-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Tsy Ylds Inches Lower Ahead Week's PPI/CPI Data

- MNI US: Harris Continues To Strengthen In Swing State Polling

- MNI US: State Dept Expects Gaza Ceasefire Talks To Take Place As Planned

- MNI US DATA: Housing Inflation Seen Holding Large Part Of June’s Surprise Moderation

- MNI US DATA: Sharp Decline In 3Y Inflation Expectations, Delinquencies Expected To Rise Further - NY Fed

US

US (MNI): Harris Continues To Strengthen In Swing State Polling

Vice President Kamala Harris’s presidential campaign received another polling boost with a New York Times/Siena College survey showing Harris leading former President Donald Trump 50-46% in the three critical Rust Belt states - Michigan, Pennsylvania and Wisconsin. The Siena College poll is notable as it was a previous poll from the organisation that accelerated anxiety over President Biden’s electability.

NEWS

SECURITY (MNI): US State Dept Expects Gaza Ceasefire Talks To Take Place As Planned

US State Department spokesperson, Vedant Patel, has told reporters that the US expects Gaza ceasefire talks, planned for August 15 in Doha or Cairo, to go ahead despite comments from Hamas warning they could reject the talks, in light of an IDF strike on a school over the weekend. Patel: "I am aware of those comments from Hamas and we fully expect talks to move forward as they should. All negotiators should return to the table and bring this deal to conclusion."

SECURITY (MNI): UKRAINE's Olena Tregub at Ukraine's Independent Anti-Corruption Commission (NAKO) writes on X that Ukrainian President Volodymyr Zelenskyy has been, "briefed by his commander-in-chief that Ukraine currently controls 1000 square kilometers of Russian territory." AFP ran a headline a short time ago, likely noting that same report: "Ukrainian troops hold 1,000 square kilometres of Russia: military chief."

US TSYS Brewing Geopol Tension Underpins Tsys

- Thin summer markets exacerbated market moves Monday, brewing tension in the Middle East where Israel in on full alert ahead of an expected attack from Iran/Hamas, while fighting continues in Eastern Europe after Ukraine took control of over 1,000 square kilometers of Russian territory in a counter-offensive that kicked off over the weekend.

- Treasury futures climbed to 113-09.5 high in late trade, still well below technical resistance at 114-03 (High Aug 6). Tsy 10Y yield slipped to 3.8940% low in late trade.

- Limited data, NY Fed inflation expectations were unchanged for 1Y and 5Y ahead measures (1Y unchanged on a rounded basis at 3.0% but unrounded at 2.97% after 3.02%, 5Y at 2.8%).

- Focus on Tuesday morning's PPI data while Richmond Fed Bostic will discuss his economic outlook (no text, Q&A) at 1315ET.

OVERNIGHT DATA

US DATA (MNI): Sharp Decline In 3Y Inflation Expectations, Delinquencies Expected To Rise Further - NY Fed

NY Fed inflation expectations were unchanged for 1Y and 5Y ahead measures (1Y unchanged on a rounded basis at 3.0% but unrounded at 2.97% after 3.02%, 5Y at 2.8%). However, the 3Y saw a sharp 0.6pp decline from 2.93% to 2.33%, poking below the 2.35 in January for a low since the series started in 2013.

US DATA (MNI): Housing Inflation Seen Holding Large Part Of June’s Surprise Moderation

Services drove the downside surprise in June core CPI inflation, with both housing and non-housing components playing a significant role. The second mildly negative reading in non-housing inflation was helped by some CPI-specific factors that didn’t translate to core PCE but the typical persistence of housing inflation made its surprise lower all the more notable.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 198.27 points (-0.5%) at 39297.76

- S&P E-Mini Future down 9.25 points (-0.17%) at 5360

- Nasdaq up 11.6 points (0.1%) at 16753.71

- US 10-Yr yield is down 3.8 bps at 3.9016%

- US Sep 10-Yr futures are up 10/32 at 113-8.5

- EURUSD up 0.0014 (0.13%) at 1.0931

- USDJPY up 0.44 (0.3%) at 147.05

- WTI Crude Oil (front-month) up $3.04 (3.96%) at $79.88

- Gold is up $39.57 (1.63%) at $2470.82

- European bourses closing levels:

- EuroStoxx 50 down 3.4 points (-0.07%) at 4671.88

- FTSE 100 up 42.15 points (0.52%) at 8210.25

- German DAX up 3.59 points (0.02%) at 17726.47

- French CAC 40 down 19.04 points (-0.26%) at 7250.67

US TREASURY FUTURES CLOSE

- 3M10Y -3.222, -131.48 (L: -132.241 / H: -122.961)

- 2Y10Y +0.598, -11.147 (L: -13.727 / H: -10.308)

- 2Y30Y +1.848, 17.986 (L: 13.854 / H: 18.957)

- 5Y30Y +2.635, 44.714 (L: 40.715 / H: 45.333)

- Current futures levels:

- Sep 2-Yr futures up 2.375/32 at 103-8.5 (L: 103-04.375 / H: 103-09.25)

- Sep 5-Yr futures up 6.5/32 at 108-30.75 (L: 108-20 / H: 108-31.75)

- Sep 10-Yr futures up 10/32 at 113-8.5 (L: 112-25 / H: 113-09.5)

- Sep 30-Yr futures up 13/32 at 123-10 (L: 122-17 / H: 123-15)

- Sep Ultra futures up 18/32 at 131-16 (L: 130-13 / H: 131-21)

US 10Y FUTURE TECHS (U4) Pullback Considered Corrective

- RES 4: 116-00 Round number resistance

- RES 3: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 114-03/115-03+ High Aug 6 / 5 and the bull trigger

- PRICE: 113-08 @ 1530 ET Aug 9

- SUP 1: 112-03 20-day EMA

- SUP 2: 111-05 50-day EMA values

- SUP 3: 110-18+ Low Jul 22

- SUP 4: 110-07 Low Jul 9

A bullish theme in Treasuries remains intact following recent gains. Moving average studies are in a bull-mode position and the recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for 115-17, a Fibonacci projection. The contract has pulled back from the Aug 5 high. At this stage, the move down is considered corrective. Initial support to watch is 112-00, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.005 at 95.130

- Dec 24 +0.010 at 95.750

- Mar 25 +0.025 at 96.205

- Jun 25 +0.040 at 96.505

- Red Pack (Sep 25-Jun 26) +0.055 to +0.075

- Green Pack (Sep 26-Jun 27) +0.055 to +0.065

- Blue Pack (Sep 27-Jun 28) +0.045 to +0.055

- Gold Pack (Sep 28-Jun 29) +0.045 to +0.050

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00425 to 5.33777 (-0.01672 total last wk)

- 3M +0.00333 to 5.11602 (-0.11504 total last wk)

- 6M -0.00166 to 4.80431 (-0.20166 total last wk)

- 12M -0.00833 to 4.34795 (-0.23980 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.170T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $816B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $795B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $239B

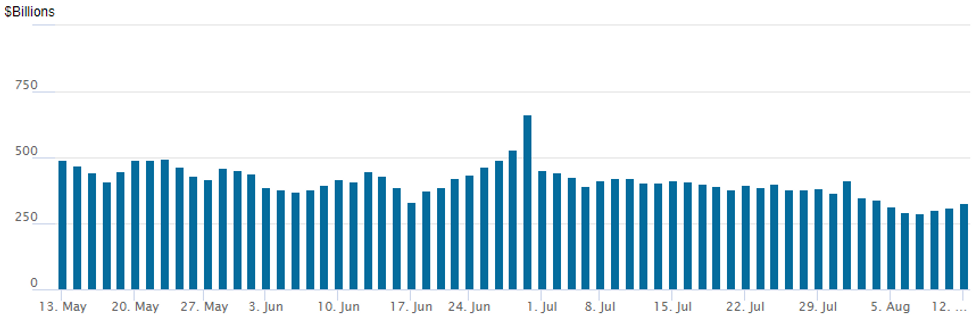

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $328.641B from $312.198B last Friday -- compares to $286.660B last Wednesday -- the lowest since mid-May 2021. Number of counterparties climbs to 64 from 62 prior.

PIPELINE $5B Eli Lilly 5Pt Debt Leads Monday's $17.9B

$17.9B to price Monday

- Date $MM Issuer (Priced *, Launch #)

- 8/12 $5B #Eli Lilly $750M 3Y +35, $1B 5Y +50, $1.25B 10Y +70, $1.25B 30Y +88, $750M 40Y +100

- 8/12 $2.5B #Caterpillar $750M 2Y +47, $500M 2Y SOFR+69, $650M 3Y +58, $600M 5Y +68

- 8/12 $2.5B #Bank of America 11NC10 +152

- 8/12 $1.75B #NatWest $500M 4.25NC3.25 SOFR+130, $1.25B 6NC5 +122

- 8/12 $1.2B #CDW $600M +5Y +137.5, $600M 10Y +168

- 8/12 $800M #CenterPoint Energy $400M 30.5NC5.25 7%, $400M 30.5NC10.25 6.85%

- 8/12 $650M #Equifax +5Y +105

- 8/12 $500M #Principle Life 3Y +80

- 8/12 $500M #Arrow Electronics 5Y +143

- 8/12 $500M #EnLink Midstream 10Y +180

- 8/12 $500M #O'Reilly Automotive 10Y +113

- 8/12 $1.5B JetBlue 7NC3 7%a investor calls

EGBs-GILTS CASH CLOSE: Modest Gilt Outperformance Ahead Of Key UK Data

European yields closed little changed Monday, with Gilts modestly outperforming ahead of a heavy UK data schedule this week.

- Bunds and Gilts weakened in European morning trade, paring some of Friday's gains amid a quiet data/speaker slate.

- They ultimately recovered those losses in the afternoon in volatile trade (albeit within last week's ranges) that mirrored the wider risk picture, as equities vacillated despite no major headline triggers.

- The German curve modestly bear flattened, with the UK's bull flattening. Periphery EGB spreads closed mixed, but basically unchanged vs Bunds.

- Most market focus in Europe is on UK labour market data Tuesday and inflation Wednesday (MNI's preview went out today), though US PPI/CPI on those respective days will of course be of global importance.

- In the Eurozone, Tuesday sees final Spain CPI, with the second reading of Q2 Eurozone GDP on Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at 2.393%, 5-Yr is up 0.4bps at 2.136%, 10-Yr is up 0.1bps at 2.226%, and 30-Yr is up 0.1bps at 2.459%.

- UK: The 2-Yr yield is down 1.6bps at 3.636%, 5-Yr is down 1.4bps at 3.711%, 10-Yr is down 2.9bps at 3.916%, and 30-Yr is down 2.3bps at 4.493%.

- Italian BTP spread down 0.3bps at 141.5bps / Spanish bond spread down 0.3bps at 85.7bps

FOREX: USDJPY Remains Higher Despite Pullback, NZD Strengthens

- Despite volatile trading for equities on Monday, risk sentiment remains a touch firmer on Monday, contributing to Japanese yen and Swiss franc weakness overall, while antipodeans trade on the front foot.

- USDJPY rose as high as 148.22 in early US trade before the more volatile equity backdrop then prompted a gradual 100 pip turnaround.

- Note that the bear trend for USDJPY remains in an extreme oversold condition, and the latest recovery - a correction - is allowing this condition to unwind. Initial firm resistance is not seen until 151.10, the 20-day EMA and support comes in at 144.29, the Aug 7 low.

- The firmer tone for risk sentiment on Monday is benefitting the Kiwi most notably in G10 and the aforementioned pressure on the Yen has seen NZDJPY rise by 0.75%.

- The cross briefly pierced last week’s highs earlier in the session, rising back above 89.00, which may strengthen the scope for a more protracted recovery to the psychological 90.00 mark which has been technically pivotal in recent months. A close back above here would then target trendline resistance closer to 93.00.

- Elsewhere, adjustments across major G10 pairs were more limited as global markets await key US CPI data on Wednesday. Elsewhere, UK labour market and CPI is scheduled, as well as the RBNZ decision.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/08/2024 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 13/08/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/08/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/08/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/08/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/08/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/08/2024 | 1230/0830 | *** |  | US | PPI |

| 13/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/08/2024 | 1715/1315 |  | US | Atlanta Fed's Raphael Bostic | |

| 14/08/2024 | - |  | NZ | Reserve Bank of New Zealand Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.