-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Tsy Discount Hawkish Fed Speak

- MNI US FED: Bowman Warns Of Fed Divergence With Other Central Banks

- MNI US: GOP Could Further Embrace Crypto Sector Under Trump

- MNI US DATA: Conference Board Labor Differential Lifts After Downward Revision

US

US FED (MNI): Bowman Warns Of Fed Divergence With Other Central Banks

Federal Reserve Governor Michelle Bowman Tuesday said it will likely be "some time" before the U.S. central bank can begin lowering interest rates, warning that U.S. monetary policy over the coming months could diverge from that of other advanced economies.

- "My baseline outlook continues to be that U.S. inflation will return to the FOMC’s 2% goal, with the target range of the federal funds rate held at its current level of 5.25% to 5.5% for some time," she said in prepared remarks at a Policy Exchange event in London.

- Bowman said she expects U.S. inflation to remain elevated for some time, even as continued softness in consumer spending and weaker housing activity early in the second quarter also suggest less momentum in economic activity so far this year.

NEWS

US (MNI): Biden Edges Ahead Of Trump In 538 Forecast And Polling Average

US President Joe Biden has edged back ahead of former President Donald Trump in the 538 presidential election forecast model. The move comes on the back of some strong polling for Biden and indicates that the 538 model continues to project that the political environment favours Biden despite Trump's strength in swing states.

US (MNI): GOP Could Further Embrace Crypto Sector Under Trump

Former President Donald Trump is reportedly in talks to speak at the Bitcoin 2024 convention in Nashville, Tennessee on July 25-27, another bullish pivot towards the sector after scepticism in his first term.

- Trump's move is part of a broader shift within the GOP to align with the crypto industry and follows a strong month of May when the sector won a series of legislative victories including House votes to create a regulatory regime tailored for crypto and repeal SEC crypto guidance.

US (MNI): US Announces Sanctions On Iranian "Shadow Banking" Network

The US Treasury Department has announced sanctions on nearly 50 entities and individuals connected to a “shadow banking” network used by Iran to gain illicit access to the international financial system and process billions of dollars of oil and petrochemical revenue.

US TSYS Off Lows, Tsys Discounting Fed Gov Bowman Opinion on Rate Cut Wait Time

- Treasury futures pared early morning gains, trading near steady after near in-line FHFA House Price Index MoM (0.2% vs. 0.3% est, prior down revised to 0.0% from 0.1%). More of a reaction to higher than expected Canada core CPI data as rates extended modest lows into midday.

- Contributing to the pressure, Federal Reserve Governor Michelle Bowman Tuesday said it will likely be "some time" before the U.S. central bank can begin lowering interest rates, warning that U.S. monetary policy over the coming months could diverge from that of other advanced economies.

- Large 2Y/10Y-utra bond flattener blocked at 0942:00ET: -28,000 TUU4 102-05.25, sell through 102-05.62 post time bid, DV01 $1.06M vs. +12,000 UXYU4 114-12.5, post time offer, DV01 $1.09M.

- Tsy Sep'24 10Y futures have drifted off lows in late trade, near the middle of the session range after the bell: TYU4 +2.5 at 110-19.5, 10Y yield 4.2282%, -.0039.

- Look Ahead: New Home Sales, 5Y Auction on Wednesday, main focus on PCE inflation data in the latter half of the week.

OVERNIGHT DATA

US DATA (MNI): Conference Board Labor Differential Lifts After Downward Revision

Conference Board consumer confidence was close to expectations in June at 100.4 (cons 100.0) after a downward revised 101.3 (initial 102.0).

- With limited surprises on the headline print there was greater focus on the labor differential as an early indicator ahead of next week’s payrolls report.

- The differential increased to 24.0 in June but only from a downward revised 22.7 in May (initial 24.0).

- It averaged 23.2 in Q2, consolidating the pullback from the short-lived increase to 30.4 averaged in Q1.

US DATA (MNI): Philly Fed Survey Shows Big Jump In Nonmanufacturing Sector Optimism

The June Philadelphia Fed Nonmanufacturing Business Outlook survey showed an improvement in activity, employment and sentiment among nonmanufacturers, alongside mixed price pressures.

- The Philly Fed nonmanufacturing current General Activity index (comparing current activity vs the prior month) rose by 3.5 points to 2.9, the first positive reading of 2024 - but the standout in the report was the 6-month forward expectations index jumping over 38 points to 44.7, which was the highest since November 2021.

- Inflation dynamics were slightly divergent: prices paid fell to a 12-month low 24.4 (basically back to January 2021 levels), whereas prices received jumped over 11 points to a 13-month high 16.6.

MNI: US APR FHFA HPI SA +0.2% V +0.0% MAR; +6.3% Y/Y

MNI: US REDBOOK: JUN STORE SALES +5.6% V YR AGO MO

CANADA DATA (MNI): Canada CPI Faster Than Expected, Core Rose For First Time In 5M

Canada inflation accelerated more than expected in May as CPI +2.9% YOY vs the consensus for +2.6% and +0.6% MOM vs +0.2% expected.

BoC preferred core measures increased for the first time since Dec 2023, but remain within the target band.

Inflation has remained below 3% so far in 2024, meeting the BoCs expectations.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 275.43 points (-0.7%) at 39133.71

- S&P E-Mini Future up 18.25 points (0.33%) at 5535

- Nasdaq up 226.7 points (1.3%) at 17723.46

- US 10-Yr yield is down 0.2 bps at 4.2302%

- US Sep 10-Yr futures are up 2.5/32 at 110-19.5

- EURUSD down 0.0018 (-0.17%) at 1.0715

- USDJPY up 0.01 (0.01%) at 159.63

- WTI Crude Oil (front-month) down $0.86 (-1.05%) at $80.77

- Gold is down $15.19 (-0.65%) at $2319.46

- European bourses closing levels:

- EuroStoxx 50 down 15.01 points (-0.3%) at 4935.97

- FTSE 100 down 33.76 points (-0.41%) at 8247.79

- German DAX down 147.96 points (-0.81%) at 18177.62

- French CAC 40 down 44.59 points (-0.58%) at 7662.3

US TREASURY FUTURES CLOSE

- 3M10Y -0.149, -112.608 (L: -116.633 / H: -109.306)

- 2Y10Y -0.599, -50.151 (L: -51.252 / H: -48.446)

- 2Y30Y -0.677, -36.938 (L: -37.994 / H: -34.62)

- 5Y30Y -0.614, 10.245 (L: 9.728 / H: 11.312)

- Current futures levels:

- Sep 2-Yr futures up 0.125/32 at 102-5.75 (L: 102-04.375 / H: 102-07)

- Sep 5-Yr futures up 1/32 at 106-27.75 (L: 106-24.25 / H: 106-31)

- Sep 10-Yr futures up 3/32 at 110-20 (L: 110-14 / H: 110-25)

- Sep 30-Yr futures up 6/32 at 120-6 (L: 119-27 / H: 120-20)

- Sep Ultra futures up 8/32 at 128-12 (L: 127-27 / H: 128-29)

US 10Y FUTURE TECHS: (U4) Bullish Continuation Pattern

- RES 4: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-13 High Mar 25

- RES 1: 111-01 High Jun 14

- PRICE: 110-19 @ 11:00 BST Jun 25

- SUP 1: 109-24+/109-00+ 50-day EMA / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-13+ Trendline drawn from the Apr low

- SUP 4: 107-31 Low May 29 and a key support

A bull cycle in Treasuries remains in play and recent consolidation still appears to be a flag formation - a bullish continuation signal. Furthermore, the breach of resistance at 110-21, Jun 7 high, confirmed a resumption of the bull leg that started Apr 25, and has paved the way for an extension towards 111-17+, a Fibonacci projection. Key support to watch lies at 109-00+, the Jun 10 low. Clearance of this level is required to reinstate a bearish theme.

SOFR FUTURES CLOSE

- Sep 24 steady at 94.855

- Dec 24 steady at 95.165

- Mar 25 -0.005 at 95.465

- Jun 25 -0.005 at 95.725

- Red Pack (Sep 25-Jun 26) -0.005 to steady

- Green Pack (Sep 26-Jun 27) steady to +0.005

- Blue Pack (Sep 27-Jun 28) +0.010 to +0.015

- Gold Pack (Sep 28-Jun 29) +0.020 to +0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00244 to 5.34594 (+0.00071/wk)

- 3M -0.00117 to 5.33939 (-0.00516/wk)

- 6M -0.00306 to 5.26830 (-0.00728/wk)

- 12M -0.00372 to 5.04090 (-0.01075/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.992T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $755B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $737B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

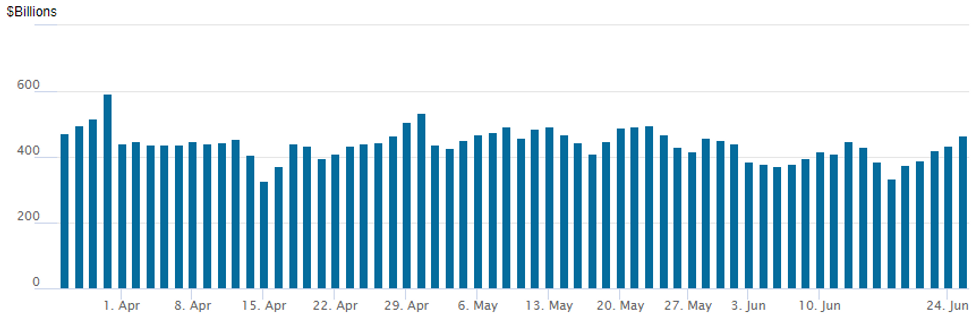

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $466.310B from $435.916B on Monday; number of counterparties at 74. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $15.05B Corporate Issuance to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 6/25 $3B #Vodafone $2B 30Y +143, $1B 40Y +157

- 6/25 $2.35B #NTT Finance $600M 3Y +65, $900M 5Y +85, $850M 7Y +90

- 6/25 $2.35B #Indonesia $750M 5Y 5.1%, $1B 10Y 5.2%, $600M 30Y 5.5%

- 6/25 $2B #International Finance Corp (IFC) 5Y SOFR+37

- 6/25 $1.5B *UAE 10Y +60

- 6/25 $1B #Vale Overseas 30Y +210

- 6/25 $1B *Republic of Finland 10Y SOFR+55

- 6/25 $750M *Jackson National Life 3Y +112.5

- 6/25 $600M #Choice Hotels 10Y +175

- 6/25 $500M *Edison International 5Y +120

- Expected Wednesday:

- 6/26 $Benchmark Korea 5Y +25a

EGBs-GILTS CASH CLOSE: Further Flattening

EGBs and Gilts closed Tuesday mixed, with curve flattening evident for the second consecutive session.

- After a constructive start to the day, albeit within the ranges seen since late last week, European yields ticked higher in early afternoon following stronger-than-expected Canadian CPI.

- The UK and German curves twist flattened, with a second consecutive session of short-end underperformance. Bunds modestly outperformed Gilts.

- Periphery EGB spreads closed modestly wider amid a broader subdued risk tone, partially reversing Monday's tightening.

- Wednesday's schedule includes UK CPI and German/French consumer confidence data. The week's focus continues to be Euro national level inflation data on Friday - MNI's preview will be published on Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at 2.809%, 5-Yr is down 0.6bps at 2.424%, 10-Yr is down 0.8bps at 2.411%, and 30-Yr is down 1.4bps at 2.601%.

- UK: The 2-Yr yield is up 2.1bps at 4.211%, 5-Yr is up 1.1bps at 3.952%, 10-Yr is down 0.2bps at 4.079%, and 30-Yr is down 0.8bps at 4.576%.

- Italian BTP spread up 0.7bps at 151.7bps / Spanish up 0.1bps at 85.9bps

FOREX: Euro Reverses Monday Advance as Markets Await More Significant Event Risk

- G10 currencies have shown only moderate adjustments Tuesday, as the USD index (+0.20%) reversed the majority of Monday’s move lower. In similar vein, EURUSD finds itself down 0.26%, oscillating either side of 1.0700 as French political risks continue to linger in the background.

- GBP/USD's early progress off the Monday low had the pair again testing 1.2700 and further gains through 1.2724 would form the beginnings of a reversal pattern off the recent low and support at the 50-dma. GBP’s resilience on Tuesday has seen EURGBP edge lower once more, having respected resistance around 0.8475 in the prior session.

- The greenback bid has helped USDJPY rise roughly 50 pips from session lows of 159.19 to once again narrow the gap to the psychological 160.00 mark. For now, the technical trend in USD/JPY remains bullish, but the intraday volatility noted during the Monday session shows markets remain subject to corrective pullbacks, especially against the backdrop of rising verbal intervention once more.

- USD strength was more notable in emerging markets, especially for USDMXN (+1.15%) as post-election volatility remains heightened ahead of Thursday’s Banxico decision. The current bull cycle in USDMXN remains in play and the pullback from the Jun 12 high still appears to be a correction. Support to watch lies at 17.9786, the 20-day EMA. It has been pierced, however, a clear break would be needed to expose the 50-day EMA at 17.5048.

- Australian CPI and US new home sales headline the data calendar on Wednesday before both the Riksbank and multiple emerging market central bank decisions on Thursday.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2024 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 26/06/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/06/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 26/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 26/06/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/06/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2024 | 1040/1240 |  | EU | ECB's Lane speech at Bank of Finland MonPol conference | |

| 26/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/06/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 26/06/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/06/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/06/2024 | 2000/2100 |  | UK | BBC Leaders Head-to-Head debate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.