-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Yld Curves Steepen On Dovish BOC Guidance

EXECUTIVE SUMMARY

CANADA

BOC: The Bank of Canada raised its key lending rate 25bps to 4.5% Wednesday and policy makers expect this to be the peak because of confidence the economy is on track to pull back overheated demand and hasten progress slowing inflation to target.

- “If economic developments evolve broadly in line with the Monetary Policy Report outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases. Governing Council is prepared to increase the policy rate further if needed to return inflation to the 2% target,” policymakers led by Governor Tiff Macklem said in a statement.

- "There is growing evidence that restrictive monetary policy is slowing activity, especially household spending." The statement is a shift from December's more even-handed comment the Bank was weighing whether or not to hike again. For more see MNI Policy main wire at 1004ET.

BOC: Bank of Canada Governor Tiff Macklem told reporters Wednesday that "we are turning the corner on inflation" and time is needed to pause and assess the drag from raising interest rates by 425 basis points.

- "We have raised rates rapidly, and now it's time to pause and assess whether monetary policy is sufficiently restrictive to bring inflation back to the 2% target," Macklem said in opening remarks for a press conference after hiking a quarter point to 4.25%.

- Macklem also reiterated the rate decision earlier today, saying if inflation remains stubborn he can tighten again. "To be clear, this is a conditional pause," he said, adding he's balancing risks of over- and under-tightening.

EUROPE

ECB: Strong interest rate rises in line with ECB president Christine Lagarde's December guidance will be necessary in February and March, Bundesbank president Joachim Nagel said in an interview published Wednesday [in German], with further hikes possible after that.

- “We will look at where the inflation rate is in the spring and what our experts' forecast looks like then," he said. "I wouldn't be surprised if we have to keep raising interest rates even after the two steps that have been announced. We are currently only at two percent for the currently most important key interest rate. And inflation, especially core inflation, is still very high,” he said.

US TSYS: Late Market Summary: Dovish Take on Expected BOC 25Bp Hike

Whipsaw action in US FI markets Wednesday, finishing mildly higher, near middle of session range. Early volatility, rates rallied after Bank of Canadas 25bp hike to 4.5% and dovish inflation language. “Slower demand growth, combined w/ improvements in the supply chain, lead the economy into modest excess supply in 2023” MPR.

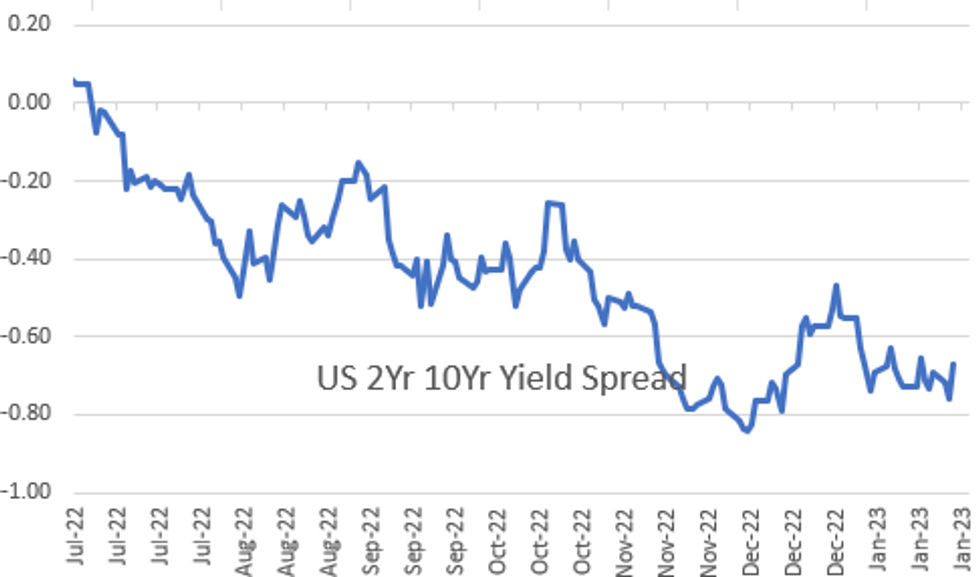

- BOC-tied support evaporated aby midmorning, yield curves bouncing off deeper inversion (and holding): 2s10s +8.092 at -68.087 (-77.338 low).

- While monthly core inflation suggests core has peaked rather than early indicator price pressures may be losing momentum helped drive early bid, reversal less a function of active sellers than support has waned following BOC Macklem's "conditional" pause comment.

- "Overall, we view the risks around our inflation forecast as balanced, but with inflation still well above our target, we continue to be more concerned about the upside risks. If these upside risks materialize, we are prepared to raise interest rates further."

- Trading desks reported prop and fast$ buying 10s as sector climbs back to steady/mildly higher, pre-auction short sets in 5s ahead today's $43B 5Y auction. Tsy futures gain slightly after strong $43B 5Y note auction (91282CGH8) stops through: 3.530% high yield vs. 3.555% WI; 2.64x bid-to-cover vs. 2.46x the prior month.

OVERNIGHT DATA

No significant data released Wednesday while the Fed remains in policy blackout through Feb 2. Tomorrow, however, sees surge of data w/ Q4 GDP, PCE, Weekly Claims, Retail/Wholesale Inv, Durables/Cap Goods, and New Home Sales.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 32 points (-0.09%) at 33702.62

- S&P E-Mini Future down 6.5 points (-0.16%) at 4026.25

- Nasdaq down 29.9 points (-0.3%) at 11304.63

- US 10-Yr yield is up 0.7 bps at 3.4599%

- US Mar 10-Yr futures are up 3/32 at 115-4

- EURUSD up 0.0021 (0.19%) at 1.0908

- USDJPY down 0.54 (-0.41%) at 129.63

- WTI Crude Oil (front-month) up $0.5 (0.62%) at $80.63

- Gold is up $6.68 (0.34%) at $1944.06

- EuroStoxx 50 down 4.91 points (-0.12%) at 4148.11

- FTSE 100 down 12.49 points (-0.16%) at 7744.87

- German DAX down 11.47 points (-0.08%) at 15081.64

- French CAC 40 down 6.6 points (-0.09%) at 7043.88

US TSY FUTURES CLOSE

- 3M10Y +3.632, -121.734 (L: -129.5 / H: -119.454)

- 2Y10Y +8.642, -67.537 (L: -77.338 / H: -66.177)

- 2Y30Y +9.401, -51.617 (L: -62.425 / H: -50.378)

- 5Y30Y +2.967, 5.822 (L: 1.354 / H: 6.941)

- Current futures levels:

- Mar 2-Yr futures up 1.375/32 at 102-31.375 (L: 102-29.125 / H: 103-01)

- Mar 5-Yr futures up 3.25/32 at 109-21 (L: 109-15.75 / H: 109-27)

- Mar 10-Yr futures up 3/32 at 115-4 (L: 114-29.5 / H: 115-13)

- Mar 30-Yr futures steady at at 130-27 (L: 130-16 / H: 131-21)

- Mar Ultra futures down 3/32 at 142-22 (L: 142-05 / H: 143-31)

US 10YR FUTURE TECHS: (H3) Remains Above Key Short-Term Support

- RES 4: 117-17+ 1.00 proj of the Nov 3 - Dec 13 - Dec 30 price swing

- RES 3: 117-06+ 2.0% 10-dma env

- RES 2: 117-00 High Sep 8 2022

- RES 1: 115-21/116-08 High Jan 20 / 19 and the bull trigger

- PRICE: 115-05 @ 1400ET Jan 25

- SUP 1: 114-14/13+ Low Jan 24 / 20-day EMA

- SUP 2: 114-09+ Low Jan 17 and a key support

- SUP 3: 113-26+ Low Jan 10

- SUP 4: 112-18+ Low Jan 5

Treasury futures resistance at 116-08, the Jan 19, high remains intact. The latest pullback is considered corrective and medium-term trend conditions are bullish. Moving average studies are in a bull mode position and a positive price sequence of higher highs and higher lows remains intact. On the continuation chart, the 200-dma has recently been pierced. A clear break of it would reinforce current conditions. Key support is 114-09+, the Jan 17 low.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.030 at 950

- Jun 23 +0.045 at 94.930

- Sep 23 +0.055 at 95.050

- Dec 23 +0.055 at 95.395

- Red Pack (Mar 24-Dec 24) -0.005 to +0.030

- Green Pack (Mar 25-Dec 25) -0.005 to steady

- Blue Pack (Mar 26-Dec 26) -0.005 to +0.005

- Gold Pack (Mar 27-Dec 27) -0.005 to +0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 4.30800% (+0.000286/wk)

- 1M +0.00129 to 4.50729% (-0.00599/wk)

- 3M -0.00729 to 4.81457% (-0.00100/wk)*/**

- 6M -0.00028 to 5.10829% (+0.00629/wk)

- 12M -0.00471 to 5.33929% (-0.00800/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $104B

- Daily Overnight Bank Funding Rate: 4.32% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.163T

- Broad General Collateral Rate (BGCR): 4.27%, $464B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $441B

- (rate, volume levels reflect prior session)

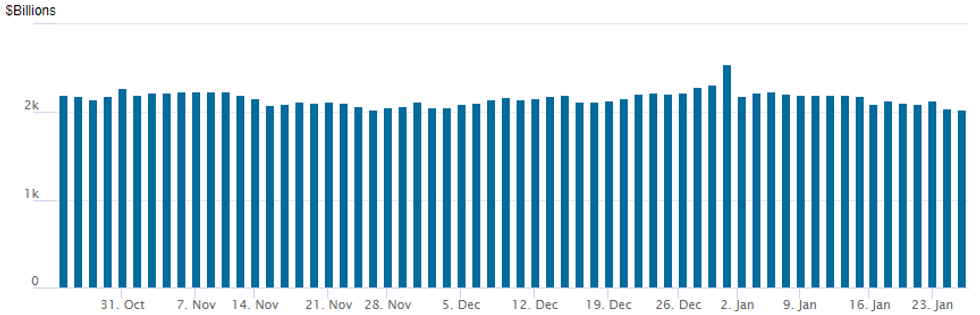

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,031.561B w/ 99 counterparties vs. prior session's $2,048.386B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.25B Capital One 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/25 $2.25B Capital One $1B 6NC5 +190, $1.25B 11NC10 +235

- For Thursday:

- 01/26 $2.75B Mauser Packaging 3.5NC1.5 investor calls

EGBs-GILTS CASH CLOSE: Early Rally Peters Out

Bund and Gilt yields finished well off their session lows Wednesday, with periphery EGB spreads likewise re-widening.

- Soft UK PPI data helped Gilts rally early, with BoE hike expectations dialled back and end-year cut pricing picking up.

- Hawkish commentary from ECB's Vasle, Makhlouf, and Nagel helped turn yields higher in early afternoon.

- After briefly ticking higher in mid-afternoon as the Bank of Canada signalled it was pausing its hiking cycle, the sell-off resumed.

- 10Y BTP spreads to Bunds fell below 174bp in the morning, but headed above 180bp in the afternoon amid the broader sell-off.

- Fairly limited data and speaker slate Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.5bps at 2.529%, 5-Yr is down 1.3bps at 2.176%, 10-Yr is up 0.3bps at 2.158%, and 30-Yr is up 1.6bps at 2.127%.

- UK: The 2-Yr yield is up 2.9bps at 3.407%, 5-Yr is down 3.9bps at 3.133%, 10-Yr is down 3.4bps at 3.243%, and 30-Yr is down 2.9bps at 3.593%.

- Italian BTP spread up 3bps at 179.1bps / Spanish up 0.9bps at 95.3bps

FOREX: USD Index Hovering Close To Cycle Lows Approaching US GDP Data

- Greenback pressure resumed on Wednesday with the USD index gravitating towards the worst levels of the week and nearing fresh trend lows set last Wednesday. A light data calendar overall has seen the path of least resistance remain lower for the greenback ahead of key US growth data on Thursday.

- AUD strength remains the standout in G10, following a stronger set of inflation data in Australia, helping to push market pricing towards a 25bps hike for the February RBA meeting. In the process of rallying, AUDUSD has cleared resistance at 0.7063, the Jan 18 high. The breach confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows. Attention is on the next key resistance at 0.7137, the Aug 11 high where a break would strengthen underlying bullish conditions.

- Conversely, New Zealand inflation came in below RBNZ expectations, which has worked against the NZD (-0.32%), a key underperformer on the session.

- The Bank of Canada hiked 25bp but signalled that they should be in the position to pause rate hikes which also worked against the Canadian dollar. USDCAD had a firm spike from 1.3365 to 1.3425 following the release of the statement, however, broad USD weakness had seen the pair trade back close to the unchanged mark approaching the APAC crossover.

- EURUSD sits just shy of Monday’s high of 1.0927 with moving average studies continuing to highlight positive market sentiment. Sights remain on 1.0954, the Apr 11 2022 high.

- Despite Lunar New Year and the Fed’s blackout period continuing, markets will receive the advanced reading of Q4 US GDP tomorrow which will likely be a key indicator for US policy makers as we near the end of the tightening cycle. Friday’s release of US Core PCE Price Index will round off the week’s major data releases.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/01/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/01/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/01/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 26/01/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 26/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 26/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/01/2023 | 1330/0830 | ** |  | US | durable goods new orders |

| 26/01/2023 | 1330/0830 | *** |  | US | GDP (adv) |

| 26/01/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/01/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 26/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 26/01/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/01/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.