-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Soft Landings and Tolerating Over 2% Inflation

EXECUTIVE SUMMARY

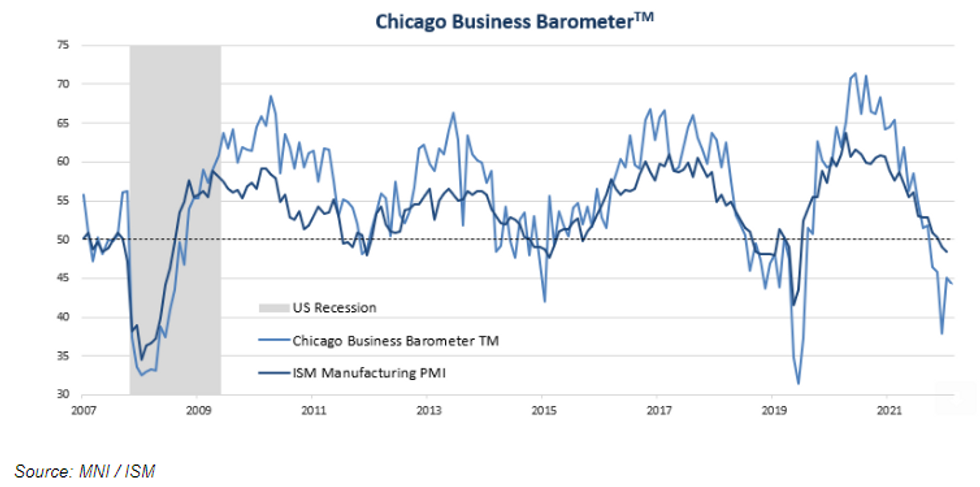

The Chicago Business BarometerTM, produced with MNI, moderated by -0.8 points to 44.3 in January; the fifth consecutive month below 50. This follows a 7.2-point December rebound to signal a softer downturn.

- Production, Supplier Deliveries and Prices Paid increased over the month in January, with Production recording the strongest growth (albeit remaining below 50). All other subindexes weakened, led by a marked drop in Order Backlogs.

US

FED: The Federal Reserve would be likely to tolerate inflation rates above 2% for longer than it would prefer in order to prevent unemployment from rising too quickly, former senior Fed officials told MNI, though they stressed that going further to enshrine a 3% target as some experts have favored won't happen anytime soon.

- Inflation is expected to decline rapidly this year, helped by lower energy prices, increased goods supply and falling shelter inflation, but there's uncertainty over how much unemployment must rise to bring down wage growth and more stubborn core-services-excluding-housing price categories. Forced into a tradeoff between still-high inflation and rising joblessness, the FOMC could accept slower progress on both.

- "My view is it’s implausible to contemplate that the committee will raise the inflation objective any time soon or outside of a formal framework review. (Fed Chair Jerome) Powell was unequivocal that it’s not going to happen in the near term," said former Fed Board research director David Wilcox, who has argued for a switch to a 3% target in order to deliver a long-term boost to employment while allowing more room to cut rates in downturns. For more see MNI Policy main wire at 1107ET.

- "What the Fed is doing is definitely affecting things and we're seeing that in the wage inflation and so while we really saw an acceleration over the year that growth is definitely slowing," he said in an interview.

- The rate of hourly wage growth for U.S. small businesses continued to decline to 4.66% year-over-year in January according to the latest Paychex IHS Markit Small Business Employment Watch, the lowest since January last year. That comes as its jobs index measuring national employment growth for businesses with fewer than 50 workers increased for the first time since 2020, up 0.18% to 99.56. For more see MNI Policy main wire at 1336ET.

- While coupon sizes will grow again in future, that may not happen until well into 2023, and our estimates reflect an unchanged schedule through the 1st half at least

- Key topics outside the auction sizes will include discussion of potential Treasury buybacks and any plans surrounding the debt limit – including indications of cash management and bill supply.

- Our Deep Dive includes an estimated U.S. issuance schedule, review of October's auctions, and sell-side Refunding expectations.

UK

BOE: A stagnating UK workforce and a likely higher equilibrium rate of unemployment have raised the chances that the Bank of England will ratchet its already-low estimate for trend economic growth still lower when it produces its annual supply-side stock take in its February Monetary Policy Report.

- The BOE last assessed potential supply growth in November 2021 as around 1.5%, but the the labour force seems to have moved away from a prolonged period of growth prior to the Covid pandemic. Private sector economists have already adjusted their estimates of how quickly the economy can grow without driving inflationary pressures, with Allan Monks at JP Morgan saying the rate may have slipped below 1%.

- At the same time, and uniquely among advanced economies, the labour force participation rate has also headed lower since the end of pandemic restrictions, with mooted causes including early retirement, long-term sickness, strains on the health services, an ageing population and the loss of freedom of movement for European workers post Brexit. For more see MNI Policy main wire at 1204ET.

US TSYS: No Month End Fireworks Ahead Wed FOMC

Tsys trading firmer after the bell, near middle of narrow range (30YY 3.6487%, -.0033, yield curves steeper 2s10s +1.591 at -68.776) - no month end fireworks. Several factors at play as markets otherwise await Wed's FOMC policy annc.

- US FI broke higher after Q4 ECI data rises less than expected: 1% vs. 1.1% est (Q3 1.2%), equities reacted positively as well as SPX eminis bounced back to steady at the time (ESH3 4032.5). Rates peaked following round of mixed data (Home Prices dip 0.1%, Chicago PMI contracts: 44.3 vs. Dec 45.1, Consumer Confidence decline 107.1; EST. 109.0).

- Rate support evaporated around midmorning, long end extended session lows amid spurious reports that German inflation data (delayed since late last wk) had been released - it has not. MNI has received nothing from German stats agency that can back up any German Jan inflation release. MNI's latest confirmation is that the Destatis release has been delayed, and publication date to be confirmed later this week.

- Citing historicals, brief opportunity for tactical month-end buyers: reversal in Tsys (partially spurred by Block sale of 6.6k FVH3 at 109-06) presented a speculative opp ahead month end rebalancing today. Indeed, Tsys did rebound off lows. - still time to unwind risk.

- Fed funds implied hike for Feb'23 at 25.8bp (-.6), Mar'23 cumulative 46.1bp (-.8) to 4.793%, May'23 56.6bp (-1.3) to 4.898%, terminal at 4.91% in Jun'23.

OVERNIGHT DATA

- US Q4 EMPLOYMENT COST INDEX 1% V Q3 1.2%

- US Q4 EMPLOYMENT COST INDEX Y/Y 5.1% V Q3 5%

- US Q4 BENEFIT PAYMENTS 0.8% V Q3 1%; Q4 Y/Y 4.9%(Q3 4.9%)

- US NOV. S&P CORELOGIC CS 20-CITY ADJUSTED INDEX FELL 0.5% M/M - bbg, expected -0.6%

- US NOV. HOME PRICES FALL 0.1% VS PREVIOUS MONTH, FHFA SAYS - bbg, expected -0.5%

- US REDBOOK: JAN STORE SALES +5.0% V YR AGO MO

- US REDBOOK: STORE SALES +4.9% WK ENDED JAN 28 V YR AGO WK

- MNI JAN CHICAGO BUSINESS BAROMETER 44.3 VS DEC 45.1

- MNI CHICAGO: JAN PRICES PAID 72.5 VS DEC 65.1

- MNI CHICAGO: JAN EMPLOYMENT 42.0 VS DEC 42.6

- MNI CHICAGO: JAN PRODUCTION 48.6 VS DEC 40.1

- MNI CHICAGO SURVEY PERIOD JAN 2 to 17

- US JAN. CONSUMER CONFIDENCE AT 107.1; EST. 109.0

- CANADIAN NOV GDP +0.1% MATCHES EXPECTED

- CANADA FLASH Q4 GDP +0.4% QOQ, +1.6% ANNUALIZED PACE

- CANADA NOV GOODS INDUSTRY GDP -0.1%, SERVICES +0.2%

- CANADA REVISED OCT GROSS DOMESTIC PRODUCT +0.1% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 205.37 points (0.61%) at 33925.23

- S&P E-Mini Future up 36.25 points (0.9%) at 4068.5

- Nasdaq up 137.9 points (1.2%) at 11532.42

- US 10-Yr yield is down 1.7 bps at 3.5198%

- US Mar 10-Yr futures are up 9/32 at 114-18

- EURUSD up 0.0013 (0.12%) at 1.0865

- USDJPY down 0.25 (-0.19%) at 130.14

- WTI Crude Oil (front-month) up $1.14 (1.46%) at $79.04

- Gold is up $5.2 (0.27%) at $1928.43

- EuroStoxx 50 up 4.82 points (0.12%) at 4163.45

- FTSE 100 down 13.17 points (-0.17%) at 7771.7

- German DAX up 2.19 points (0.01%) at 15128.27

- French CAC 40 up 0.41 points (0.01%) at 7082.42

US TSY FUTURES CLOSE

- 3M10Y -4.111, -116.585 (L: -123.135 / H: -114.512)

- 2Y10Y +1.797, -68.57 (L: -72.239 / H: -68.015)

- 2Y30Y +3.289, -55.529 (L: -60.32 / H: -54.533)

- 5Y30Y +3.025, 1.85 (L: -1.973 / H: 3.063)

- Current futures levels:

- Mar 2-Yr futures up 3.125/32 at 102-26.5 (L: 102-24 / H: 102-27.625)

- Mar 5-Yr futures up 7.5/32 at 109-8.5 (L: 109-02 / H: 109-13)

- Mar 10-Yr futures up 8.5/32 at 114-17.5 (L: 114-09.5 / H: 114-25.5)

- Mar 30-Yr futures up 7/32 at 130-0 (L: 129-15 / H: 130-18)

- Mar Ultra futures up 3/32 at 141-30 (L: 141-05 / H: 142-25)

US 10YR FUTURE TECHS: : (H3) Support At The 50-Day EMA Exposed

- RES 4: 117-00 High Sep 8 2022

- RES 3: 116-08 High Jan 19 and the bull trigger

- RES 2: 115-21 High Jan 20

- RES 1: 114-28/115-13 High Jan 27 / High

- PRICE: 114-17 @ 16:26 GMT Jan 31

- SUP 1: 114-05+ Low Jan 30

- SUP 2: 114-00 50-day EMA

- SUP 3: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

- SUP 4: 112-29 76.4% retracement of the Dec 30 - Jan 19 bull leg

Treasury futures traded to new lows Monday, taking out key support at the Jan 17 low of 114-09+. The break of this level undermines the recent bull theme and signals scope for a deeper retracement. Next support undercuts at the 50-day EMA, at 114-00. The average represents a key support. On the upside a key short-term resistance is at 115-13, the Jan 25 high. A break would ease any developing bearish threat.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.020 at 95.020

- Jun 23 +0.020 at 94.915

- Sep 23 +0.025 at 94.990

- Dec 23 +0.045 at 95.320

- Red Pack (Mar 24-Dec 24) +0.065 to +0.095

- Green Pack (Mar 25-Dec 25) +0.070 to +0.090

- Blue Pack (Mar 26-Dec 26) +0.050 to +0.065

- Gold Pack (Mar 27-Dec 27) +0.030 to +0.050

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00686 to 4.29843% (-0.00628/wk)

- 1M +0.00872 to 4.57429% (-0.00458/wk)

- 3M +0.00000 to 4.81357% (-0.01172/wk)*/**

- 6M +0.00886 to 5.10043% (-0.00186/wk)

- 12M +0.01157 to 5.33757% (+0.02143/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $109B

- Daily Overnight Bank Funding Rate: 4.32% volume: $289B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.158T

- Broad General Collateral Rate (BGCR): 4.27%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $452B

- (rate, volume levels reflect prior session)

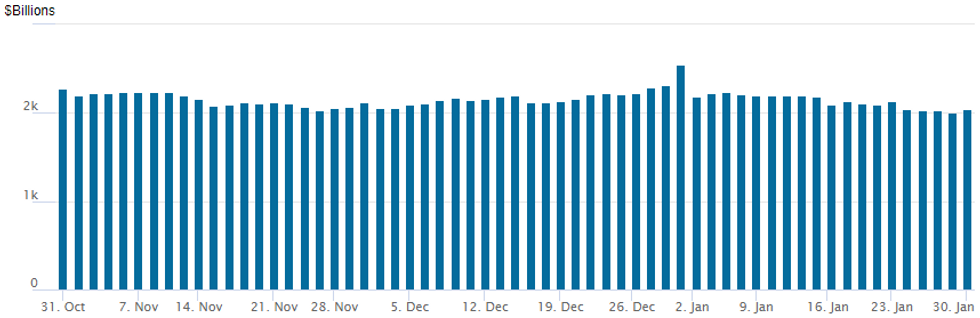

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbed to $2,061.572B w/ 104 counterparties vs. prior session's $2,048.714B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2B PEMEX 10Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/31 $2B #Pemex 10Y 10.375%

- 01/31 $1.25B *CABEI 3Y SOFR+120

- 01/31 $Benchmark Dominican Rep 8Y 7.5%a

FOREX: US Data Weighs On Greenback, Swiss Franc Surges

- Early weakness in equities underpinned a firmer USD in early trade on Tuesday, extending on Monday’s more buoyant price action. However, lower than expected US data and potential flows relating to month-end prompted a reversal for the greenback, with the USD Index trading close to unchanged for the week approaching the Fed’s February decision tomorrow.

- US Employment Cost Index data confirmed that AHE wage growth moderated in Q4, sparking a quick gap lower from which the US dollar was unable to recover from.

- Topping the G10 leaderboard is the Swiss Franc, which has advanced close to 1% against both the Euro and the dollar. The move lower in USDCHF follows three straight days of gains, the entirety of which have been erased today. The pair has significantly narrowed the gap with the trend lows and key support around the 0.91 handle. There appears nothing notable driving the CHF bid, with potential month-end dynamics contributing to the outperformance.

- The Norwegian Krone is one of the poorest performers in G10, as the Norges Bank confirmed a larger than expected schedule for February FX purchases. Consensus looked for an unchanged clip of NOK 1.5lbn per day, not the NOK 1.9bln confirmed this morning. EUR/NOK rallied to new cycle highs in response, trading as high as 10.9276 in early US trade before moderating.

- GBP has also traded on the weaker side, with cable unable to bounce amid the broad dollar weakness. EURGBP (+0.37%) has maintained a bid tone throughout the session and further gains would expose resistance at 0.8897, the Jan 13 high and a bull trigger. Clearance of this hurdle would confirm a resumption of the bull cycle that started early December last year.

- US ADP, ISM Manufacturing PMI and JOLTS data all play second fiddle to the FOMC decision where the Fed will downshift its rate hike pace in February for the second consecutive meeting, to 25bp from 50bp. All eyes will then be on Chair Powell’s press conference.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/02/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/02/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/02/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 01/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2023 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/02/2023 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.