-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk Starts Wk on Positive Tone

EXECUTIVE SUMMARY

US

US/EU: Christine Lagarde, President of the European Central Bank, has warned of trade fragmentation in a speech at Deutsche Brse Annual Reception in Eschborn, Germany.

- Legarde said that, "major economies - led by the United States and China - are increasingly using trade to limit the ambitions of geopolitical rivals. That could fragment world trade with potentially huge costs. The IMF estimates that severe trade fragmentation may cost global output roughly 7% in the long term - an amount similar to the annual output of Japan and Germany combined."

- Lagarde identifies the US Inflation Reduction Act as a "geopolitical wind" which may lead to a "scramble for resources," and argues that the EU must protect its "critical interests in a fast-changing world," because as an economy that is deeply integrated into global supply chains, the EU is more exposed to trade risk than the United States or China.

CANADA

BOC: The BoC is expected to opt for a final 25bp hike to 4.5%. The 25bp hike is almost fully priced but the Bank had form last year at surprising markets, and five analysts expect no change.

- A recent easing in financial conditions could see statement language err on the moderately hawkish side.

- Core inflation and labour data have come in stronger than expected and near-term inflation expectations pushed higher but medium- and longer-term expectations have cooled somewhat and a majority of both firms and consumers expect a recession this year.

BOC: The Bank of Canada will probably raise its key lending rate a quarter point to 4.5% on Wednesday and signal it’s about done after what would be a record eighth consecutive move to tame inflation expectations.

- Eighteen economists surveyed by MNI are calling for a hike and two see no change, in a decision due at 10am EST that includes a fresh economic forecast and is followed by a press conference. Most economists say this is the last hike of this cycle and there will be no cut later this year, though it's not guaranteed that policymakers will signal their intentions in the decision.

- Governor Tiff Macklem said after December's 50bp increase he could pause and decisions are becoming more data dependent. While inflation has continued to decelerate from a peak of 8.1% in June to 6.3% in December some ex-staff have said progress is slow. (See: MNI INTERVIEW: BOC In One And Done Zone- Chamber Of Commerce) Officials have also kept their options open, saying they could be forceful again if needed.

US TSYS: Late Market Roundup

Tsys weaker after the bell, Bonds off early session lows (30YY +.0400 at 3.6947% vs. 3.7148% high) w/ curves running mixed after bear steepening earlier (2s10s -1.950 at -71.523 vs. -67.092 high).

- Trade volumes remain subdued (TYH3 <950k) w/ much of Asia out for Lunar New Year holidays this week (China, Taiwan Mon-Fri; Vietnam Mon-Thu; Hong Kong Mon-Wed; Singapore and South Korea Mon-Tue).

- No react to midmorning data: US December Leading Indicator -1.0% MoM vs. -0.7% est, while absence of Fed speak w/ members in media blackout through Feb 2, has sapped market interest somewhat.

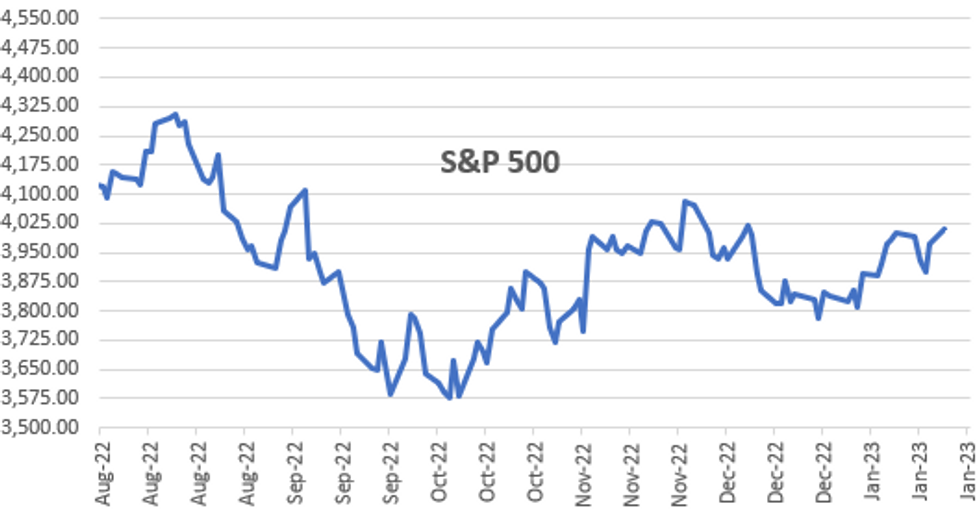

- Equities remain strong, however, off highs amid modest profit taking in late trade Monday. Information Technology and Communication Services sectors continued to outperform.

- Pick-up in data Tue w/ Philly-Fed Non Mfg Activity (-12.8 rev, --), Richmond Fed Mfg Index (1, -5); Bizz Cond (-14, --) and S&P Global US Manufacturing PMI (46.2, 46.0), Services PMI (44.7, 45.0); Comp PMI (45, 47.0) expected.

- Treasury auctions: $34B 52W bill CMB auction at 1130ET, $42B 2Y Note auction (91282CGG0) at 1300ET.

OVERNIGHT DATA

US December Leading Indicator -1.0% MoM vs. -0.7% est - The Leading Index saw its third consecutive circa -1% M/M decline in December, pushing the index down -7.4% Y/Y.

- Consistent with the latest sharp turn lower in ISM Services, this is the largest decline its seen since 2009 outside of Apr and May 2020 (trough -10.3% Y/Y).

- Both remain in stark contrast to tracking estimates such as the Atlanta Fed's GDPNow estimating Q4 GDP growth between 3.5-4% annualized.

- Within the details, only two of the ten indicators that comprise the LEI increased on the month: manufacturers' new orders for nondefense capital goods excluding aircraft and manufacturers' new orders for consumer goods and materials.

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 204.78 points (0.61%) at 33578.4

- S&P E-Mini Future up 42.5 points (1.07%) at 4030.25

- Nasdaq up 199.8 points (1.8%) at 11339.58

- US 10-Yr yield is up 3.9 bps at 3.5172%

- US Mar 10-Yr futures are down 11/32 at 114-23

- EURUSD up 0.0005 (0.05%) at 1.0861

- USDJPY up 1.07 (0.83%) at 130.67

- WTI Crude Oil (front-month) down $0.05 (-0.06%) at $81.59

- Gold is up $2.94 (0.15%) at $1928.97

- EuroStoxx 50 up 30.92 points (0.75%) at 4150.82

- FTSE 100 up 14.08 points (0.18%) at 7784.67

- German DAX up 69.39 points (0.46%) at 15102.95

- French CAC 40 up 36.03 points (0.52%) at 7032.02

US TSY FUTURES CLOSE

- 3M10Y +4.428, -115.185 (L: -125.853 / H: -112.97)

- 2Y10Y -2.078, -71.651 (L: -72.104 / H: -67.092)

- 2Y30Y -2.765, -54.742 (L: -55.296 / H: -49.581)

- 5Y30Y -2.61, 6.372 (L: 6.008 / H: 10.463)

- Current futures levels:

- Mar 2-Yr futures down 3.125/32 at 102-28.75 (L: 102-28 / H: 103-01.375)

- Mar 5-Yr futures down 8.25/32 at 109-13 (L: 109-11.5 / H: 109-25)

- Mar 10-Yr futures down 11/32 at 114-23 (L: 114-19 / H: 115-07)

- Mar 30-Yr futures down 18/32 at 129-29 (L: 129-18 / H: 130-24)

- Mar Ultra futures down 24/32 at 141-7 (L: 140-18 / H: 142-07)

(H3) Corrective Pullback

- RES 4: 117-17+ 1.00 proj of the Nov 3 - Dec 13 - Dec 30 price swing

- RES 3: 117-05 2.0% 10-dma env

- RES 2: 117-00 High Sep 8 2022

- RES 1: 116-08 High Jan 19

- PRICE: 114-28 @ 16:14 GMT Jan 23

- SUP 1: 114-16 Low Jan 18

- SUP 2: 114-10+ 20-day EMA

- SUP 3: 114-09+ Low Jan 17 and a key support

- SUP 4: 113-26+ Low Jan 10

Treasury futures have pulled back from last week’s high of 116-08 on Jan 19. The move lower is considered corrective and trend conditions remain bullish. Last week’s trend highs maintain the positive price sequence of higher highs and higher lows - the definition of an uptrend. On the continuation chart, the 200-dma has been pierced. A clear break would reinforce current conditions. The focus is on 117-05. Key support to watch is 114-09+, Jan 17 low.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.010 at 94.965

- Jun 23 -0.025 at 94.875

- Sep 23 -0.045 at 94.980

- Dec 23 -0.070 at 95.325

- Red Pack (Mar 24-Dec 24) -0.085 to -0.07

- Green Pack (Mar 25-Dec 25) -0.075 to -0.06

- Blue Pack (Mar 26-Dec 26) -0.05 to -0.035

- Gold Pack (Mar 27-Dec 27) -0.03 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 4.30457% (-0.000857 total last wk)

- 1M -0.00728 to 4.50586% (+0.05871 total last wk)

- 3M +0.00214 to 4.81771% (+0.02314 total last wk)*/**

- 6M -0.00357 to 5.09843% (+0.00086 total last wk)

- 12M -0.00500 to 5.34229% (-0.00971 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $99B

- Daily Overnight Bank Funding Rate: 4.32% volume: $276B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.169T

- Broad General Collateral Rate (BGCR): 4.26%, $462B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $435B

- (rate, volume levels reflect prior session)

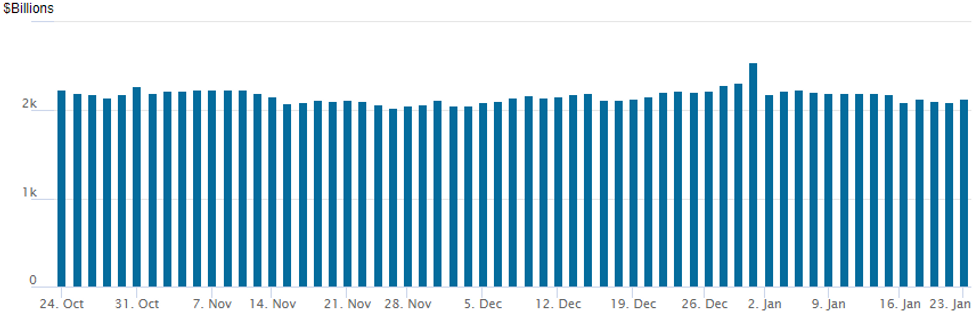

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,135.499B w/ 105 counterparties vs. prior session's $2.090.523B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: Procter & Gamble, KeyBank, State Street Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/23 $3B #Truist Bank $1.5B 6NC5 +125, $1.5B 11NC10 +160

- 01/23 $2.1B #Procter & Gamble $650M 3Y +23, $600M 5Y +35, $850M 10Y +53

- 01/23 $2B #Caesars Entertainment 7NC3 7%, upsized from $1.25B

- 01/23 $1.5B #KeyBank $500M 3Y +83, $1B 10Y +153

- 01/23 $1.25B #State Street $500M 3NC2 +62.5, $750M 11NC10 +130

- 01/23 $Benchmark Autozone 5Y +90, 10Y +125

- 01/23 $Benchmark Turk Eximbank (Turkiye Ihracat Kredi Bankasi) 3Y investor calls

- 01/23 $Benchmark M&T Bank Investor calls

EGBs-GILTS CASH CLOSE: ECB Hawks Continue To Move The Needle

European curves steepened Monday with Bunds underperforming Gilts.

- With a fairly thin data slate (EC consumer confidence was a little worse than expected but not a market mover), and Asian holidays muting overnight price action, ECB speakers took centre stage as the day proceeded.

- On the hawkish end of the commentary were Kazimir and Vujcic who continued to signal support for 50bp hikes, whereas Stournaras and Visco proposed a more measured approach.

- Pricing for cumulative further ECB hikes rose by nearly 4bp at one point to just under 147bp to Jul 2023, joint-highest since Jan 11.

- The German curve bear steepened, with the UK's bull steepening.

- ECB's Lagarde speaks after the cash close Monday. Attention swiftly turns to flash PMI data on Tuesday morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.1bps at 2.598%, 5-Yr is up 3.1bps at 2.241%, 10-Yr is up 2.9bps at 2.206%, and 30-Yr is up 3.2bps at 2.173%.

- UK: The 2-Yr yield is down 2.5bps at 3.465%, 5-Yr is down 2.7bps at 3.269%, 10-Yr is down 1.8bps at 3.36%, and 30-Yr is down 0.9bps at 3.712%.

- Italian BTP spread up 0.7bps at 182.3bps / Spanish up 1bps at 96.8bps

FOREX: AUDJPY Matches Post-BOJ Highs, Greenback Consolidating

- The Japanese Yen remains the poorest performing currency across G10, although price action largely subsided around Friday’s best trading levels for USD/JPY around 130.60. The pair remains below last week’s high of 131.58 and the 20-day EMA, at 131.01 has capped the price action on Monday.

- Recent activity appears to be a bear flag formation - if correct it reinforces the downtrend and signals scope for a continuation of the trend. A break lower would open 126.81, a Fibonacci projection - the bear trigger is 127.23, the Jan 16 low. On the upside, clearance of 131.58, the Jan 18 high, would be bullish and signal scope for a stronger correction.

- At the other end, AUD is outperforming amid a more positive tone for equity markets with the main indices firming just under one percent. AUDJPY has risen an impressive 1.65%, and now focuses in on the post BOJ highs and horizontal resistance just below the 92.00 mark.

- By a small margin, Scandi currencies are also outperforming, putting both SEK and NOK behind the Aussie on the G10 leaderboard, however, macro drivers are few and far between ahead of the APAC crossover.

- The Chinese Lunar New Year and the beginning of the Fed's pre-rate decision media blackout period have made for a relatively quiet start to the week for the greenback with the USD index trading in marginally positive territory.

- European and US flash PMIs kick off Tuesday’s docket before the main event’s this week of Wednesday’s Bank of Canada rate decision and the advanced reading of US GDP, due Thursday.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/01/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/01/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 24/01/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/01/2023 | 0945/1045 |  | EU | ECB Lagarde Video Message at Croatia Conference | |

| 24/01/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 24/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/01/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 24/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 24/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/01/2023 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.