-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI ASIA OPEN: Projected Yr End Rate Cut Revived

- MNI: Fed's Mester Expects 'Somewhat Further' Tightening

- MNI US: Recessionary Philly Fed Headline And Prices But Some Improvements Elsewhere

- MNI BRIEF:US March Existing Home Sales Fall More Than Expected

- MNI INTERVIEW:BOC Faces Sticky Inflation Fight-Research Winner

US

FED: Federal Reserve Bank of Cleveland President Loretta Mester on Thursday endorsed a May interest rate increase and said she's prepared to adjust her views on how much higher and for how much longer rates will need to rise based on changing economic and banking conditions.

- Still-unfelt effects from previous interest rate hikes and a potentially large contraction in credit conditions as a result of bank failures last month argue for prudence in projecting the Fed's policy path this year, even as inflation remains too high, she said.

- "In order to put inflation on a sustained downward trajectory to 2%, I anticipate that monetary policy will need to move somewhat further into restrictive territory this year, with the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time," she said in remarks prepared for The Akron Roundtable Signature Series in Ohio.

- "Precisely how much higher the federal funds rate will need to go from here and for how long policy will need to remain restrictive will depend on economic and financial developments." For more see MNI Policy main wire at 1220ET.

US: The Philly Fed business outlook index surprisingly weakened further in April, falling from -23.2 to -31.3 (cons -19.3), only lower in Apr/May’20 and before that 2008/09.

- The decline goes firmly against the surprise bounce in the (far more volatile) Empire State survey that helps push yields higher at the time.

- Price components stood out on the weak side: current prices received falling from 7.9 to -3.3 saw the first negative since the pandemic and aside from -0.2 in Jun'19 were last seen in 2016.

- Some improvements elsewhere though, with new orders (from -28.2 to -22.7) and shipments (from -25.4 to -7.3), and the 6-mth ahead general business outlook also pushed up from -8 to -1.5. The latter sees a growing disconnect between current conditions and forward expectations.

US: U.S. existing home sales slid 2.4% in March to a seasonally adjusted annual rate of 4.44 million, a decline of 22.0% from one year ago, the National Association of Realtors said Thursday.

- Month-over-month sales declined in three out of four major U.S. regions, while sales in the Northeast remained steady. Single-family home sales faded to a seasonally adjusted annual rate of 3.99 million in March, down 2.7% from 4.10 million in February and 21.1% from one year ago.

- The median existing-home sales price dipped 0.9% from the previous year to USD375,700, driven by price declines in the Western region that offset rises in all other parts of the country. The inventory of unsold existing homes rose 1.0% from the prior month to 980,000 at the end of March.

CANADA

BOC: Canada needs "moderately" high interest rates while facing sticky inflation after seeing big price gains take root through the pandemic, while bloated housing costs threaten long-term productivity, an economist whose research has been backed by a central bank award told MNI.

- The Bank of Canada, which has recently begun describing its policy stance as “restrictive”, needs tight policy after a slow response to the inflation run-up, University of Toronto professor Murat Celik said. Inflation has been stubborn compared with other economic cycles because of turbocharged stimulus including money sent directly to households, he said, without being more specific about the levels of interest rates he would recommend.

- “If we never had that inflation go up as much as it did, maybe it would have been easier to keep things in check," Celik said. "But now that people's expectations regarding inflation are high, that has a self-fulfilling prophecy component that makes it harder to go back to 2%, 3% inflation.”

- “We will have periods where we will have moderately high interest rates and moderately high inflation,” he said. For more see MNI Policy main wire at 0930ET.

US TSYS: Revisiting Early Monday Levels After Weak Philly Fed Mfg Index

- Treasury futures are see-sawing near session highs, holding to a relatively narrow range since this morning's weaker than expected Philly Fed MFG index at -31.3 (-19.3 est). At odds with the surprise bounce in the (far more volatile) Empire State survey on Monday (10.8 reported vs. -18.0 ext).

- Price components stood out on the weak side: current prices received falling from 7.9 to -3.3 saw the first negative since the pandemic and aside from -0.2 in Jun'19 were last seen in 2016.

- Treasury futures gapped higher post data, Jun'23 10Y tapped 114-26 high (+20), back near early Monday levels. Initial firm resistance is at 114-30, the 20-day EMA. A break of this average is required to ease the current bearish threat.

- The 10Y contract remains in a short-term downtrend however after Wednesday’s move lower marked an extension of the pullback from 117-01+, Mar 24 high. The contract has recently traded through the 20- and 50-day EMAs and yesterday pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Federal Reserve Bank of Cleveland President Loretta Mester on Thursday endorsed a May interest rate increase and said she's prepared to adjust her views on how much higher and for how much longer rates will need to rise based on changing economic and banking conditions.

OVERNIGHT DATA

- US APR PHILADELPHIA FED MFG INDEX -31.3

- US JOBLESS CLAIMS +5K TO 245K IN APR 15 WK

- US PREV JOBLESS CLAIMS REVISED TO 240K IN APR 08 WK

- US CONTINUING CLAIMS +0.061M to 1.865M IN APR 08 WK

- US EXISTING HOME SALES -2.4% TO 4.44M SAAR IN MARCH

- US NAR: MEDIAN HOME PRICE FALLS 0.9% YOY TO $375,700

- US NAR: WESTERN REGION PRICES -7.5% YOY; OTHER REGIONS UP

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 164.18 points (-0.48%) at 33734.21

- S&P E-Mini Future down 32 points (-0.77%) at 4146.5

- Nasdaq down 103.4 points (-0.9%) at 12054.26

- US 10-Yr yield is down 4.4 bps at 3.547%

- US Jun 10-Yr futures are up 14.5/32 at 114-20.5

- EURUSD up 0.0007 (0.06%) at 1.0962

- USDJPY down 0.38 (-0.28%) at 134.34

- WTI Crude Oil (front-month) down $1.87 (-2.36%) at $77.29

- Gold is up $9.86 (0.49%) at $2004.82

- EuroStoxx 50 down 8.71 points (-0.2%) at 4384.86

- FTSE 100 up 3.84 points (0.05%) at 7902.61

- German DAX down 99.23 points (-0.62%) at 15795.97

- French CAC 40 down 10.73 points (-0.14%) at 7538.71

US TREASURY FUTURES CLOSE

3M10Y +0.439, -155.73 (L: -173.5 / H: -153.911)

2Y10Y +3.024, -62.902 (L: -66.202 / H: -61.431)

2Y30Y +4.082, -42.07 (L: -47.303 / H: -40.309)

5Y30Y +2.628, 10.965 (L: 7.469 / H: 12.359)

Current futures levels:

Jun 2-Yr futures up 5.75/32 at 102-31.625 (L: 102-26.125 / H: 103-01.375)

Jun 5-Yr futures up 11.5/32 at 109-9.75 (L: 108-31.25 / H: 109-13.75)

Jun 10-Yr futures up 14.5/32 at 114-20.5 (L: 114-07 / H: 114-26)

Jun 30-Yr futures up 18/32 at 130-9 (L: 129-20 / H: 130-23)

Jun Ultra futures up 27/32 at 139-20 (L: 138-19 / H: 140-06)

US 10YR FUTURE TECHS: (M3) Bear Threat Remains Present

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 114-30/115-23 20-day EMA / High Apr 14

- PRICE: 114-20+ @ 1515ET Apr 20

- SUP 1: 113-30+ Low Apr 19

- SUP 2: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 3: 113-08+ Low Mar 15

- SUP 4: 112-30 61.8% retracement of the Mar 3 - 24 bull run

Treasury futures remain in a short-term downtrend and Wednesday’s move lower marks an extension of the pullback from 117-01+, Mar 24 high. The contract has recently traded through the 20- and 50-day EMAs and yesterday pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement. On the upside, initial firm resistance is at 114-30, the 20-day EMA. A break of this average is required to ease the current bearish threat.

STIR: SOFR FUTURES CLOSE

- Jun 23 +0.030 at 94.915

- Sep 23 +0.060 at 95.145

- Dec 23 +0.095 at 95.505

- Mar 24 +0.135 at 95.970

- Red Pack (Jun 24-Mar 25) +0.120 to +0.155

- Green Pack (Jun 25-Mar 26) +0.075 to +0.105

- Blue Pack (Jun 26-Mar 27) +0.065 to +0.075

- Gold Pack (Jun 27-Mar 28) +0.050 to +0.060

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01834 to 4.96430 (+.07124/wk)

- 3M +0.01510 to 5.07060 (+.08772/wk)

- 6M +0.02125 to 5.09934 (+.15662/wk)

- 12M +0.04508 to 4.92801 (+.24374/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80671%

- 1M +0.02771 to 5.01000%

- 3M +0.01128 to 5.27271% */**

- 6M +0.02272 to 5.47329%

- 12M -0.02114 to 5.46057%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $109B

- Daily Overnight Bank Funding Rate: 4.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.307T

- Broad General Collateral Rate (BGCR): 4.76%, $517B

- Tri-Party General Collateral Rate (TGCR): 4.76%, $509B

- (rate, volume levels reflect prior session)

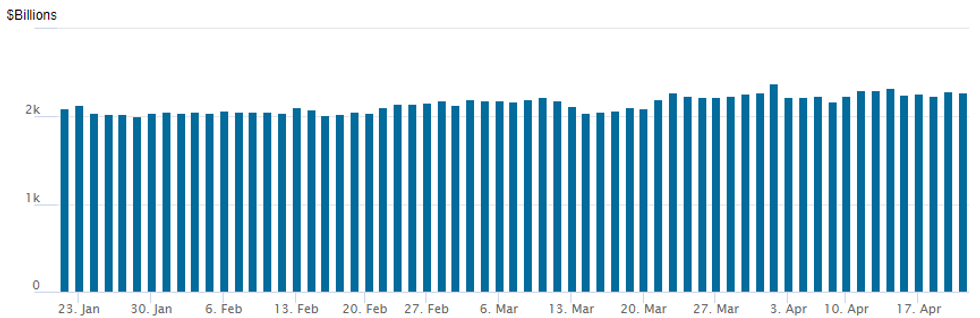

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,277.259B w/ 103 counterparties, compares to prior $2,294.677B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE

- Date $MM Issuer (Priced *, Launch #)

- 04/20 $1B *Japan Finance for Municipalities (JFM) 5Y SOFR+81

- 04/20 $Benchmark United Mexican States 30Y +290a

- $24.75B Priced Wednesday

- 04/19 $8.5B *Bank of America $3.5B 6NC5 +148, $5B 11NC10 +168*

- 04/19 $7.5B *Morgan Stanley $1.5B 3Y +80, $2.75B 6NC5 +145, $3.25B 11NC10 +165

- 04/19 $4B *Canadian Government Bond 5Y +11

- 04/19 $2.5B *Bank of NY Mellon $1.5B 4NC3 +97, $1B 11NC10 +137

- 04/19 $1.25B *New Development Bank (NEWDEV) 3Y SOFR+125

- 04/19 $1B *Kommuninvest WNG -3Y SOFR+27

EGBs-GILTS CASH CLOSE: Soft US Data Spurs First Yield Pullback This Week

European yields pulled back Thursday for the first time this week, with equities setting a risk-off tone and US data disappointing.

- An early move higher in Bunds on soft PPI and French confidence data reversed. And despite a multitude of ECB speakers and the March meeting accounts release, they conveyed little surprise and had limited market impact.

- Instead, core yields took their cue over most of the session from equity struggles (particularly in the auto sector) and a weak US Philly Fed reading.

- After underperforming in a bear flattening move Wednesday, the UK curve reversed, outperforming Germany with bull steepening.

- Terminal BoE and ECB rates pulled back by around 4bp, the largest decline in a week (though 25bp hikes remain fully priced for May).

- Periphery EGB spreads widened modestly.

- Friday's schedule is highlighted by prelim PMIs and UK retail sales.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.893%, 5-Yr is down 7.6bps at 2.49%, 10-Yr is down 7bps at 2.445%, and 30-Yr is down 4.7bps at 2.505%.

- UK: The 2-Yr yield is down 10.1bps at 3.729%, 5-Yr is down 8.9bps at 3.627%, 10-Yr is down 9bps at 3.766%, and 30-Yr is down 7.9bps at 4.104%.

- Italian BTP spread up 2.1bps at 186.9bps / Spanish up 1bps at 103.8bps

FOREX: Greenback Weakens, AUDNZD Rises 0.75% Following Soft NZ Inflation Print

- Philly Fed Manufacturing index data was surprisingly weak in April (-31.3 vs. -19.3 est.), marking a near-three year low for the metric. Despite a brief bout of USD strength before the data, the greenback weakened in the aftermath and sits moderately lower approaching the APAC crossover.

- An associated recovery for major equity indices boosted the likes of the Aussie, which is the strongest in G10. In particular, AUDNZD gains of 0.75% are notable on Thursday as the New Zealand dollar remains weighed down by a softer inflation print overnight. Q1 CPI slowed to 1.2% against expectations of a 1.5% print, helping prompt a number of sell-side outfits to redraw RBNZ expectations around the May interest rate hike possibly being the last in the cycle.

- The Japanese Yen was among the best performers on the back of lower core yields with particular outperformance seen at the front-end of the US curve following the US data. USDJPY had reached an overnight high of 134.97 before sliding all the way back to the 134.00 handle throughout US hours.

- EUR/NOK continues to grind higher, hitting a new cycle best at 11.6444 today and the highest since Apr'20. Key upside level in EUR/NOK crosses at 11.7486 - the 61.8% retracement for the 2020-2022 downleg and could come into play should the Apr'20 high of 11.6966 give way.

- Focus quickly turns to flash PMI data on Friday for any signals on the trajectory for the health of eurozone and the US economies. Retail Sales data for both the UK and Canada will also cross.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 21/04/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/04/2023 | 2330/0830 | *** |  | JP | CPI |

| 20/04/2023 | 2345/1945 |  | US | Philadelphia Fed's Pat Harker | |

| 21/04/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 21/04/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/04/2023 | 0700/0900 |  | EU | ECB de Guindos Remarks at Fundacion La Caixa | |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/04/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/04/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/04/2023 | 1430/1630 |  | EU | ECB Elderson at Peterson Institute Climate Event | |

| 21/04/2023 | 1745/1945 |  | EU | ECB de Guindos at Colegio de Economistas de Madrid Event | |

| 21/04/2023 | 2035/1635 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.