-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Tsy Auctions Tail, Heavy Corp Debt Weighs

- MNI INTERVIEW: Canada's Investment Slump Is Beyond Intangible

- MNI US: Raimondo: "AI Will Be The Defining Technology Of Our Generation"

- MNI NATO: Kristersson: "Nordic Region Has Common Defence For First Time In 500 Yrs"

- MNI US DATA: New Home Sales Lower Than Expected Whilst Supply Still Elevated

US TSYS Pressured By Heavy Corporate Issuance, 2Y, 5Y Auctions Both Tailed

- Tsys holding near session lows after the bell, under pressure amid a flood of new corporate bond issuance, two Treasury coupon auctions that both tailed and mixed data.

- Treasury futures holding near recent lows after lower than expected New Home Sales (661k vs 684k est, 664k prior); MoM (1.5% vs. 3.0% est, prior down revised to 7.25 from 8.0%). There were some wild moves regionally that makes it hard to get a sense of underlying trends: northeast (72%, smallest segment), west (39%), midwest (8%), south (-16%, easily largest segment).

- Tsy futures extended lows (TYH4 -12 at 109-16) after the $64B 5Y note auction (91282CKD2) tailed: drawing 4.320% high yield vs. 4.312% WI; 2.41x bid-to-cover vs. 2.31x prior. This after after the $63B 2Y note auction (91282CKB6) drew 4.691% high yield vs. 4.687% WI; 2.49x bid-to-cover vs. 2.57x prior.

- Corporate debt issuance remained heavy with over $22B expected to price Monday.

- Mar'24 10Y currently -6 at 109-222, 10Y yield 4.2815% +.0335, curves mildly steeper vs. Fri close: 2s10s +.245 at -44.245.

- The trend direction in Treasuries remains down and the contract is trading closer to its recent lows. Price has pierced 109-17, 50.0% of the Oct - Dec bull cycle. A clear break of this retracement would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level.

MNI INTERVIEW: Canada's Investment Slump Is Beyond Intangible

- Canadian business investment has been in a long nosedive that shows little sign of reversing, a federal statistics office researcher told MNI, a trend that could make it harder for the central bank to lower interest rates over time.

- Investment per worker has dropped 20% from 2006 to 2021 according Statistics Canada's Wulong Gu, the latest in his series of papers seeking to learn why Canada has fallen behind the U.S. economy in particular. Large companies are leading the cutbacks, while the creation of smaller competitive new firms has also declined in recent years, he found.

NEWS

US (MNI): Raimondo: "AI Will Be The Defining Technology Of Our Generation"

Commerce Secretary Gina Raimondo, speaking at an event hosted by CSIS on implementation of the USD$50 billion CHIPS Act, states that the US, "cannot lead the world" on technology with such "a shaky foundation," of research, development, and production of leading-edge semiconductors.

NATO (MNI): Hungary Set To Vote To Ratify Sweden's NATO Accession

Hungarian National Assembly is set to vote shortly on ratifying Sweden's NATO bid. At the opening of the new session of parliament earlier today, PM Viktor Orban gave an address focusing on the aftermath of the resignation of President Katalin Novak, where the Orban gov'ts pro-family values credentials have come into question, as well as the international situation.

NATO (MNI): Kristersson: "Nordic Region Has Common Defence For First Time In 500 Yrs"

Swedish Prime Minister Ulf Kristersson has told reporters that, "with Sweden in NATO, the Nordic region has a common defence for first time in 500 years," following today's ratification of Sweden's NATO members by Hungary.

SECURITY (MNI): Israeli Officials "Less Optimistic" About Hostage Deal With Hamas

Amichai Stein at Kann reporting on X: "Israeli officials say tonight: less optimistic about the chances of reaching a hostage deal, 'It seems the Paris document doesn't correspondent with Hamas demands.'"

OVERNIGHT DATA

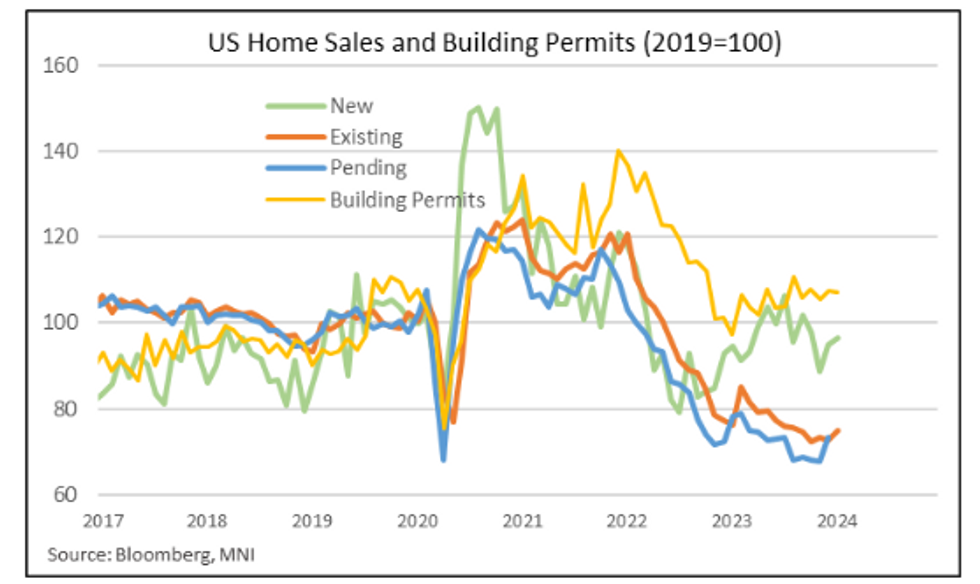

US DATA (MNI): New Home Sales Lower Than Expected Whilst Supply Still Elevated

- New home sales were softer than expected in January at 661k (cons 684k) after a downward revised 651k (initial 664k).

- It means new sales increased 1.5% M/M in Jan after 7.2% in Dec, but the two monthly gains don’t yet reverse a cumulative 13% decline in the prior two months.

- There were some wild moves regionally that makes it hard to get a sense of underlying trends: northeast (72%, smallest segment), west (39%), midwest (8%), south (-16%, easily largest segment).

- Months of supply was unchanged on the month at 8.3 and remains below the 8.9 recent peak seen in Nov, but is still high compared to the 5.7-7.0 seen in January’s in 2017-19 for a pre-pandemic comparison.

- That relative supply is helping keep downward pressure on the noisy median price series, -2.6% Y/Y in January after -13.8% Y/Y in Dec.

US FEB. DALLAS FED MANUFACTURING INDEX -11.3; EST. -15.0

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 16.9 points (-0.04%) at 39115.43

- S&P E-Mini Future down 13.5 points (-0.26%) at 5087.75

- Nasdaq up 0.2 points (0%) at 15997

- US 10-Yr yield is up 4.3 bps at 4.2913%

- US Mar 10-Yr futures are down 7.5/32 at 109-20.5

- EURUSD up 0.0026 (0.24%) at 1.0847

- USDJPY up 0.23 (0.15%) at 150.74

- WTI Crude Oil (front-month) up $1.21 (1.58%) at $77.70

- Gold is down $4 (-0.2%) at $2031.38

- European bourses closing levels:

- EuroStoxx 50 down 8.28 points (-0.17%) at 4864.29

- FTSE 100 down 21.98 points (-0.29%) at 7684.3

- German DAX up 3.9 points (0.02%) at 17423.23

- French CAC 40 down 36.86 points (-0.46%) at 7929.82

US TREASURY FUTURES CLOSE

- 3M10Y +3.953, -113.158 (L: -123.028 / H: -111.122)

- 2Y10Y +0.627, -43.963 (L: -45.67 / H: -42.546)

- 2Y30Y +0.518, -31.943 (L: -34.191 / H: -30.621)

- 5Y30Y +0.157, 9.018 (L: 7.611 / H: 9.615)

- Current futures levels:

- Mar 2-Yr futures down 2.25/32 at 101-26 (L: 101-25.125 / H: 101-29.875)

- Mar 5-Yr futures down 4.75/32 at 106-10.5 (L: 106-08 / H: 106-19.75)

- Mar 10-Yr futures down 7.5/32 at 109-20.5 (L: 109-16 / H: 110-04)

- Mar 30-Yr futures down 12/32 at 118-22 (L: 118-11 / H: 119-22)

- Mar Ultra futures down 20/32 at 125-6 (L: 124-28 / H: 126-24)

US 10Y FUTURE TECHS: (H4) Outlook Remains Bearish

- RES 4: 111-16+ High Feb 7

- RES 3: 111-07 High Feb 13

- RES 2: 110-26 50-day EMA

- RES 1: 110-16 20-day EMA

- PRICE: 109-19 @ 18:48 GMT Feb 26

- SUP 1: 109-09 Low Feb 23

- SUP 2: 109-05+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 108-14 Low Nov 15

The trend direction in Treasuries remains down and the contract is trading closer to its recent lows. Price has pierced 109-17, 50.0% of the Oct - Dec bull cycle. A clear break of this retracement would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level. On the upside, initial firm resistance is seen at 110-26, the 50-day EMA.

SOFR FUTURES CLOSE

- Mar 24 -0.015 at 94.673

- Jun 24 -0.030 at 94.870

- Sep 24 -0.040 at 95.155

- Dec 24 -0.040 at 95.470

- Red Pack (Mar 25-Dec 25) -0.045 to -0.04

- Green Pack (Mar 26-Dec 26) -0.03 to -0.015

- Blue Pack (Mar 27-Dec 27) -0.01 to steady

- Gold Pack (Mar 28-Dec 28) -0.01 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00439 to 5.32852 (+0.00828 total last wk)

- 3M +0.00724 to 5.33781 (+0.01655 total last wk)

- 6M +0.00545 to 5.27896 (+0.04235 total last wk)

- 12M -0.00145 to 5.07098 (+0.09453 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.736T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $672B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $279B

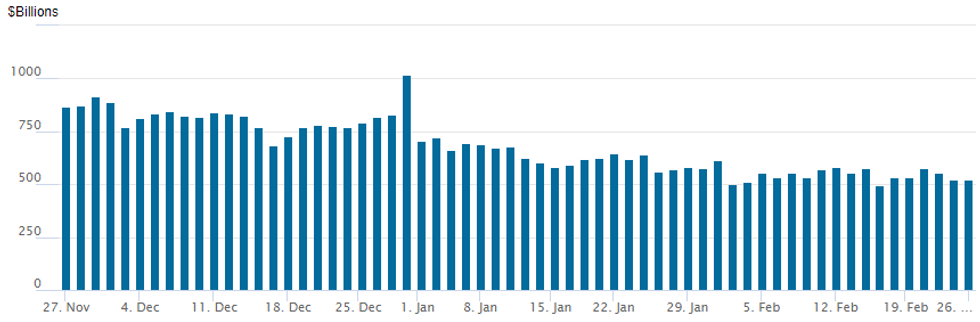

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage back up to $524.959B vs. 520.107B Friday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties at 81 from 79 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: $4.15B Honeywell 5Pt Leads Heavy Corp Issuance Docket

- Date $MM Issuer (Priced *, Launch #)

- 2/26 $4.15B #Honeywell $500M +5Y +55, $500M +7Y +65, $750M 11Y +75, $1.75B 30Y +85, $650M 40Y +95

- 2/26 $2.8B #Natwest $1B 4NC3 +110, $300M 4NC3 SOFR+125, $1.5B 11NC10+150

- 2/26 $2.75B #HSBC 6NC5 +123, $1.25B 11NC10 +143

- 2/26 $2.25B #PG&E $850M +5Y +125, $1.1B 10Y +153, $300M 30Y +170

- 2/26 $2.25B #Danske Banke $1B 4NC3 +95, $1.25B 6NC5 +140

- 2/26 $2B #Fiserv $750M 3Y +68, $500M 7Y +105, $750M 10Y +115

- 2/26 $1.5B #Phillips 66 $700M Y +100, $400M 2033 Tap +110, $500M 30Y +1425

- 2/26 $1.5B #HSBC USA $1B 3Y +80, $500M 3Y SOFR+96

- 2/26 $1.3B #BP Capital Markets PerpNC10 6.45%

- 2/26 $1B #Dubai Islamic Bank (DIB) Sukuk 5Y +125a

- 2/26 $1B #Keycorp 11NC10 +210

- 2/26 $900M #Ryder $350M 3Y +83, $550M 5Y +105

- 2/26 $800M #Xcel Energy 10Y +125

- 2/26 $800M #Southern Co $400M 5Y +85, $400M 10Y +117

- 2/26 $750M #Lyondellbasell WNG 10Y +130

- 2/26 $750M *Brookfield Finance 30Y +155

- 2/26 $500M *Westinghouse Air Brake WNG 10Y +132

- 2/26 $1.5B Wesco $750M 5NC2, $750M 8NC3

- 2/26 $1B KommuneKredit WNG 3Y SOFR+35a

- 2/26 $Benchmark SMFG PerpNC10.25

- 2/26 $Benchmark Agence Francaise de Developpement (AFD) 5Y +55a

- 2/26 $Benchmark Public Investment Fund (PIF) Saudi Arabia wealth fund Sukuk 7Y

EGBs-GILTS CASH CLOSE: Steady Sell-Off To Start The Week

Bund and Gilt yields rose steadily throughout Mondays session to finish sharply higher, reversing Friday's drop.

- In trading reminiscent of late last week, there was little evident catalyst that could be identified for the upward yield move, which was in orderly fashion intraday but decidedly bearish.

- With little new on the central bank speaker front (Lagarde reiterated January's guidance; dove Stournaras again eyed June for first cut), and no important data, focus appeared to be on issuance dynamics including French and Slovak syndication announcements, and a front-loaded US Treasury auction calendar.

- End-2024 implied ECB and BoE rates rose by 7bp on the day (now implying 93bp of cuts) and 6bp (64bp of cuts), respectively.

- Bunds underperformed their UK counterparts, though 10Y Gilt yields closed at their highest since early December. Periphery spreads closed marginally wider to Bunds.

- Tuesday sees an appearance by BoE's Ramsden, with ECB money supply data out as well. The focus of the week will be February flash inflation on Thursday-Friday - MNI's preview was published today (PDF here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.1bps at 2.924%, 5-Yr is up 8.1bps at 2.454%, 10-Yr is up 7.8bps at 2.441%, and 30-Yr is up 8.2bps at 2.575%.

- UK: The 2-Yr yield is up 5.6bps at 4.312%, 5-Yr is up 6.4bps at 4.044%, 10-Yr is up 5.7bps at 4.162%, and 30-Yr is up 3.8bps at 4.637%.

- Italian BTP spread up 1.5bps at 145.2bps / Spanish bond spread up 0.4bps at 89.3bps

FOREX USD Losses Trimmed, USDJPY Stops Short Of 2024 High With Japan CPI Eyed

- The USD has seen a day of two halves, slipping through European hours and into the early part of the US session, before a EGBs-led climb in Treasury yields helped support the USD index to limit the day’s losses to -0.1%.

- AUD and NZD are clearly bottom of the G10 FX pack today, pulling back after last week’s gains, and especially so NZD as focus turns to the Feb 28 RBNZ decision.

- JPY has also come under pressure amidst that yield backdrop, but USDJPY topped out at 150.84 as it met resistance at the 2024 high of 150.89. Our technical analyst has noted that the trend outlook for the pair remains bullish and the latest pause appears to be a bull flag formation. A break of the early '24 peak would expose the Nov '23 highs and increase the risk of intervention out of Tokyo. Recent moves have triggered increased vigilance and comments on the part of the Japanese authorities.

- At the other end of the spectrum sits the EUR, owing to the larger sell-off in EGBs, and by extension SEK, the latter holding up well considering the reversal of earlier strength in equity futures.

- Ahead, Japan CPI headlines the Asia Pac session whilst KC Fed’s Schmid (’25 voter) is still to come for potentially his first monetary policy relevant comments since being appointed in August. After that, US durable goods orders land before the Conference Board’s consumer survey including its closely watched labor differential after it increased strongly ahead of the January blowout payrolls report.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 26/02/2024 | 0040/1940 |  | US | Kansas City Fed's Jeff Schmid | |

| 27/02/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/02/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/02/2024 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/02/2024 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 27/02/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2024 | 1340/1340 |  | UK | BOE's Ramsden at Association for Financial Markets | |

| 27/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/02/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1405/0905 |  | US | Fed Vice Chair Michael Barr | |

| 27/02/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/02/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 27/02/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.