-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Ylds Dip, July Employment Data Ahead

EXECUTIVE SUMMARY

- MNI INTERVIEW: Tough Credit Terms Squeeze US Homebuilding-NAHB

- MNI BOJ WATCH: Ueda Says Flexible YCC Not Move To Easy Policy

- MNI ECI Growth Softer Than Expected In Q2

- MNI Core PCE Consistent With 2% Target In June

US

US: American home prices will keep rising with demand pulling further ahead of supply weighed down by Fed hikes and tougher lending terms from commercial lenders, National Association of Home Builders chief forecaster Danushka Nanayakkara-Skillington told MNI.

- "We expect healthy demand from Millennials going for the next few years. It's the fact that we just don't have enough housing for them to support it. That's what is keeping house prices higher," she said in an interview.

- Chair Jerome Powell said Wednesday after raising interest rates to the highest in more than two decades that home prices are nearing their peak but the market could have “a ways to go” before balancing out. The NAHB expects one more 25bp increase at the next Fed decision to a peak range of 5.5% to 5.75%. (See: MNI INTERVIEW: Powell Opens Door To End Of Fed Hikes-Weinberg)

- Higher rates and tougher lending terms will further squeeze a housing market where inventories are already half of normal levels, Nanayakkara-Skillington said. "The biggest thing for the builders would be lending. Lending standards have gotten much stricter and tighter since the banks collapsed earlier this year," she said. Builders are now paying double on their Acquisition Development and Construction loans, with rates around 11% or 12%. For more see MNI Policy main wire at 1356ET.

JAPAN

BOJ: The Bank of Japan announced on Friday it would tolerate greater movement of the 10-year bond yield to as high as 1%, but Governor Kazuo Ueda said the change was aimed at making easy monetary settings more sustainable and brushed off any suggestion that this was a step towards policy normalization.

- “The BOJ is still some distance away from removing its negative short-term policy interest rate,” Ueda told reporters after the two-day meeting. “Sustainable and stable achievement of the price stability target of 2%, accompanied by wage increases, has not yet come in sight.”

- While the BOJ will now tolerate moves in the 10-year yield above its recent upper limit of 0.5%, the long-term rate target remains at around zero percent. (See MNI POLICY: BOJ Mulls Softer 10-Yr Target, Flexible YCC Bands). Ueda said he does not expect the yield to rise to 1%, despite the relaxation, which is nonetheless intended to allow the rate to respond to economic and price developments. For more see MNI Policy main wire at 0236ET.

Late Roundup: Tsys Hold Midrange, Focus on July Employ Next Friday

- Treasury futures remain in positive territory, off early session highs following a knee-jerk bid on lower than est Employment Cost Index gains 1.0% vs. 1.1% est, Core PCE 4.1% vs. 4.1% est.

- Rates quickly reversed the gap move as markets deemed it an overreaction to near in-line data. Services saw a mild acceleration from 0.25% to 0.275% M/M but importantly the Fed’s preferred indicator of core non-housing services eased a tenth to 0.22% M/M. Softer ECI data an afterthought while benign price pressure evinced from UofM survey helped buoy rates back to middle of the range.

- Tsy curves off early highs, currently mixed w/ 3M10Y -2.594 at -146.816, 2s10s +.600 at -92.849 (vs. -86.190 high) as short end rates lagged the rally in intermediates. As such, rate hike projections through year end remained subdued (18-36% chance of 25bp hike before year end). Markets much more eager to price in rate CUTS in 2024 (first 25bp cut in May '24, second in July'24.

- Focus turns to next week's ISMs on Tue (Mfg 46.98 est, prices paid 44.0 est), ADP on Wednesday (+188k est vs. 497k prior), and July employment data next Friday, current estimate of +200k job gains vs. +209k in June.

- Equity earnings resume Monday, premarket: Immunogen; after the close: Diamondback Energy, Tenet Health, Monolithic Power, Welltower, Rambus, and Western Digital.

OVERNIGHT DATA

US DATA: Core PCE Unrounded

- M/M (SA): 0.165% in Jun -- Follows 0.309% in May (initial 0.315%), 0.351% in Apr (initial 0.380%)

- Y/Y (SA): 4.1% in Jun from 4.581% in May -- Largest downward revision for back in April.

- Core PCE printed a ‘low’ 0.2 in June at 0.165% M/M (cons 0.2) and with downward revisions to the prior two months but the largest -0.03pp back in April which limits some of the impact (revisions were expected after yesterday’s soft Q2 advance).

- It’s a monthly rate consistent with the 2% target, having last been there or lower in Jul’22 and before that Feb’21.

- Services saw a mild acceleration from 0.25% to 0.275% M/M but importantly the Fed’s preferred indicator of core non-housing services eased a tenth to 0.22% M/M. It was unrevised at 0.23% in May although also saw a downward revision in April, from 0.42% to 0.37% M/M.

- US Q2 EMPL COST INDEX 1% V Q1 1.2%

- US Q2 EMPL COST INDEX Y/Y 4.5% V Q1 4.8%

- US Q2 BENEFIT PAYMTS 0.9% V Q1 1.2%; Q2 Y/Y 4.2%(Q1 4.5%)

- The ECI was softer than expected in Q2 at 1.02% Q/Q (cons 1.1) after an unrevised 1.16%, a reasonable miss considering the data are non-annualized. It’s the softest quarter since 2Q21 but still equivalent to 4.1% annualized.

- Wages & salaries saw a similar trend, moderating from 1.16% to 0.95% (3.9% annualized) for also the softest since 2Q21, as did the private sector specific measure of wages & salaries easing from 1.21% to 1.00% (4.1% annualized).

- Taken together, the data lend credence to the downtrend trend seen in the monthly AHE data from payrolls, albeit one that started to stall in latest months, due an update for July next week.

US DATA: UMICH CONSUMER EXPECTATIONS FINAL JUL INDEX 68.3. U.Mich consumer sentiment revised 1pt lower to 72.6 in the final July reading.

- 1Y expectations: 3.4% (prelim 3.4%) in July after 3.3% June

- 5-10Y expectations: 3.0% (prelim 3.1%) in July after 3.0% June. The downward revision from the preliminary print means it last hit 3.1% in May and before that in Jun’22.

- Remember long-term expectations have been in the 2.9-3.1% range for all but one month (when it surprised lower) since Aug’21. A tick higher to 3.2% would mark the highest since Mar'11.

CANADA: Canada May GDP +0.3%, main contributors were wholesale and public administration. Mining, quarrying and oil and gas extraction was the biggest detractor, caused by Alberta wildfires. June flash estimate -0.2%, the expected contraction is led by a trend reversal in wholesale and manufacturing.

- April GDP revised from 0% to +0.1%.

- Annualized Q2 GDP growth +1% according to a flash estimate, slower than Q1.

- CANADA FLASH JUNE GDP -0.2%

- CANADA FLASH Q2 GDP +1% ANNUALIZED

- CANADIAN MAY GDP +0.3% V +0.4% EST; YOY +1.9%

- STATSCAN REVISES APRIL GDP TO +0.1% FROM 0%

- CANADA MAY GROSS DOMESTIC PRODUCT +0.3% MOM

- CANADA MAY GOODS INDUSTRY GDP -0.3%, SERVICES +0.5%

- CANADA REVISED APR GROSS DOMESTIC PRODUCT +0.1% MO

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 169.87 points (0.48%) at 35453.04

- S&P E-Mini Future up 44 points (0.96%) at 4608.25

- Nasdaq up 274.3 points (2%) at 14325.62

- US 10-Yr yield is down 3.4 bps at 3.9646%

- US Sep 10-Yr futures are up 11/32 at 111-11.5

- EURUSD up 0.0046 (0.42%) at 1.1025

- USDJPY up 1.65 (1.18%) at 141.14

- WTI Crude Oil (front-month) up $0.29 (0.36%) at $80.38

- Gold is up $12.27 (0.63%) at $1958.27

- EuroStoxx 50 up 19.06 points (0.43%) at 4466.5

- FTSE 100 up 1.51 points (0.02%) at 7694.27

- German DAX up 63.72 points (0.39%) at 16469.75

- French CAC 40 up 11.23 points (0.15%) at 7476.47

US TREASURY FUTURES CLOSE

- 3M10Y -2.793, -147.015 (L: -152.581 / H: -144.419)

- 2Y10Y +0.393, -93.056 (L: -93.912 / H: -86.19)

- 2Y30Y +2.432, -87.139 (L: -89.735 / H: -80.555)

- 5Y30Y +3.743, -16.764 (L: -21.918 / H: -14.184)

- Current futures levels:

- Sep 2-Yr futures up 2.625/32 at 101-16 (L: 101-12.875 / H: 101-19.75)

- Sep 5-Yr futures up 8/32 at 106-25 (L: 106-13.25 / H: 106-31.75)

- Sep 10-Yr futures up 11.5/32 at 111-12 (L: 110-25.5 / H: 111-21)

- Sep 30-Yr futures up 12/32 at 124-8 (L: 123-09 / H: 124-21)

- Sep Ultra futures up 21/32 at 131-31 (L: 130-22 / H: 132-16)

US 10Y FUTURE TECHS: (U3) Corrective Bear Leg Remains In Play

- RES 4: 113-08 High Jul 18 and a bull trigger

- RES 3: 112-31 50-day EMA

- RES 2: 112-17+ High Jul 24

- RES 1: 112-07 High Jul 27

- PRICE: 111-12+ @ 1415 ET Jul 28

- SUP 1: 110-25+ Intraday low

- SUP 2: 110-13 Low Jul 7

- SUP 3: 110-05 Low Jul 6 and the bear trigger

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Treasuries traded lower Thursday. For now, the recent bear leg appears to be a correction. However, price has traded through all relevant short-term retracement points. This highlights scope for a continuation lower that would expose the key support at 110-05, the Jul 6 low. Clearance of this support point would confirm a resumption of the medium-term downtrend. Key resistance has been defined at 113-08 high, the Jul 18 high.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.585

- Dec 23 +0.020 at 94.615

- Mar 24 +0.040 at 94.825

- Jun 24 +0.050 at 95.140

- Red Pack (Sep 24-Jun 25) +0.050 to +0.065

- Green Pack (Sep 25-Jun 26) +0.060 to +0.070

- Blue Pack (Sep 26-Jun 27) +0.055 to +0.060

- Gold Pack (Sep 27-Jun 28) +0.045 to +0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00055 to 5.31810 (+.02011/wk)

- 3M +0.00279 to 5.37191 (+.02070/wk)

- 6M -0.00483 to 5.44800 (+.01957/wk)

- 12M +0.00536 to 5.40788 (+.04638/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $261B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.501T

- Broad General Collateral Rate (BGCR): 5.28%, $591B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $583B

- (rate, volume levels reflect prior session)

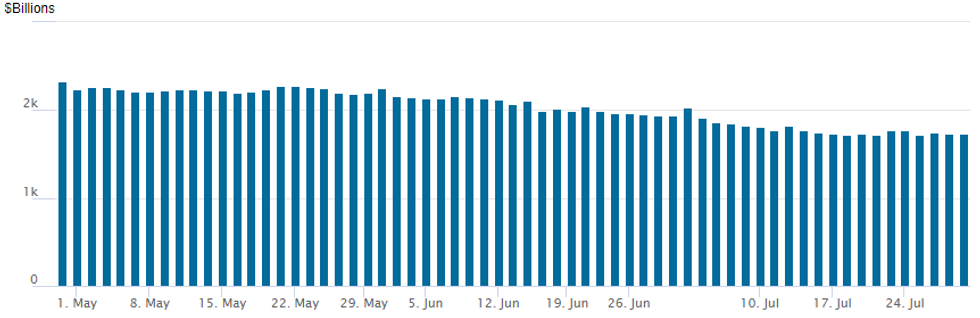

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation recedes to $1,730.227B, w/99 counterparties, compared to $1,735.783B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: High-Grade Corporate Issuance Running Total for July at $84.875B

$6.35B Priced Thursday, $15.05B total for week, $84.875B running total for July

- Date $MM Issuer (Priced *, Launch #

- 07/27 $1.1B *Penske Trucking 5Y +187.5

- 07/27 $2B *WM $750M +5Y +75, $1.25B +10Y +105

- 07/27 $3.25B *L3Harris $1.25B +3Y +85, $1.5B 10Y +140, $500M 3Y +155

FOREX USDJPY Grinds Towards Highs Post BOJ-Induced Volatility, EURAUD Surges

- USDJPY looks set to close just below session highs despite the earlier BOJ decision to tweak its yield curve control policy. An impressive 300 point range in the direct aftermath of the decision has capped the price action throughout the remainder of Friday’s session, however, the pair has remained well supported on dips and currently trades just shy of the day’s peak of 141.07.

- Two early attempts back below 139.00 were met with stiff demand and given the more optimistic price action, markets will turn their focus to the topside, where clearance of 141.96 would reinstate a bullish technical theme.

- Mixed numbers from the US that also came in close to expectations, kept the greenback in check overall. The USD index (-0.13%) is just marginally softer on the day, with broad outperformance for major equity benchmarks weighing at the margin.

- The Euro and GBP are outperforming, while Antipodean currencies are among the laggards on Friday. There is little to explain this divergence apart from AUD/USD breaking a series of key supports to hit the lowest levels since early July. Additionally, early substantial weakness across Monday and Tuesday for EURAUD has now entirely reversed and the pair is pressing fresh weekly highs at typing, ahead of the weekend close.

- China manufacturing and non-manufacturing PMI will kick off the global data calendar next week before Eurozone July CPI takes centre-stage. Highlights next week include the RBA and BOE rate decisions, both preceding the July US non-farm payrolls release.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/07/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/07/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/07/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/07/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/07/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/07/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/07/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/07/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.