-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Talk of Inflation Target Band Shift

- MNI POLICY: Fed To Consider Shift To Inflation Target Band

- MNI FED: UBS Adds July Hike To Expected Path, With A June "Skip"

- MNI: Quarter Of Emerging Economies Cut Off From Bond Market

- MNI BoC Preview, Jun'23: A Decision To Hike Now Or In July

- MNI NY Fed’s GSCPI Points To Renewed Disinflationary/Deflationary Pressures Ahead

US

FED: The Federal Reserve is likely to consider moving away from a singular inflation target of 2% and toward a band system possibly ranging from 1.5% to 2.5%, that allows for a wider, more realistic set of outcomes.

The next framework review is slated for 2025 but top policymakers have signaled they are already thinking about possible changes.

- "I haven't heard anything or seen anything that would make me think that 2% is the wrong target. But whenever we next talk about policy I'd certainly be open to talking about a range as a concept,” Richmond Fed President Thomas Barkin told reporters earlier this year.

- Still stung by the rapidity of the rise in post-pandemic inflation pressures, which officials initially argued were transitory, U.S. central bankers are looking back on their pre-Covid concerns about undershooting the 2% inflation goal by a couple of tenths of a percentage point as relatively quaint. For more see MNI Policy main wire at 1009ET.

FED: UBS now sees a final 25bp Fed funds hike in July to a terminal 5.25-5.50% rate, with a "skip" at the June meeting "consistent with how we view the recent FOMC communications."

- Previously UBS had seen May's 25bp hike as the last. Key to this view change are their expectation that "the May core CPI data [out Jun 13] looks strong" in addition to last Friday's "robust" payrolls data, while UBS also sees the median rate "dot" in the upcoming projections to be revised up to 5.4% from 5.1% previously.

- They still see rate cuts starting this year but have pushed the first one back to December (vs September prior), with a US recession beginning later this year. With inflation falling below 2% by end-2024, they see the Funds rate dropping to 1.00-1.25% at the September 2024 FOMC.

FED: Released earlier today, the NY Fed’s global supply chain pressure index (GSCPI) fell to a record low at -1.71 standard deviations below average in May for a series starting 1997, continuing its sharp decline from intense supply side challenges of 2H21/1H22.

- Whilst the Fed is still focused on services and in particular non-housing pressures, it offers some hope that at least goods prices could be due some renewed disinflationary pressure and possible outright deflation after a recent stalling of declines.

- It tallies with the recent sharp declines in ISM manufacturing and service prices paid components, with the latter falling to its lowest since May’20.

GLOBAL ECONOMICS: One-quarter of emerging and developing market economies have been cut off from international bond markets amid the global credit squeeze according to a World Bank report Tuesday, adding to strains from stalling economic growth.

- Most of those economies "have seen only limited harm from the recent banking stress in advanced economies so far, but they are now sailing in dangerous waters," according to the latest Global Economic Prospects report.

- "Fiscal weaknesses have already tipped many low-income countries into debt distress," said World Bank chief economist Indermit Gill. Poorer nations with low creditworthiness have seen their growth projections for this year cut in half and leaving them vulnerable to more shocks, the report said.

- Global growth will slow to 2.1% this year from 3.1% in 2022 according to the report, with financial stress now adding to the strain of the Ukraine war. Higher U.S. interest rates can trigger a rise of borrowing costs in "frontier markets" that's three times higher relative to developing-market peers, the World Bank said.

CANADA

BOC: The BoC is seen having a close decision between hiking this week or waiting five weeks until July. Consensus leans to no change although market pricing has increased to 50/50 chance of a hike and we edge into the hike camp this week.

- It comes down to the strength of domestic data vs the timing of BoC commentary with the far more thorough MPR landing with the July meeting and the recently emerged Fed skipping narrative.

- We expect hawkish language in the single page statement either way, but outright market reaction is likely larger in the event of a dovish surprise.

- There is circa 40bps of hikes priced to October from current levels and a large higher rates for longer push has seen Canada 2Y OIS exceed that of the US for the first time since Sep, whilst there has also been an apparent sizeable trimming of CAD net shorts.

US TSYS: Rates and Stocks Back Near Mid-Range

- Treasury futures trading mixed after the bell, near the middle of the session range, curves extending inversion with short end rates underperforming.

- Front month Treasury 2Y futures tapped 102-18.38 low (-4.38) after a large 10.5k midday Block sale, with yield climbing to 4.5413% high. Sep 10Y futures tapped 113-18.5 (-10) low, above initial technical support of 113-10 (Monday low) before drifting back to 113-26 (-2.5) after the bell.

- Attention is on key support and the bear trigger at 112-29+, the May 26 / 30 low. A break would resume the downtrend since May 4.

- Curves extending inversion but remain above early March low around -110 (multi-decade low not seen since early 1980s).

- The early morning selloff was partially tied to swings in EGBs, while incoming corporate debt issuance is creating some rate lock sale pressure, surge in supply is expected to continue as issuers return following the passage of debt ceiling bill late last week.

- Meanwhile, stocks have rebounded back to mildly higher levels, SPX (+9.5 at 4290.5) buoyed by bank shares recovering from Monday sell-off tied to talk of increasing capital requirements for banks by an average of 20%.

OVERNIGHT DATA

- Tuesday economic data limited to

- MNI: US REDBOOK: MAY STORE SALES +0.6% V YR AGO MO

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 32.88 points (-0.1%) at 33530.87

- S&P E-Mini Future up 6.25 points (0.15%) at 4287.75

- Nasdaq up 52.7 points (0.4%) at 13282.68

- US 10-Yr yield is up 1.2 bps at 3.6947%

- US Sep 10-Yr futures are down 3/32 at 113-25.5

- EURUSD down 0.002 (-0.19%) at 1.0693

- USDJPY up 0.1 (0.07%) at 139.68

- WTI Crude Oil (front-month) down $0.48 (-0.67%) at $71.70

- Gold is up $1.02 (0.05%) at $1962.88

- EuroStoxx 50 up 1.98 points (0.05%) at 4295.22

- FTSE 100 up 28.11 points (0.37%) at 7628.1

- German DAX up 28.55 points (0.18%) at 15992.44

- French CAC 40 up 8.09 points (0.11%) at 7209

US TREASURY FUTURES CLOSE

- 3M10Y +0.066, -162.25 (L: -174.488 / H: -156.988)

- 2Y10Y -4.296, -82.991 (L: -83.008 / H: -78.075)

- 2Y30Y -6.826, -65.34 (L: -65.588 / H: -57.143)

- 5Y30Y -4.701, 1.681 (L: 1.347 / H: 8.11)Z

- Current futures levels:

- Sep 2-Yr futures down 3.375/32 at 102-19.375 (L: 102-18.375 / H: 102-25.875)

- Sep 5-Yr futures down 4/32 at 108-17.5 (L: 108-14 / H: 108-28.75)

- Sep 10-Yr futures down 3/32 at 113-25.5 (L: 113-18.5 / H: 114-06.5)

- Sep 30-Yr futures up 1/32 at 127-30 (L: 127-09 / H: 128-11)

- Sep Ultra futures up 11/32 at 136-14 (L: 135-11 / H: 136-20)

US 10YR FUTURE TECHS: (U3) Bearish Engulfing Candle Still In Play

- RES 4: 115-19 High May 18

- RES 3: 115-06 1.0% 10-dma Envelope

- RES 2: 115-02+ 50-day EMA

- RES 1: 114-22 / 115-00 20-day EMA / High Jun 1

- PRICE: 113-25+ @ 1500 ET Jun 6

- SUP 1: 113-10 Low Jun 05

- SUP 2: 112-29+ Low May 26 / 30 and key support

- SUP 3: 112-16 76.4% retracement of the Mar 2 - May 4 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures faltered last Friday and have remained below last week’s 115-00 high. Friday’s price action also resulted in a bearish engulfing candle at the close, signaling the end of the recent recovery and suggesting potential for a continuation lower. Attention is on key support and the bear trigger at 112-29+, the May 26 / 30 low. A break would resume the downtrend since May 4. Clearance of 115-00, is required to reinstate a bullish theme

SOFR FUTURES CLOSE

- Jun 23 +0.015 at 94.748

- Sep 23 +0.005 at 94.790

- Dec 23 -0.035 at 95.045

- Mar 24 -0.070 at 95.465

- Red Pack (Jun 24-Mar 25) -0.09 to -0.055

- Green Pack (Jun 25-Mar 26) -0.04 to -0.005

- Blue Pack (Jun 26-Mar 27) +0.005 to +0.010

- Gold Pack (Jun 27-Mar 28) +0.010 to +0.020

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01160 to 5.13842 (-.00225/wk)

- 3M -0.01439 to 5.23884 (+.00850/wk)

- 6M -0.01078 to 5.27695 (+.03148/wk)

- 12M +0.00223 to 5.09477 (+.06780/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00400 to 5.06871%

- 1M +0.01057 to 5.20114%

- 3M +0.00415 to 5.51329 */**

- 6M -0.01872 to 5.64457%

- 12M -0.03543 to 5.74414%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $136B

- Daily Overnight Bank Funding Rate: 5.07% volume: $294B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.472T

- Broad General Collateral Rate (BGCR): 5.05%, $605B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $594B

- (rate, volume levels reflect prior session)

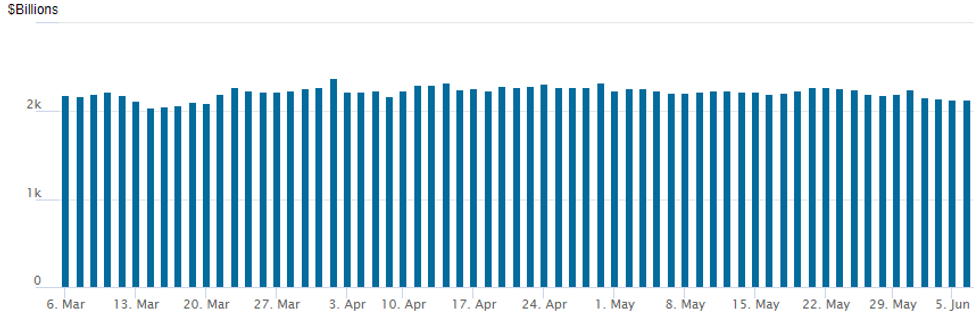

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches back up to $2,134.638B w/ 101 counterparties, compared to $2,131.417B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Late Corporate Bond Summary

- $14B To price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 06/06 $4B *ADB {Asian Development Bank) $2B 2Y SOFR+23, $2B 10Y SOFR+49

- 06/06 $2.5B #NAB (National Australia Bank) $850M 2Y +70, $650M 2Y SOFR+76, $1B 5Y +110

- 06/06 $1.5B #Bacardi Ltd $400M +5Y +140, $700M 10Y +175, $400M 20Y +190

- 06/06 $1.4B #Cheniere Energy 10Y +228

- 06/06 $1.25B *RENTEN (Landwirtschaftliche Rentenbank) 5Y SOFR+35

- 06/06 $1B #Guatemala 2036 bond 6.6%

- 06/06 $1B *MuniFin 2027 SOFR+45

- 06/06 $750M #New York Life 5Y +107

- 06/06 $600M #Fortune Brands 10Y +220

- Rolled to Wednesday's order of business:

- 06/07 $1B Kommuninvest WNG 2Y SOFR+32a

- 06/07 $Benchmark Swedish Export Credit 5Y SOFR+55a

EGBs-GILTS CASH CLOSE: Rally Fades, German Short End Outperforms

A morning rally across EGBs and Gilts faded in the afternoon Tuesday, with the only consistent theme throughout being German short-end outperformance.

- The stand out move early in the session was strong bull steepening in the German curve as Schatz yields dropped over 9bp.

- Multiple factors were behind the move, including some comments by ECB's Knot interpreted as relatively dovish; weak German factory orders; lower oil prices and equities; a pullback in consumer inflation expectations per the ECB survey; and mixed Eurozone retail sales.

- The move faded in the afternoon, with no particular driver, though heavy issuance (including multiple syndications today and announced for tomorrow, including E7bln in EU today / Spain Weds) weighed, as did a recovery in equities in the afternoon alongside some selling pressure in US Treasuries.

- By the end of the session, the German curve had twist steepened, with the UK's twist flattening. Periphery EGB spreads widened slightly, led by BTPs.

- Wednesday's docket includes German industrial and Italian retail sales data, and appearances by ECB's Guindos / Knot / Panetta.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3.5bps at 2.854%, 5-Yr is down 1.9bps at 2.384%, 10-Yr is down 0.9bps at 2.372%, and 30-Yr is up 1bps at 2.555%.

- UK: The 2-Yr yield is up 3.3bps at 4.478%, 5-Yr is up 1.5bps at 4.184%, 10-Yr is down 0.1bps at 4.207%, and 30-Yr is down 3.8bps at 4.473%.

- Italian BTP spread up 2.7bps at 178.4bps / Spanish up 0.4bps at 99.9bps

FOREX: AUD Consolidates Post-RBA Strength, USD Index Moderately Firmer

- Despite the initial greenback advance moderating on Tuesday, the USD index has risen 0.15%, reasserting itself above the 104.00 handle following Monday’s post ISM slide. Greenback strength was not enough to keep the Australian dollar from consolidating its post RBA strength. AUDUSD remains the strongest pair across G10, advancing 0.85% to a three-week high.

- As a reminder, the RBA marginally pushed against consensus with a 25bps hike to the cash rate target, boosting rates to 4.10% and signalling that further policy tightening could follow.

- In response, AUD surged to an intra-day peak of 0.6685 and despite the pullback throughout the first half of the European session, sits firmer against all others in G10 - helping to extend the streak of higher intraday lows into a fifth session against the USD.

- Technically, price action marks an extension of the recovery from the May 31 low and resistance at the 50-day EMA, which intersects at 0.6653, has been cleared. This signals scope for a stronger recovery and opens 0.6710, May 16 high. Above here, the May 10 high at 0.6818 remains the key short-term resistance point.

- Elsewhere, the Mexican Peso rose to a seven-year high against the dollar, with USDMXN once again testing below the bear trigger at 17.4207. A sustained break would confirm a resumption of the downtrend and opens the potential for a move to 17.0507, the Apr 29 2016 low.

- Focus on Wednesday turns to RBA Governor Lowe who will speak at the Morgan Stanley Australia Summit, in Sydney where Q&A is expected. Additionally, Australian Q1 GDP Data will hit the wires. Attention will then turn to the Bank of Canada rate decision where analysts remain split whether the BOC will hike by 25bps or keep rates unchanged at 4.50%.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2023 | 0130/1130 | *** |  | AU | Quarterly GDP |

| 07/06/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 07/06/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2023 | 0750/0950 |  | EU | ECB de Guindos Speech at EC/ECB Conference | |

| 07/06/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2023 | 0910/1110 |  | EU | ECB Panetta Moderates EC/ECB Conference Panel | |

| 07/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/06/2023 | - | *** |  | CN | Trade |

| 07/06/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/06/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.