-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Stocks Surge, McCarthy Sees Debt Path Resolution

- MCCARTHY SAYS HE SEES DEBT LIMIT DEAL ON HOUSE FLOOR NEXT

- FED JEFFERSON: DEMAND HAS CLEARLY BEGUN TO FEEL EFFECT OF HIKES

- FED JEFFERSON: INFLATION TOO HIGH, PROGRESS HAS BEEN SLOWING

- FED LOGAN (VOTER) SAYS CURRENT DATA DOESN’T JUSTIFY PAUSE

- FED LOGAN DOESN’T YET SEE CASE FOR PAUSE AMID HIGH PRICES

- SUPREME COURT LEAVES INTACT SOCIAL MEDIA LIABILITY SHIELD

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: 10s Back To Mid-March Levels, Late Yr Rate Cuts Receding

Treasury futures continue to extend session lows in late trade: 10Y futures through key support of 113-30.5 (Apr 19 low) to 113-28.5, just above major support at 113-26 Mar 22 Low).- Main factors in play included hawkish Fed speak: Dallas Fed Logan signaled support for an eleventh straight Fed rate hike in June amid sticky core inflation and still-high wages. "The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet," Logan stated.

- While optimism over a debt ceiling resolution to avoid default helped push stocks to their best levels since early May, rates trade weaker ahead a likely deluge in bill issuance (estimated over $1T) as the Treasury moves to increase cash buffers following a debt ceiling resolution, roughly the same impact as a 25bp rate hike all else equal.

- Fed funds implied move for the next FOMC on June 14 inches up to 8.1bp, while projected late year rate cuts recede: September cumulative is -4.9bp (-20.8bp early Tuesday) at 5.030%, November cumulative -22.8bp (-43.7bp early Tuesday) at 4.851%, Dec'23 cumulative -44.6bp (-69.0bp Tuesday) at 4.633%, while Jan'24 cumulative is -64.7bp (-93.3bp Tuesday) at 4.32%. Fed Terminal currently at 5.165% in Jul'23 this morning.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00886 to 5.08212 (+.02521/wk)

- 3M +0.01703 to 5.12936 (+.05956/wk)

- 6M +0.02488 to 5.09376 (+.10829/wk)

- 12M +0.04230 to 4.79666 (+.19552/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 5.06057%

- 1M +0.01600 to 5.14843%

- 3M +0.01014 to 5.37914% */**

- 6M +0.02628 to 5.42514%

- 12M +0.04672 to 5.39243%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.37914% on 5/18/23

- Daily Effective Fed Funds Rate: 5.08% volume: $130B

- Daily Overnight Bank Funding Rate: 5.07% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.02%, $576B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $569B

- (rate, volume levels reflect prior session)

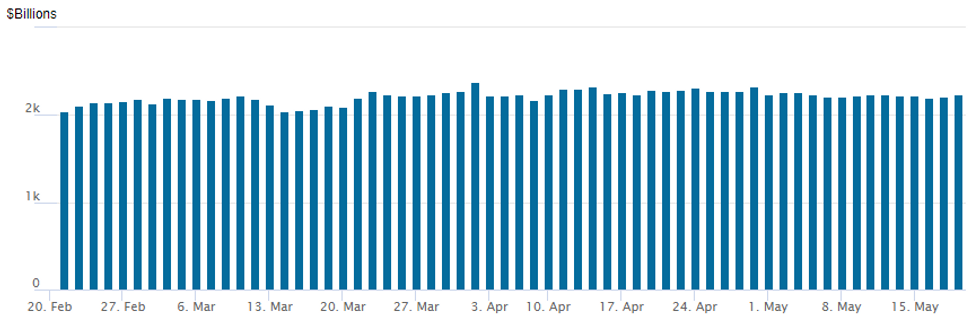

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,238.266B w/ 102 counterparties, compares to prior $2,213.676B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Carry-over interest in low delta SOFR and Treasury puts and put spreads noted Thursday as underlying futures trade weaker on the back of hawkish Fed speak (Dallas Fed Logan: "current data doesn't justify a pause" in current policy). Chances of a 25bp cut in November have fallen to 80%. Salient trade:- SOFR Options:

- Block, +20,000 SFRU3 94.50/94.75/94.93 broken put trees, 5.25

- Block/screen, 10,000 SFRM3 94.75/94.81/94.87 put flys, 0.75 ref 94.8375

- -10,000 SFRM3 94.93/95.06/95.18 call flys, 0.75

- +5,000 SFRM3 94.93/95.06 call spds, 1.25

- +1,500 SFRM4 100.0 calls, 2.5

- +5,000 SFRM3 94.75 puts, 5.25 ref 94.825

- Block, 10,000 SFRU3 94.75/94.87 put spds, 3.5 over 95.37/95.50 call spds vs. 95.04

- Block/screen, 15,000 SFRM3 94.62/94.68/94.75/94.81 put condors, 1.25 ref 94.875

- Block, 10,000 SFRM3 94.56/94.62/94.68/94.75 put condors, 1.5 ref 94.845

- Block, 6,500 SFRM3 94.37/94.62 put spds, 1.0 ref 94.8525

- Block, 3,000 SFRZ3 94.50/95.00 put spds, 12.0 ref 95.51

- 3,900 SFRM3 94.75/94.87/95.00 call flys ref 94.8675

- Treasury Options:

- 8,600 FVM3 109/109.25 put spds, 8 ref 108-31.5

- Over 40,000 TYM3 113 puts, 6-8

- over 13,000 FVM3 108.5 puts, 7.5 last ref 109-03 to -03.25

- 2,000 TYM 115/116/117 call flys, 5 ref 114-06

- 1,000 USM3 125/127/128 put trees, 19

- 5,300 TYM3 116 calls, 5 last ref 114-14.5

- 5,000 TYU3 119.5/121.5 call spds ref 115-10

- 2,000 TYM3 113.5 puts, 8 ref 114-14

- 2,600 TYM3 118 calls, 1 ref 114-13.5

- 4,500 FVN3 112 calls, 17 ref 110-00.5

- 5,000 FVN3 109 puts, 23 ref 110-00

- 1,450 FVN3 111.5 calls, 24 ref 110-04.25

EGBs-GILTS CASH CLOSE: Yields Resume Their Ascension

The long ends of the German and UK curves saw double-digit yield rises Thursday in a bear steepening.

- Though Ascension Day holidays meant a fairly thin calendar (BoE TSC testimony was a non-event), yields resumed their ascent largely on US-centric considerations.

- Optimism over a debt ceiling deal in Washington kept risk assets bid, and an indication of support for a June Fed hike from Dallas Fed Pres Logan put pressure on the global short-end.

- Greece was the standout performer, with spreads vs Italy falling 9bp to nearly the biggest all-time premium to BTPs (closed 27.2bp vs the record 29.2bp close on Jul 27) ahead of May 21 elections.

- After a dearth of data today, we get some 2nd tier reports Friday to conclude the week, including German PPI. We also hear from BoE's Haskel, along with the ECB's Schnabel, Lagarde, and de Cos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.1bps at 2.762%, 5-Yr is up 8.9bps at 2.416%, 10-Yr is up 11bps at 2.446%, and 30-Yr is up 12bps at 2.632%.

- UK: The 2-Yr yield is up 8.8bps at 3.955%, 5-Yr is up 10.7bps at 3.795%, 10-Yr is up 12bps at 3.957%, and 30-Yr is up 11.2bps at 4.381%.

- Italian BTP spread up 2bps at 186.7bps / Greek down 6.8bps at 159.5bps

EGB Options: No Shortage Of Upside

Thursday's Europe rates / bond options flow included:

- IKN3 112/110ps vs 114.50/115.50cs, bought the ps for 29 in 2k

- ERH4 100.50c, bought for 10 in 30k

- ERZ4 99.25/100cs 1x2, bought for flat in 9k

- 2RM3 97.50/98.00/98.25 broken c fly, sold at 3.25 down to 2.75 in 5k

- ERZ4 99.25/100.00 1x2 call spread bought for flat in 15k

- ERH4 100.50 call bought for 1 in 61k

FOREX: Greenback Rally Extends, USDJPY Highest Since November

- The greenback spent Thursday building upon its most recent strong performance, with a notable 0.70% advance for the USD index. Gains were broad based against all others in G10 as further optimism for a debt ceiling deal underpin the dollar bid. Furthermore, hawkish remarks Dallas Fed Pres Logan put pressure on the global short-end, adding an additional tailwind for the greenback.

- The pressure on front-end yields has boosted USDJPY to fresh highs this year and with the powerful break a key resistance zone between 137.77-91 strengthens bullish conditions and confirms a resumption of the uptrend that started on Jan 16. The pair trades just below session highs of 138.69 approaching the APAC crossover, the best levels since November 2022. The focus above is on 139.00 and 139.59, a Fibonacci retracement.

- In similar vein, EURUSD continues to weaken and Thursday’s move lower marks an extension of the bear leg that started on Apr 26. Price action has narrowed the gap with 1.0713, the Mar 24 low.

- USDCNH (+0.64%) has extended the move higher this week, confirming a resumption of the bull trend that started mid-January. This week’s breach of key resistance at 6.9971, the Mar 8 high, represents an important bullish short and medium-term price development.

- The pair is approaching the neckline of a former head and shoulders reversal pattern. The line intersects at 7.0655 and if this level is breached, it would signal scope for a climb further out towards the top of a bull channel that is drawn from the Feb 2 low. The channel top intersects at 7.1313 today. Initial support lies at 6.9971 and 6.9425, the 20-day EMA.

- Canadian retail sales headlines a quiet Friday global docket, however, markets will remain attentive to any comments from Fed Chair Powell, due to participate in a panel discussion with Ben Bernanke.

FX Expiries for May19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E539mln), $1.0820-35(E747mln), $1.0850(E943mln), $1.0900(E831mln)

- USD/JPY: Y136.00($650mln)

- GBP/USD: $1.2280-90(Gbp732mln)

- AUD/USD: $0.6645-50(A$545mln)

- USD/CAD: C$1.3500($1.4bln)

- USD/CNY: Cny7.00($2.4bln)

Equities Roundup: Best Levels Since Mid-Feb on Debt Ceiling Optimism

Stocks continue to extend highs on the back of optimism over a debt ceiling resolution to avoid default. House Speaker McCarthy says that he 'sees [a] debt limit deal on the House floor next week', adding that 'we are at a much better place than a week earlier, I can see now where a deal can come together'.- SPX Eminis climb to the best levels since mid-February are currently up 21.25 points (0.51%) at 4193.25; DJIA down 15.52 points (-0.05%) at 33409.33; Nasdaq up 133.2 points (1.1%) at 12633.72.

- Leading gainers: Chip stocks (Synopsis +7.5%, Micron +4.65%) helping IT sector outperform followed closely by Consumer Discretionary and Communication Services sectors. Laggers: Utilities, Consumer Staples and Real Estate sectors trading weaker.

- From a technical point of view S&P E-minis remain in consolidation mode, remains above the 50-day EMA, which intersects at 4112.23. A continuation higher would open key resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level would confirm an extension of the bull trend from Mar 13.

- Key support is at 4062.25, the May 4 low. A move through this level would instead highlight a bearish threat.

E-MINI S&P TECHS: (M3) Trend Signals Remain Bullish

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4206.25 High May 1 and a key short-term resistance

- PRICE: 4175.75 @ 15:12 BST May 18

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis traded higher Wednesday and the contract has pushed slightly higher again today. Price remains above the 50-day EMA, which intersects at 4112.23. A continuation higher would open key resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level would confirm an extension of the bull trend from Mar 13. Key support is at 4062.25, the May 4 low. A move through this level would instead highlight a bearish threat.

COMMODITIES: Oil Slips But Gold Slumps With USD Strength On Debt Talks & Fedspeak

- Crude oil has unwound a little over half of yesterday’s risk-on push higher, hurt primarily by more hawkish Fedspeak and with the US dollar getting a further boost from McCarthy seeing the debt limit deal on the House floor next week.

- WTI is -1.5% at $71.72 but remains off support at $69.41 (May 15 low) whilst pulling back from resistance at $73.93 (Apr 28 low).

- Brent is -1.6% at $75.75, holding above support at $73.49 (May 15 low) whilst pulling back from resistance at $77.60 (May 10 high).

- Gold is -1.2% at $1957.28 for a now 2.9% decline since Monday’s close on the aforementioned factors with the USD surging on debt deal optimism. It has easily cleared support at $1975.1 (May 18 low) and the key $1969.3 (Apr 19 low), opening $1934.3 (Mar 22 low).

- US HH natural gas has also seen a notable +9.5% increase at typing, continuing to surge after a smaller than expected build in EIA US inventories (+99bch vs expected +108bcf vs 5-year average for time of year of +95bcf).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/05/2023 | 2330/0830 | *** |  | JP | CPI |

| 19/05/2023 | 2330/0830 | *** |  | JP | CPI |

| 19/05/2023 | 0600/0800 | ** |  | DE | PPI |

| 19/05/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/05/2023 | 1245/0845 |  | US | New York Fed's John Williams | |

| 19/05/2023 | 1300/0900 |  | US | Fed Governor Michelle Bowman | |

| 19/05/2023 | 1400/1000 | * |  | US | Services Revenues |

| 19/05/2023 | 1455/1655 |  | EU | ECB Schnabel Speech at Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 19/05/2023 | 1600/1800 |  | EU | ECB Schnabel Panels Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1900/2100 |  | EU | ECB Lagarde Video Presentation at Banco Central Brasil |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.