-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: SF Fed Daly Echoes Powell, Cautious on Cut Size

- MNI FED BRIEF: Fed’s Daly: Time To Cut Interest Rates Is Now

- MNI CANADA BRIEF: Canada Tightens Temporary Foreign Worker Rules

- MNI CANADA BRIEF: Canada Sets 100% Tariff On Chinese EVs, Mirrors US

- MNI US DATA: Dallas Fed Mfg Index Least Negative Since Jan’23, Prices Paid Firm

- MNI US DATA: Away From Aircraft Noise, Durable Goods Disappoint

US

FED BRIEF (MNI): Fed’s Daly: Time To Cut Interest Rates Is Now

San Francisco Fed President Mary Daly said Monday the central bank is ready to start cutting interest rates as the disinflation process has proved more durable. “We just needed to get a little more confidence inflation is truly on its path to 2%, and I wanted to see the labor market come into balance. But I think that's completely happened, and the risks to our goals are now balanced, and the time to adjust policy is upon us,” she told Bloomberg TV in an interview. “The direction of change is down, and the time to adjust is now.”

NEWS

CANADA BRIEF (MNI): Canada Tightens Temporary Foreign Worker Rules

Canada is tightening rules on its temporary foreign worker program, responding to criticism around worsening housing shortages and bypassing domestic workers at a time of rising unemployment. Employment Minister Randy Boissonnault said in a statement Monday the program will no longer accept low-wag candidates in most industries in cities where unemployment is 6% or higher.

CANADA BRIEF (MNI): Canada Sets 100% Tariff On Chinese EVs, Mirrors US

Canada is imposing a 100% tariff on Chinese electric vehicles and a 25% levy on steel and aluminum, seeking to head off any perception it will become a back door to the North American trade zone before the USMCA is up for review in 2026. Finance Minister Chrystia Freeland in a statement Monday also said Canada will restrict eligibility for any low-emissions vehicles to nations it has a free trade agreement with, and launched a 30-day consultation on "other sectors critical to Canada’s future prosperity, including batteries and battery parts, semiconductors, solar products, and critical minerals."

(Bbg) Libya Eastern Govt Says It Will Stop All Oil Production, Export

Eastern-based govt announces “force majeure” on all fields, terminal and oil facilities, it says in statement on Facebook. Says move in response to rival Tripoli-based government’s attempt to take over Libyan central bank.

FED: SF's Daly Echoes Powell On Starting Cuts Now, But Doesn't Sound Pro-50bp

Judging from a Bloomberg TV interview this afternoon, SF Fed Pres Daly (2024 FOMC voter) doesn't seem to be a proponent of an outsized 50bp rate cut in September.

- While she echoed Chair Powell's Jackson Hole speech by saying that the time to adjust policy "is now", and it's "hard to imagine" a September cut being derailed and "the direction of rates is down" - a step further from her pre-Jackson Hole comment that it's time to consider cuts - she sounds slightly more cautious in tone than Powell.

- On the subject of rate cut sizes, for example, she said it's "too early" to know "what the tactics will be there", and that it's "reasonable" to cut at "the regular, normal cadence" if her core scenario of slowing inflation and "steady, sustainable" job growth plays out. If there is greater labor market weakness than anticipated, the Fed could be more aggressive.

- Her general take is that policy is currently "highly restrictive" and needs to be "right-sized" in order to keep policy from becoming even tighter as inflation slows.

- On the labor market, she noted that it is "completely" back in balance, as are the risks to the FOMC's dual mandate goals, which is similar to Powell. While she said she agreed with the Chair's declaration that "we do not seek or welcome further cooling in labor market conditions", Daly also highlighted that "at this point I don't see any warning signs" (and cites for example low initial jobless claims; notes “we’re not hearing signs that firms are poised for layoffs").

- On the end-goal for rates, Daly commented that she saw the neutral real rate "as high as" 1%, implying a 3% Fed funds rate at neutral (with 2% inflation). Though she also said that she didn't think "we want to declare that we are on a path towards neutral" given economic uncertainty.

US TSYS Extend Late Session Lows, SF Daly Echoes Powell, Cautious on Cut Size

- Treasury futures extended lows into the closing bell, gradually declining since midday: Sep'24 10Y marked 113-18.5 (-4), 10Y yield at 3.8160% (+.0170).

- The late extension possible tied to SF Fed Daly sounding a little more cautious over pace/size of rate cuts while generally echoing Chairman Powell's "the time is now" opinion from Jackson Hole.

- Treasury futures have reversed the modest overnight support after the open, see-sawing lower on narrow range after Core durable goods orders were softer than expected in preliminary July data, falling -0.1% M/M (cons 0.1) after a downward revised 0.5% (initial 0.9%).

- The Dallas Fed manufacturing survey improved by more than expected to -9.7 (cons -16.0) in August from -17.5, still firmly negative but its highest level since Jan 2023.

- Despite London close for bank holiday, heavier volumes so far (TYU4>3.5M) driven by Sep/Dec roll efforts with percentage complete near 60% in 5s ahead Fri's first notice.

- Cross asset roundup: US$ index gained (+.148 at 100.866), crudes trading higher (WTI +2.0 at 76.83) on Libya announcing force majeure recently, not to mention mid-East tension following after Israel bombed target in Lebanon.

- Data on tap Tuesday: Housing Data, Consumer Confidence, regional Fed data from Dallas and Richmond Fed.

OVERNIGHT DATA

US DATA (MNI): Away From Aircraft Noise, Durable Goods Disappoint

Core durable goods orders were softer than expected in preliminary July data, falling -0.1% M/M (cons 0.1) after a downward revised 0.5% (initial 0.9%). The underlying trends are weak, the year-ago rate was just 0.7% Y/Y (albeit the strongest pace since March – SA data to adjust for trading day differences) and 3m/3m orders slipped to -1.9% annualized.

- A cautionary word on overall orders, which were much stronger than expected as they jumped 9.9% (cons 4.9) after -6.9% (initial -6.7%).

- Recall that nondefense aircraft orders plunged to a rare negative reading in June owing to what we thought at the time was linked to a Boeing cancellation. Indeed, nondefense aircraft orders swung to $23.4bn in July from -$4.2bn in June and $15.6bn in May, which meant that total transportation orders swung from -21% M/M to 35% M/M in July.

- Core shipments meanwhile were more notably weaker than expected, -0.4% M/M (cons 0.2) after a downward revised 0.0% (initial 0.2). It left core shipments at -0.1% Y/Y and -2.7% annualized on a 3m/3m basis.

US DATA (MNI): Dallas Fed Mfg Index Least Negative Since Jan’23, Prices Paid Firm

The Dallas Fed manufacturing survey improved by more than expected to -9.7 (cons -16.0) in August from -17.5, still firmly negative but its highest level since Jan 2023. Sequential improvements were seen across the vast majority of components, including new orders (-4.2 after -12.8), shipments (0.8 after -16.3) and capacity utilization (-2.5 after -10.0).

- Employment was a notable exception though, giving back a spike higher to 7.1 in July as it fell back to -0.7.

- Price components meanwhile were within recent ranges except for current period prices paid, with the increase from 23.1 to 28.2 leaving it at its highest since Oct’22 and the highest for regional Fed surveys.

- Note that single year pre-pandemic comparisons can be misleading: the index averaged 16.0 in 2019 but 43.5 in 2018.

MARKET SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 54.09 points (0.13%) at 41220.08

- S&P E-Mini Future down 19.25 points (-0.34%) at 5633.5

- Nasdaq down 159.8 points (-0.9%) at 17715.87

- US 10-Yr yield is up 1.5 bps at 3.8141%

- US Sep 10-Yr futures are down 3.5/32 at 113-19

- EURUSD down 0.003 (-0.27%) at 1.1162

- USDJPY up 0.2 (0.14%) at 144.57

- WTI Crude Oil (front-month) up $2.41 (3.22%) at $77.24

- Gold is up $7.85 (0.31%) at $2520.39

- European bourses closing levels:

- EuroStoxx 50 down 12.51 points (-0.25%) at 4896.69

- German DAX down 16.08 points (-0.09%) at 18617.02

- French CAC 40 up 13.33 points (0.18%) at 7590.37

US TREASURY FUTURES CLOSE

- 3M10Y +2.032, -131.994 (L: -138.04 / H: -131.994)

- 2Y10Y -0.135, -11.977 (L: -12.378 / H: -9.754)

- 2Y30Y -0.407, 16.932 (L: 16.721 / H: 20.065)

- 5Y30Y -0.111, 43.94 (L: 43.856 / H: 46.513)

- Current futures levels:

- Sep 2-Yr futures down 1.25/32 at 103-10.625 (L: 103-10.5 / H: 103-14)

- Sep 5-Yr futures down 2.75/32 at 109-4.5 (L: 109-04 / H: 109-12)

- Sep 10-Yr futures down 3.5/32 at 113-19 (L: 113-18.5 / H: 113-30)

- Sep 30-Yr futures down 2/32 at 124-17 (L: 124-10 / H: 125-03)

- Sep Ultra futures down 4/32 at 133-0 (L: 132-25 / H: 133-28)

US 10Y FUTURE TECHS: (U4) Trend Structure Remains Bullish

- RES 4: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-03+ High Aug 5 and the bull trigger

- RES 1: 114-03/114-16 High Aug 6 / 76.4% of the Aug 5 - 8 pullback

- PRICE: 113-27 @ 1040 ET Aug 26

- SUP 1: 112-30+ 20-day EMA

- SUP 2: 111-29 50-day EMA values

- SUP 3: 111-06+ Low Jul 29

- SUP 4: 110-18+ Low Jul 22

A bullish theme in Treasuries remains intact and the contract is trading above support. Note that moving average studies are in a bull-mode position and this continues to highlight bullish sentiment. The recent breach of 111-01, Jun 14 high, confirmed a resumption of the uptrend, maintaining the price sequence of higher highs and higher lows. Sights are on 115-17, a Fibonacci projection. Support to watch is 112-30+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.018 at 95.078

- Dec 24 -0.030 at 95.755

- Mar 25 -0.035 at 96.265

- Jun 25 -0.030 at 96.575

- Red Pack (Sep 25-Jun 26) -0.025 to -0.005

- Green Pack (Sep 26-Jun 27) -0.005 to steady

- Blue Pack (Sep 27-Jun 28) steady to +0.005

- Gold Pack (Sep 28-Jun 29) +0.010 to +0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements: London Bank holiday - no new settles, below are Friday's for reference:

- 1M -0.00194 to 5.27601 (-0.05579/wk)

- 3M +0.00933 to 5.08064 (-0.04777/wk)

- 6M +0.01895 to 4.77370 (-0.06599/wk)

- 12M +0.03663 to 4.30022 (-0.08838/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.02), volume: $2.152T

- Broad General Collateral Rate (BGCR): 5.32% (+0.01), volume: $779B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.01), volume: $760B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $275B

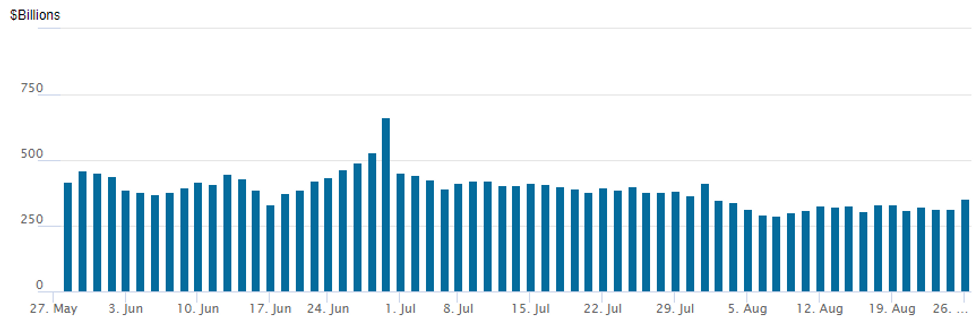

US Fed Reverse Repo Operation

RRP usage rebounds to $353.557B from $312.896B Friday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties 63 from 65 prior.

PIPELINE

No new US$ corporate issuance since last Friday, $38.4B total corporate debt issued last week.

BONDS: EGBs CASH CLOSE: Yields Tick Higher, With German Belly Underperforming

EGBs softened modestly Monday, amid a UK market holiday.

- Yields rose early in the session, in part due to a rise in crude oil prices on a Libyan output stoppage.

- German IFO came in largely in line with expectations, but nonetheless showed a slight deterioration in sentiment in August vs July.

- 10Y Bund yields briefly tested the Aug 15 high but pulled back toward the cash close, ultimately trading within recent ranges. The belly of the German curve modestly underperformed.

- Periphery EGB spreads were little changed, as risk assets failed to find a decisive direction.

- Tuesday brings the final reading of German 2Q GDP and GfK Consumer Confidence, and ECB's Knot and Nagel speaking.

- UK markets return from holiday as well (with an expected policy speech by PM Starmer).

- The main event of the week is the Eurozone August flash CPI round on Thursday and Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.4bps at 2.398%, 5-Yr is up 3bps at 2.162%, 10-Yr is up 2.3bps at 2.248%, and 30-Yr is up 1.3bps at 2.483%.

- Italian BTP spread up 0.6bps at 134.8bps / Spanish up 0.4bps at 79.9bps

FOREX: USD Hovers Near Session Highs Up 0.15% as Equities Dip

- The modest pressure on equities Monday has supported the greenback, although volumes and ranges have remained capped, largely owing to the UK holiday and the lack of tier one data across global markets.

- The most volatile pair has unsurprisingly been USDJPY, which having extended Friday’s weakening trend to reach a fresh low of 143.45 overnight in the APAC session has since bounced over 100 pips. USDJPY’s trend structure is bearish and moving average studies remain in a bear-mode set-up. A stronger reversal lower would refocus attention on key support at 141.70, the Aug 5 low. Clearance of this level would confirm a resumption of the bear trend.

- The slightly firmer greenback on Monday has weighed on the likes of EUR, AUD and NZD, with the latter underperforming its G10 counterparts, down 0.4%.

- In emerging markets, the elevated uncertainty surrounding political risks in Mexico continue to weigh on the peso. USDMXN is +1.5% at typing and trading around 19.40 as we approach the APAC crossover. Protestors took to the streets across Mexico on Sunday in the latest opposition to AMLO’s proposed judicial overhaul and the President described some of the latest criticism as ridiculous earlier today.

- A bullish theme in USDMXN remains intact following the rally between Jul 12 and Aug 5. Last week’s gains also represent a positive development. Initial short-term objectives are 19.5999 and 19.8362, the 61.8% and 76.4% retracement points of the sell-off between Aug 5 - Aug 16.

- US consumer confidence and Richmond Manufacturing highlight Tuesday’s economic data schedule.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/08/2024 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/08/2024 | 0600/0800 | *** |  | DE | GDP (f) |

| 27/08/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/08/2024 | 0600/0800 | ** |  | SE | PPI |

| 27/08/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/08/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/08/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/08/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/08/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/08/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/08/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.