-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Shutdown Risk Kicked Out to November 17

- MNI: Fed's Barr Says Can 'Proceed Carefully' On Rates

- MNI BRIEF: Barr Says Fed Could Continue QT While Cutting Rates

- MNI BRIEF: Fed Gov Bowman Sees Need For Further Rate Increases

- MNI BRIEF: BOE Forecasts Over Estimate Tightening Impact- Mann

- MNI INTERVIEW: ISM Manufacturing Seen Topping 50 By Year End

US

FED: Federal Reserve officials can be patient in determining the extent of monetary policy tightness needed to bring inflation under control as the economy proves stronger than policymakers had foreseen, Fed Vice Chair for Supervision Michael Barr said Monday.

- “Given how far we have come, we are now at a point where we can proceed carefully as we determine the extent of monetary policy restriction that is needed,” said Barr. “In my view, the most important question at this point is not whether an additional rate increase is needed this year or not, but rather how long we will need to hold rates at a sufficiently restrictive level to achieve our goals.”

- He cited “a lot of progress” in the fight against inflation, saying the Fed’s aggressive hikes of 525 basis points in less than 1-½ years had helped keep inflation expectations contained despite the post-Covid surge in price pressures. For more see MNI Policy main wire at 1300ET.

- "You might say maybe there's a conflict there between financial stability goals and monetary policy, but I think we can actually work our way towards normalization in both of these tools separately," he said in Q&A after a speech Monday, where he said interest rates may be "at, or near" sufficiently restrictive levels needed to get inflation down to 2%. "Both these tools can be used I think in a coherent fashion. They don't necessarily create conflicts between two goals that we're talking about."

FED: Federal Reserve Governor Michelle Bowman on Monday reaffirmed her view that "further rate increases" are needed to return inflation to 2% amid risk that high energy prices could reverse recent progress on inflation.

Friday's PCE inflation reading showed overall inflation rose in part due to higher oil prices, she noted. The median FOMC official expects inflation to stay above 2% through 2025.

- "This, along with my own expectation that progress on inflation is likely to be slow given the current level of monetary policy restraint, suggests that further policy tightening will be needed to bring inflation down in a sustainable and timely manner," she said in remarks prepared for a Mississippi Bankers Association and Tennessee Bankers Association conference.

- "I expect it will likely be appropriate for the Committee to raise rates further and hold them at a restrictive level for some time to return inflation to our 2 percent goal in a timely way." For more see MNI Policy main wire at 1030ET.

UK

BOE: The Bank of England's central economic projections underestimate the impact of the tightening that the Monetary Policy Committee has carried out to date and inflation has proven stickier than expected, MPC member Catherine Mann said Monday.

- Speaking at a Redburn Atlantic event Mann argued that policymakers should not take the risk of assuming that inflation expectations are well anchored and should err on the side of tighter policy. Mann has repeatedly pushed for higher interest rates in her time on the MPC and she argued that the Bank models have overestimated how restrictive policy has been, with the long-run neutral rate driven up in part by UK inflation premia.

- Our model "underestimates. the stickiness of inflation. The forecast over-estimates the amount and the effects of the monetary policy tightening to date, " Mann said, adding in a Q and A that the impact of tightening in the US was larger than in the UK. She said that UK "households are in pretty good shape," downplaying the financial stability risks from policy tightening.

US Tsys Back Near Midday Lows, Mixed Data, Shutdown Averted

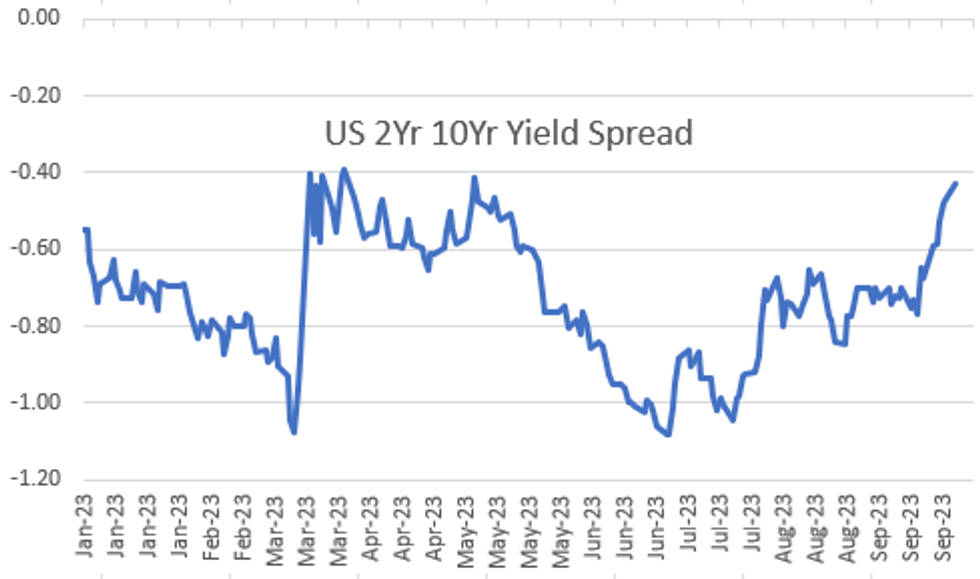

- Tsy futures remain weaker, near midday lows after attempting to rebound in the second half. Dec'23 10Y futures are at 107-11 (-23) vs. 107-07 low, 10YY at 4.6785% (+.1074) vs. 4.7014% high. Curves remain steeper: 3M10Y +9.262 at -79.260, 2Y10Y +4.686 at -42.976.

- No delay in economic data this week after Congress passed a stopgap funding bill Saturday evening that will keep Federal agencies open through November 17, 2023.

- Tsys extended lows after S&P Global US Manufacturing PMI comes out higher than expected (49.8 vs. 48.9 est). Fast two way trade was noted after ISM data.

- Treasury futures extend early session lows (TYZ3 107-12.5) then rebound mixed ISM manufacturing came out higher than expected (49.0 vs. 47.8 est). ISM Prices Paid lower than expected (43.8 vs. 48.8 est), Employment higher: (51.2 vs. 48.5 prior) and New Orders (49.2 vs. 46.8 prior). in contrast, Construction Spending was in line with expectations at 0.5%.

- Cross asset summary: Greenback remains strong (DXY +.731 at 106.905), Gold remains weak (-18.77 at 1829.86), crude weaker too (WTI -2.16 at 88.64). Stocks mixed, Nasdaq outperforming: up 21.43 points (0.3%) at 13240.75, DJIA down 201.42 points (-0.6%) at 33310.09, S&P E-Mini Future down 24.75 points (-0.57%) at 4302.

- Limited data release Tuesday, focus on ADP early Wednesday ahead Fri's September Jobs data.

OVERNIGHT DATA

- S&P Global US Manufacturing PMI comes out higher than expected (49.8 vs. 48.9 est)

- US ISM SEP MANUF PURCHASING MANAGERS INDEX 49

- US ISM SEP MANUF PRICES PAID INDEX 43.8

- US ISM SEP MANUF NEW ORDERS INDEX 49.2

- US ISM SEP MANUF EMPLOYMENT INDEX 51.2

- US ISM SEP MANUF PRODUCTION INDEX 52.5

- US ISM SEP MANUF SUPPLIER DELIVERY INDEX 46.4

- "We can easily go to something above 50 in the next two or three months," said Fiore of the dividing line that separates contraction from expansion in the sector. "This month supports that we can get above 50 by the end of the year. I don't really see us going backwards from this," he said. But "we're probably sitting at another 49 in October."

- The ISM manufacturing index increased 1.4pp to 49.0 in September, better than expectations and the highest in 10 months. But September was the eleventh consecutive month the ISM reading was below 50 indicating contraction.

- US AUG CONSTRUCT SPENDING +0.5%

- US AUG PRIVATE CONSTRUCT SPENDING +0.5%

- US AUG PUBLIC CONSTRUCT SPENDING +0.6%

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 203.69 points (-0.61%) at 33307.35

- S&P E-Mini Future down 24.5 points (-0.57%) at 4302

- Nasdaq up 7 points (0.1%) at 13229.32

- US 10-Yr yield is up 11 bps at 4.6806%

- US Dec 10-Yr futures are down 24/32 at 107-10

- EURUSD down 0.0081 (-0.77%) at 1.0493

- USDJPY up 0.39 (0.26%) at 149.75

- WTI Crude Oil (front-month) down $2.14 (-2.36%) at $88.66

- Gold is down $18.69 (-1.01%) at $1830.33

- European bourses closing levels:

- EuroStoxx 50 down 37.03 points (-0.89%) at 4137.63

- FTSE 100 down 97.36 points (-1.28%) at 7510.72

- German DAX down 139.37 points (-0.91%) at 15247.21

- French CAC 40 down 66.9 points (-0.94%) at 7068.16

US TREASURY FUTURES CLOSE

- 3M10Y +9.73, -78.792 (L: -89.039 / H: -78.017)

- 2Y10Y +4.685, -42.977 (L: -48.556 / H: -41.943)

- 2Y30Y +3.172, -31.685 (L: -37.327 / H: -30.271)

- 5Y30Y -0.851, 7.811 (L: 5.186 / H: 9.318)

- Current futures levels:

- Dec 2-Yr futures down 4.25/32 at 101-7.125 (L: 101-06 / H: 101-10.625)

- Dec 5-Yr futures down 14.25/32 at 104-29.25 (L: 104-27.5 / H: 105-08.25)

- Dec 10-Yr futures down 24/32 at 107-10 (L: 107-07 / H: 107-29.5)

- Dec 30-Yr futures down 1-13/32 at 112-12 (L: 111-31 / H: 113-24)

- Dec Ultra futures down 1-22/32 at 117-0 (L: 116-18 / H: 118-20)

(Z3) Bear Trend Remains Intact

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-07+ 50-day EMA

- RES 2: 109-20 High Sep19

- RES 1: 108-17/109-00 Low Sep 27 / 20-day EMA

- PRICE: 107-11+ @ 1500 ET Oct 2

- SUP 1: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 2: 106-23 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 106-10 2.0% Lower 10-dma envelope

- SUP 4: 106.00 Round number support

The bear trend in Treasuries remains intact and the contract traded to a fresh cycle low last week. The move down confirmed a resumption of the downtrend, maintaining the bearish price sequence of lower lows and lower highs. Sights are on 107-05, a Fibonacci projection. On the upside initial firm resistance is seen at 109-00, the 20-day EMA. A break would signal a possible base. For now, gains are considered corrective.

SOFR FUTURES CLOSE

- Dec 23 -0.035 at 94.515

- Mar 24 -0.045 at 94.580

- Jun 24 -0.060 at 94.755

- Sep 24 -0.075 at 95.015

- Red Pack (Dec 24-Sep 25) -0.11 to -0.095

- Green Pack (Dec 25-Sep 26) -0.125 to -0.115

- Blue Pack (Dec 26-Sep 27) -0.135 to -0.125

- Gold Pack (Dec 27-Sep 28) -0.145 to -0.14

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00509 to 5.32408 (+0.00148/wk)

- 3M -0.00735 to 5.38815 (-0.00417/wk)

- 6M -0.01467 to 5.45260 (-0.01228/wk)

- 12M -0.03258 to 5.43368 (-0.01937/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% volume: $174B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.537T

- Broad General Collateral Rate (BGCR): 5.30%, $510B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $496B

- (rate, volume levels reflect prior session)

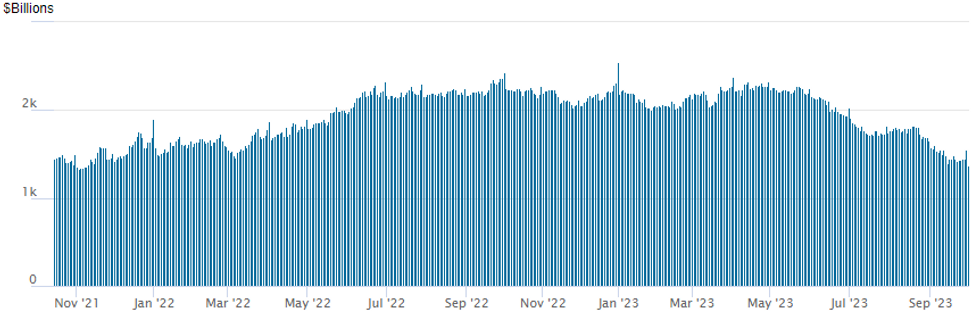

FED REVERSE REPO OPERATION: Falls Back To Early Nov'21 Lows

NY Federal Reserve/MNI

After Friday's month-end surge to $1,557.569B, Repo operation usage falls to $1,365.739B - lowest since early November 2021 w/99 counterparties. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $1.75B American Honda 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/02 $1.75B #American Honda $950M 2Y +75, $300M 2Y SOFR+79, $500M 7Y +115

- 10/02 $1.7B #Diageo $800M 3Y +60, $900M 10Y +100

- 10/02 $1B #PSEG $600M 5Y +120, $400M 10Y +150

- 10/02 $500M #Aviation Capital Group 5Y +225

- 10/02 $500M #Kimco Realty +10Y +178

- 10/02 $Benchmark Oman Telecom 7Y Sukuk investor calls

- 10/02 $Benchmark Emirates NBD 5Y

FOREX: Yields, USD Move in Lockstep as Uptrend Resumes

- Markets traded on a steadier footing early Monday, with the worst case scenario of a US government shutdown avoided - helped stabilise equity markets on both sides of the pond. This steadier outlook didn't last through US hours, however, as an underlying USD bidtone followed US bond markets in lockstep. The US 10y yield inched higher still to show above last week's 4.6861% to once again touch levels not seen since late 2007.

- The better-than-expected Manufacturing ISM also proved to be a positive factor for US yields, with the tip in the employment subindex back above 50.0 also factoring in a stronger jobs market ahead of this Friday's nonfarm payrolls release.

- The greenback was the strongest performing currency in G10 Monday, with JPY and CHF also trading well. The NOK and SEK accompanied AUD lower.

- The RBA is likely to leave rates at 4.10% again at its Tuesday meeting, as the economy is developing broadly as the bank expects. Decisions are highly data and outlook dependent and while there have been some upside surprises there haven’t been any developments that would shift the Board from its on hold stance. The tightening bias will probably be retained to keep the central bank’s options open going forward and the accompanying statement may again be little changed.

- Speakers due on Tuesday include Fed's Mester and Bostic, as well as ECB's Simkus, Lane and Villeroy.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/10/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/10/2023 | 2330/1930 |  | US | Cleveland Fed's Loretta Mester | |

| 03/10/2023 | 0030/1130 | * |  | AU | Building Approvals |

| 03/10/2023 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 03/10/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 03/10/2023 | 0610/0810 |  | EU | ECB's Lane speaks at Annual Economics Conference | |

| 03/10/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/10/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/10/2023 | 0835/1035 |  | EU | ECB's Lane participates in panel at Annual Economics Conference | |

| 03/10/2023 | 1145/0745 |  | CA | BOC Deputy Nicolas Vincent speech in Montreal | |

| 03/10/2023 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 03/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/10/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 03/10/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 03/10/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 03/10/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 03/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.