS: (M4) Bearish Trend Structure

- RES 4: 109-31 50-day EMA

- RES 3: 109-26+ High Apr 10

- RES 2: 108-31+ 20-day EMA

- RES 1: 108-22+ High Apr 19

- PRICE: 107-27+ @ 1100 ET Apr 22

- SUP 1: 107-13+ Low Apr 16

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend outlook in Treasuries is unchanged and a bear cycle remains in play. Last week’s move lower reinforces the current bear theme and the move down has resumed this year’s bear trend and in the process, cleared a number of short-term support points. Moving average studies remain in a bear-mode set-up too, reinforcing current conditions. Sights are on 107.07+ next, a Fibonacci retracement. Firm resistance is 108-31+, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.010 at 94.730

- Sep 24 -0.005 at 94.885

- Dec 24 steady00 at 95.065

- Mar 25 +0.005 at 95.250

- Red Pack (Jun 25-Mar 26) -0.005 to steady

- Green Pack (Jun 26-Mar 27) -0.005 to -0.005

- Blue Pack (Jun 27-Mar 28) -0.005 to -0.005

- Gold Pack (Jun 28-Mar 29) -0.01 to -0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00119 to 5.31571 (-0.00239 total last wk)

- 3M -0.00346 to 5.32294 (-0.00116 total last wk)

- 6M -0.00487 to 5.29803 (-0.00047 total last wk)

- 12M +0.00153 to 5.21604 (+0.02823 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.780T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $701B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $689B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $256B

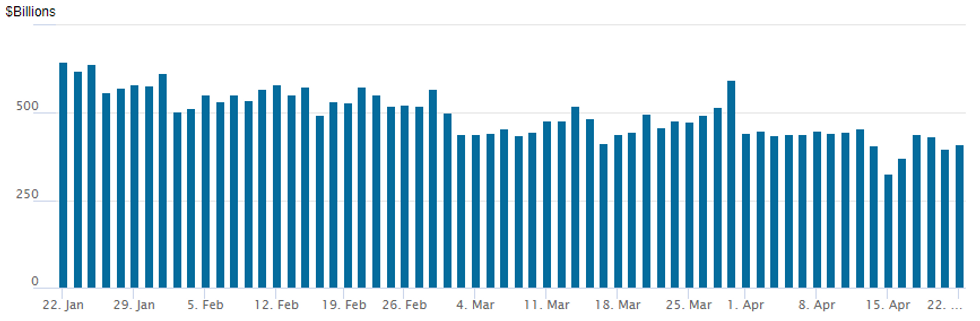

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage back over $400B to $409.816B Monday vs. $397.234B Friday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties climbs to 73 vs. 68 prior.

PIPELINE $3.5B American Express 4Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 4/22 $3.5B #American Express $1.3B 3NC2 +68, $300M 3NC2 SOFR+75, $1.4B 6NC5 +88, $500M 11NC10 +130

- 4/22 $Benchmark CDP (Italian bank) 5Y investor calls

- 4/22 $Benchmark OCP 10Y, 30Y investor calls

- Expected Tuesday:

- 4/23 $Benchmark Canada Gov Int Bond 5Y +12a

- 4/23 $Benchmark Kuwait Int Bank Reg S 5.5Y Sukuk investor calls

EGBs-GILTS CASH CLOSE: Dovish ECB/BoE Repricing Spurs Bull Steepening

Core FI reversed early losses to close Monday stronger, with Gilts outperforming Bunds.

- In a quiet day for European data, central banker commentary continued to be the driving force in rates.

- UK short-end yields fell further as last week's dovish BoE speak continued to be priced. Implied 2024 BoE cuts increased by 7bp to 59bp, the most since April 10.

- While he is a noted dove, ECB's Centeno's comment Monday that easing this year could exceed 100bp helped implied 2024 ECB rate cuts rise 4bp on the day to 78bp.

- Against this backdrop, both the German and UK curves bull steepened.

- Periphery EGBs benefited from benign ratings announcements Friday as well as the softer central bank rate outlook, with BTP spreads compressing the most in 2 months despite an otherwise mixed backdrop.

- Tuesday's scheduled highlight is the April round of flash PMIs, while we also get UK public finance data - which is likely to lead to an upward revision to the FY24/25 gilt remit (as we note in our Gilt Week Ahead).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.5bps at 2.965%, 5-Yr is down 2.9bps at 2.495%, 10-Yr is down 1.4bps at 2.486%, and 30-Yr is up 0.4bps at 2.627%.

- UK: The 2-Yr yield is down 6.3bps at 4.32%, 5-Yr is down 4.8bps at 4.08%, 10-Yr is down 2.5bps at 4.205%, and 30-Yr is down 1.8bps at 4.682%.

- Italian BTP spread down 7.1bps at 136.1bps / Spanish bond spread down 3.7bps at 77.5bps

FOREX More Stable Sentiment Shores Up Antipodean FX, GBP Underperforms

- Diminishing geopolitical tensions have moderately bolstered risk sentiment to start the week with global indices in the green and higher beta currencies firmer in G10. Both AUD and NZD have risen around 0.4%, modestly extending the pullback from Friday’s sharp selloff.

- Overall, the AUDUSD trend condition remains bearish, and the pair is trading close to key support at 0.6443, the Feb 13 low, which has recently been cleared. Scope remains seen for an extension towards 0.6339, the Nov 10 ‘23 low. Firm resistance is seen at 0.6532, the 50-day EMA.

- The Japanese yen has had a subdued start to the week, however, continues to trade with a downward bias. USDJPY has matched the recent cycle highs at 154.79, however, low volumes capped topside momentum for the pair, as well as notable option expiries at the 155.00 mark.

- We wrote last week that while the technical trend condition in USDJPY remains positive, the next phase of strength could be harder to come by without another major shift in Fed policy pricing, as positioning looks stretched and diplomatic blockers to potential intervention appear to peel away.

- Elsewhere, GBP was a notable laggard on Monday, with EURGBP extending outperformance to trade fresh multi-month highs. The shift higher coincides with the confirmed close and break above the late March highs at the Friday close as well as the 200-dma at 0.8607, with momentum possibly picking up on the slippage through the 1.16 handle in GBP/EUR also - a cross closely watched by UK importers/exporters.

- Eurozone flash PMIs will take focus on Tuesday and markets will most likely then turn their attention to the April inflation round, commencing next week. US GDP (Thursday) will be the highlight for the global calendar this week, with Fed speakers notably absent as the FOMC enter their pre-meeting media blackout period.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/04/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/04/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/04/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/04/2024 | 0800/0900 |  | UK | BOE's Haskel Panelist at Econometric Seminar | |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/04/2024 | 1115/1215 |  | UK | BOE's Pill Speech at University of Chicago | |

| 23/04/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/04/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/04/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/04/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/04/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.