-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stocks Bid, Risk Appetite Simmers

EXECUTIVE SUMMARY

US

TSY: U.S. Treasury Secretary Janet Yellen said Monday she is keeping an eye out that market volatility does not expose financial stability risks in the nonbank sector, and the Treasury market appears to be functioning well.

- Regulators are "attentive to the possibility that higher market volatility could expose vulnerabilities in nonbank financial intermediation," she said in a speech to the Securities Industry and Financial Markets Association. "Since I arrived at Treasury, financial regulators have been working together to better monitor leverage in private funds and develop policies to reduce the first-mover advantage that could lead to investor runs in money market funds and open-end bond funds."

CANADA

BOC: Bank of Canada Governor Tiff Macklem is expected to raise the overnight lending rate another 75 basis points Wednesday to the highest since 2008 and signal more is coming to tackle inflation lingering well above target even as recession warnings mount.

- The rate will rise to 4% according to 13 of 21 economists surveyed by MNI and trading in futures markets, taking this year's total to 375bps in the G7's most aggressive tightening campaign. Many investors revised up views from a half-point hike just last week as inflation slowed less than expected to 6.9% from 7% and the Bank's quarterly surveys showed record consumer and business price expectations.

- Macklem even took to a Twitter video in recent weeks to tell the public strong medicine is needed before inflation returns to 2% and to warn big price gains could become entrenched. That stern message comes as the IMF, major commercial banks and former Governor Mark Carney say Canada is likely heading to recession. For more, see MNI Policy main wire at 1153ET.

EUROPE

ECB: The European Central Bank may have to bypass conditions it set for the activation of its Transmission Protection Instrument to contain a blowout in bond spreads if markets turn ugly fast, a former Polish central banker and consultant to the European Parliament told MNI.

- While use of the TPI, which would allow the ECB to buy the debt of weaker eurozone states if prices moved out of line with fundamentals, is contingent on criteria including compliance with the European Union’s fiscal framework, in practice it is unlikely there would be enough time to check, said Marek Dabrowski in an interview.

- “I don't think that the ECB has this kind of expertise. It will have to rely either on national central banks, which are part of it, or perhaps it will have to consult with the European Commission or with the ESM,” said Dabrowski, author of a recent briefing paper for the European Parliament on TPI. For more see MNI Policy main wire at 0911ET.

US TSYS: Carry-over Short End Bid, Stocks Strong

Tsys trading mixed - bods weaker but off midmorning lows, short end firmer (but well off overnight highs) amid ongoing debate over hawkish policy and risk of over-hiking from Friday.

- No obvious headline trigger as bonds reversed early support - no react to Chicago Fed National Activity Index higher than expected at 0.1 vs. -0.1 est, August revised to 0.1 from 0.0.

- Weak US S&P Global PMI preliminary reports see short-end Tsys rally appr 4bps, US$ recede. The S&P composite surprisingly fell from 49.5 to 47.3 (cons 49.3), the second sharpest monthly decline since 2009 barring the initial pandemic period.

- Quiet second half w/ Fed in policy blackout through the Nov 2 FOMC. No substantive reaction to Rishi Sunak replacing Liz Truss as PM.

- Tuesday data on tap (prior, est): FHFA House Price Index MoM (-0.6%, -0.6%); S&P CoreLogic CS 20-City MoM SA (-0.44%, -0.80%); YoY (16.06%, 14.10%); Consumer Confidence (108.0, 106.0); Richmond Fed Mfg Index (0, -5).

- Q3 equity earnings annc pick up in earnest tomorrow: sampling of pre-open annc: United Parcel Service (UPS) $2.847 est; General Motors (GM) $1.893 est; General Electric (GE) $0.468 est;

OVERNIGHT DATA

US OCT FLASH S&P GLOBAL SERVICES PMI 46.6 (FCST 49.5); SEP 49.3

US OCT FLASH S&P GLOBAL MANUFACTURING PMI 49.9 (FCST 51.0); SEP 52.0

US OCT FLASH S&P GLOBAL COMPOSITE PMI 47.3 (FCST 49.2); SEP 49.5

- Weak US S&P Global PMI preliminary reports see front-end Treasuries rally circa 4bps and the dollar fall back to flat on the day.

- The composite surprisingly fell from 49.5 to 47.3 (cons 49.3), the second sharpest monthly decline since 2009 barring the initial pandemic period.

- The fall in service business activity was more pronounced (from 49.3 to 46.6, cons 49.5), with a solid decline stronger than that seen in Sept whilst business confidence fell to the weakest level since Sep’20 as higher operating costs and client hesitancy weighed on optimism.

- Jobs: “In line with weaker client demand, private sector firms scaled back their hiring activity, leaving employment broadly unchanged on the month” and the SA employment index below the 50.0 neutral mark for the first time since Jun’20.

- Prices: "In an effort to drive new sales and remain competitive, firms reportedly offered concessions to customers following the decrease in some costs such as transportation. The rate of output charge inflation eased to the softest since Dec’20, but was still quicker than the long-run series average."

MARKETS SNAPSHOT

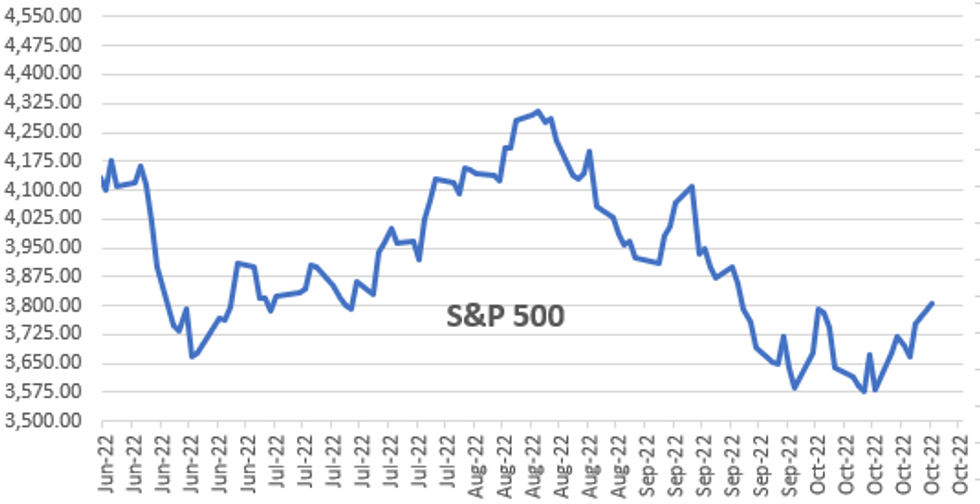

Key late session market levels:- DJIA up 505.33 points (1.63%) at 31587.15

- S&P E-Mini Future up 51.25 points (1.36%) at 3815

- Nasdaq up 89.6 points (0.8%) at 10949.21

- US 10-Yr yield is up 1.5 bps at 4.2318%

- US Dec 10Y are down 2.5/32 at 109-23

- EURUSD up 0.0014 (0.14%) at 0.9875

- USDJPY up 1.21 (0.82%) at 148.88

- WTI Crude Oil (front-month) down $0.36 (-0.42%) at $84.69

- Gold is down $7.43 (-0.45%) at $1650.16

- EuroStoxx 50 up 51.16 points (1.47%) at 3527.79

- FTSE 100 up 44.26 points (0.64%) at 7013.99

- German DAX up 200.55 points (1.58%) at 12931.45

- French CAC 40 up 95.97 points (1.59%) at 6131.36

US TSY FUTURES CLOSE

- 3M10Y +3.67, 20.992 (L: 8.765 / H: 28.043)

- 2Y10Y -0.866, -27.279 (L: -31.903 / H: -23.49)

- 2Y30Y +0.299, -14.431 (L: -20.183 / H: -9.831)

- 5Y30Y +1.026, -0.09 (L: -3.365 / H: 3.371)

- Current futures levels:

- Dec 2Y down 0.125/32 at 102-6.25 (L: 102-04.625 / H: 102-12.125)

- Dec 5Y steady at at 106-4.75 (L: 105-30.75 / H: 106-20.5)

- Dec 10Y down 2/32 at 109-23.5 (L: 109-13 / H: 110-15)

- Dec 30Y down 25/32 at 118-11 (L: 117-19 / H: 120-02)

- Dec Ultra 30Y down 27/32 at 124-18 (L: 123-07 / H: 126-12)

US 10YR FUTURE TECH: (Z2) Trend Needle Still Points South

- RES 4: 113-23 50-day EMA

- RES 3: 112-22+ High Oct 6

- RES 2: 111-28+ High Oct 12 and key near-term resistance

- RES 1: 110-16+ 20-day EMA

- PRICE: 109-23 @ 1455ET Oct 22

- SUP 1: 108-26+ Low Oct 21

- SUP 2: 108-06+ Low Oct 2007 (cont)

- SUP 3: 107.09 3.0% 10-dma envelope

- SUP 4: 106-20+ Low Aug 2007 (cont)

Despite the recovery from Friday’s low, Treasuries remain in a downtrend. The extension lower last week confirmed a break of support at 110.02, the Oct 13 low and the psychological 110.00 handle. This marks a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. The focus is on 108-20, a Fibonacci projection. Initial firm resistance has been defined at 111-28+, high Oct 13.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.035 at 94.885

- Mar 23 -0.045 at 94.795

- Jun 23 -0.020 at 94.855

- Sep 23 -0.010 at 94.995

- Red Pack (Dec 23-Sep 24) +0.015 to +0.035

- Green Pack (Dec 24-Sep 25) steadysteady0 to +0.030

- Blue Pack (Dec 25-Sep 26) -0.035 to -0.01

- Gold Pack (Dec 26-Sep 27) -0.05 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00115 to 3.06571% (-0.0172 total last wk)

- 1M -0.00914 to 3.57643% (+0.14257 total last wk)

- 3M -0.03157 to 4.32686% (+0.16472 total last wk) * / **

- 6M +0.00200 to 4.87700% (+0.18971 total last wk)

- 12M -0.10957 to 5.36600% (+0.19243 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.35843% on 10/21/22

- Daily Effective Fed Funds Rate: 3.08% volume: $99B

- Daily Overnight Bank Funding Rate: 3.07% volume: $265B

- Secured Overnight Financing Rate (SOFR): 3.02%, $955B

- Broad General Collateral Rate (BGCR): 3.00%, $387B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $372B

- (rate, volume levels reflect prior session)

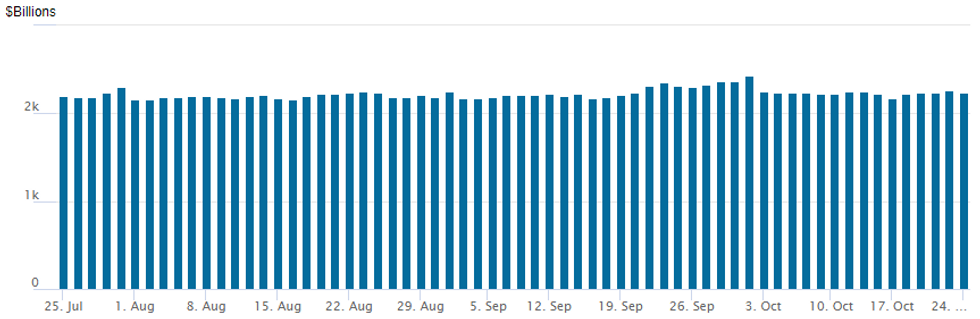

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,242.044B w/ 102 counterparties vs. $2,265.071B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: Fifth Third Bank, Dow Chemical, Marsh & McLennan All Launched

$4.5B to price Monday:

- Date $MM Issuer (Priced *, Launch #)

- 10/24 $2B #Fifth Third Bank $1B 3NC2 +135, $1B 6NC5 +200

- 10/24 $1.5B #Dow Chemical $600M 10Y +210, $900M 30Y +250

- 10/24 $1B #Marsh & McLennan $500M 10Y +160, $500M 30Y +190

- Expected Tuesday:

- 10/25 $1B OKB WNG 3Y SOFR+40

- 10/25 $Benchmark CADES 3Y Social SOFR+40

- 10/25 $Benchmark Greece investor calls Wednesday

EGBs-GILTS CASH CLOSE: UK Yields Drop Sharply As Sunak Seals Win

GIlts easily outperformed global core FI peers Monday, with ex-UK Chancellor Sunak's victory in the Conservative leadership race appearing to augur renewed political and policy certainty.

- Indeed, 30Y UK yields nearly returned to pre-mini budget levels, with the UK curve bull steepening as BoE hike pricing subsided. BoE's Ramsden was the lone Europe central bank speaker, and said it was "really important" for the MPC to get fiscal clarity in time for the November policy decision.

- The German curve bull flattened. Weaker-than-expected European PMIs didn't bring any immediate market reaction upon release, but helped set a constructive tone for the FI session.

- Periphery EGBs outperformed Bunds: 10Y Greek spreads fell 12.4bp, with gains accelerating after PDMA announced a FRN auction Tuesday.

- The ECB decision looms large Thursday - our preview, looking for a 75bp hike, went out today (see here).

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 3.5bps at 2.006%, 5-Yr is down 6.4bps at 2.148%, 10-Yr is down 8.7bps at 2.33%, and 30-Yr is down 10.4bps at 2.338%.

- UK: The 2-Yr yield is down 37.2bps at 3.427%, 5-Yr is down 33bps at 3.823%, 10-Yr is down 30.8bps at 3.746%, and 30-Yr is down 30.4bps at 3.756%.

- Italian BTP spread down 7.4bps at 225.6bps / Greek down 12.1bps at 252.2bps

FOREX: CNH, AUD & NZD Consolidate Overnight Weakness Amid Sour Risk Backdrop

- Sentiment across global currency markets remains sour to start the week as Chinese stock markets registered one of their worst sessions since the financial crisis of 2008. Amid the declines, the yuan weakness extended and USDCNH is now seen comfortably north of the 7.30 mark.

- Technical trend readings are unsurprisingly in a bull mode position. Moving average studies, a positive price sequence of higher highs and higher lows and rising momentum, all point to a continuation higher in the pair. Initial resistance is seen at 7.3693, a Fibonacci projection of the Sep 12 - 28 - Oct 5 price swing.

- Markets will remain on watch for any further intervention following state banks supposedly selling dollars to contain the CNY weakness last week. Initial support is at 7.1611, the 20-day EMA.

- Amid the more pessimistic risk backdrop, AUD and NZD both sold off over 1% during APAC trade and have consolidated their declines throughout Monday.

- EURUSD (+0.10%) has largely shrugged off a dire set of PMI manufacturing and services numbers from across Germany and France, with conviction light ahead of the ECB rate decision on Thursday.

- In similar vein, GBP remains close to unchanged as the election of Rishi Sunak as the new PM provides a slightly more optimistic view for UK investors.

- Japanese authorities have yet to confirm that they were behind the steep JPY rallies seen on Friday and overnight on Monday. Despite the rapid sell-off to fresh lows at 145.56, JPY is also among the poorest performers on Monday following a firm USDJPY bounce to around the 149 level.

- A fairly light data calendar on Tuesday with German IFO and US consumer confidence expected. The ECB meeting remains the key event risk this week with central bank meetings in both Canada and Japan also in focus.

Tuesday Data Calnedar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0855/0955 |  | UK | BOE Pill at ONS ‘Understanding the cost of living through statistics’ | |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/10/2022 | 1755/1355 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.