-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Back to Pre-CPI Lvls, Focus on Powell, NFP

- MNI INTERVIEW: Fed Could Cut Fewer Than 3 Times In '24-Friedman

- MNI INTERVIEW: US Services Firm Despite ISM Miss, Prices High

- MNI INTERVIEW: UK Budget's Imaginary Cuts A "Fiscal Fiction"

- MNI ECB WATCH): ECB On Hold, As Focus On Cuts Timing

- MNI US DATA: (Volatile) Prices Paid And Employment Lead ISM Services Miss

US

INTERVIEW (MNI) Fed Could Cut Fewer Than 3 Times In '24-Friedman: Federal Reserve policymakers will stay cautious about cutting interest rates this year given strong growth and volatile inflation, and there's a rising chance they will deliver even fewer than the three cuts embedded in official projections, former New York Fed economist Steven Friedman told MNI.

- “Three rate cuts as a base case this year still looks reasonable, but the risks are now increasingly skewed to fewer than that and a later start,” he said in an interview. “This is going to be a very cautious cutting cycle.”

- This view contrasts starkly with market pricing of just a few weeks ago for as many as six rate cuts. Fed officials have since pushed back against such a prospect, and seemed to have raised the bar further with speeches highlighting that the central bank has not in the past cut rates while economic growth is robust.

NEWS

INTERVIEW (MNI): US Services Firm Despite ISM Miss, Prices High: U.S. service sector activity expanded for a 14th month in February, albeit at a slower pace and accompanied with price pressures that moderated but remain too hot for the Federal Reserve, Institute for Supply Management chair Anthony Nieves told MNI Tuesday.

INTERVIEW (MNI): UK Budget's Imaginary Cuts A "Fiscal Fiction": The UK budget to be unveiled on Wednesday looks set to show the government meeting its self-imposed fiscal rule based on unspecified spending cuts scheduled for beyond the next election but a Spending Review will ensure reality bites before the year is out, Institute for Government Deputy Chief Economist Thomas Pope told MNI.

ECB WATCH (MNI): ECB On Hold, As Focus On Cuts Timing: The European Central Bank is expected to hold key interest rates at 4.00% this Thursday, and issue projections showing lower-than-previously-expected inflation in 2024 but with little change for 2025 and 2026. The ECB could also modify its policy statement to suggest that rate cuts are getting closer. As MNI has reported, a minority of Governing Council members are pushing to discuss the timing of cuts.

SECURITY (MNI): US State Dept: Obstacles To Ceasefire Are Not Insurmountable: US State Department spokesperson Matthew Miller has told reporters that the US, "believes it is possible to reach a [ceasefire] agreement between Israel and Hamas," following a meeting today between Secretary of State Antony Blinken and Israeli War Cabinet member Benny Gantz in Washington D.C.

US (MNI): Washington Insiders Doubtful Of Trump Victory In November: A new survey from Punchbowl News has found that Washington insiders are skeptical that former President Donald Trump will win a presidential election rematch with President Biden in November.

NATO (MNI): Hungary Will Not Support Rutte For Sec-Gen: Foreign Min: Earlier today, Hungarian Foreign Minister Peter Szijjarto confirmed that the Hungarian gov't would not back outgoing Dutch PM Mark Rutte for the position of NATO Secretary General once the incumbent Jens Stoltenberg's term concludes on 1 Oct.

Treasuries at Pre-CPI Levels Ahead Chairman Powell Policy Testimony

- Treasury futures are broadly higher after the bell, off midmorning highs - yet more than making up for Monday's sell-off. Treasury futures gapped higher, extended session highs after this morning's lower than expected ISM Services Index (52.6 vs. 53.0 est) and Prices Paid (58.6 vs. 62.0 est) -- as well as lower than expected Factory Orders (-3.6% vs. -2.9% est); Ex Trans (-0.8% vs. -0.1% est) data.

- Jun'24 10Y futures currently +18 at 111-10 vs. 111-15 high, through technical resistance at 111-11.5 (38.2% retracement of the Feb 1 - 23 bear leg), focus on 111-24.5 (High Feb 13). Curves bull flatten: 2s10s -2.578 at -41.656.

- Treasury futures had pared gains briefly after higher than estimated S&P Global US Services PMI final (52.3 vs. 51.4 est) and Composite PMI final (52.5 vs. 51.4 est) data. Otherwise, the balance of data largely in-line: Durable Goods Orders final (-6.2% vs. -6.1% est) Ex Trans (-0.43% vs. -0.3% est), Cap Goods Orders Nondef Ex Air final (0.0% vs. 0.1% prior), Cap Goods Ship Nondef Ex Air final (0.9% vs. 0.8% prior).

- Late markets traded with a broad based risk-off tone ahead Fed Chairman Powell's semi-annual policy testimony to Congress tomorrow and Thursday as well as NFP on Friday.

OVERNIGHT DATA

US DATA (MNI): (Volatile) Prices Paid And Employment Lead ISM Services Miss:

- ISM services see a small miss in Feb at 52.6 (cons 53.0) after 53.4.

- More notable misses for prices paid 58.6 (cons 62.0) after 64.0 and employment 48.0 (cons 51.4) after 50.5.

- Beat for new orders at 56.1 (cons 54.4) after 55.0, for highest since August.

- Prices paid comes after a particularly volatile period, leaving it down -5.4pts after a surprise 7.3pt surge in Jan. The 58.6, whilst a miss, is still above the 57.9 averaged through 2H23.

- Employment has also been volatile recently, a -2.5pt drop coming after 7pt offsetting swings in Dec and Jan. It’s still a low reading ahead of Friday’s payrolls though, down vs the 50.4 averaged in 2H23 (and prior to the 43.8 in Dec it’s the lowest since Aug’20).

US DATA (MNI): Services PMI Revised Higher For Ultimately Little Change From January: Services, and therefore composite, PMI activity was stronger than first thought in February.

- It left the services index little changed from January whilst the composite increased 0.5pts on the back of manufacturing strength seen last week (but importantly a change not repeated in the separate ISM mfg index with its surprise decline).

- Services PMI at 52.3 (cons 51.4, flash 51.3) after 52.5

- Composite PMI at 52.5 (cons 51.4, flash 51.4) after 52.0.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 503.41 points (-1.29%) at 38484.93

- S&P E-Mini Future down 70.75 points (-1.38%) at 5067.25

- Nasdaq down 331.4 points (-2%) at 15874.68

- US 10-Yr yield is down 8 bps at 4.1331%

- US Jun 10-Yr futures are up 17.5/32 at 111-9.5

- EURUSD down 0.0006 (-0.06%) at 1.085

- USDJPY down 0.59 (-0.39%) at 149.94

- WTI Crude Oil (front-month) down $0.48 (-0.61%) at $78.26

- Gold is up $14.65 (0.69%) at $2129.03

- European bourses closing levels:

- EuroStoxx 50 down 19.85 points (-0.4%) at 4893.07

- FTSE 100 up 5.83 points (0.08%) at 7646.16

- German DAX down 17.77 points (-0.1%) at 17698.4

- French CAC 40 down 23.59 points (-0.3%) at 7932.82

US TREASURY FUTURES CLOSE

- 3M10Y -8.019, -125.419 (L: -128.272 / H: -117.658)

- 2Y10Y -2.384, -41.462 (L: -44.777 / H: -38.454)

- 2Y30Y -2.766, -27.837 (L: -29.09 / H: -24.307)

- 5Y30Y -1.362, 13.521 (L: 12.525 / H: 15.311)

- Current futures levels:

- Jun 2-Yr futures up 3.375/32 at 102-17.125 (L: 102-13.375 / H: 102-18.875)

- Jun 5-Yr futures up 10/32 at 107-14 (L: 107-03.5 / H: 107-18)

- Jun 10-Yr futures up 17/32 at 111-9 (L: 110-23 / H: 111-15)

- Jun 30-Yr futures up 1-09/32 at 120-28 (L: 119-16 / H: 121-09)

- Jun Ultra futures up 1-25/32 at 130-4 (L: 128-05 / H: 130-19)

US 10Y FUTURE TECHS: (M4) Shows Above Key Resistance At 50-Day EMA

- RES 4: 111-24+ High Feb 13

- RES 3: 111-27 50% retracement of the Feb 1 - 23 bear leg

- RES 2: 111-15 High Mar 05

- RES 1: 111-11+ 38.2% retracement of the Feb 1 - 23 bear leg

- PRICE: 111-06+ @ 16:37 GMT Mar 5

- SUP 1: 110-05+/109-25+ Low Mar 1 / Low Feb 23 and bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasures pierced resistance layered between 111-06 to 111-11+ in response to the weaker-than-expected ISM services release, extending the recovery posted off the late February lows. A confirmed close above the 50-day EMA of 111-06 would prove constructive and could signal a bullish reversal, opening 111-27 initially, the 50% retracement for the downleg off the Feb 1 high. This week’s price action has worked against the broader downward trend direction, and a failure to maintain price at or above current levels would return focus back to next support at the 109-25+ bear trigger.

SOFR FUTURES CLOSE

- Mar 24 +0.008 at 94.695

- Jun 24 +0.025 at 94.930

- Sep 24 +0.045 at 95.250

- Dec 24 +0.060 at 95.580

- Red Pack (Mar 25-Dec 25) +0.065 to +0.080

- Green Pack (Mar 26-Dec 26) +0.080 to +0.085

- Blue Pack (Mar 27-Dec 27) +0.085 to +0.095

- Gold Pack (Mar 28-Dec 28) +0.085 to +0.090

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00038 to 5.32088 (-0.00174/wk)

- 3M +0.00263 to 5.32639 (-0.00473/wk)

- 6M +0.00698 to 5.25245 (-0.01486/wk)

- 12M +0.02018 to 5.03557 (-0.02097/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.858T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $692B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $280B

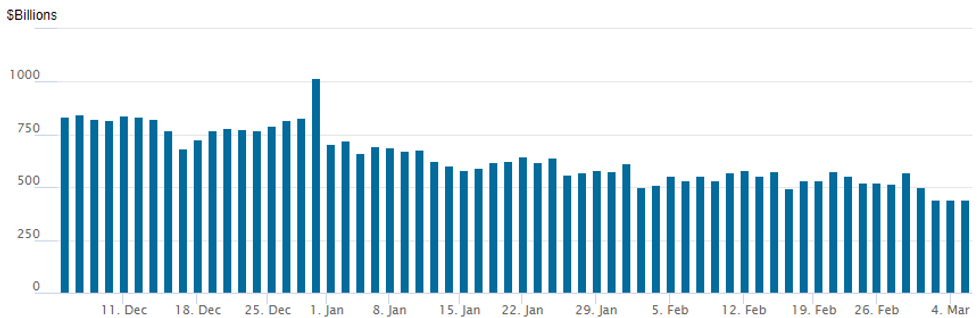

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $444.474B vs. $439.793B Monday -- the lowest since May 2021.

- Meanwhile, the latest number of counterparties slips to 74 from 75 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE Corporate Debt Roundup: $34.5B to Price Tuesday

$34.5B to Price Tuesday, $56.425B total on the week so far:

- Date $MM Issuer (Priced *, Launch #)

- 3/5 $8B #State of Israel $2B 5Y +135, $3B 10Y +145, $3B 30Y +175

- 3/5 $4.5B #Barclays $1.25B 4NC3 +135, $500M 4NC3 SOFR+149, $2B 6NC5 +155, $750M 31NC30 +175

- 3/5 $4B *EIB 3Y SOFR+26

- 3/5 $3B #Blackrock Funding $500M 5Y +60, $1B 10Y +87.5, $1.5B 30Y +105

- 3/5 $2.5B #Nestle $600M 5Y +55, $450M 7Y +65, $800M 10Y +75, $650M 30Y+85

- 3/5 $2.5B #Ford Motor Credit $1.6B 5Y +168, $900M 10Y +200

- 3/5 $2.5B #JPMorgan PerpNC5 6.875%

- 3/5 $2B #BBVA $1B 5Y +125, $1B 11NC10 +190

- 3/5 $1.5B #Cheniere Energy 10Y +153

- 3/5 $1B #Microchip 5Y +95

- 3/5 $1B *EBRD 10Y SOFR +53

- 3/5 $1B #Al Rajhi Bank 5Y Sukuk +90

- 3/5 $500M *Doha Bank WNG 5Y +130

- 3/5 $500M #Hormel WNG 3Y +50

- 3/5 $Benchmark Magna Int 5Y +85

- 3/5 $Benchmark Goldman Sachs investor calls

- Rolled to Wednesday:

- 3/6 $Benchmark KFW 3Y SOFR+29a

- 3/6 $Benchmark AIIB 10Y SOFR+65a

FOREX US Data Initially Weighs On Greenback As Event Risk Set To Intensify

- US ISM services saw a small miss in February at 52.6 (est. 53.0), however there were more notable misses for prices paid 58.6 (est. 62.0) and employment 48.0 (est. 51.4) which contributed to some downside for the greenback on Tuesday. However, depressed vols and upcoming event risk later in the week stalled any downside momentum, with some weakness for equities also bolstering the USD bounce as we approach the APAC crossover.

- Overall, lower yields in the US have supported the Japanese Yen, with USDJPY (-0.30%) hovering right around the 150.00 mark, but off the 149.71 lows. USDJPY support seen scant into 149.84, but seen stronger into 149.21, last week's low in the pair.

- In similar vein, EUR/USD reversed well off the post-ISM services intraday peak, keeping today's highs at 1.0876 and just short of key resistance and a notable upside level at 1.0888 - the top of the tail of a shooting star pattern printed on Feb 22, which continues to highlight a possible bearish reversal. The tail of the inverted hammer intersected with the 50-dma - a level pierced, but not convincingly broken in Tuesday trade.

- This raises focus on the heavier frequency of risk events this week, with Powell's House/Senate testimonies on Weds/Thurs, the ECB decision on Thurs and the NFP release on Friday.

- A EUR negative, USD positive theme over the next three days would raise focus on 1.0791 - the 50% retracement of the recovery bounce off Feb14's 1.0695. Below here, the bounce would be deemed corrective and could signal a resumption of the over-arching downtrend off the Dec28 high.

- A busier global docket on Wednesday, with Australian GDP kicking things off, followed by the UK budget release. UK construction PMI and Eurozone retail sales also cross. Later in the day, the Bank of Canada decision and US Jolts will accompany the Fed Chair’s testimony.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2024 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 06/03/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 06/03/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/03/2024 | 1230/1230 |  | UK | Budget Statement | |

| 06/03/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/03/2024 | 1445/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 06/03/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 06/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 06/03/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/03/2024 | 1530/1030 |  | CA | BOC Press Conference | |

| 06/03/2024 | 1700/1200 |  | US | San Francisco Fed's Mary Daly | |

| 06/03/2024 | 1900/1400 |  | US | Fed Beige Book | |

| 06/03/2024 | 2115/1615 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.