-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Projected Yr-End Rate Cuts Rise Post-CPI

- MNI INTERVIEW: Sticky Prices Could Require More Hikes-Fed Econ

- MNI BRIEF: US CPI Shows Encouraging Step-Down-Atl. Fed's Meyer

- MNI BRIEF: US Deficit Up Over 200% Year-To-Date

- MNI: EU Loses Patience As Italy Blocks Bank Backstop-Officials

- MNI: CPI Dispersion Measures Close To Pre-Pandemic Levels

US

FED: There is a significant risk U.S. inflation will not come down as quickly as the Federal Reserve expects this year, forcing the central bank to raise rates further despite strong market expectations for a pause in June followed by rate cuts not long after, senior Dallas Fed research economist Enrique Martinez-Garcia told MNI.

- “There’s a nontrivial risk that things could get more difficult and more challenging for the Fed to manage. Policymakers might have to consider whether or not the current path is sufficient to keep inflation on track," he told MNI’s FedSpeak podcast.

- Such an outcome would raise the chances of a recession, as well as heightening the prospect of additional financial stresses following a number of sizable U.S. bank failures since March. For more see MNI Policy main wire at 1530ET.

US: MNI’s dispersion measures of 57 items across the whole basket rather than just core CPI showed a significant further moderation in monthly price pressures.

- The share growing in excess of 3% annualized fell from 54% to 37% (2019 av 41%) for its lowest since Oct’20, whilst the share seeing outright deflation on the month rose from 35% to 40% (2019 av 38%).

- There’s seen some concentration with items growing very quickly, with the share growing above 5% annualized at 32% vs the 2019 av of 25% but that’s still down from 42% in March and again the lowest since Oct’20.

US DATA: Underlying inflation in the U.S. is showing nascent signs of cooling to a 4% to 5% annual rate but "super core goods" prices are falling slower than expected, raising concerns that above-2% inflation could persist, Federal Reserve Bank of Atlanta economist Brent Meyer wrote in a note Wednesday after the April CPI report came largely in-line with investor expectations.

- April is "another encouraging report," he said. "This is nascent, but it’s starting to look like underlying inflation has stepped down from extremely elevated to just really elevated."

- Headline CPI rose 4.9% over the past 12 months, its lowest since April 2021, and was 4.5% annualized. Core CPI rose at an annualized rate of 5.0%, down modestly from the 12-month rate of 5.5%. Core services excluding rent-of-shelter prices rose at an annualized rate of 2.7% in April and is up 3.7% over the past three months annualized, off its year-over-year rate of 5.0%, he noted.

- Alternative measures of underlying inflation "were all fairly consistent" at between 4.0% and 4.8% in April, Meyer said, down from around 6.5% at the start of the year, a sign that "some of the steam is escaping."

US: The U.S. government deficit is up 224% in the fiscal year-to-date compared to the same month last year when adjusted for calendar effects, the Treasury Department said on Wednesday.

- April saw a USD176 billion surplus even as the year-to-date deficit stands at USD925 billion, with receipts down 10% and outlays up 8% compared to last year. April's receipts were down 26% compared to last year and the monthly surplus was 43% smaller than last year's.

EUROPE

ITALY: European Union pressure on Italy to finally ratify a treaty to reform the European Stability Mechanism is set to intensify in coming months amid revived concerns about ensuring the stability and resolution mechanisms of the eurozone banking sector, EU officials told MNI.

- More than two years after the approval of the treaty reform, which would authorise funding for a backstop of up to EUR68 billion for the EU’s Single Resolution Fund, Italy is now the only country not to ratify, despite promises from Prime Minister Giorgia Meloni that she would ensure parliament does so.

- While the eurozone has weathered the shockwaves from the crisis among U.S. regional banks, officials are concerned that the ESM treaty is necessary to underpin the region’s financial architecture. “If Italy doesn’t ratify then there is no backstop and should there be a large enough [bank] resolution there will not be enough money in the pot,” one EU national official said. For more see MNI Policy main wire at 1040ET.

US TSYS: Rates, Stocks Finish on Positive Tone After In-Line CPI

Treasury futures see-saw near late session highs after initial gap bid followed in-line CPI read for April, MoM 0.4%, YoY 5.5%, and off-setting CPI figures: higher used car and medical care services vs. lower than expected lodging and airfare items. Late support tied to nascent hopes of a debt ceiling breakthrough that also buoyed stocks.

- Tsy 10s currently 115-25.5 vs. 115-31 high, yield off 3.4275% low at 3.4502%. Curves steeper but off highs, 2s10s currently +4.186 at -46.584 (-44.525 high).

- Projected rate cuts for late 2023 are firmer but still off last week's highs: November cumulative -53.3bp (-58.7bp last wk) at 4.544%, Dec'23 cumulative -77.9bp (-84.3bp last wk) at 4.293%, while Jan'24 cumulative is running at -101.8bp at 4.048%.

- For a technical perspective, initial resistance at 116-12 High May 5, a resumption of gains would open key resistance at 117-01+, the Mar 24 high. This is the bull trigger.

- Treasury futures had pared gains briefly following the $32B 10Y note auction (91282CHC8) tail: 3.448% high yield vs. 3.437% WI; 2.45x bid-to-cover vs. 2.36x prior. Indirect take-up 67.05% vs. 62.95% prior; direct bidder take-up 19.46% from 19.91% prior; primary dealer take-up falls to 13.04% vs. 17.14% prior.

OVERNIGHT DATA

- US APRIL CONSUMER PRICES INCREASE 0.4% M/M; EST. 0.4%

- US APRIL CONSUMER PRICES RISE 4.9% Y/Y; EST. 5.0%

- US APRIL CPI EX FOOD & ENERGY RISES 5.5% Y/Y; EST. +5.5%

- US APRIL CPI EX FOOD & ENERGY RISES 0.4% M/M; EST. +0.4%

- US APR ENERGY PRICES 0.6%

- US APR OWNERS' EQUIVALENT RENT PRICES 0.5%

- US DATA: CPI Unrounded - Apr'23

- Unrounded % M/M (SA): Headline 0.368%; Core: 0.409% (from 0.385%)

- Unrounded % Y/Y (NSA): Headline 4.93%; Core: 5.519% (from 5.59%)

- US APRIL BUDGET SURPLUS AT $176.2B VS SURPLUS $308.2B YR AGO

- US FISCAL YTD BUDGET DEFICIT WIDENS TO $924.5B VS YR AGO $360B

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 105.93 points (-0.32%) at 33453.07

- S&P E-Mini Future up 12 points (0.29%) at 4146

- Nasdaq up 117.1 points (1%) at 12296.45

- US 10-Yr yield is down 7.6 bps at 3.4426%

- US Jun 10-Yr futures are up 21/32 at 115-27

- EURUSD up 0.0017 (0.16%) at 1.0979

- USDJPY down 0.9 (-0.67%) at 134.32

- WTI Crude Oil (front-month) down $1.13 (-1.53%) at $72.59

- Gold is down $3 (-0.15%) at $2031.58

- EuroStoxx 50 down 16.33 points (-0.38%) at 4306.76

- FTSE 100 down 22.76 points (-0.29%) at 7741.33

- German DAX down 59.25 points (-0.37%) at 15896.23

- French CAC 40 down 35.97 points (-0.49%) at 7361.2

TREASURY FUTURES CLOSE

- 3M10Y -4.731, -177.565 (L: -184.47 / H: -173.678)

- 2Y10Y +4.242, -46.528 (L: -58.897 / H: -44.525)

- 2Y30Y +7.761, -11.059 (L: -25.431 / H: -8.272)

- 5Y30Y +7.986, 41.984 (L: 30.51 / H: 43.42)

- Current futures levels:

- Jun 2-Yr futures up 6.75/32 at 103-11.5 (L: 103-02 / H: 103-13.625)

- Jun 5-Yr futures up 16.75/32 at 110-14 (L: 109-25.25 / H: 110-17)

- Jun 10-Yr futures up 20.5/32 at 115-26.5 (L: 115-02.5 / H: 115-31)

- Jun 30-Yr futures up 29/32 at 130-19 (L: 129-19 / H: 130-29)

- Jun Ultra futures up 1-02/32 at 138-25 (L: 137-24 / H: 139-05)

US 10YR FUTURE TECHS: (M3) Bounces Ahead of Support

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 116-12/117-00 High May 5 / 4

- RES 1: 115-31 High Intra-day May 10

- PRICE: 115-27 @ 1525 ET May 10

- SUP 1: 115-01+/114-26+ Low May 9 / 50-day EMA

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures bounced Wednesday following the CPI release, however are maintaining pressure on support at 115-05, the May 8 low. Price remains below last week’s high of 117-00, on May 4. Price has breached the 20-day EMA and attention is on the 50-day EMA, at 114-26+. A clear break of this average would signal scope for a deeper retracement towards 114-10 initially, May 1 low. For bulls, a resumption of gains would open key resistance at 117-01+, the Mar 24 high. This is the bull trigger.

SOFR FUTURES CLOSE

- Jun 23 +0.040 at 94.955

- Sep 23 +0.090 at 95.315

- Dec 23 +0.130 at 95.790

- Mar 24 +0.150 at 96.335

- Red Pack (Jun 24-Mar 25) +0.135 to +0.155

- Green Pack (Jun 25-Mar 26) +0.10 to +0.120

- Blue Pack (Jun 26-Mar 27) +0.085 to +0.095

- Gold Pack (Jun 27-Mar 28) +0.060 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00279 to 5.05709 (+.00683/wk)

- 3M +0.01418 to 5.09811 (+.05938/wk)

- 6M +0.02049 to 5.05101 (+.10550/wk)

- 12M +0.03473 to 4.73358 (+.17998/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 to 5.06029%

- 1M +0.00229 to 5.10800%

- 3M +0.00329 to 5.34243% */**

- 6M +0.00857 to 5.39843%

- 12M +0.05486 to 5.35286%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $112B

- Daily Overnight Bank Funding Rate: 5.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.482T

- Broad General Collateral Rate (BGCR): 5.03%, $574B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $564B

- (rate, volume levels reflect prior session)

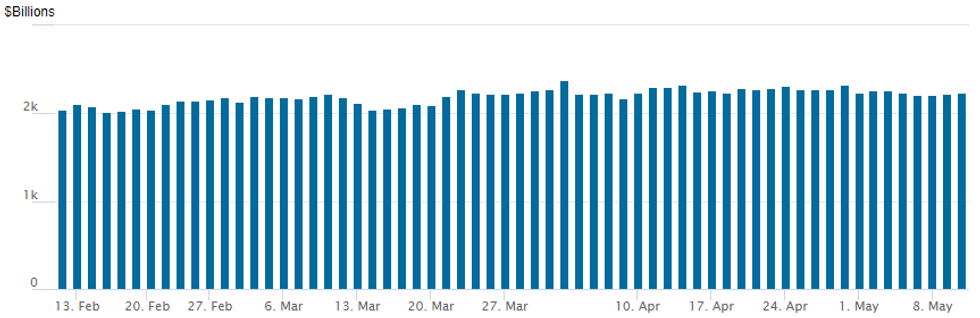

FED Reverse Repo Operation

NY Federal reserve/MNI

NY Fed reverse repo usage climbs to $2,233.149B w/ 104 counterparties, compares to prior $2,222.864B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2B Corporate Debt to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 05/10 $750M #Willis North America 10Y +175

- 05/10 $600M *Edison Int 5.5Y +190

- 05/10 $650M #Ryder 5Y +190

- Rolled to Thursday's order of business:

- 05/11 $Benchmark BNG Bank 5Y SOFR+48a

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2023 | 0130/0930 | *** |  | CN | CPI |

| 11/05/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1200/1400 |  | EU | ECB Schnabel Talk at Federal Ministry of Finance | |

| 11/05/2023 | - |  | EU | ECB Lagarde & Panetta in G7 Finance Meeting | |

| 11/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/05/2023 | 1230/0830 | *** |  | US | PPI |

| 11/05/2023 | 1245/0845 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/05/2023 | 1430/1030 |  | US | Fed Governor Christopher Waller | |

| 11/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/05/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/05/2023 | 1730/1930 |  | EU | ECB de Guindos Panels Diario Madrid Foundation Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.