-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Risk Appetite Wanes, No Debt Deal Yet

- MNI US: Yellen: US Default Could See Financial Markets "Break"

- MNI US: Biden Says "Default Is Not An Option" Ahead Of Debt Limit Talks

- MNI US: McCarthy Says Work Requirements Are "Red Line" In Debt Limit Negotiations

- NY FED WILLIAMS: STARTING TO SEE DEMAND, SUPPLY MOVE BACK INTO BALANCE .. INFLATION TOO HIGH BUT MOVING IN RIGHT DIRECTION, Bbg

Key Links: US DATA: "Core" Sales Measures Beat, But Retail Flatlining Overall / US DATA: "Real" Retail Sales Growth Weakest Since Early Pandemic

US TSYS: No Debt Deal Yet

Treasury futures remain weaker but off midday lows (10Y at 114-30.5 -9, yield 5.5376 +.0358), curves flatter (2s10s -2.560 at -53.833) after maintaining steeper profile in the first half.

- Weaker stocks contributing (SPX Eminis 4128.0 low) to the general risk-off tone as markets fret over debt ceiling, Jake Sherman, Punchbowl News tweeting: "Speaker McCarthy says the debt limit deal MUST include something on work requirements. He said it’s a red line for him."

- President Biden meeting with congressional leaders (McCarthy, Schumer, McConnell and Jeffries) to discus the debt limit at this moment. Biden still expected to leave for G7 summit in Japan tomorrow.

- Additional factors weighing on rates: nominal retail sales levels remain well above early 2021 levels, but that appears to be largely the effect of inflation - and April's Y/Y nominal growth was also the slowest since the contractions of 2Q 2020.

- Corporate bond issuance, rate lock sales: $31B Pfizer 8pt jumbo (helping finance $43B Seagen deal) is the fourth largest on record.

- Fed-speak all generally in-line with recent comments, latest from Atlanta's Barkin: support for holding rates but remains open to hikes if data warrants.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00123 to 5.06765 (+.01074/wk)

- 3M +0.00825 to 5.09792 (+.03112/wk)

- 6M +0.01368 to 5.04217 (+.05670/wk)

- 12M +0.02238 to 4.70379 (+.10265/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 to 5.06186%

- 1M +0.00358 to 5.11129%

- 3M +0.01471 to 5.34514% */**

- 6M -0.00400 to 5.37914%

- 12M -0.02529 to 5.27814%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $126B

- Daily Overnight Bank Funding Rate: 5.07% volume: $295B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.497T

- Broad General Collateral Rate (BGCR): 5.02%, $584B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $576B

- (rate, volume levels reflect prior session)

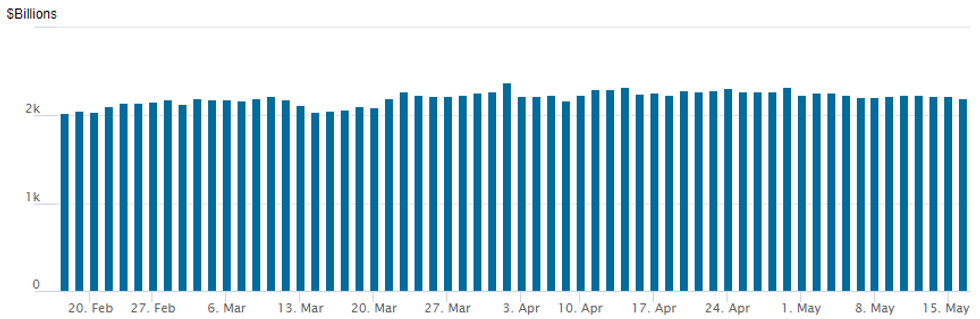

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,203.214B w/ 101 counterparties, compares to prior $2,220.927B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Mixed session trade continued to lean towards low delta put structures in SOFR options, early 5- and 10Y Treasury call trade also leaned toward puts in the second half as underlying futures held near midday lows.- SOFR Options:

- Block, 6,000 SFRZ3 97.00/97.50 call spds 6.0 vs. 95.61/0.06%

- Block, 5,000 SFRZ3 94.87 puts 2.5 over SFRZ3 96.00/96.50 call spds

- +7,000 SFRZ3 96.00/97.00/98.00 call flys, 9.0 ref 95.595

- Block, 5,000 SFRM3 95.00/95.25 call spds, 1.25 ref 94.8975

- 3,000 SFRM3 94.56/94.68/94.81 put flys ref 94.91

- 5,700 SFRM3 96.12 calls 1.75 ref 94.9125

- 13,500 SFRM3 94.62/94.68/94.75/94.81 put condors ref 94.9125 to -.915

- 4,500 SFRZ3 96.00/OQZ3 97.50 call spds, 1.0

- Block/screen, 5,000 SFRN3 95.81/95.31/95.43/95.56 call condors, 1.5 ref 95.225

- Block/screen, over 13,500 OQM3 96.37 puts, 12.0 vs. 96.66/0.30%

- Block, 2,500 SFRZ3 94.81/94.93/95.06 put flys, 2.0 ref 95.70

- 5,800 OQM3 96.37 puts ref 96.69 to -.695

- Treasury Options:

- Block, +15,000 TYM3 113.5/114 put strip 20 vs. 114-26

- +17,500 TYM3 114 puts, 15

- +12,000 TYN 114/120 strangles, 46

- Block, 10,000 TUN3 103.75 puts, 28.5 vs. 103-23/0.51%

- 3,000 FVM3 109.75/110 put spds, 9 ref 109-26.75

- +7,500 TYM 117 calls, 5

- 4,500 FVN3 109.75 puts, 26.5 ref 110-24

- 3,000 TYM3 117 calls, 8 ref 115-13.5

- over 10,500 TYN3 118 calls, 38 ref 116-10.5 to -11

- over 6,700 FVM3 109.75 puts, 22 ref 109-27.75

- over 7,600 TYN3 117.5 calls, 44-45 ref 116-09

EGBs-GILTS CASH CLOSE: Bund Weakness Extends

Gilts easily outperformed Bunds Tuesday after weaker-than-expected UK labour market data spurred a reconsideration of potential BoE hikes.

- The early bullish move reversed and both German and UK yields closed at/near session highs, but implied BoE hikes (and the UK short end) didn't quite recover lost ground - terminal cumulative pricing was pared by 4bp to 41bp, with June pulling back 2bp to 19bp.

- Other than UK jobs, European data again had little impact: a weaker-than-expected German ZEW figure was worth a few ticks higher in Bunds - but 10Y German yields finished higher for the 3rd consecutive session..

- Periphery spreads were little changed. Following Monday's outperformance, GGBs underperformed - though spreads vs Bunds tightened slightly intraday after Wed's GGB auction announcement with size up to E400mln.

- Indeed supply looms large Wednesday, with France selling up to E11bln in OAT, UK GBP3.75bln of Gilt, and Germany E4bln of Bund.

- Apart from that, final Eurozone CPI and multiple ECB speakers feature.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.3bps at 2.657%, 5-Yr is up 6bps at 2.306%, 10-Yr is up 4.4bps at 2.353%, and 30-Yr is up 3.7bps at 2.55%.

- UK: The 2-Yr yield is down 1.4bps at 3.812%, 5-Yr is unchanged at 3.628%, 10-Yr is down 0.1bps at 3.816%, and 30-Yr is up 0.7bps at 4.257%.

- Italian BTP spread down 0.9bps at 186.8bps / Greek up 0.5bps at 170.9bps

EGB Options: Mostly Upside Tuesday

Tuesday's Europe rates / bond options flow included:

- DUM3 105.90 calls bought for 13.5 in 10.7k

- SFIQ3 95.25/95.45/95.55/95.75 call condor bought for 5.25 in 3K

- ERU3 96.25/96.50/96.75 call fly bought for 3.75 in 12K all day

FX: Expiries for May17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0795-10(E751mln), $1.0825-35(E556mln), $1.0915-20(E619mln)

- USD/JPY: Y134.50($2.1bln), Y135.50($1.3bln), Y136.00-10($1.3bln), Y136.80($806mln), Y137.00($503mln)

- EUR/JPY: Y141.00(E1.0bln)

- USD/CAD: C$1.3400($1.2bln), C$1.3450($1.3bln)

- USD/CNY: Cny6.9740($595mln)

Equities Roundup: Holding Pattern Ahead Debt Limit

Stocks mixed in late trade, near the middle of a narrow session range. S&P E-Mini Future are currently down 13.5 points (-0.33%) at 4136.5; DJIA down 247.85 points (-0.74%) at 33100.77; Nasdaq up 21.5 points (0.2%) at 12386.47

- Generally speaking, markets remain in a holding pattern as they await a solution to the fast approaching debt ceiling. President Biden is currently meeting with congressional leaders (McCarthy, Schumer, McConnell and Jeffries) to discus before flying to G7 summit in Japan Wednesday.

- Leading laggers: Energy, Real Estate and Utilities continued to underperform while Communication Services and IT sectors held modest gains.

- From a technical point of view S&P E-minis remain in consolidation mode. Price is trading above the 50-day EMA, which intersects at 4109.27. An extension higher would open key resistance and the bull trigger at 4206.25, the May 1 high.

- A break of this level would resume the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

E-MINI S&P TECHS: (M3) Watching Resistance

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4173.25/4206.25 High May 10 / 1

- PRICE: 4137.50 @ 1445ET May 16

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis are unchanged and remain in consolidation mode. Price is trading above the 50-day EMA, which intersects at 4109.27. An extension higher would open key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would resume the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would instead highlight a bearish threat.

COMMODITIES: Gold Through Post-Payrolls Support As USD Strength, Tsy Sell-Off Weighs

- Crude is pulling back towards the lows of the day as the market assesses global economic growth uncertainty in the US and China against near term supply disruptions from OPEC, Iraq and Canada. A steadily strengthening US dollar since US retail sales has added to the downside pressure while US SPR restocking plans from August are providing some support.

- WTI is -0.6% at $70.67 but remains comfortably above yesterday’s lows plus also support at $68.48 (May 5 low). In options space, by far the most active strikes today have been $70/bbl puts in the CLM3.

- Brent is -0.65% at $74.74, still comfortably off support at yesterday’s low of $73.49.

- Gold is -1.3% at $1990.13 with the strengthening in the USD and higher Treasury yields weighing heavily. It has pushed through support at $1999.6 (May 5 low) seen after payrolls to open $1976.3 (50-day EMA).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/05/2023 | 2350/0850 | *** |  | JP | GDP |

| 17/05/2023 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 17/05/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/05/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2023 | 0900/1100 |  | EU | ECB Elderson Panels Beyond Growth Conference | |

| 17/05/2023 | 0930/1130 |  | EU | ECB Panetta Presentation on Digital Euro Kangaroo Group Event | |

| 17/05/2023 | 0950/1050 |  | UK | BOE Bailey Keynote Speech at British Chambers of Commerce | |

| 17/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/05/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/05/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 17/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/05/2023 | 1515/1715 |  | EU | ECB de Guindos Closes IESE Banking Meeting | |

| 17/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/05/2023 | 2350/0850 | *** |  | JP | GDP |

| 17/05/2023 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 17/05/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/05/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2023 | 0900/1100 |  | EU | ECB Elderson Panels Beyond Growth Conference | |

| 17/05/2023 | 0930/1130 |  | EU | ECB Panetta Presentation on Digital Euro Kangaroo Group Event | |

| 17/05/2023 | 0950/1050 |  | UK | BOE Bailey Keynote Speech at British Chambers of Commerce | |

| 17/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/05/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/05/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 17/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/05/2023 | 1515/1715 |  | EU | ECB de Guindos Closes IESE Banking Meeting | |

| 17/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.